Some Important Developments In Uranium

Market bifurcation, LT contracting, Zuri-Invest and spot market pressures

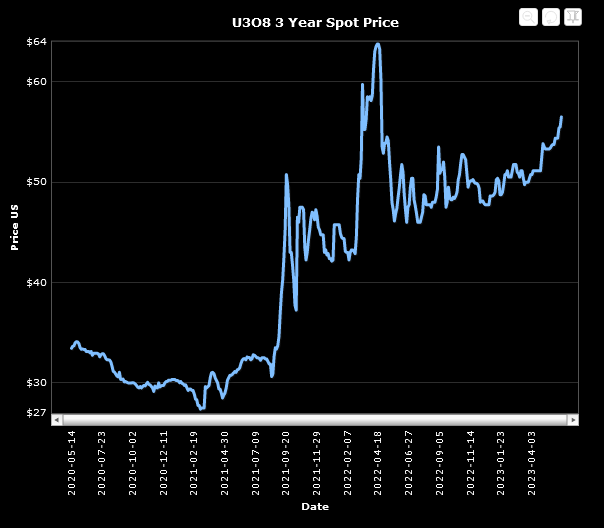

Over the last few days uranium spot prices have been grinding up from around $50 / lb to $57 / lb. Behind the scenes, a couple of important developments have been taking place. The east / west bifurcation thesis is solidifying with Kazatomprom (KAP) selling 49% interest in Budenovskoye -6 and -7 mine to Russia’s Rosatom. The deal is rumored to have been completed under pressure from Kazakhtan’s state-owned sovereign fund which owns 75% of KAP. These mines are very large, with potential production of 15mm lb/yr of U3O8. On May 25th, shareholders of KAP also approved a significant contract with China’s CNCC (a shareholder vote is required for transactions that are >200% of book value of KAP). Meanwhile legislation is moving through U.S. Congress to ban the purchase of Russian uranium. Similar efforts are underway in the EU.

I’ve also heard through the grapevine that force majeure’s are starting to ripple through the system. Converdyn (convertor) is apparently holding 2-3mm lbs of UF6 for the Russians which the US govt. is refusing to release and Russia, in retaliation, is holding back a few million lbs of enriched material to the States. With several million lbs of fuel material backed up, pressure is building on trading houses and utilities to secure supply from alternate sources.

PG&E’s Diablo Canyon plant is reported to have put in a bid for 6mm lbs of U3O8 last month (likely in response to its recent life extension) which was filled at $59 / lb in the mid-term market. A year or so ago PG&E would have submitted an RFP to the miners and if it came back at $59 / lb, they would have instead bought uranium in the spot market in a few 100K lb increments for close to $50 / lb. This recent transaction indicates that the days of loose U3O8 pounds floating around in the spot market is coming to an end. The supply / demand pressures that have been building in the nuclear fuel cycle seem to have reached the spot market.

As more western utilities look for alternate (western) fuel sources, the pressure on LT contracting and the spot market should continue to increase. Western enrichers are having to switch from under to overfeeding, creating 40 - 60mm lbs of additional U3O8 demand annually, in a market that was already in a ~20mm lb deficit. With Metropolis restarting in July, there is the potential for panic buying of enrichment capacity and corresponding U3O8 demand to meet the higher tails-assay requirements. Based on reporting by UxC, 2023 LT contracting is already 107mm lbs, relative to annual reactor demand of 180mm bls. 2023 is setting up to be the first year since 2012 when LT contracting volume could exceeded reactor demand, an indication that utilities are finally starting to wake up the reality of supply scarcity. As Tim Gitzel of Cameco warned utilities recently: “if you wait until 2025 to contract you’ll miss the contracting cycle and be exposed to a small discretionary spot market”.

Adding to all these demand pressures is increasing investor interest in uranium. A Swiss investment firm, Zuri-Invest AG, has launched a new uranium certificate that will allow investors to have exposure to uranium spot price. Unlike an ETF, the fund is structured to provide access to larger pools of capital by issuing certificates backed by physical uranium. The uranium is held in a storage facility owned by Cameco in Canada. When investors decide to redeem their certificates, instead of having to rely on a sometimes illiquid and volatile secondary ETF market, Zuri-Invest will sell the underlying uranium in the spot market to provide investors with the cash. The certificate’s NAV will be derived at the end of every trading based on Trade Tech’s U3O8 spot price. The fund has been rumored to have raised in excess of $100mm in funds and should be ready to deploy those funds in the spot market in the coming weeks.

Summary

Uranium market bi-furcation is accelerating with KAP’s recent actions aligning the miner more closely with Russia and China, and US and European governments looking to ban imports of Russian enriched uranium.

Western utilities are scrambling to find alternate fuel sources, putting pressure on western enrichment, LT contracting and uranium spot market.

LT contracting volumes suggest that the window is closing for utilities to secure their fuel supplies; once the limited capacity with major western miners like Cameco is exhausted, utilities will be forced to turn to the spot market which is already being pressured by financial players.

PG&E’s recent bid for U3O8 for Diablo Canyon should be a harbinger of things to come; a 6mm lb purchase lifted the mid-term market by almost 20%, and was contracted at a much higher enrichment tails assay than what the market is used to historically.

With the potential for commercial buyers panic-buying uranium, and financial buyers chasing / front running them, the chances of continued upward movement in uranium prices are high.