2025 Performance Review

A wild ride

Note: This will be the last post for the year as I’ll be taking some much-needed time off from the markets. I’ll be back to writing in the new year. Thank you for reading and Happy Holidays!

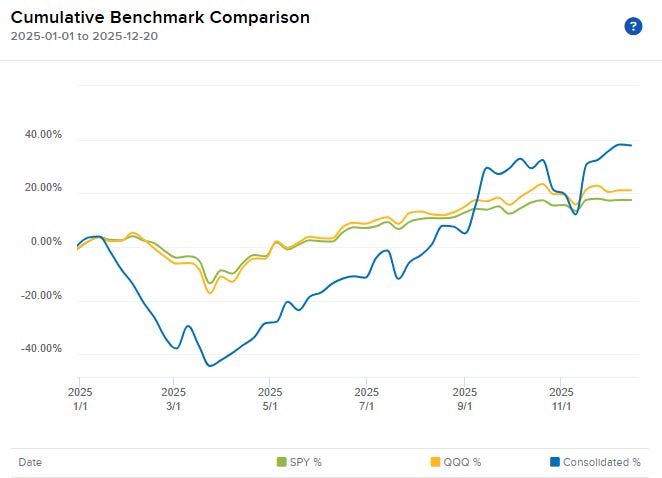

The portfolio is up 37.7% YTD and has returned a cumulative 174.1% since inception, implying an annualized return of 28.9% over roughly four years. This compares favorably to the SPX and NDX that have returned 16.2% and 20.6% respectively this year so far, and have annualized 9.5% and 11.7% respectively over the same time frame.

It was a year marked by high volatility, high portfolio turnover, and betting with courage and conviction. 2025 tested my abilities to the limit, but I’m happy to report that I survived, and came out of it with renewed confidence in my ability to navigate through all types of markets.

The portfolio was positioned aggressively coming into the year. I expected Trump to usher in a benign macro environment for stocks, and to be very bullish for the uranium and offshore sectors. The heavy concentration in these two themes led to a sharp drawdown starting in February, accelerating in March, and peaking in early April with the Liberation Day crash. Several of my top holdings fell 40-50% over this period.

The timing couldn’t have been worse, as I was just beginning to come to terms with the responsibilities of fatherhood. Watching one’s net worth drop precipitously while caring for a newborn, and a wife recovering from a third-degree episiotomy, is not for the faint of heart, to put it mildly. For any new parents, or soon-to-be parents, I would recommend moving to cash, or holding most of your portfolio in passive investments like ETFs, to avoid ruining your mental health :)

The uranium sector was particularly hard hit as a number of bearish narratives converged to raise fear, uncertainty and doubt, even amongst the most fervent bulls. I addressed these narratives in a note in early March, and took advantage of the continued sell off in March and April by switching a portion of my physical uranium position (SPUT) to higher torque bets like URNJ and long-dated call options on Cameco (CCJ). This was probably the most important decision I made this year. Cameco and URNJ staged a roughly 200% recovery from the trough in April, to the peak in October. While I didn’t catch the entire move, I caught enough of it to swing the portfolio from red to green by July.

Another critical decision was to exit the offshore sector. As the year progressed, it became clear to me that oil prices would remain weak due to a number of factors: 1/ OPEC+ was committed to increasing production (likely to appease Trump) 2/ sanctions on Russia and Iran were not leading to significantly lower supplies and 3/ tariffs and trade frictions were likely to put a cap on global oil demand. The offshore drillers earnings calls also suggested that contracting activity remained weak.

After exiting the offshore names, I thought deeply about the macro landscape, and where to redeploy the capital to make up for the losses. As Trump started to back away from tariffs (TACO trade), and the whole idea of fiscal conservatism started to unravel, I started to look closely at bitcoin and precious metals. It appeared the conditions were ripe for the ‘debasement trade’ to take off, a theme I’ve been writing about for several years.

Looking at the price action across asset classes, it appeared to me that gold and bitcoin were signaling a loss of confidence in the dollar. The plan to reign in fiscal deficits was no longer credible, and Fed independence was at risk. Global central banks had started buying gold aggressively for the first time in decades, in an effort to de-dollarize their reserves. There was also widespread speculation that the Trump administration had ushered in an era of increased grift, insider trading, and non-arm’s-length dealings.

The precious metals and the mining stocks looked like a bargain in this environment of eroding confidence in central authority. As I sorted through the precious metals names, I built conviction on Andean Precious Metals (APM), and accumulated a large position in the ~$3.5 range in July. I also added New Pacific Metals (NEWP) at ~$2.5 per share in October. At ~$10 and ~$3.60 respectively today, both APM and NEWP have earned handsome returns in a short time frame.

As the bitcoin rally faltered and stopped me out of my position, I doubled down on silver via calls on SLV and futures, which helped the portfolio to continue its outperformance. The silver futures curve has slipped into backwardation, signaling that shortages are continuing in the physical market, and that the rally is likely to be sustained. Silver’s implied lease rates in London are currently ranging between 7% - 8% (vs. the historical norm of -0.5% to +0.5%), providing a second data point to validate the tight physical conditions.

After decades of lackluster performance, silver is facing the perfect storm of accumulated deficits, rising industrial demand, and a macro environment that is supportive of investment demand.

During a bull phase, silver and gold trade as momentum assets, and rallies become self-reinforcing: the longer gold and silver sustain their bull run, the greater their credibility as stores of value, and the greater the investment demand. It is worth noting that despite a strong demand pull from the East, most portfolio managers in the West still have minimal (1-2%) exposure to precious metals. Goldman Sachs estimates that every 1bp increase in portfolio allocation towards gold increases the price of gold by 1.4%.

