Note: since I started researching the copper thesis earlier this year, copper prices have experienced a nearly uninterrupted 15% rise. Many copper mining stocks are trading at or close to their 52 week highs, with RSIs in overbought territory. There has also been a barrage of sell-side research notes expressing bullish views on the commodity. The current price action and sentiment make me reluctant to chase copper stocks higher, and I’m waiting for a correction in prices to get more aggressive. In light of this, I’m limiting my copper exposure to 10-15% of portfolio NAV for now.

Given the jurisdictional and operational risks inherent in copper mining, buying a diversified copper ETF such as the Global Copper Miner's ETF (COPX) for a long-term hold is suitable for most investors, especially if you don’t have the time to sift through hundreds of stocks to find ones that meet all the important criteria for a resource company (experienced management team, asset quality, capital structure and capital allocation track record). However, for those that have a higher risk tolerance and want torqued upside, below are three stocks that I find attractive. Each stock offers exposure to a different stage of the copper supply cycle, and unique business model. Similar to my uranium holdings, I will be adding more names to the basket as I continue researching the sector.

Amerigo Resources (ARG)

Amerigo (ARG) is a Canadian company in the business of processing waste streams from the world’s largest underground copper mine, the El Teniente mine owned by Chilean copper giant Codelco. The Company has a contract with Codelco to receive daily tailings from the mine, slurrify them using high-pressure water hoses, and recover copper (and some molybdenum). In return, Amerigo pays royalties to El Teniente linked to the copper price.

What I like about the tailing treatment businesses model is that you don’t need to worry about many of the operational and exploration risks that come with traditional mining. El Teniente’s life of mine (LOM) runs out to 2082, so there are decades worth of tailings for Amerigo to process without having to explore or develop any deposits of its own. Capex needs are low, with 2024 production guidance of ~62mm lb/y of copper and ~1mm lb/y of Molybdenum, with minimal sustaining capex of US$8mm. The capital-light nature of the business allows ARG to have minimal debt and equity dilution, and return most cash flow to shareholders.

The Company’s current dividend per share of C$0.12, represents a dividend yield of ~7% vs. free cash flow to equity (FCFE) at current copper prices of ~10-11%. However, if copper prices rise to US$5/lb, ARG’s FCFE will increase to US$35mm or 17% yield, allowing ARG to increase the current dividend, announce a special / “performance” dividend, and/or buyback shares. Since the inception of ARG’s capital return strategy in 2021, the Company has retired ~11% of shares outstanding.

Like all resource Companies, ARG has had its fair share of operational issues, but management has handled them well. Results in Q2 2023 were weak as ARG’s production facility was shut down for several days due to a flooding event that disrupted its power supply. Q3 was more challenging, as heavy rainfalls in central Chile disrupted operations on two separate occasions, leading to a 31.5% decrease in output to 11.12 million pounds, and pushing up cash costs per pound to $2.44. These rainfall incidents were odd, given Chile has been suffering from drought for several years. But they also demonstrate the environmental challenges facing commodity producers, especially in light of climate change. ARG has rebounded strongly from these setbacks. Q1 2024 results were stellar, with copper production 2% above guidance, and cash costs of $1.89/lb, 9% below 2024 cash cost guidance of $2.08/lb. The Company is expecting to produce 62.4mm lbs this year vs. 57.6mm lbs in 2023.

