It’s been around 2 months since I started adding to energy positions, and the rebound in the sector has been quicker and stronger than I expected. WTI hit US$83+ this week, up ~15% from my cost basis of US$72, representing a good opportunity to lock-in some profits. Below is a brief discussion on what I’m doing with energy positions.

WTI July $80 / $85 call spread: +100% (sell majority, leave small ‘runner’ tranche)

My original thesis for going long oil in the low-70s was threefold: 1/ geopolitical risks will remain elevated 2/ US production will slow 3/ trader positioning is too bearish. All three factors have now played out to some degree.

There has been no de-escalation in the Middle East or the Russia-Ukraine war. The Gaza war is continuing unabated, and the Houthis have continued their rocket attacks. The US has so far done nothing to restrict Iranian exports, but the situation remains precarious. Russian exports have declined recently due to a Ukrainian attack on Russian refineries. I believe that part of the recent rally in oil can be attributed to a re-pricing of geopolitical risk in light these ongoing developments.

With regards to US oil production, recent data has corroborated my thesis that the surge in supplies in Q3-Q4 last year was a one-time event. Production is currently running 0.4mm b/d below the December highs, and analysts are quickly downgrading their US oil production estimates, and revising higher their oil price forecasts for the year. Significantly more rigs / capex will be needed to repeat last year’s growth spurt, as DUC inventories are running low, and decline rates from flush production are high.

