While my portfolio is mostly allocated to uranium right now, I’ve been opportunistically adding to energy positions (sweet spot for me is low-$70s WTI, or lower) over the last few weeks:

WTI July $80 / $85 call spread

Offshore names: Transocean (RIG), Tidewater (TDW)

E&Ps: MEG Energy (MEG), Whitecap (WCP), Baytex (BTE), Freehold Royalties (FRU)

Oil and energy stocks have fallen out of favor over the past few months as expectations of sharp inventory drawdowns in Q4 never materialized. Demand growth has remained tepid, non-OPEC production (especially US Shale) surprised to the upside and sanctioned barrels (Iran, Venezuela, Russia) have continued to make their way seamlessly into the market. As a result, oil prices (WTI) dropped from the $90s in September, to the high $60s in mid-December. The major energy ETFs fell~15%+ from September to mid-January. The offshore names suffered an even sharper pullback, with my two offshore holdings, Transocean (RIG) and Tidewater (TDW), drawing down 41% and 26% respectively.

While some of the pessimism is warranted, I think investors have become too complacent and aren’t paying attention to the gradually changing macro and geopolitical landscape. Take this week’s developments for example: WTI prices declined from ~$79 back to ~$72 due to a combination of macro woes (Fed pushing back against a March rate cut), and the prospect of a ceasefire between Hamas and Israel. It seems to me that the market is missing the bigger picture:

A ceasefire, even if announced, will not lead to lasting peace in the Middle East.

The economy has remained resilient to higher interest rates for longer than anyone expected, and there is no reason to believe this will change in 2024 (especially with fiscal deficit still running at 7% of GDP).

The physical market has started rebounding, with global inventories drawing counter-seasonally, crack spreads and time spreads perking up, suggesting that global growth is healthy.

Let’s dig a bit deeper into the geopolitical angle. Since Biden came to power, Iranian production has increased ~50% to a 5-year high of 3.2mm b/d. After draining the SPR, the US government has decided to turn a blind eye to sanctioned oil barrels from Iran and Venezuela, which has played a major role in keeping a cap on oil prices. High oil prices are extremely problematic for Biden as they help Russia fund its war against Ukraine, and lead to higher inflation at home, which is politically damaging. While a ‘quiet de-sanctioning’ may have seemed like an elegant solution for high oil prices at the time, there is rarely a free lunch in geopolitics. By allowing Iranian crude exports to surge, the US government has given Iran access to billions of dollars, which it is now using to fund a proxy war in the Middle East.

After last weekend’s direct attacks on American troops, the US has responded with airstrikes on Iran-based militias in Iraq and Syria on Friday night. It’s also likely that the Biden administration will take some action to reduce the flow of oil from Iran. The market seems to be discounting this possibility because it feels Biden has too much to lose with higher oil prices. But fighting Iranian proxies, while allowing Iranian oil to flow freely, is the equivalent of trying to walk forward with one leg, backwards with the other.

Similarly, the market seems to be shrugging off what’s going on in Venezuela. Earlier this week, the US threatened to reimpose sanctions on Venezuelan oil after licenses expire in April. This was in response to President Maduro arresting members of the opposition party and barring them from competing in this year’s presidential elections. Oil exports by PDVSA and its JVs have risen 13% to an average of 700K b/d over 2023.

Investors also seem quite certain that US Shale will continue to grow strongly this year, with most analysts estimating growth of 700K - 1mm b/d. 2023 US shale growth surprised to the upside, with Q4 production back above 13mm b/d, representing a YoY increase of ~1mm b/d. While this seems to negate the new ‘capital discipline’ narrative for the industry, you have to dig deeper into the production mix to better understand what’s going on. The majority of the growth (~600K b/d) last year came from private producers (i.e. companies that are under private equity ownership). The majors and other independent, publicly-traded producers maintained production discipline.

Why is this important? The state of the HY markets, and the lack of PE investor appetite for fossil fuel investments, is not conducive to growth capex going forward. To a large extent, the growth from private producers in 2023 was the result of M&A and DUC (drilled uncompleted wells) drawdowns. A number of PE firms are trying to sell oil assets to the majors, and they want to show robust production growth to attract a rich valuation multiple. For example, CrownRock, which was acquired by Occidental in December, grew its production by 12% in 2023. Hess cut its DUC inventory to the bare operational minimum until its takeover by Chevron in October. Exxon has been drilling aggressively in the Bakken as those assets are a prime divestment candidate.

There is a strong case to be made that US production will not repeat the same pace of growth in 2024. In fact, recent EIA data suggests that the slowdown already started towards the end of last year. The EIA released its monthly oil production report this week for November, and while the headline number shows production of 13.3mm b/d, it also has a -315K b/d ‘adjustment’ factor. The adjustment factor is the balancing item which ensures that oil dispositions (oil added to inventory, plus refinery throughput and exports) equal oil supply (production plus imports). The EIA knows with a high degree of certainty the: 1/ inventory level 2/ refinery throughput and 3/ crude imports and exports (customs data). US oil production data is the most prone to errors because it’s survey-based, and because of by-products such as NGLs. Therefore, the negative adjustments are most likely over-stated production.