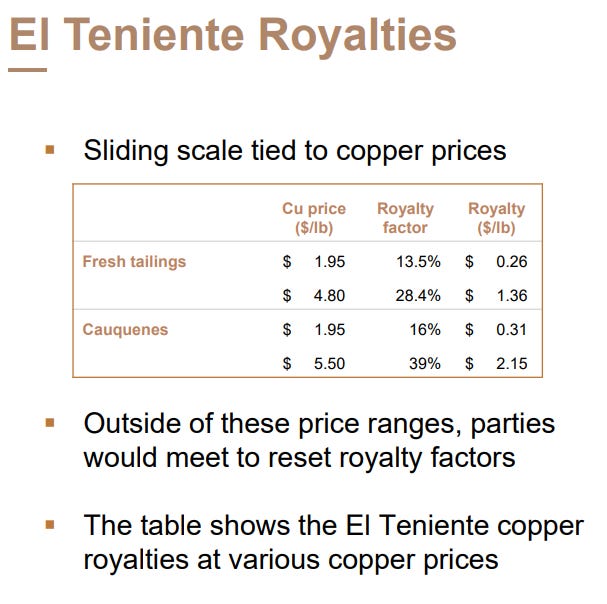

One of the downsides of the waste processing business model is that ARG’s unit cash costs are relatively high at ~US$2.00/lb (the sale of Molybdenum as a by-product is used to reduce copper unit cash cost). This is because the grades of the tailings are low, as most of the copper has already been processed by Codelco before it makes it way to ARG. Mitigating this risk is the fact that copper supply/demand fundamentals are strong, and it’s improbable that prices could sustain below US$2/lb given current cost curves, global growth trends and green demand tailwinds. Another mitigating factor is ARG’s low sustaining/maintenance capex, and current capital structure. The Company has only US$19.5mm of bank debt outstanding, US$13.8mm in cash, relative to NTM EBITDA of ~US$61mm at US$4.50/lb copper price. ARG’s royalty payments to El Teniente are also on a sliding scale, so the expense burden becomes proportionally lower when copper prices are lower (although on the flip side, it also caps the ultimate upside to cash flows).

Water scarcity is also a risk for ARG, as Chile has suffered severe droughts recently, and the Company’s tailings processing requires high pressure water jetting. To ameliorate this risk, management has built water reserves to last 18 months.

Finally, there is geopolitical / contractual risk, as ARG’s entire revenue stream is based on its contracts with Codelco, which is a state-owned enterprise. ARG’s “Fresh Tailings Contract” and “Cauquenes Contract” run until 2037, there is also a contract for Colihues, one of El Teniente’s historic tailings deposit, that runs until 2033 (or deposit depletion, if earlier). Given the rising trend towards socialist / progressive policies, there is a risk that these contracts are renegotiated in the future at terms that are adverse for ARG. This risk can only be mitigated by diversifying your copper miner exposure across geographies, however it’s notable that ARG has had a relationship with Codelco for almost 30 years.

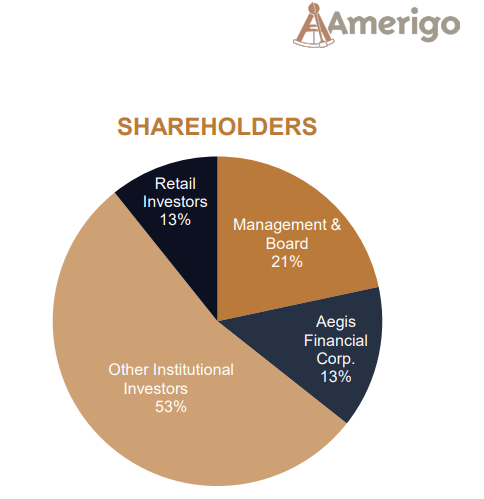

It’s also notable that management has a 21% ownership in the Company, aligning their interest with shareholders and ensuring that they make every effort to manage these risks prudently.

From a valuation perspective, the stock has run up very strongly over the past month, forcing me to take a pause from accumulating the shares. While I do have a small position in ARG, my target price to add more aggressively would be around C$1.40, which represents 20%+ FCF yield at US$5/lb copper prices. From a technical perspective, this price would also represent the 200dma, which should act as support during a correction.

Ero Copper (ERO)

ERO is headquartered in Vancouver, Canada with mining operations in Brazil where the Company produces copper and gold. Brazil has historically been an attractive destination for mining companies, with abundant mineral resource, power generation capacity and a secure political and legislative environment to operate and permit new mines. The Country is the world’s 3rd largest iron ore miner, 8th largest nickel producer and 9th largest oil producer.

ERO’s MCSA mining complex has 2 of the 5 largest copper mines in Brazil. ERO's flagship Caraiba operation currently produces around 50kt of copper annually, and the Xavantina operations produce 50koz of gold. The company is looking to ramp up its Tucuma project (previously known as Boa Esperanza), which is expected to add another 24kt of copper in 2024 and 57kt the following year. This would bring ERO's total copper output in 2025 to more than 100kt.