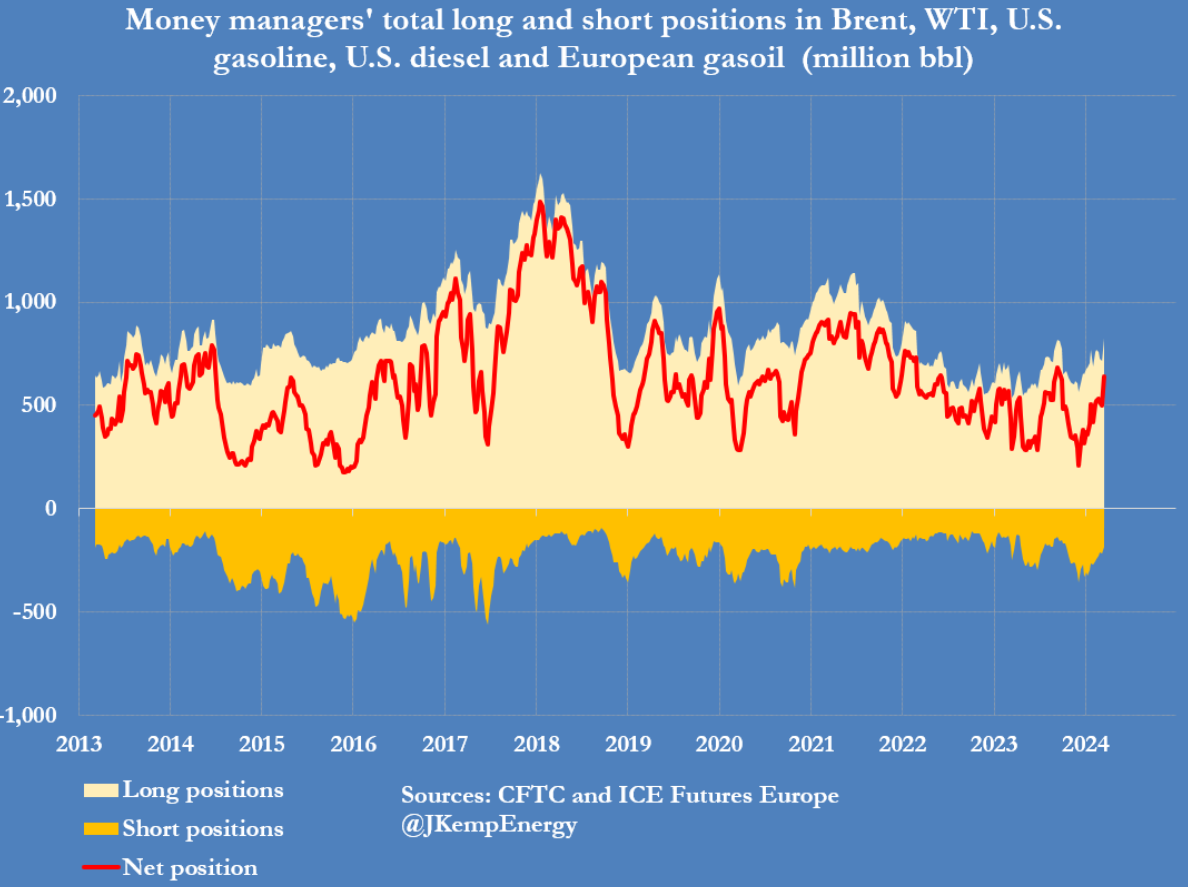

In response to the above, as well as continued resilience of the US and global economy, trader positioning has started to normalize. The recent COT (commitment of traders) data shows that hedge funds have been adding back crude exposure rapidly.

With trader positioning no longer skewed so heavily to one side, I think it’s prudent to de-risk the call spread position given its binary nature and outsized beta (though I have left a small ‘runner’ tranche).

If geopolitical risks flare up, US production continues to flatline, and/or global growth picks up, I can see oil going to 90+ or even triple digits. However, there are multiple buffers to minimize the duration of such a price spike. The Chinese growth story remains on shaky ground, and China has significant stocks in strategic reserve that they can release to temper oil’s rally. OPEC+ is sitting on significant spare capacity, and OPEC+ members are notorious for cheating on production quotas when oil prices rise. With the upcoming elections, the Biden administration is also likely to release some oil from the SPR to prevent an energy price spike (though the DOE has recently signaled its intention to refill the SPR). In the near-term, we are entering a seasonally soft patch for oil as refiners enter peak turnaround during April.

Offshore names

Transocean (RIG): +12% (hold)

Tidewater (TDW): +64% (trim ~50%)

Transocean (RIG) shares have rebounded strongly after dipping below $5 briefly in late February. I took advantage of the sell off to add to the shares and lower my cost basis. I’m now up +12% on the position and intend to hold the shares for the long term (2025+) as the offshore thesis is progressing favorably. Investor impatience / myopia is creating an opportunity for long-term holders in my opinion. I’ve discussed RIG’s most recent earnings and contracting activity here.

Tidewater (TDW) has been a big winner for the portfolio, and has now reached a valuation where I think it’s prudent to take some money off the table. When I first wrote about TDW, the stock was trading in the low-60s (I purchased shares in the mid 50s) which implied a ~6x 2024E EBITDA multiple. With the stock now trading in the low-90s, I’ve realized a 64% return in just 6 months. The EBITDA multiple has expanded to 7.6x. From a technical perspective, the stock looks overbought and ripe for consolidation.

TDW experienced a robust Q4 with FCF increasing nearly 110% QoQ as a result of improving dayrates, utilization and margin expansion. Average dayrate increased slightly to $18K from $17K in Q3, and is expected to be $22K in 2024. The Company has authorized a share repurchase plan of $48.6mm to return FCF to shareholders. As I stated in my original note, TDW has the opportunity to use its FCF to continue with accretive acquisitions and roll-up the OSV/PSV space.

On a YoY basis, revenues were up 56%, EBITDA 132%. Looking forward, the Company is guiding to $1.4bn in revenues and $635mm of EBITDA, which should equate to ~$500mm in FCF (excluding working capital changes), representing a 10% FCF yield on current market cap of ~$4.8bn.

Over the next couple of years, EBITDA and cash flow should continue to inflect higher as contracts roll off and the average dayrate converges with the current leading-edge dayrate of ~$30K. The leading edge dayrate should also continue to move higher and converge with newbuild economics, which would imply dayrates of $40K+. This means there is a path for TDW to generate $1bn+ in FCF (probably a 2026+ story), which could justify a market cap of $10bn+. I will take advantage of any weakness in oil prices over the coming months to add back the shares.

