Baytex Energy - Improved Hedge Book + Clearwater Optionality

Baytex has been a core long oil position in my portfolio for some time, but I’ve been hesitant to increase sizing primarily because of their terrible hedge book. The company entered 2022 with almost 12% of production hedged at US$53.50/bbl WTI through a fixed-price swap and another 12% of production capped at US$58 - US$73 WTI through 3-way collars (put spread + sold call). 2021 was even worse.

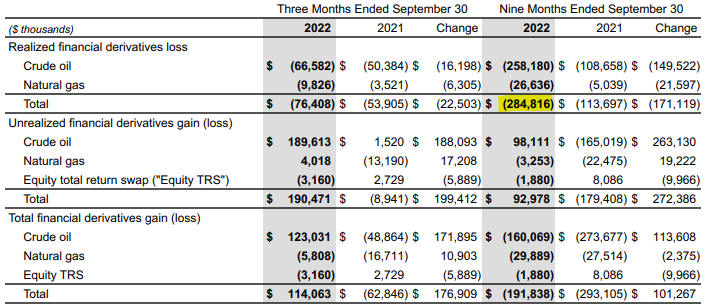

The result has been massive realized hedging losses over the last couple of years. During the first 9 mos of 2022 realized losses were ~$285mm. To put this into perspective, the company generated ~$480mm in FCF over the same period. As an oil E&P investor, losing that much upside during one of the best macro environments for oil in almost a decade is very bad outcome. I understand that hedging is important, especially when you have debt on the books. But having seen dozens of hedging programs across several oil E&Ps I’ve analyzed, I think Baytex’s hedges were definitely some of the worst in the industry.

Looking forward, it seems that the company may have learned its lesson. The proposed hedge book for 2023 is a lot lighter and at significantly better pricing.

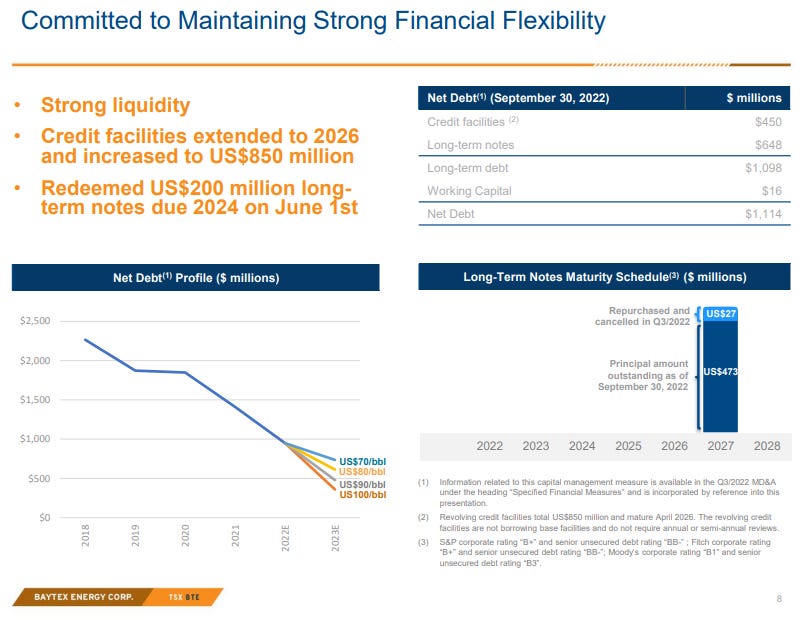

Baytex has also been de-leveraging rapidly with a 21% reduction in debt to $1.1bn (Q3 2022) representing ~1x 2022 annualized FFO, from $1.4bn at YE 2021. The company redeemed US$200mm of long-term notes due 2024 in June last year and extended its credit facility to 2026. This makes the leverage situation quite manageable going into 2023.

However, I think the primary reason for owning Baytex is the quality of the company’s acreage. Across its 5 plays (Peace River, Duvernay, Lloydminster, Viking and Eagle Ford), Baytex’s assets are almost all Tier 1/ Tier 1.5.

Baytex has >125 prospective sections in Clearwater/Peavine which is arguably the top conventional acreage in all of North America. The company is currently producing around 12K bbl/d from Peavine from ~28 producing wells (up from zero at the beginning of 2021) and it expects to produce 15K bbl/d over the long-term. But if the asset continues to be de-lineated and the company decides to deploy capital more aggressively, it could be producing as high as 50K bb/d in a couple of years. These wells are cheap, fast growth, very high IRR; Baytex’s development in the area has exhibited some of the best IP rates with the top wells clearing 1K bbl/d+ in peak production. In fact, Baytex holds the top 15 Clearwater wells drilled to-date.

Another attractive aspect of owning Baytex is its light oil production which diversifies my heavy oil exposure from owning MEG Energy and Gear Energy. As we have seen recently, heavy oil differentials have a habit of blowing out temporarily due to egress issues, refinery outages (and more recently release of heavy, sour barrels from the SPR). These issues will eventually be resolved with TMX expansion which will allow Canadian heavy oil to be exported to a more diverse set of buyers, but that’s most likely a 2024 event.

From a valuation perspective the company’s current market cap and enterprise value of roughly $3.3bn and $4.4bn respectively imply a FCF yield of 17% at US$80 WTI and 32% at US$100 WTI and EV / DACF of 3.7x and 2.6x (assuming mid-point production guidance at 87.5K bbl/d, ~4% growth). At a more reasonable valuation which accounts for the company’s FCF generation and growth potential (8-10% FCF yield or 5-7x DACF multiple), I can see a 2-3x return in the stock over the next 2-3 years.

To take advantage of the current undervaluation, the company is purchasing back its shares with 25% of FCF (with the remaining being used to pay down debt). After reaching US$400mm debt target, this will increase to 50% payout. At US$80 WTI this would happen sometime in H1 2024, but at US$100 WTI it could happen by the end of this year.

Conclusion

While E&P investors are solely focused on capital returns (dividends, buybacks) at the moment, as the oil bull cycle matures they will start to value asset quality and production growth potential as well. In a supply-constrained environment with higher-for-longer oil prices, companies that are able to grow production efficiently to take advantage of higher oil prices will fetch a premium multiple.

Baytex is currently projecting production growth at 4% (production per share growth of 8%) with a modest 2023 capital program. I think this can be ramped up in the right environment and at that time Baytex’s quality acreage will shine vs. peers. Baytex should also consider selling its Eagle Ford assets which are non-operating. Permian Eagle Ford acreage is selling at a premium to Canadian acreage, so it might make sense to divest those assets and re-deploy into debt reduction or accelerate development of core assets.

With the hedging overhang gone and significant upside torque from de-leveraging and Clearwater development, I think the shares are compelling here for a long-term hold.