Revisiting Old Friends - Baytex ($BTE) and MEG Energy ($MEG)

Latest thoughts on a couple of energy names

A couple of weeks ago, I explained the logic behind why I had taken advantage of the sell off in oil and energy stocks to add a couple of my favorite names back to the portfolio. In this piece, I wanted to provide a brief update on two names in particular, MEG and BTE, both of which I’ve written about previously.

Baytex

Almost exactly a year ago, I wrote an article describing why I wasn’t a big fan of BTE’s decision to double down in the Eagle Ford through the Ranger acquisition. At the time the shares were trading at ~C$6 / share. With the Company paying down some debt, returning capital to shareholders (50% of FCF to shareholders in the form of dividends and buybacks), and the stock price falling to C$4 (in mid-Jan and early Feb) I decided the stock was worth a shot again.

There are a few other important insights that have made me more sanguine on BTE’s prospects:

The Eagle Ford acreage acquired through Ranger was comprised of two largely contiguous blocks, allowing for optimal development and lower costs per barrel.

The new CEO, Eric Greager, was previously the CEO of Civitas Resources, a Colorado-based shale E&P. He has extensive experience drilling in the Eagle Ford, and management is confident they can improve the productivity of Ranger assets through new and improved drilling techniques.

The deal gives BTE access to US Gulf Coast pricing; this allows BTE to sell its light oil at a $2 premium to WTI.

One of my major concerns regarding the acquisition was the quality of the acreage. Eagle Ford production peaked in 2015 and has since been steadily declining and getting gassier (higher GORs). However, despite my concerns, BTE has managed to maintain a high liquids weighting. The reason is that 60% of Ranger Oil’s assets come from predecessor company, Penn Virginia, which had a high oil cut (70%) and lower operating costs than BTE’s legacy Eagle Ford assets. Ranger’s other predecessor company, Lonestar Resources, has suffered from gassier production. However, Lonestar assets are now only 20% of BTE’s overall Eagle Ford reserve. Based on this asset mix, BTE should not have an issue maintaining its liquid weighting over the next few years (at least).

From a valuation point of view, BTE’s shares are undeniably cheap, and possess tremendous upside torque to WTI prices. At US$80 WTI, Baytex generates ~C$900mm of free cash flow (FCF), representing ~23% of its current market cap. At US$90 WTI, this increases to $1.2bn of FCF. Using the mid-point of 2024 production guidance (153K boe/d), the Company’s 2P RLI is ~11.5 years. This implies that at the current valuation, the market is ascribing no value to BTE’s reserves post 4 years of production (at US$80 oil price). I see the shares as having roughly 60 - 100% upside, based on a 12 - 15% FCF yield target at US$80 WTI.

The biggest risk with BTE is, not surprisingly, lower oil prices. Torque works both ways, and at US$65 WTI, the stock is likely worth <$3 / share. Another near-term risk is overhang from Juniper Capital’s holdings of BTE shares which it is slowly divesting (Juniper is a PE firm that owned 54% of Ranger assets, and was offered BTE shares as part of the consideration). Juniper still owns ~51mm shares of BTE, which represents 13x average daily trading volume. This could lead to pressure on the shares in the coming months, but with higher oil prices and increased capital returns, the shares should eventually re-rate higher.

MEG

The reason for buying MEG hasn’t changed since my original write up in 2022: 1/ long life (50 yr) reserves with minimal exploration risk 2/ strong operational track record 3/ value accretion through de-leveraging 4/ potential M&A / takeout premium and crystallizing value of tax assets. While MEG’s valuation is not as cheap / attractive today as when I was buying it aggressively in 2022 (share price <$20), I think it’s worth paying up a bit for the shares given everything the company has accomplished, and the continued upside torque to oil prices. I’m a buyer of the stock in the mid-to-low-$20s.