There are three major reasons I find the Company exciting from an investment point of view:

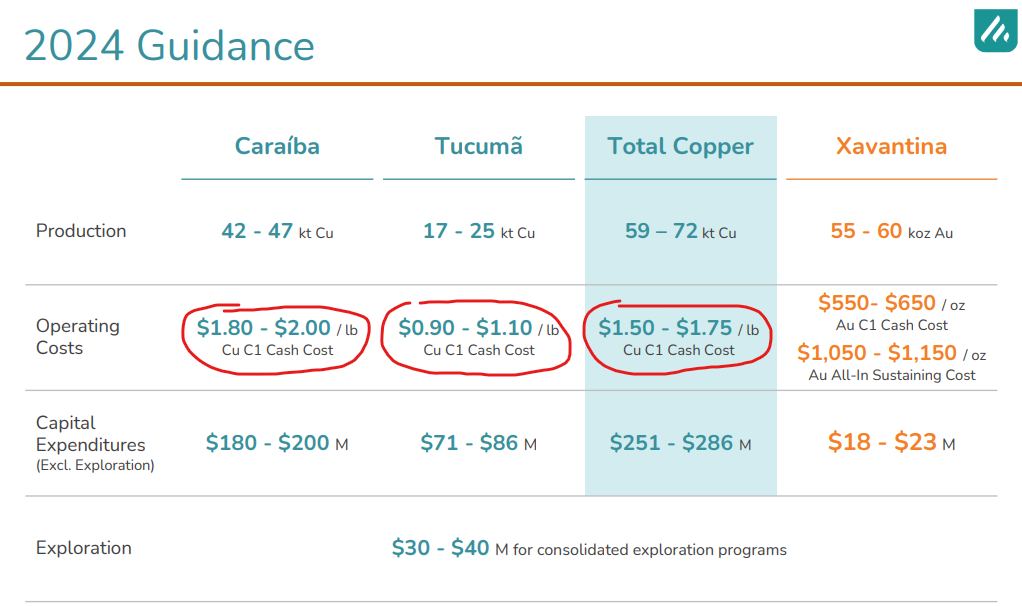

ERO has one of the lowest cash costs in the industry, with 2024 guidance of US$1.50 - US$1.75/lb, expected to decline by 20 - 25% by 2025 as production increases. AISC is expected to be in the US$2.00 - US$2.20/lb range, which is comparable to best-in-class copper producing companies such as Lundin, First Quantum, Teck Resources etc.

The Company is expected to double production by 2026, giving management the unique opportunity to create shareholder value if copper prices inflect upwards over the next couple of years.

The ability to grow copper production is increasingly rare, as discussed in my note regarding copper supply.

Only a handful of producers such as Teck and Ivanhoe are in the position to grow volumes significantly (Ivanhoe is based out of DRC however, which is a riskier jurisdiction vs. Brazil).

Many of the copper majors like Lundin, Hudbay and Freeport are looking to maintain current production levels.

ERO owns its water and power infrastructure, avoiding reliance on third-parties, and reducing carbon emissions.

Water scarcity is a huge problem in copper mining, with some countries like Chile forcing copper miners to build expensive desalination plants as part of the permitting process.

ERO has the distinct advantage of having built an aqueduct that directly connects its mill with a dam. ERO also owns an electrical line connecting to the hydroelectric generation of this dam.

While this infrastructure was costly to develop upfront, it allows ERO to access water and electricity at very low ongoing / marginal cost, while reducing emissions significantly.