Last but not least, my investment in Millennial Potash (MLP) is worth highlighting because it holds important lessons for idea generation and capital allocation. Despite being unfamiliar with the potash market, I was able to make a quick decision on MLP from one single data point: insider buying.

It all started when someone sent me a message highlighting that Ross Jennings, a major investor in MLP, had been buying the stock recently and that the company might be worth exploring further as a potential investment. As the saying goes: “there are many reasons insiders sell, but there is only one reason they buy”. Ross was not just buying, he was going in HEAVY.

It took me only a few hours of research to realize how undervalued the stock was, and the potential for a massive re-rating from an imminent catalyst in the form of an updated resource estimate. This opportunity existed because of MLP’s small market cap, which meant it had no analyst coverage, and little / no institutional interest.

The day after I published my note on the company, MLP released an updated MRE with a >200% increase in both measured & indicated, and inferred resource. The stock is up ~57% since, and is likely to be acquired at a significant premium next year, which is why I remain long.

MLP is a great example of how retail investors can develop an edge by turning over rocks in the small cap space, and thinking critically. It also teaches a lesson that sometimes the best ideas don’t come from weeks of intensively researching a company or a sector, but from simply honing in on a few crucial factors that the market has missed. Despite having done a lot more work on several other stocks in the portfolio, I decided to sell a significant chunk of those positions to make room for MLP, as it offered a better upside potential in the near-term. It’s important to not get anchored / biased towards ideas based on how much time you’ve spent on them.

To wrap things up, I want to touch briefly on some of the other ideas I’ve mentioned on the blog. I’ve taken some profits on uranium and precious metals positions to add to some of these recently. I hope to write more detailed updates early next year:

The company is suffering from a crisis of confidence due to management’s inability to meet deadlines, and lack of clear revenue guidance. With the acquisition of Renergen about to close, I’m expecting management to provide firmer guidance on run-rate revenues and EBITDA.

The spin off of QLE will add further clarity with respect to the strategy and financial profile of each of the various business segments (medical isotopes, semiconductors, nuclear/HALEU etc.). Converting the MOU with Fermi to a binding contract will be a major catalyst.

While I’m down on my position, I remain long and think that the market has become too pessimistic with the current enterprise value <$500mm (pro forma for cash from the most recent capital raise). I am waiting for more clarity on revenue guidance, and the QLE spin off, to add more to my position.

Commercializing isotopes like Ytterbium-176 and Silicon-28 is no small feat, and while delays are never welcome, they’re not a deal-breaker to me given the complexity of the technology, and the long sales cycle (customer due diligence, feedstock delivery and preparation etc.).

With tin prices above $40K/t, AFM should be earning roughly US$100mm in EBITDA every quarter, on a current enterprise value of C$1.5bn / US$1.1bn.

Unfortunately, despite US involvement in the region, the DRC remains prone to violence, with the M23 recently having seized the city of Uvira in South Kivu (Alphamin’s Bisie mine is in North Kivu). This news forced me to exit my position a few days ago as it put into question whether US involvement can be a force for lasting change in the region.

While there are reports that M23 is withdrawing from the city, it’s unclear what M23’s intentions are longer-term, and whether Rwanda will bow to pressure from the US which is threatening sanctions if Rwanda doesn’t de-escalate.

For now, I’m staying out of the stock until I see firmer evidence that US pressure is working. Given the amount of cash flow AFM is generating at the current tin prices, I expect the company to announce a bonus dividend that will likely re-rate the stock higher if the geopolitical situation calms down.

The market remains asleep on the wheel on this name despite mounting evidence that the biofuels market will recover next year, and the company’s MRL subsidiary could potentially double the current run-rate EBITDA.

MRL’s decision to focus on sustainable aviation fuel (SAF) will pay off handsomely as environmental mandates are putting a squeeze on the SAF market, especially in Europe.

The EPA’s finalized RVO, and SRE reallocation decisions remain the key catalysts to unlock the value potential in the stock. I believe this will play out in the first half of next year.

Meanwhile, the base business (SPS + PB) is performing well and can support the current valuation. This is a classic ‘heads I win big, tails I don’t lose much’ situation. I remain long, and own some January 2027 call options.

New Stratus Energy (NSE)

In the Q3 earnings press release, NSE stated that it expects to sign a new joint venture deal to acquire and develop existing oil and gas production blocks in Colombia. The company is also close to exiting the Mexico venture (Soledad), resulting in termination of all obligations related to the contract, and a reimbursement of capex outlays.

This is another situation where the market cap is so small (<C$60mm) that very few investors are interested, and any good news could re-rate the stock significantly. The company stated it expects to close these transactions before year-end 2025, which suggests they are in final negotiations with the counterparties. This remains a significant long for the portfolio and I’ve added to it recently.

Other recent adds / exits (more details on these in the new year):

Adds: BORR, Meta, Global Atomic (GLO), Comstock Inc. (LODE).

Exits: Iris Energy (IREN), Greenland Resources (MOLY).

Great performance!

Have a good Christmas break with your family! Usually not one to comment but i have thoroughly enjoyed all of your posts and thoughts, keep it up.

We have a fair bit of overlay in our portfolios there, hoping for good things in 26 from the ASPI/LODE stories. Had a look at MLP around the same time but couldnt pull the trigger - instead, researched the EQR.ax turnaround story and build big convinction there and sized this up. If you havent looked into, take a look. This might be up your alley, the risk/reward here looks excellent and expect a big re-rate in 2026 (comparing to Almonty the valuation gap is immense).

Keep up the posts, it is appreciated!