Portfolio Reallocation

Some more thoughts on the sell off, changes to the portfolio, upcoming catalysts for uranium

Someone messaged me a few days ago asking how quickly I think uranium stocks will recover. My response was that this is the wrong question to ask. What we should be asking ourselves, as uranium investors, is whether we got something wrong in our analysis. Over the last couple of weeks I’ve gone back to the basics, going through the math underpinning the deficit, reviewing the current supply and demand dynamics, and updating my valuation targets for the uranium miners I own in the portfolio. I shared some of my initial reflections last week.

As I continue to think through things, I remain convicted that the steep correction in uranium stocks is not justified by fundamentals. If I had to pick one data point that I think provides the strongest validation of this idea, it’s the resilience of uranium pricing signals across the fuel cycle (conversion, enrichment and LT U3O8 contracting). Company CEOs are paid to talk their own book, so you have to take their market views with a grain of salt (though I would mention here that Cameco’s management team has done an excellent job over the years in helping investors understand uranium market dynamics, and they have largely been correct in their forecasts). Deficit and inventory estimates can always be wrong, especially given the opaque nature of the industry and data sources. However, commodity price is the ultimate arbiter of truth, and traders and commercial buyers have not been willing to transact uranium at lower prices, despite the significant drop in uranium equities.

This brings us back to the broader macro factors I discussed earlier, that I believe explain the majority of the price drop in uranium stocks. What happened in markets last week was in many ways historic:

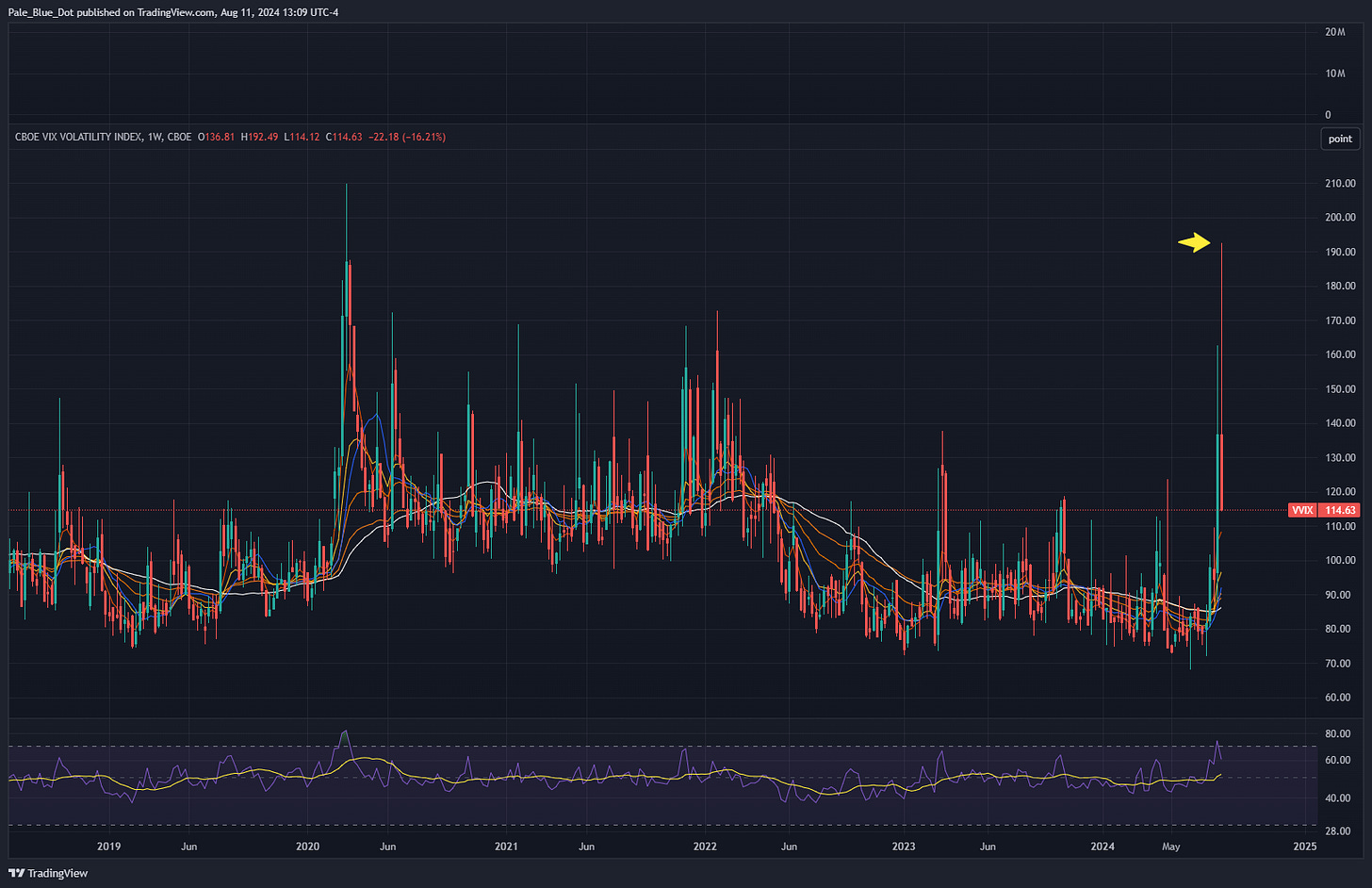

1/ The VIX spiked to the highest level since COVID.

2/ Same with VVIX (the vol of vol).

3/ Same with options skew (SDEX).

4/ UVIX (2x Long VIX Futures) experienced its highest volume week since inception.

5/ The SPY experienced its highest volume day since the SVB crisis. Same with the QQQ.

6/ Currency markets were in turmoil from the strongest Yen appreciation since October 2022, when the Fed had to step in.

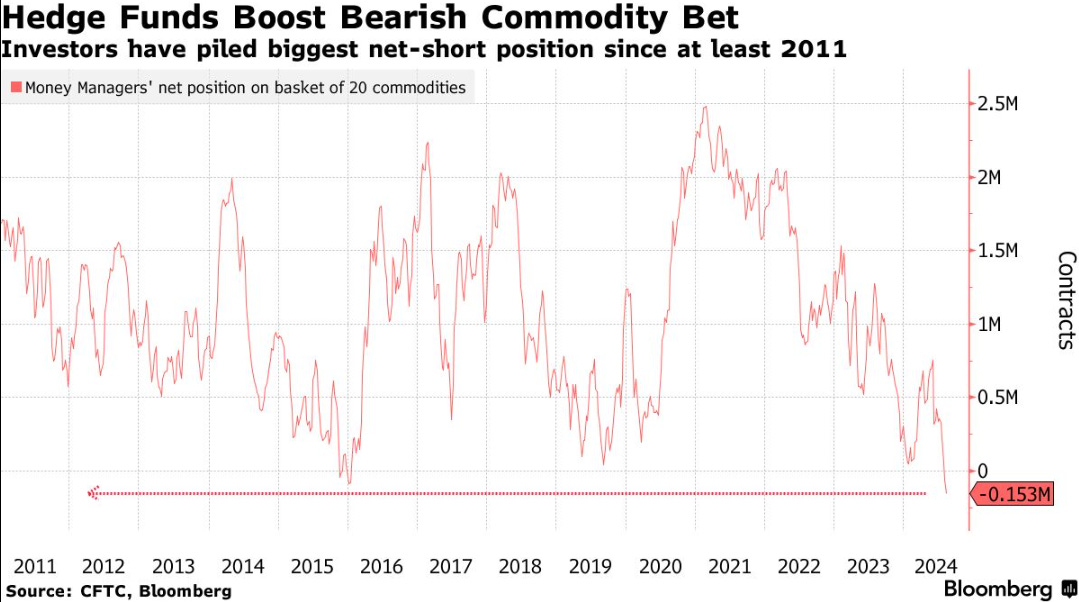

7/ Hedge funds piled into short commodity bets.