E&Ps:

MEG Energy (MEG): +30% (trim ~50%)

Whitecap (WCP): +2.2% (trim ~25%)

Baytex (BTE): sold at breakeven

Freehold Royalties (FRU): +15% (trim ~25%)

New position: Add Hemisphere Energy (HME)

MEG has had an incredible ~2 month run from my cost basis of ~$24 to the low-$30s. At US$80 WTI, I can justify MEG shares being valued as high as $40 / share. But given the speed of the recent run up, and the technicals looking overbought, it’s hard for me to not take some money off the table. A pullback to the mid-$20s would get me to start accumulating the shares again. My most recent thoughts on MEG valuation are here.

I’ve written about my entry and exit from Baytex recently here and here. There isn’t anything more to say on this name for now.

I haven’t written about WCP, FRU and HME previously, and a detailed discussion of all three would make this post extremely lengthy. Instead, I’ll summarize the thesis behind WCP for now, and write a separate post on FRU and HME.

Whitecap (WCP)

WCP is a light oil producer with inventory in both Alberta and Saskatchewan. The Company focuses on acquiring portfolios of low-risk oil assets in well-established plays, and then using enhanced recovery techniques to minimize natural declines and maximize production.

What attracted me to WCP originally is its M&A track record. It’s one of the few E&Ps I’ve analyzed that I believe has deployed capital into M&A in a countercyclical manner, and generated shareholder value in the process. Since the oil price sell off in 2015, WCP has consistently acquired assets when WTI has been <$60, vacuuming up several companies during the COVID crash, when the entire sector was trading at a fraction of its reserve value.

The result of these acquisitions is that WCP now sits on a vast land base with 6000+ drilling locations, that can be exploited for many years of production growth; the Company boasts impressive RLIs of 6 years for PDP, 13 years for TP and 19 years for TPP. Throughout these acquisitions, WCP has made prudent use of leverage and minimized equity dilution. As a result, FCF and production per share have grown at a mid-teens CAGR for more than a decade.

WCP has a successful track record of de-leveraging post M&A, and returning excess FCF to shareholders. In 2023, the Company paid down ~C$490mm in debt, bringing its debt / EBITDA below the 1x target, while also growing production and increasing its dividend to C$0.73 / share. The current dividend is sustainable down to $50 WTI oil price, with remaining cash flow being deployed towards share repurchases. The reasons I’ve trimmed only 25% of the WCP position is that I’m getting paid a 7.3% dividend yield to ride out the volatility in oil prices.

At $70 WTI, WCP generates ~C$500mm of FCF on market cap of C$6.2bn, representing a FCF yield of 8%. At $80 WTI this increases to ~$C730mm of FCF and a 12% FCF yield. PDP NAV per share is ~C$6.5, while Proved NAV per share is ~C$14.5.

It’s important to note that unlike an oil sands producer like MEG, that is limited in its ability to grow production, WCP management is targeting 3% - 8% production growth for the long term. If we take the mid-point of this target and assume a 5.5% growth rate, we can expect WCP to return 12.5% - 17.5% return at $70 - $80 WTI (FCF + growth). A convergence to Proved NAV implies 41% return on the stock price.

The one area I’ve been disappointed in recently is WCP’s capital efficiency and operating costs. In Q3, management increased capex guidance by C$250mm to C$1.1bn. However C$165mm of that amount is to build the infrastructure necessary for growth in the Montney and Duvernay acquisition (XTO), and avoid relying on third-party midstream operators. In other words, the front-loaded capex will allow management to de-risk future production growth. In the coming quarters I’ll be keeping a close eye on WCP’s operating costs per barrel and capex guidance.

While WCP may look close to fairly valued on a FCF yield basis, and may not have as much upside torque as some of the other E&P names, it offers an attractive cash yield, compounding return from share buybacks and production growth, M&A upside optionality and exposure to light oil that is complementary to my other core E&P holdings. Last but not least, WCP management has significant holdings of shares, aligning their interests with shareholders. Grant Fagerheim, who has been WCP’s CEO since 2009, owns 2.85 million shares valued at C$29 million. He is one of several insiders who have purchased shares consistently over the past couple of years.

Good timing and great start of the year! I am also not selling any of my RIG, VAL and BORR positions.

Any thoughts on natural gas? I entered a small starter position back in January in RRC that I intend to increase in upcoming dips. I believe it is a matter of time when US and EU prices converge (2025+ timeframe).