Uranium's Relative Strength: There Is More To Come

Contracting continues to increase as buyers are waking up to a new reality

After a brief pullback from $73 to $69, uranium spot prices are on the rise again reaching $74 on Friday. This is despite the broader markets being weak. The SPX and NDX were down 2.5% and 2.6% respectively this week. Meanwhile the Sprott Physical Uranium Trust (SPUT) closed up 1.1% and the uranium equity ETFs URNM and URA closed down 1.2% and 1.6%. If broad market weakness continues, I expect uranium equities to be dragged lower, however I also expect them to recover strongly once things stabilize given the tightening market dynamics and increasing investor awareness of the bull case.

In my H1 2023 Performance Review, I wrote the following:

“For uranium, investors remain apathetic despite rapidly accumulating bullish developments and rising spot prices. Just last week there was news of reactor extensions in the US and Europe. The Netherlands is exploring the development of two new reactors. In my mind, it’s a matter of ‘when’ not ‘if’ for uranium bulls, and the ‘when’ continues to be challenging to predict given the nature of the fuel cycle and the lumpiness of capital inflows to the sector. As we’ve seen with PG&E / Diablo Canyon, the spot market is already extremely tight and 1-2 big RFPs can trigger a big price move.”

I wrote the following earlier in June:

“LT contracting volumes suggest that the window is closing for utilities to secure their fuel supplies; once the limited capacity with major western miners like Cameco is exhausted, utilities will be forced to turn to the spot market which is already being pressured by financial players.”

And the following in April:

“If you can focus on only one variable / data point in the sector, it should be term contracting volumes; ultimately the supply / demand deficit will be crystallized by a pick up in utility contracting above available primary supply, pressuring both the term contracting and spot markets.”

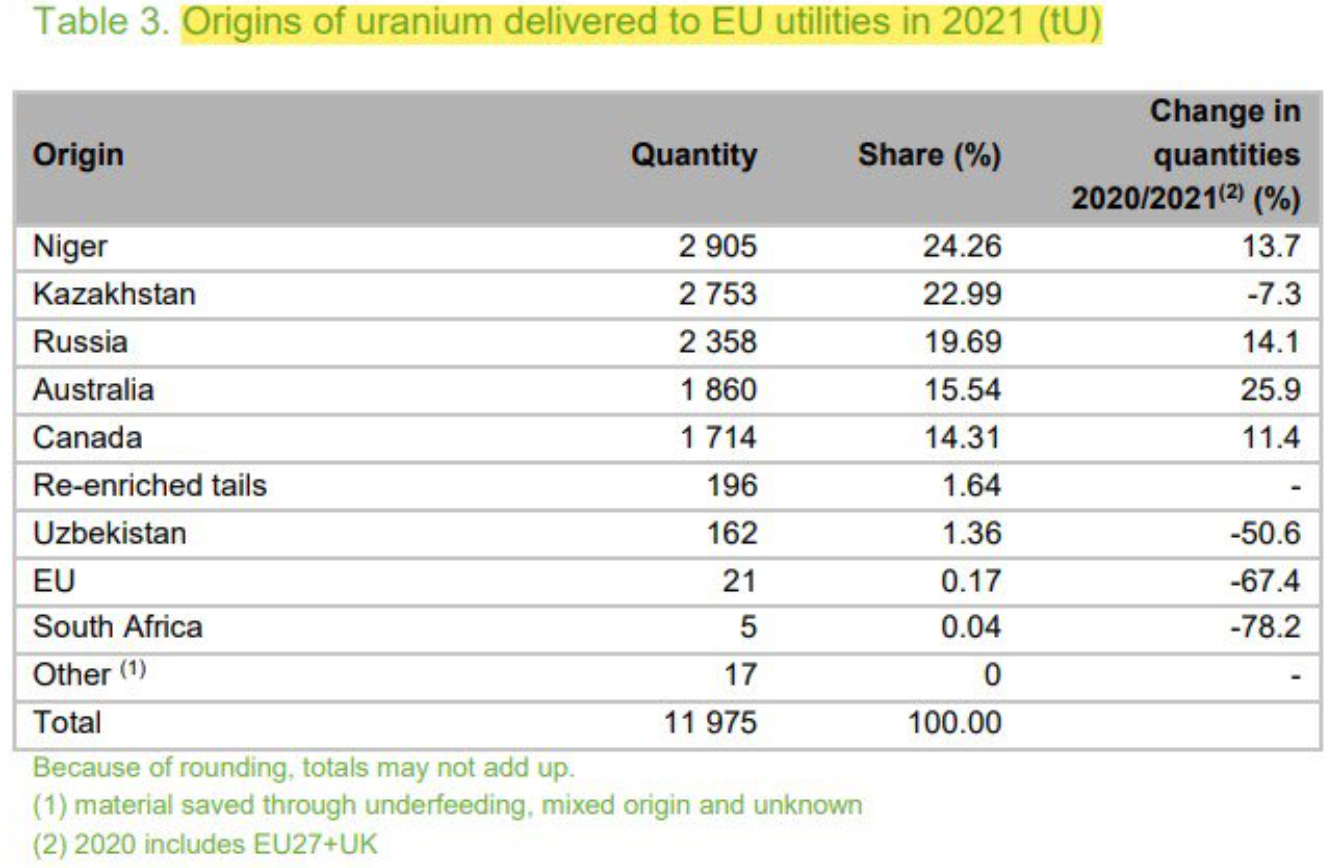

The above has proven to be prescient with contracting volumes continuing to rise, creating pressure on the spot price. There are currently 4-6 utility RFPs in the market that are struggling to get filled, most of them being from Europe. European utilities tend to be more proactive in terms of replenishing their inventory. They also have greater exposure to uranium from Kazakhstan, Russia and Niger, all of which are now geopolitically challenged regions to source fuel from.