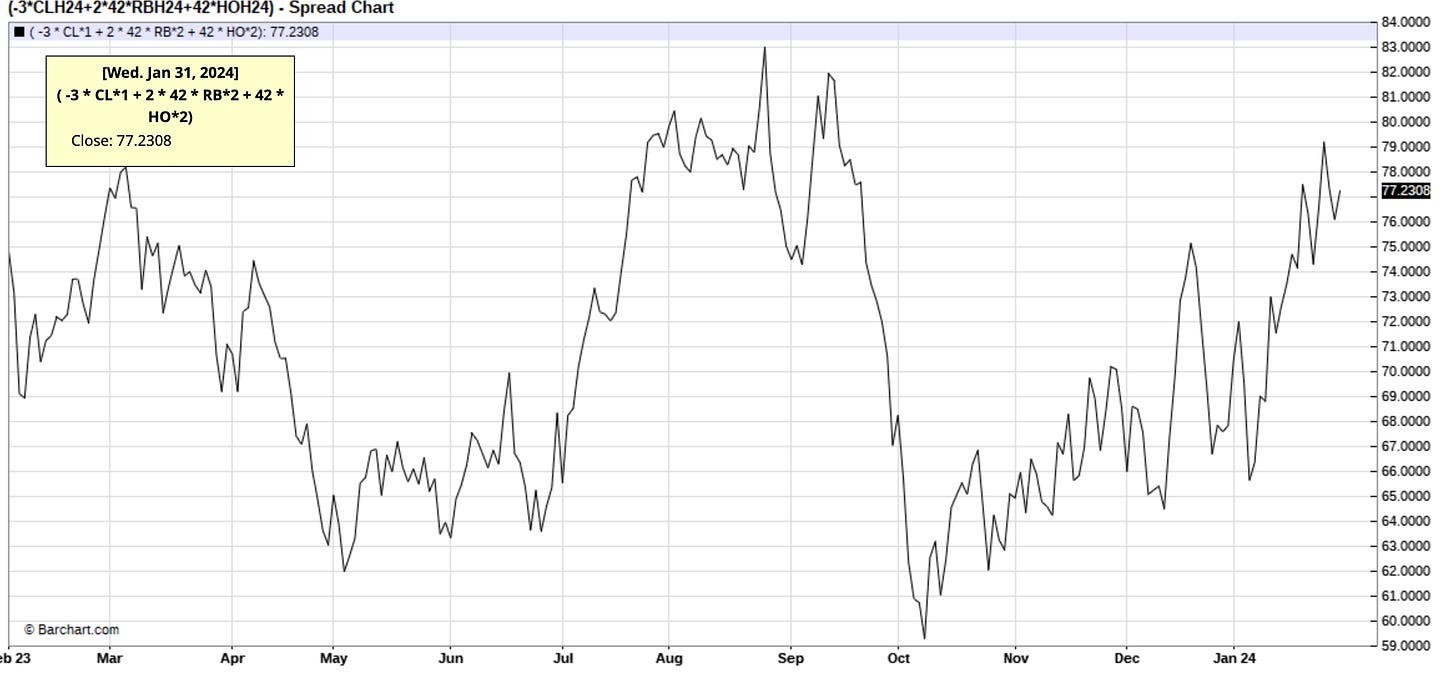

Finally, looking at the physical market, there are no signs of deterioration. Both US and global crude stocks are drawing counter seasonally, and while we are entering a seasonally weak period for oil in spring due to refinery maintenance, cracks and timespreads suggest that the market will tighten up significantly by the summer.

Brent time spreads are firmly in backwardation, after slipping briefly into contango in December. The 3-2-1 crack spread suggest demand is robust.

Meanwhile positioning is extremely pessimistic. Bloomberg reported at the beginning of the year that money manager short positions in Brent and WTI futures were the highest since March (SVB crisis) and the second highest since 2017.

CTA positioning is also extremely bearish. The chart below from GS shows that expected flows for WTI and Brent futures for systematic strategies are heavily skewed to the upside; CTAs would need to buy oil futures heavily if there was even slight positive momentum in oil prices.

With the market betting so heavily on one side, we don’t need much to see a positioning unwind. Supply disruptions due to a widening Middle East conflict, re-sanctioning of Iranian and Venezuelan crudes, slowing US production, and a resilient global economy could all potentially lead to a short squeeze in oil. OPEC+ also seems to be committed to their production cuts, with export data showing that Saudis are keeping supplies tight.

Summary

A bearish Q4 has led to a washout in investor sentiment in oil and energy stocks.

Higher than expected US production, de-sanctioning of Iranian and Venezuelan crudes and tepid demand have all kept inventory balances stable vs. the expectation of sharp draws.

However, while investors and traders are exiting the sector en masse, the fundamentals are starting to skew bullish:

The Middle East conflicting is threatening to spill over and cause supply disruptions, as well as renewed sanctions on Iran.

US oil production is slowing, as the one-time surge from M&A-related growth capex and DUC drawdown is coming to an end.

The economy has so far proven resilient to high interest rates, and real-time physical market data suggests that demand is still holding up.

Because of extreme CTA and money manager positioning, the market is vulnerable to an upwards squeeze.