Not A Fan Of Baytex / Ranger Deal

FCF accretive, but Eagle Ford exposure and PE overhang are a deal breaker

I sold out of all my Baytex shares this morning. I had originally bought Baytex because of 1/ de-leveraging torque 2/ improved hedge book 3/ increasing shareholder returns 4/ Clearwater optionality. The deal announced this morning, while accretive on a free cash flow per share basis, makes the story a lot more complex / messy and is not really needed at this time in my opinion. It appears Baytex is doing the deal to increase its inventory and scale, but it had never been clearly communicated to shareholders that large scale M&A was on the cards. In fact, during the Q4 earnings conference call the CEO stated:

“On the inorganic side, I would say one never wants to do M&A for the sake of doing M&A or A&D, it's all in the interest of serving shareholder value creation. And so if you think about the marginal use of a company resource or the marginal use of an operating free cash flow dollar you say, look, I could pay down debt at whatever the return on that is. You can buy back shares at whatever the return on that incremental operating cash flow dollar is. You can reinvest in your business. Right now, reinvesting in our business is, by many multiples, the best return”

Based on this statement above, I’m a bit confounded by why the company thought it prudent to go out and almost double its size rather than continuing to de-lever, develop the Clearwater (one of the most economic plays in North America) and accelerate capital returns to shareholders.

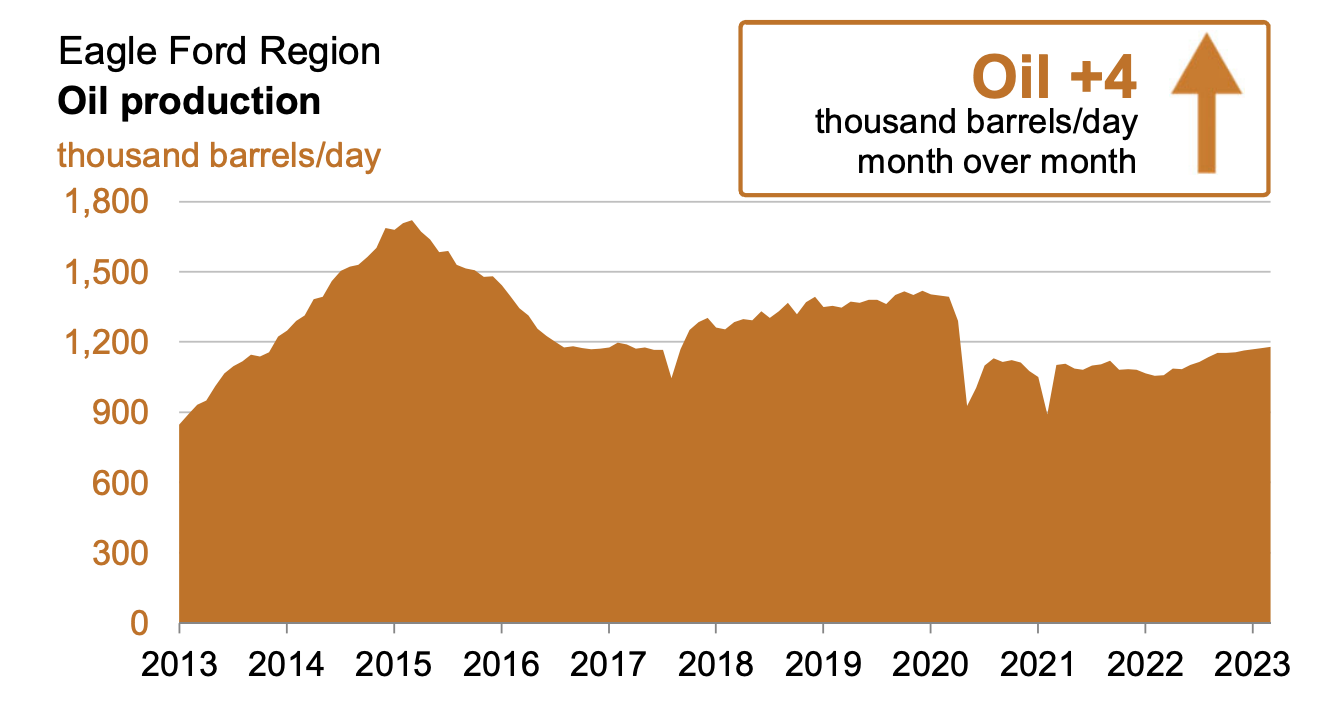

Eagle Ford is not a region that’s compelling from an acreage quality point of view. The basin’s production has peaked and productivity has been declining for some time now. This means there is a risk of higher declines (existing decline rate for Ranger is already pretty high at 35%) and greater than expected capex spend in the future to keep production stable.

In fact, in my original write up I had suggested that Baytex consider selling their existing Eagle Ford assets to re-invest in the core Canadian acreage. With this acquisition the company is headed in the opposite direction.

Due to the large equity component of this deal, Ranger shareholders will own 37% of the pro forma entity. Ranger is 54% owned by Juniper Capital, a private equity firm based out of Texas. I’m not familiar with Juniper and their mandate, but they have a short lock up (1/3rd free for sale in 3 mos, 9 mos, 12 mos) which could create overhang on the stock if they decide they don’t want to hold shares of the New Co.

Ultimately I didn’t buy Baytex for Eagle Ford exposure, I bought it for Peavine / Clearwater which is clearly no longer the focus. And while higher oil prices could make this deal work out, I’m not a fan of companies who do deals for the sake of doing deals / getting bigger which is what this feels like. I also can’t own a stock if I don’t trust the management team and this transaction has put a big dent in my perception of the company leadership. I’ll be rotating capital from Baytex towards my other oil holdings (MEG, Gear, Whitecap, OXY).