The current annualized LT contracting rate is 192mm lbs. In contrast, primary supply is close to 135mm lbs. In the past, this deficit was filled by excess inventories, but those have now been exhausted. On the primary supply side, Cameco and Kazatomprom (KAP), the two largest uranium miners, are sold out until 2027. Cameco recently reduced production guidance from its Cigar Lake mine from 18mm lbs to 16.3mm lbs for this year, citing supply chain challenges and labour shortages. Cameco has already been buying uranium in the spot market to meet delivery obligations under its contracts.

Cameco had the following to say regarding production issues:

“This expected production shortfall further highlights the growing security of supply risk at a time when we believe the demand outlook is stronger and more durable than ever and where the risk has shifted from producers to utilities. Uncertainty about where nuclear fuel supplies will come from to satisfy growing demand continues to drive long-term contracting, with clear evidence that the broader uranium market is moving toward replacement rate contracting for the first time in over a decade. This is the type of contracting necessary to promote the price discovery already seen in the enrichment and conversion markets and that is expected to incentivize investments in the supply needed to satisfy the growing long-term requirements.”

Kazatomprom has become increasingly influenced by Russia, and it’s becoming clear that KAP’s production will be staying East (I covered this here), absent a sharp turnaround in Western relations with Russia and China. A few weeks ago KAP announced aggressive 2025 production guidance, targeting production that’s 6000 tU higher than its 2024 estimated production (2025 total production of 30,500 - 31,500 tU vs. 2024 production of 25,000 - 25,500 tU).

A number of uranium bears and skeptics pounced on this development to say that the rise in uranium prices will be over soon given the huge volumes that can ‘easily’ be brought online by KAP at the current prices. Before you get too excited about KAP’s production guidance, let me highlight a few observations:

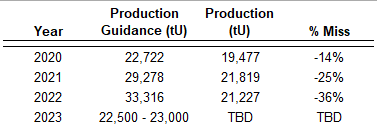

Below is a table showing KAP’s previous production estimates and the actual production:

Production has missed guidance every year since 2020, with very large misses in 2021 and 2022.

In 2021, KAP guided to 2023 production of 22,500 - 23,000 tU. In January this year the guidance was lowered to 20,500 - 21,500 tU.

With annual uranium demand tracking 200mm lb+ and the deficit estimated to be 40 - 50mm lbs, even if KAP managed to increase its production to the upper end of 2025 guidance of 31,500 tU (+26mm lbs growth from 2023 to 2025), that would still not be enough to cure the deficit.

It’s uncertain if any of these additional pounds will be going towards Western utilities.

KAP is in the process of signing a megadeal with China

The executive suite has lost 7 senior members since the company has come under heavy Russian and Chinese influence

Despite the recent spike higher in spot prices and the KAP announcement, the overall picture for the uranium market remains unchanged from earlier this year: demand for uranium over the next 12 - 24 months exceeds primary supply, and there is no way to fix that even if uranium prices keep rising. Utilities have under-contracted for several years and will increasingly find themselves at the mercy of the spot market. They will also find that the largest miners are already fully contracted for the next 3-4 years, which means they will have to resort to signing LT contracts with brownfield projects in care and maintenance or new projects like Denison, Global Atomic, which are not coming online until 2026+.

A number of utilities are also exercising their ‘flex options’ (option to increase purchase volume by 10-15% of the base contract amount) as they realize that the era of excess inventories and a loose spot market is gone. The switch from under to overfeeding is also triggering flex demand as enrichers are now demanding more U3O8 for the same amount of enriched product. All this flex demand will inevitably pressure the spot market as miners like Cameco, KAP and Orano don’t have the primary production required to cover the additional pounds required.

While contracting volumes are rising, it’s still early days for the fuel cycle. So far, it’s mostly the European utilities that have been putting out RFPs aggressively. North American utilities won’t be far behind (likely next year). Money is also continuing to flow into SPUT and the uranium ETFs, further adding to demand.

The bull market skeptics are wrongly focused on the plethora of global uranium projects that currently exist. Their contention is that there is more than sufficient uranium under the ground that, at current prices, will somehow all make it above ground on time. I have a simple question to probe this line of reasoning: If Tier 1 producers like Cameco and KAP haven’t been able to ramp up production on time and budget, and experienced management teams with brownfield assets are unable to either (see what happened with Peninsula Energy and Global Atomic as an example), is it reasonable to expect inexperienced and greenfield developers to do so?