Cutting Baytex ($BTE) (Again), Adding More Physical Uranium ($U.UN) and Transocean ($RIG)

Portfolio re-allocation

Unfortunately, my love-hate relationship with Baytex continues. After laying out the thesis for going long the stock just a few weeks ago, I’ve decided to exit the position post the Company’s Q4 and FY 2023 earnings report. While the operational performance during the quarter and the past year has been solid, I found some concerning updates in the year-end reserves report that put into question my optimistic re-assessment regarding the Ranger acquisition. I also found it troubling that the Company changed the format in which the NPV calculations were presented, making it harder for investors to assess the per share impact of the changes in the report.

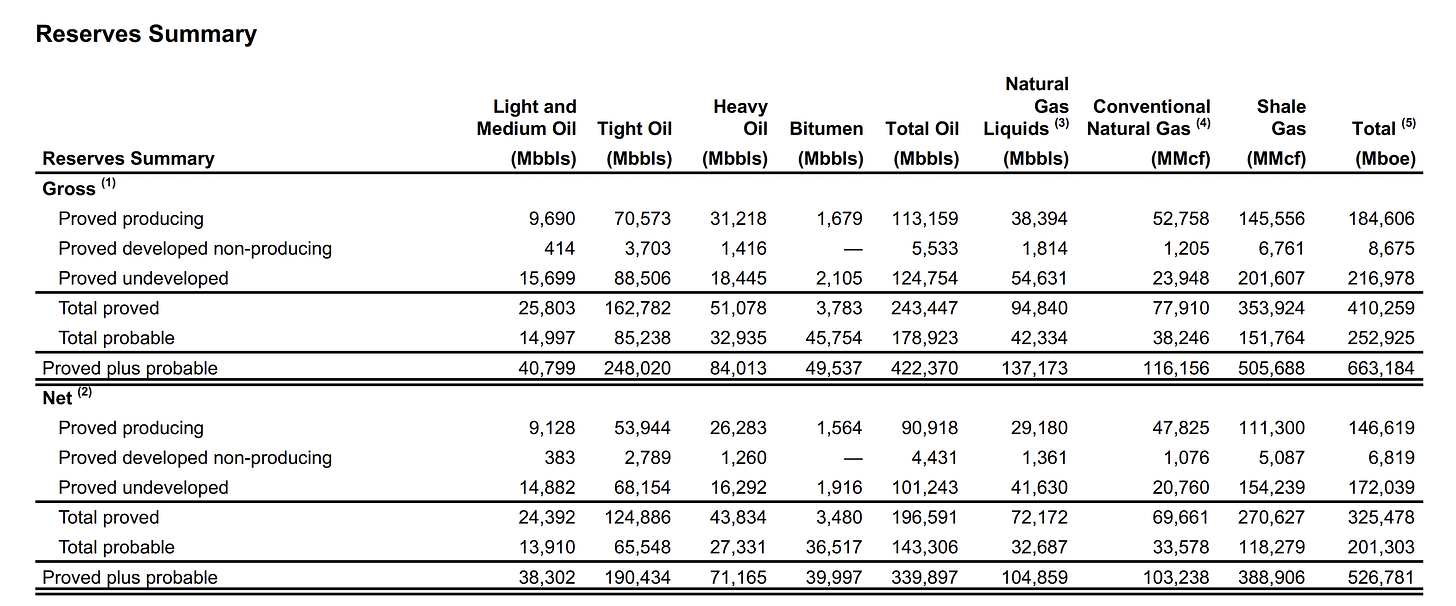

Below is the NPV of Baytex’s reserves as of 12/31/2023:

Historically, Baytex has presented these values both, in aggregate terms, and also on a per share basis. This year however, the per share data was omitted, and no explanation was provided for the change in disclosure. See the 2022 table below.

At year-end, the Company had $2.5bn in debt outstanding and ~822 shares outstanding. Subtracting the debt from the latest NPV figures and dividing by shares outstanding yields a 2P NPV per share of C$6.4 at 10% discount rate. This compares to a 2P NPV per share of C$9.3 in 2022, implying that the Ranger acquisition has diluted the Company’s reserves value per share by ~31%. Even more concerningly, the PDP (proved developed producing) NPV per share declined from C$2.6 to C$1.4, representing a 46% decrease!