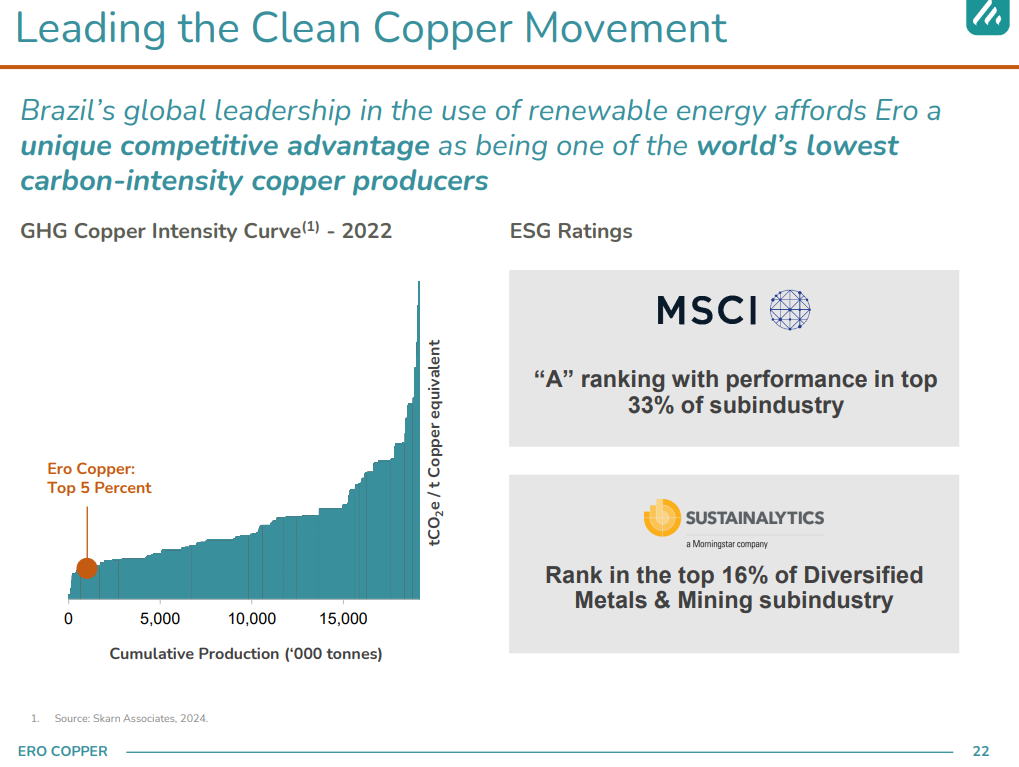

ERO is currently ranked in the bottom 5% of copper producers in terms of carbon-intensity, which should attract investment flows from ESG-focused funds. It currently has an “A” ESG rating from MSCI.

ERO’s management has a conservative bent when it comes to financing growth capex, taking advantage of fixed rate debt, and deploying copper price hedges to mitigate downside volatility. In November last year, ERO completed a bought equity financing deal for US$104mm in proceeds, leading to a strong current liquidity position of US$261mm, including US$150mm undrawn revolver and US$111mm in cash. 2024 will be a big capex year for ERO, with US$300 - US$350mm of capital expenditures slated for the year, largely due to the ramp up of Tucuma. However, this should lead to a dramatic shift in ERO’s cash flow profile in the coming months as capex ramps down in H1, and Tucuma production ramps up going into H2. By 2025, the Company will be producing 95-105Kt of copper and 55-60Koz of gold.

Let’s translate these numbers into potential profit, at the lower end of production guidance. If we assume copper realized price of US$10K/t (US$4.5/lb), AISC of US$4400/t (US$2/lb) and gold price of US$2400/oz, AISC of US$1000/oz for gold, this should equate to pre-tax profit of ~U$610mm, and after-tax profit of US$518mm (Brazil corporate tax rate is 15%). Using shares outstanding of 103mm, this equates to EPS of US$5/share or C$6.9/share, relative to the current share price of C$20.14, or an earnings multiple of ~3x on 2025 basis. In comparison, ERO’s low growth peers trade at 15-20x, while higher growth names trade at 30x+.

Of course, ERO is a smaller company vs. the peers listed above, and there are numerous risks involved when ramping up new mining projects. But even if we value ERO at a discounted 10-15x multiple, the stock should trade at C$69-C$103.5. If the Tucuma project fails, the base business should still generate US$265mm of after-tax profit, or US$2.57/C$3.5 per share.

