Disclaimer: I built my position in AFM at a weighted-average cost basis of ~C$1.05 in mid-to-late September. Since then, the stock has rallied ~22%. Unfortunately, I was unable to get this post out in time, so if you’re just reading this and don’t have a position, it might be best to wait for a pullback vs. chasing here.

A couple of months ago I made the decision to go all-in on oil and uranium. Since then, both sectors have rebounded strongly, giving me some room to rebalance / re-diversify the portfolio. Over the last two weeks I’ve been adding back to my positions in copper names, Ero Copper and Amerigo. If you haven’t already read about my views on copper, you can find them here, here and here.

In contrast to the copper rally earlier this year, when big banks / sell-side research were tripping over themselves to raise their copper price targets, there has been a more muted response to the recent rebound in prices to US$4.5 / lb (which is what you want to see as a contrarian investor!). Chinese copper inventories have started drawing, and with the Chinese authorities unleashing a torrent of monetary stimulus measures, the risk of increased downward pressure on demand should start to abate (albeit I expect Chinese economic growth to remain slow). That said, I would be buying more enthusiastically if prices were closer to US$4 / lb.

Additionally, I bought back my position in Alphamin Resources (AFM), a company I haven’t previously mentioned on this blog, but has been in the portfolio on / off this year. AFM is one of the largest, lowest cost producers of tin, producing ~4% of the world’s tin supply from the Bisie Tin Project in the Democratic Republic of the Congo (DRC). Operating in the DRC comes with significant challenges. DRC is a poor nation with GDP per capita of ~US$700. Eastern DRC, where AFM operates, has witnessed years of instability. More than 120 armed groups have fought here for decades for power, land and valuable mineral resources, making it one of the most violent regions in the world. The most powerful group is the M23 which the Congolese government, alongside the United States and France, has accused Rwanda of sponsoring.

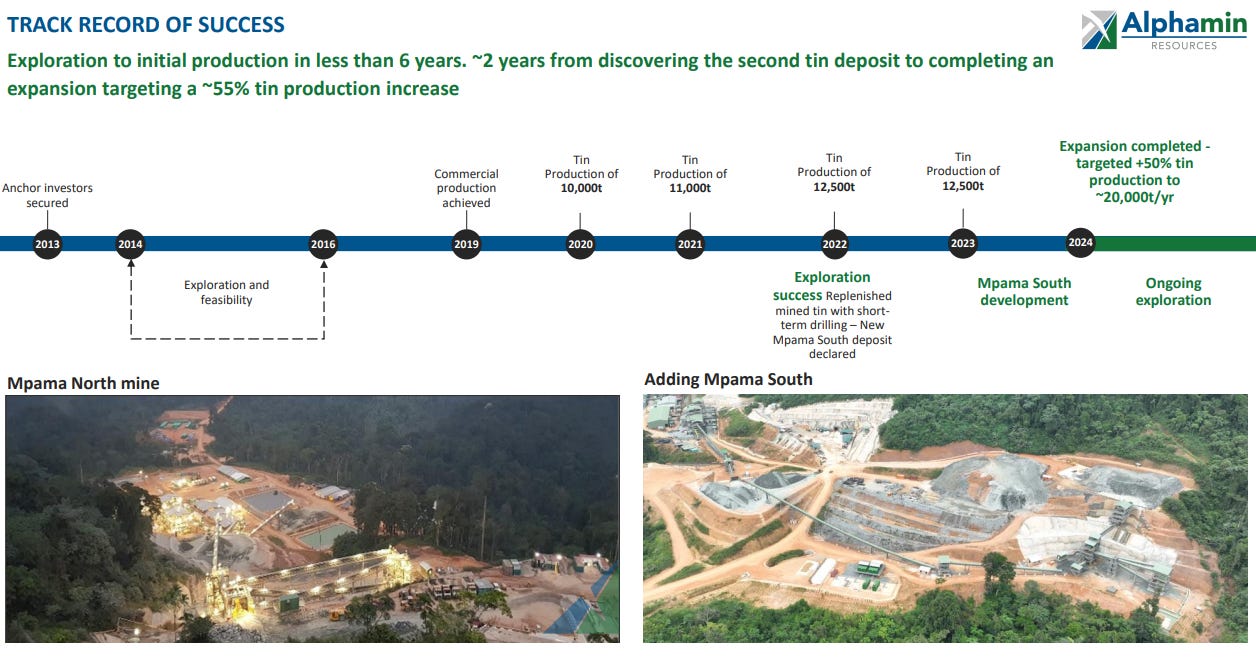

Despite the inherent risks operating in such a region, AFM has managed to achieve a strong operational track record. After starting exploration activities in 2014, the Company took only 6 years to progress towards becoming a producer, with annual output of 10Kt by 2020 from its Mpama North mine. By 2022 production increased to 12.5Kt, and the Company announced the development of the Mpama South deposit. AFM’s new Mpama South processing facility achieved commercial production in May this year, allowing the Company to produce ~4Kt of tin in Q2 2024, roughly 30% higher QoQ and YoY. Q3 is the first quarter to benefit from full production from both the North and South mines. This week AFM released an operational update in which it announced record quarterly production of ~4.9Kt for Q3. AFM expects to produce ~20Kt of tin per annum going forward, while maintaining a rolling life-of-mine (LOM) of 10 years.