In case you’re unfamiliar with E&P valuation, proved and developed inventories are the most important for investors when thinking in terms of margin of safety. Undeveloped reserves and probable reserves are much harder to estimate, and are reliant on a number of assumptions regarding operating and capital costs that have a high degree of uncertainty. As a result of the latest update, the current share price of Baytex is ~3x the PDP value, which means you are relying heavily on higher oil prices and / or the undeveloped and probable resources to justify your investment.

These figures suggest Baytex will likely find it challenging to maintain production levels without spending significantly on development capex going forward. The Company’s proved and developed resource (153.4MM boe) is only 29% of its overall resource base (526.8MM boe) and represents a PD RLI of only 2.7 years, assuming mid-point of production guidance (153K b/d).

Based on the above, I’ve decided once again that the stock is too risky to own. I’ve used the proceeds to add to my position in SPUT at around ~$27 and Transocean (RIG) at ~$5, which I believe represent more compelling risk / reward. I’ve talked about the uranium sell off recently, so I won’t repeat those points here. But there are some important updates on RIG that are worth covering.

RIG shares have continued their downtrend from last year as contracting activity and dayrate momentum in the offshore drilling sector has slowed. Stranded newbuild drillships (that were ordered ~10 years ago) and coldstacked drillships have eased the supply / demand situation, creating a temporary ceiling in dayrates in the mid-to-high $400K range. E&Ps are pushing back their drilling programs to allow for these stacked ships to be re-activated, and many are looking for longer-duration programs (3-5 years) to earn a dayrate discount. These longer-duration programs also take longer to negotiate, which is contributing to the slowdown in activity. Sentiment for RIG further soured in mid-February when the Company’s fleet status report showed contract awards and extensions at rates the market deemed lackluster:

Transocean Barents awarded 540 day contract in Romanian Black Sea at $465K

Deepwater Skyros awarded three-well extension in Angola at $400K

Barents is a 2009 vintage rig so a $465k rate is quite healthy (and a 22% uplift from its prior rate of $380K). Skyros is a 2013 rig, and was previously on a $310K rate. Despite these significant increases in dayrates, many investors are unhappy as dayrates of $500K+ are required for RIG to generate sufficient cash flows to de-lever its balance sheet and start returning capital to shareholders. Based on these developments, and RIG management comments on the earnings call, $500K+ dayrates are increasingly looking like a 2025-26 scenario.

RIG reported EBITDA of $122mm, down 25% QoQ. Cash flow from operations was $98mm with capex of $220mm, leading to negative free cash flow of $122mm. The drop in EBITDA and cash flow is primarily due to the $45mm increased O&M expenses QoQ and the $170mm increase in capex. The rise in O&M expenses was the result of rigs returning to work after undergoing contract preparation in the prior quarter, and higher in-service maintenance costs across the fleet. The higher capex is related to the acquisition of Deepwater Aquila (currently under construction), a 1,400 ton rig selected by Petrobras for a 3 year contract, bought out by RIG from its joint venture holding company last year.

For 2024 RIG expects revenues of $3.6 - $3.75bn, O&M expenses of $2.2bn, G&A expenses of $196mm, capex of $242mm (including $134mm for Deepwater Aquila). This should equate to EBITDA of $1.2 - $1.3bn and FCF of ~$250mm. RIG’s annual interest expense of ~$530mm is comfortably covered by the EBITDA. Additionally, RIG’s ample liquidity (revolver, cash / cash equivalents), $9bn in contract backlog, and the continued momentum in offshore capex spend, should alleviate any concerns about RIG’s financial leverage. Bond investors seem to share this view, with RIG’s unsecured bonds trading at close to par.

While these operating results might appear uninspiring relative to the current market cap and EV (~$4.3bn and ~$11bn, respectively), we have to skate to where the puck is going. Despite the recent slowdown in activity, the offshore thesis is continuing to progress, as evidenced by multiple offshore tenders awarded recently and offshore capex outlooks issued by operators. With US shale assets starting to mature and produce more gas, the largest oil producers are increasingly looking offshore where many projects break even at $40 / bbl, (Brent) and earn 30%+ IRRs at $70 / bbl. Oil service giant SLB expects $100bn of offshore FIDs for both 2024 and 2025. The RIG management team does a good job of laying out the demand outlook on a region-by-region basis during its earnings calls, which I would encourage investors to listen to carefully.

