Over the last couple of weeks, WTI has retreated from the mid-80s to the mid-70s. While I’m not surprised by this move, given that I recommended exiting the oil trade about a month ago, there are a couple of developments that have my attention. Most importantly, there is something strange going on with OPEC+ exports. Satellite data has been showing for weeks now that the Saudis and Russians have reduced export volumes drastically.

The weekly export data can be noisy, so I didn’t want to jump to any conclusions when this trend first appeared. But now we have enough data points to confirm that this reduction in exports is real, and not a data blip. The Saudi data could (initially) also be explained by the timing of Hajj being in June this year. Every year, millions of Muslims visit the holy cities of Mecca and Medina for the annual pilgrimage. Thousands of planes and buses carry pilgrims around the religious sites, and hotel rooms and facilities all need lighting and air-conditioning. This leads to a strong oil demand pull domestically, which causes Saudi exports to drop during this period. However, we are now well into July, and the export drop doesn’t appear to be reversing. The impact of Hajj also doesn’t explain why Russian exports have been dropping precipitously.

Vortexa had the following to say about recent Russian export data [emphasis mine]:

“Russian seaborne crude exports have sharply declined in the first two weeks of July, reaching 2.7mbd, the lowest since December 2022. As Russia’s domestic refineries ramp up to meet summer seasonal demand, a decline in exports during this time of year is expected. However, even accounting for seasonality, the country’s crude exports are still down 13% compared to the historical average. Notably, exports from Russia’s Baltic ports have recorded 1.07mbd in the first 14 days of the month, marking a 19-month low, while supplies from the Black Sea have decreased to 200kbd, the lowest since at least 2016.”

One possible theory is that KSA and Russia are doing this as a political move, aimed at reducing the chances of Democrats retaining power in the upcoming elections. Fuel prices, inflation, and the economy, are all very important to voters. Engineering an oil price spike in the fall, and potentially causing a recession, could help the Saudis and Russians skew the results of the election in their favor. It’s not a secret that the Saudi Crown Prince, Mohammed Bin Salman (MBS), would much prefer the Republicans being in power, given Donald Trump’s friendlier posture towards the Saudis, and stricter Iran policy. The same goes for Putin. The Russian Government recently accused the Biden Administration of creating an atmosphere that led to the assassination attack on Trump.

How will we know if this strategy is working? The first sign will be inventories. The Saudis have not been exporting much to the US since 2020, therefore the reduction in crude exports won't have any direct impact on US crude storage. Instead, lower OPEC+ crude exports will first lower crude inventories globally, which will then increase the demand for US crude exports, lowering US crude storage with a lag. Based on the transit times of crude shipments, the impact of the Saudi and Russian cuts should be apparent by September / October in the inventory data, just when the election cycle is in full swing.

Another important development in oil markets is stagnating US oil production growth. Earlier in February, I had warned that forecasts for strong Shale production growth in 2024 and 2025 were misguided, and that the surge in H2 2023 production was largely driven by one-time factors (M&A), as well as EIA overestimation of US oil production through the ‘adjustment factor’. I wrote:

“The state of the HY markets, and the lack of PE investor appetite for fossil fuel investments, is not conducive to growth capex going forward. To a large extent, the growth from private producers in 2023 was the result of M&A and DUC (drilled uncompleted wells) drawdowns. A number of PE firms are trying to sell oil assets to the majors, and they want to show robust production growth to attract a rich valuation multiple. For example, CrownRock, which was acquired by Occidental in December, grew its production by 12% in 2023. Hess cut its DUC inventory to the bare operational minimum until its takeover by Chevron in October. Exxon has been drilling aggressively in the Bakken as those assets are a prime divestment candidate.”

“The EIA released its monthly oil production report this week for November, and while the headline number shows production of 13.3mm b/d, it also has a -315K b/d ‘adjustment’ factor. The adjustment factor is the balancing item which ensures that oil dispositions (oil added to inventory, plus refinery throughput and exports) equal oil supply (production plus imports). The EIA knows with a high degree of certainty the: 1/ inventory level 2/ refinery throughput and 3/ crude imports and exports (customs data). US oil production data is the most prone to errors because it’s survey-based, and because of by-products such as NGLs. Therefore, the negative adjustments are most likely over-stated production.”