In addition to the significant jump in production, AFM has been able to maintain strict cost controls and high levels of profitability. EBITDA is guided to increase 69% QoQ to US$91.5mm (supported by sales of inventory built in Q2). Given the significant increase in earnings, the interim dividend was doubled to C$0.06 per share (semi-annual), representing a 9.4% dividend yield on Friday’s closing stock price, and 11.4% on my cost basis. Management has stated that dividends remain their preferred means of capital return.

Assuming 20Kt annual production next year and average realized tin price equal to the current price of US$33K/t, AFM should generate 2025 EBITDA of ~$US340mm and FCF of ~US$232mm (deducting taxes and interest expense). Accounting for the DRC’s 16% interest, ~US$195mm of the FCF would be attributable to shareholders, implying a ~16% FCF yield at the current market cap of C$1.64bn. Management thinks that there is upside to the production targets if Mpama South ore grades reconcile higher (as they have historically), allowing AFM to produce as much as 25Kt annually.

Importantly, AFM is rapidly expanding production at a time when the tin market is tightening, and prices could rise substantially (more on this in a separate note / article). The tin market has many similarities to copper and uranium. Supply has suffered from decades of underinvestment, while demand is relatively inelastic to price, and is expected to inflect sharply higher, given tin’s critical role in modern technologies (see slide below). Tin is used for soldering, the process of joining two metals together, which means that it literally holds together the world around us. As we work towards transforming our societies through green energy and AI, we will need a lot more tin.

Not only have the largest and most prolific tin deposits reached maturation, a significant proportion of tin supply comes from underdeveloped and unstable regions of the world. Last year in August 2023, the Wa authorities, an autonomous ethnic group that controls most of Myanmar's tin resources (7-8% of global supply), ordered a total suspension of all mining and processing activities to allow an audit of the numerous informal operations in the country’s tin sector. The suspension was expected to last only a few months, but is ongoing, with only some small mines operational at present. Recently, Typhoon Yagi (a category 5 storm) caused severe flooding in several regions of Myanmar, which may have further disrupted production. Indonesia, another major tin producer, saw exports fall by 44% YoY in the January-August period due to a new permitting process for producers.

So far, the tin market has been able to absorb these supply shocks through stockpiles, and a prolonged two-year slump in semi-conductor sales. However, as the semi-conductor and electronics cycle turns, and inventory levels continues to drop, tin prices have been steadily grinding up, and have found a floor at the US$30K/t level. Based on the latest cost curves, tin prices will need to exceed US$40K/t to meet long-term demand. At US$40k/t price, AFM cash flows would inflect ~50% higher, and at a 12.5% target FCF yield, would imply a stock price roughly double from today’s level.

The big risk with AFM is obviously geopolitical. In order to get its product to end markets, AFM has to transport truckloads of tin concentrate through thick jungle and rebel-held territories to where it can finally be exported. Levels of violence in the region rose last October following the break down of a peace agreement between the Kinshasa Government and M23. This has led to tensions between Rwanda and DRC, with each side accusing the other of fighting using proxy forces (M23 in the case of Rwanda, and Wazalendo for DRC). A full scale war in Eastern Congo with Rwanda remains a major risk, however there are some recent developments to suggest that tensions are easing.

There are some mitigating factors to these risks. AFM’s operations are critical to the local economy with Mpama being the only mechanized mine in the North Kivu Province, generating >50% of the provincial tax revenues and employing hundreds of miners. The Mpama North mine has brought cell phone connectivity, security and governance to the region, helping small businesses flourish. AFM also helps the community by buying from local suppliers wherever possible. All these factors have helped the Company earn trust with the local governments and people.

It’s also important to understand the geography of the region. In the map of North Kivu below, the red dot represents roughly where AFM / Mpama is located. The orange dots are recorded events of violence against civilians earlier this year. The closest major town to the fighting (Biruwe) is ~320km away, and only accessible through dirt road. Mpama is even further north from Biruwe, in a far more remote / isolated region. Obviously, this doesn’t guarantee that there couldn’t be spillover violence, but it’s important to recognize that the fighting is occurring in a different region of North Kivu and that the key strategic target for the M23 rebels is Goma.

AFM’s current logistics plan avoids the violent parts of the North Kivu by trucking the tin concentrate north to Bisi, then east into Uganda, and finally to Mombasa, in Kenya, where the product is shipped out.

Even if the rebels somehow reached AFM’s operations, the mines themselves would be of little value as they would be inoperable without skilled workers. The rebels would also be unable to smuggle much of the tin concentrate given its weight / volume, and the strict international customs and regulations in place with respect to industrial commodities. Smuggling metals like tin or copper is a whole different ball game than smuggling something like gold or diamonds.

There are only a handful of publicly traded names that offer pure play tin exposure (I’m also looking at Metals X, the largest tin producer in Australia), and AFM is the largest and most liquid. Despite being in a difficult region, management has a proven track record of operating safely, profitably as well as consistently increasing production on time, and on budget. Cash flow is inflecting significantly higher with the successful completion of Mpama South, and if tin prices take off from here, investors can expect a 20%+ cash yield, most of which will be returned through dividends. For all those reasons, I think AFM deserves an allocation to the portfolio despite the geopolitical risks.