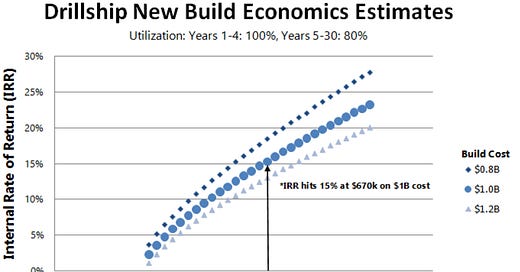

As offshore capex increases, and supply tightens, eventually dayrates will converge with newbuild economics (as discussed in my original note on the sector). Currently, tightness is showing up mostly in the shorter-cycle jackup market that has lower breakevens. However, as the jackup market becomes saturated, tightness will eventually move into the deepwater and floater plays which RIG specializes in. Below is an illustration of the dayrates required to breakeven on newbuild drillships, assuming a cost in the $0.8 - $1.2bn range.

Assuming a $1bn newbuild cost, dayrates would need to rise to $1mm+ to achieve the same IRRs as the last cycle (20%+). But we don’t need $1mm+ day rates for the RIG thesis to work. Given the operational and financial leverage, RIG possesses tremendous torque to even moderate upside in dayrates. At $500K dayrates, RIG EBITDA will inflect to ~$2.3bn. At $600K dayrates, EBITDA will inflect to ~$3.7bn. Of course, it’s not guaranteed that these dayrates will be achieved, and one has to keep close tabs on the developments in the sector to ensure the macro thesis is on track. But that’s what you are getting paid for as an investor. To earn a multi-bagger return on this stock, you need to be correct on the offshore thesis (dayrates converging to newbuild economics), you need to understand that timing the cycle is going to be hard, and you need to be able to tolerate high levels of volatility and correlation with oil prices in the interim (something I have alluded to in prior RIG write ups, but bears repeating).

A number of investors seem to be pessimistic regarding RIG’s debt position and the possibility of further equity dilution for coldstacked reactivations capex. I’ve already addressed the debt / liquidity issue above. For cold reactivations, it’s important to understand that management has been disciplined with capex, and that these rigs are not going to be coming online until they can earn a dayrate that earns an attractive IRR. RIG has also stated that they will be asking customers to pay for the re-activation costs, but even if this isn’t the case, RIG has a number of unencumbered rigs that can be used as collateral to raise debt financing to fund the re-activations. Debt-funded re-activations would be de-leveraging, as RIG would likely earn $75-$90mm incremental EBITDA per annum in exchange for one-time upfront reactivation cost of $75 - $100mm. Equity dilution is not necessary.

Some investors / analysts have also compared Valaris (VAL) more favorably to RIG (I also own Valaris 2028 warrants), because VAL is debt-free and already buying back shares with free cash flow. However, one should keep in mind that Valaris wiped out its equity holders in the downcycle to get to its current position. I think owning both companies makes sense given the very different balance sheets, cash flow profiles. RIG management made a not-so-thinly veiled dig at the competition / comparison in the latest earnings call:

“2023 will be remembered as a significant year at Transocean. We take great pride in being the sole company among our peer group of publicly traded international offshore drilling contractor to successfully navigate the financial challenges of the downturn, ensuring preservation of value for our shareholders”

So far, there is nothing I’ve read / seen to suggest that the offshore thesis is going off track and that dayrates won’t eventually rise to newbuild economics. Dayrates were ~$200K from 2016 - 2021, and now RIG is signing contracts at $450K+. Of course, RIG investors want rates to move higher even faster, but industry cycles move at their own pace. RIG management has successfully navigated the company through a vicious downcycle, despite having a mountain of debt. They have upgraded their fleet and positioned it to have the greatest upside torque on the upturn. They’ve also been very strategic about contracting, balancing the need for upfront cash flow with preserving supply capacity to earn the highest rates possible for the longest duration. While the market may not appreciate these factors at the present moment, I think the long-term strategy will reward shareholders handsomely in the coming years.