To understand why this ‘vol event’ occurred, we need to look at the dominant macro narratives and market positioning over the last couple of years. Since the Fed started its post-COVID hiking cycle, the macro narrative has been driven by fears of a hard landing. Several prominent macro analysts and economists have decried the Fed’s apparent recklessness in terms of the pace and magnitude of interest rate increases, predicting that the economy and credit markets would eventually unravel. However, this view has been proven consistently incorrect. Investors and traders have been punished numerous times for positioning for a hard landing, most recently post the SVB / regional bank crisis.

Not surprisingly then, with the economic data continuing to be benign, the fight against inflation seemingly at the last mile, and visibility towards an monetary easing cycle, the number of ‘soft landing’ / short volatility bets rose considerably this year. With soft landing having become consensus, the one-sided positioning became the equivalent of a pile of dry tinder waiting for a spark. This spark was provided by the weaker than expected NFP report on August 2nd, which showed a much lower than expected 114K addition to payrolls, and a rise in unemployment rate to 4.3%. The short vol trade had a violent unwind, as hard landing fears were priced back in.

With recent economic data (initial claims, continuing claims, ISM Services PMI) soothing hard landing fears, the VIX has dropped back to the ~20 mark. This week’s inflation data on Tuesday (PPI) and Wednesday (CPI), and retail sales data on Thursday, will be critical in setting the tone for any further market weakness. I would caution investors that while the worst seems to be over, there is still a very large short vol position across the Street that would have to be further unwound if hard landing fears re-ignite. As such, I’m not calling a bottom here, but I do think the current prices of uranium stocks represent a compelling opportunity to add to positions.

In light of this, I’ve made some changes to the portfolio:

I’ve exited out of all positions where I have lower conviction (copper, tin, some event driven situations, some macro trades etc) to focus exclusively on my two highest conviction plays: uranium and oil.

For oil (latest thoughts here), I think the risk / reward is superior in the commodity itself vs. producers. As such, I have sold my two remaining E&P positions, Whitecap and Hemisphere Energy, in favor of WTI futures and futures options.

I’m continuing to hold my offshore positions in RIG and VAL, as I believe they’re already close to a floor valuation.

For uranium, I’ve added to my positions across the board, but most aggressively to the Sprott Physical Uranium Trust (SPUT), which at one point traded at one of its highest discounts to NAV last week.

I’ve also opened a new position in UR Energy (ticker: URG), a small-cap US-based uranium miner. More on this in a future post.

To increase upside torque to the uranium play I’ve added some option positions*:

Cameco (CCJ) $40/50 Call Spread expiring Jan '25

URA $26/30 Call Spread expiring Jan '25

NexGen (NXE) $6 Call Option expiring Dec '24

*Please note that options are extremely risky, and this is not meant to be investment advice. I trade frequently in / out of these instruments and may sell out of any of these positions without notice / warning. Please do your own due diligence and make sure you understand the risks involved before investing.

Looking forward to the next few months, uranium investors should pay close attention to the following events:

Kazatomprom (KAP) will release earnings and an updated 2025 production outlook on August 23rd. I’m expecting a significant downgrade to current 2025 guidance of 31K tU, but a slight increase from 2024 production volumes.

WNA, the biggest nuclear fuel buyers conference, is going to be held during September 2-6. This conference typically marks the beginning of fuel buying season, and leads to an increase in spot market volumes.

There might be some more clarity on the waiver process for US utility purchasing of Russian EUP.

I expect things to stay volatile, but for the uranium sector to eventually de-couple when spot prices start their next leg up. The consolidation we’re seeing right now is quite similar to the sideways price movement in 2022 and 2023, after the large move up in prices in H1 2021 / H2 2022. Waiting is the hard part.