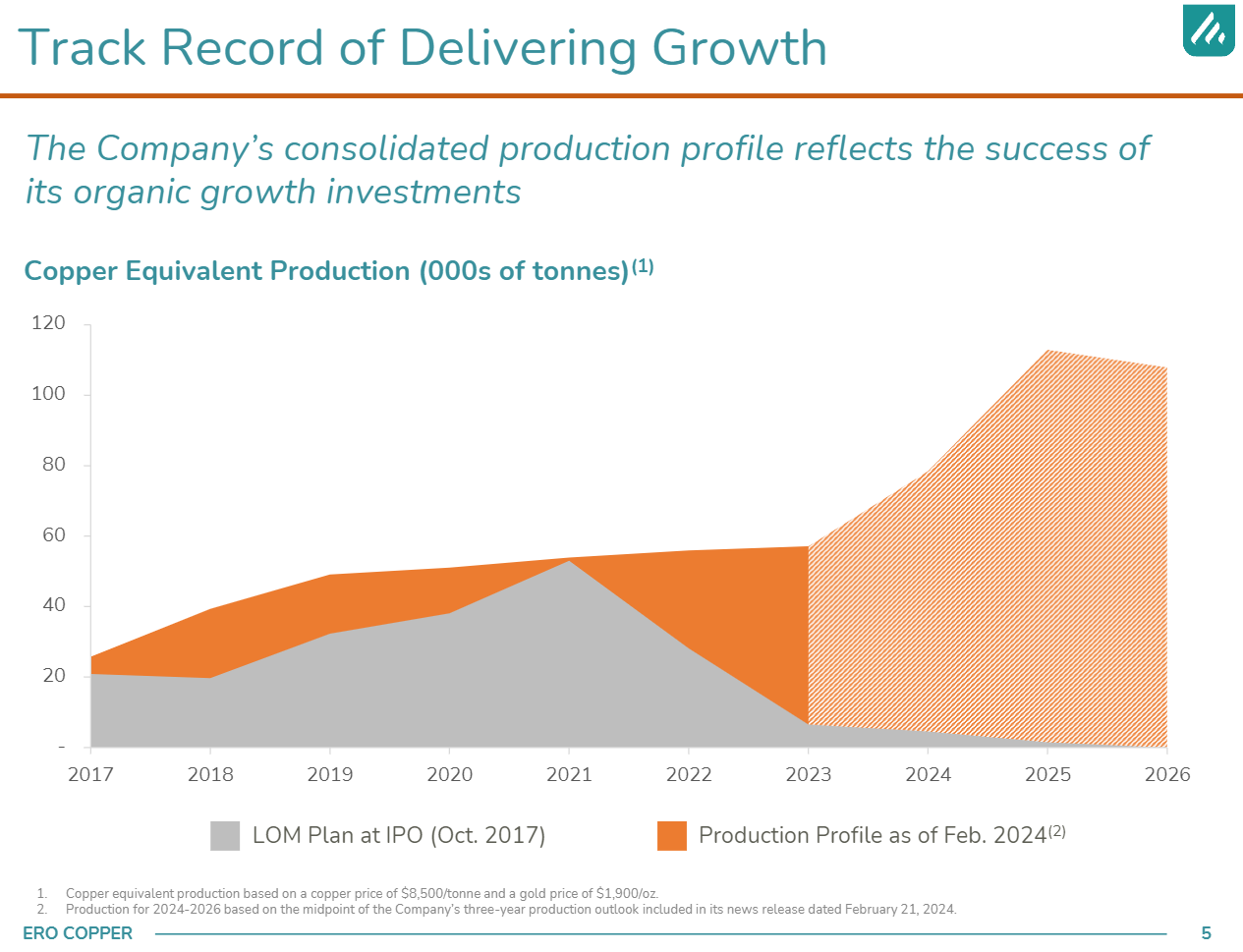

Another area of risk that might be limiting the upside to the stock price is the ability to sustain production levels over the medium to longer term. However, the Company has done a good job of exploration and extending mine life historically, and there is a good chance that it will continue to do so with reasonable costs / capex intensity:

The Company’s mine plan at IPO projected a sharp decrease in production starting 2021, but the plan has now been extended to 2040+.

Under the LOM plan released last year (see chart above), copper production was expected to decline back to 80Kt starting 2026+, but 2026 guidance has now been revised higher to 90 - 100Kt.

The Carabia operations have yielded some of the best copper drill holes in the world in the past 5 years (see chart below), highlighting the high geological potential of ERO’s operations.

ERO bought the NX gold mine in 2016 (now known as Xavantina) with almost no remaining mine life at the time, but the Company’s expertise has allowed it to continue to discover more gold, and the mine now has a LOM of 6 years.

In terms of longer-term growth prospects, the Company has 60% ownership in Vale’s Furnas iron oxide, copper and gold project in Brazil. This project provides a very long runway for ERO to grow production, but will also be very capital intensive. The important takeaway for investors is that if we do see a sustained bull market in copper that lasts many years, ERO will have a multitude of assets to grow production and take advantage. ERO is also in process of discovering a nickel project in Brazil. Even though this project is losing money at the moment, it could be sold to a mining company more focused on Nickel (Vale or Sibanye Stillwater for example), or ERO could collect fees to explore the deposit on behalf of such a company.