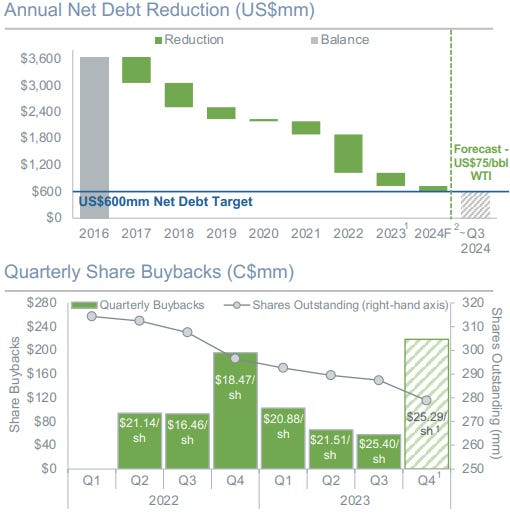

MEG expects to achieve its final net debt target of US$600mm by Q3 of this year (assuming WTI > US$75). This will represent a US$2.9bn reduction in debt since 2016, a significant accomplishment given oil price volatility and the egress issues facing Canadian heavy oil over this period. The company has also ramped up its share buybacks, buying back $898mm worth of shares since April 2022, representing 39.6mm shares, or 13% of the shares outstanding as of YE 2021.

Once the US$600mm net debt target is achieved, MEG expects to deliver 100% of FCF to shareholders. The Company’s 2024 capex program of $550mm to produce 102-108K b/d is resilient down to US$50 WTI. While MEG has had the reputation of being a highly indebted oil producer for a long time, the reduction in debt over 7 years has made the Company a lot more resilient to lower oil price.

Based on the latest cash flow sensitivities, at US$80 WTI, MEG should generate $955mm of free cash flow on a current market cap of $7.4bn, representing a 13% FCF yield. However, this calculation assumes US$16.25/bbl WTI-WCS differential. Which brings me to the other reason to own MEG: the company will be one the primary beneficiaries of the completion of the Trans Mountain (TMX) expansion. TMX is supposed to start line fill in March to May period after which it will be fully operational, giving Canadian oil producers access to the Pacific, and connectivity to US West Coast and Eastern Asia markets. With TMX operational, the WTI-WCS discount should compress to US$10-12 / bbl.

Not only does TMX compress the WTI-WCS differential, it also reduces the volatility of the differential. In the past, WCS differential would often ‘blow out’ to as high as $40 - $50 / bbl (i.e. WCS would trade at a $40 - $50 discount to WTI), due to pipeline bottlenecks. High production and/or unexpected US refinery maintenance would cause excess crude to build up in the system with no place to go, forcing Canadian producers to sell their oil at deep discounts and transport it through rail to prevent storage overflows. Recent examples include 2018 and 2020. In 2019 Alberta put mandatory production cuts in place to prevent WCS prices from dropping precipitously. As the Wall Street Journal recently reported, those days are coming to an end, which bodes well for Canadian oil producer cash flows.

MEG’s cash flow generation exhibits significant leverage to the WTI-WCS differential. Every US$1.00 decrease in the differential leads to a cash flow increase of C$47mm. With the differential expected to settle at US$12.00 / bbl after the startup of TMX, MEG should experience a C$200mm cash flow boost from TMX restart, relative to the sensitivities I stated above. This would imply FCF of C$1.15bn, or a FCF yield of 15% at US$80 WTI.

Based on MEG’s significant reserves (50 year 2P RLI at 105K b/d production), corresponding lack of exploration risk, as well as a long track record of operational and capital allocation excellence, I think MEG deserves a premium valuation. A 10% - 12% FCF yield target implies a share price in the mid-$30s to $40 / share using a US$80 WTI price, and a US$12 WTI-WCS differential. At US$70 WTI price this drops to $25 - $30 / share. One can also argue for an additional $2 - $4 premium for the Company’s tax pools, which would be attractive to a larger operator like Suncor or Cenovus with taxable income.