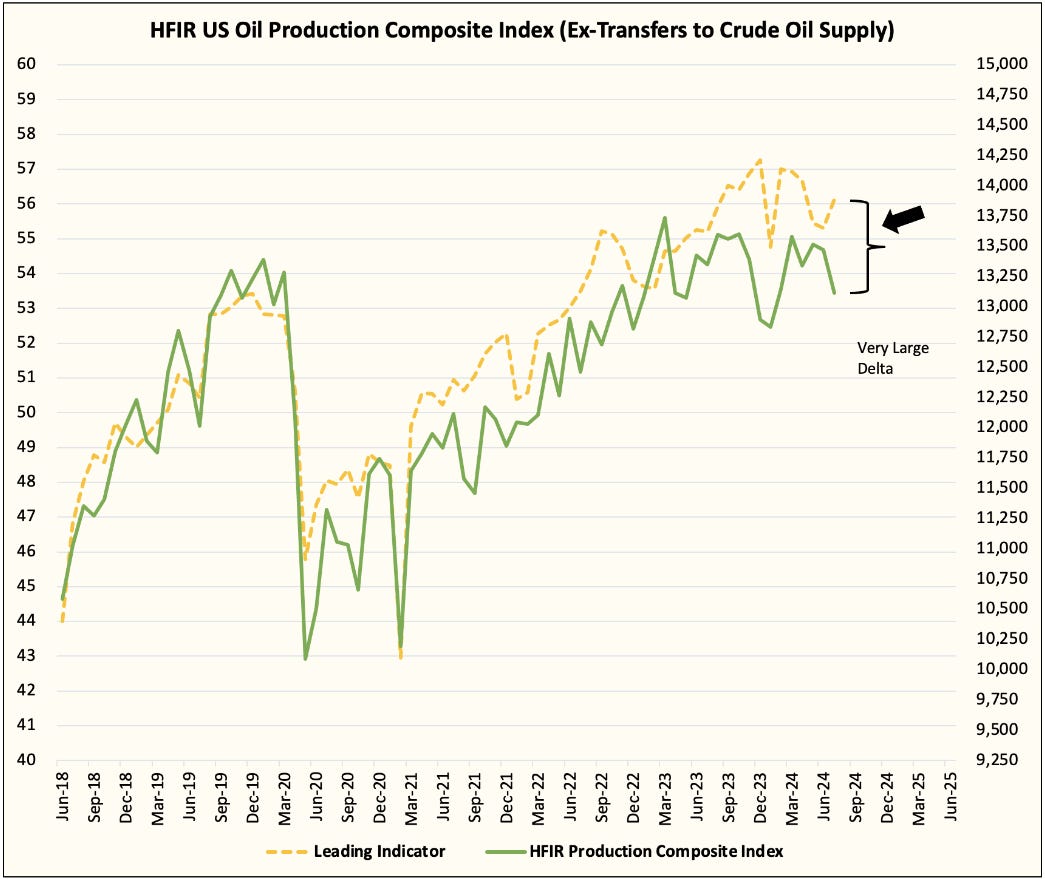

Not only did the EIA overestimate 2023 US oil production, it also underestimated 2022 production, leading analysts to assume much stronger YoY production growth vs. reality. As such, the sell side consensus for 2024 production growth coming into the year was 700K - 1mm b/d+. In contrast, recent high frequency US oil production data is currently tracking flat to lower by 200K b/d YoY. Based on data collected by energy research firm HFI Research (HFIR), July 2023 US oil production came in at ~13.4mm b/d, while this July, HFIR is estimating production average of ~13.2mm b/d.

If you’ve been following my analysis of US Shale over the last few years, this shouldn’t come as a surprise. Since 2020, US oil producers have engaged heavily in high-grading; i.e. they’ve focused drilling primarily on Tier 1 inventory. They’ve also maximized short-term production with minimal capex through tighter well spacings, longer laterals, DUC draw downs. While these are all great ways for E&Ps to earn a high ROIC , they come at the cost of lower well productivity and lower ultimate recovery from those reservoirs over the long term. The analysis below from FLOW, an oil and gas research consultancy, shows the clear deterioration in per foot productivity occurring over the years (left column, middle box).

Another sign of US Shale exhaustion is the increase in the gas to oil ratio (GOR). Historically, associated gas production acted as a good leading indicator for oil production (i.e., you could track gas production volumes and predict with some certainty what that implied for oil production). However, recently, natural gas volumes have started to rapidly overtake oil production, suggesting that oil wells are starting to become gassier.

Overall, these signals all point to the maturation of US oil production, which is a natural process that plays out for every oil resource. It’s hard to predict whether US Shale production will peak this year, or if we’re still a few years out, but I’m more certain that the the second derivative, i.e. the rate of change of the rate of change, is now negative. The days of 1mm b/d+ US Shale growth are likely behind us, and as US E&Ps focus on free cash flow and capital returns, Wall Street will have to continue downgrading its assumptions for future US oil supplies.

The problem for oil bulls, however, is that while the supply picture is supportive, demand growth remains weak. China, the big driver of oil demand growth of the past decade, continues to be in a structural economic slump. The policies required to fix the imbalances in the Chinese economy will take many years, if not decades to implement. The Chinese Government has also been aggressively pushing electric vehicle adoption. Chinese oil demand this year is running flat YoY, and this has been a big drag on the physical oil market. Developed world demand is also going sideways, with current US demand only marginally higher than 2022 levels. The only bright spots for oil demand growth are India, South East Asia and other smaller emerging economies.

Will demand growth from EMs ex-China be enough to support a secular bull market? If US Shale production starts to flatline, while demand continues to grow, albeit at a modest rate, then OPEC+ will have significant control over the market. This can be both good and bad for oil investors. On the one hand, the Saudis need high oil prices to finance their fiscal profligacy and are motivated to defend an oil price floor. However, on the other hand, OPEC+ can be an unpredictable ally as they are prone to internal squabbles, and susceptible to external political influences. What if Donald Trump comes to power and asks MBS to open the spigots? Long time oil investors / traders will remember the painful 2018 oil flush, when Trump convinced MBS to flood the market, causing an oil price crash.

In my opinion the structural bull story for oil starts when oil demand growth gradually erodes OPEC+ spare capacity, and RoW supply can’t keep up either due to years of underinvestment. The peak in US Shale growth is an important first step in that process, but we’re not fully there yet as demand growth needs to pick up, and OPEC+ still has ample spare capacity.

For the next few months however, I think there is a decent chance of oil reversing its recent drop as the OPEC+ supply squeeze starts hitting inventories. It’s important to recognize that any sharp rise in oil prices will be unsustainable at this stage due to the weaker demand picture, and the ability of the White House to release SPR barrels, so it’ll be important for oil traders to take their money and run for the exits once the market tightens. I’m long WTI December 85/90 Call Spread to play this setup.