From a capital structure point of view, ERO is modestly leveraged with US$315mm of net debt, and net debt / LTM EBITDA of ~1.7x. The Company’s debt is all fixed interest rate, with the largest component being US$400mm unsecured note with a coupon of 6.5%. ERO has a credit facility with US$150mm limit, of which ~US$20mm is currently drawn.

Overall, I view ERO is a high risk, high reward stock. Given the significant growth capex and development risks over 2024, the stock could experience downside volatility if management is unable to deliver on its ambitious production plans on cost, and on time. However, if Tucuma production ramp is successful, I expect the stock to re-rate significantly, especially if the production increase coincides with higher copper prices. At the current stock price / valuation, I think the downside scenario is priced in more heavily than the upside potential. Management’s operational track record, and insider ownership (management owns 11% of the Company) should give investors additional comfort.

Filo Mining (FILO)

I usually avoid investing in exploration companies, but I find the investment thesis for FILO to be quite compelling. FILO is the ultimate long duration play on the copper bull market, one that you buy and hope to one day transfer to your kids. The Company is a Canadian-listed developer with operations in Vicuna district, in Argentina. The Lundin family, which owns a 33% stake in the Company, have operated in the region for many decades, and have worked closely with many presidents and country ministers. The Lundins have a long and successful history of global resource entrepreneurship, dating back to the 1970s, when Adolf Lundin built an oil and gas mining empire in the Middle East. His sons and grandsons have continued to grow the Lundin Group, often choosing to operate in remote, far-flung regions that others don’t dare to take on, with much success. Today, the Group operates in 25 countries through 12 companies.

In Argentina, the Lundins acquired the Bajo de la Alumbrera deposit in the 1990s, which became one of the largest copper and gold producing mines at the time. The same exploration team discovered the Veladero deposit, also in Argentina, which is now a producing mine for Barrick Gold. The Lundins then acquired a large landmass for exploration in between the region’s two famous copper and gold belts, identifying three early-stage exploration prospects which in 2009 were put into a company called NGEx Resources. NGEx then spun off individual mining projects into their own companies, with FILO being one of them, spun off in 2016.

The Filo property was what initially attracted the Lundins to the land package, with its turquoise-colored rocks visible from space, hinting at potential copper mineralization.

FILO was able to delineate a development project by 2019, and release a pre-feasibility (PFS). At the same time, FILO conducted exploratory drilling beneath the envisioned mine outline, and later announced the discovery of over 1km of copper mineralization. This suggested a much larger mineralized system lay beneath the project, and opened up potential for future exploration activities. To give you a sense for how deep this deposit is, the Burj Khalifa in Dubai is 828m tall, something the Company likes to illustrate in its investor presentation.

In 2021 FILO released what many consider to be a generational copper discovery. In addition to the high grades of copper that were discovered, the drill results indicated exceptional grades of gold and silver. Gold and silver byproducts add financial flexibility for FILO, as future byproduct revenue streams can be sold in exchange for an upfront capital investment to develop the mine. Follow-up drilling has yielded additional kilometer-scale intercepts and confirmed the exceptionally high grades of the deposit. The current mineralization is thought to be at least 7.5km across, and at least 1.5km deep, with massive testing volume of ~6km3. The boundary of the deposit is still unknown. Currently, there are 11 target zones identified where FILO is continuing its drilling activities.

FILO will not be an easy deposit to develop. The region where the deposit is located is extremely isolated, with no infrastructure. Upfront capital costs are going to be significant and transportation logistics will also be challenging, as the deposit sits thousands of meters above sea level. Up to US$8-US$10bn may be required to build the camp site. However, FILO can consider a JV partnership to help fund the mine development. BHP, which has a 6% stake in FILO, would be a logical choice for JV partner. There are also opportunities to share the mining infrastructure with other projects in the region. For example the Josemaria project, also owned by the Lundin Group, and the furthest advanced project in the region, could serve as a processing hub for multiple mines. Despite the challenges, I think FILO is in good hands for investors to achieve a good outcome. It would be hard to think of anyone more capable than the Lundins to solve the complex puzzle of exploring, de-risking, funding and building the infrastructure required to bring FILO to production.