Uranium Update

Addressing the bear thesis

Housekeeping Note:

This will be a longer post as I haven’t had a chance to address the numerous bearish arguments that have emerged in the uranium space over the past few months, so bear with me.

Reflecting on the new demands on my time with parenting responsibilities, I’ll be writing at a lower frequency going forward (once every 2-3 weeks vs. weekly). Topics that will be de-emphasized for now:

Macro updates

Short-term trades

Non-core ideas (anything that’s <10% position)

If you have questions on any topic I’ve written about (past or present), you can always DM me and I’ll respond when I get a chance.

As always, thank you for your readership and support.

It feels like death by a thousand cuts for uranium investors. Every couple of months, a new bearish narrative takes hold of the sector. With utilities still on the sidelines, and the spot market continuing to grind lower, investors have been capitulating in waves, leading to precipitous declines in the stocks. Many of the equities are in process of retesting or breaking their lows from last summer, during the Yen carry trade unwind.

On Monday, January 8th, the sector was gripped by fears that new, more efficient AI models from Chinese company DeepSeek would invalidate the thesis for nuclear power. More recently, news that Microsoft (MSFT) is canceling numerous datacenter leases has further soured sentiment with respect to AI-related capex, with some fearing a potential cancelation of the Three Mile Island (TMI) restart.

Of course, in a sector known for knee-jerk reactions, investors haven’t paused to think about how much AI demand is currently penciled into uranium demand models (the answer is almost none). Those who have done their homework however, know that the uranium thesis doesn’t need AI. It’s AI that potentially needs nuclear power / uranium to be viable.

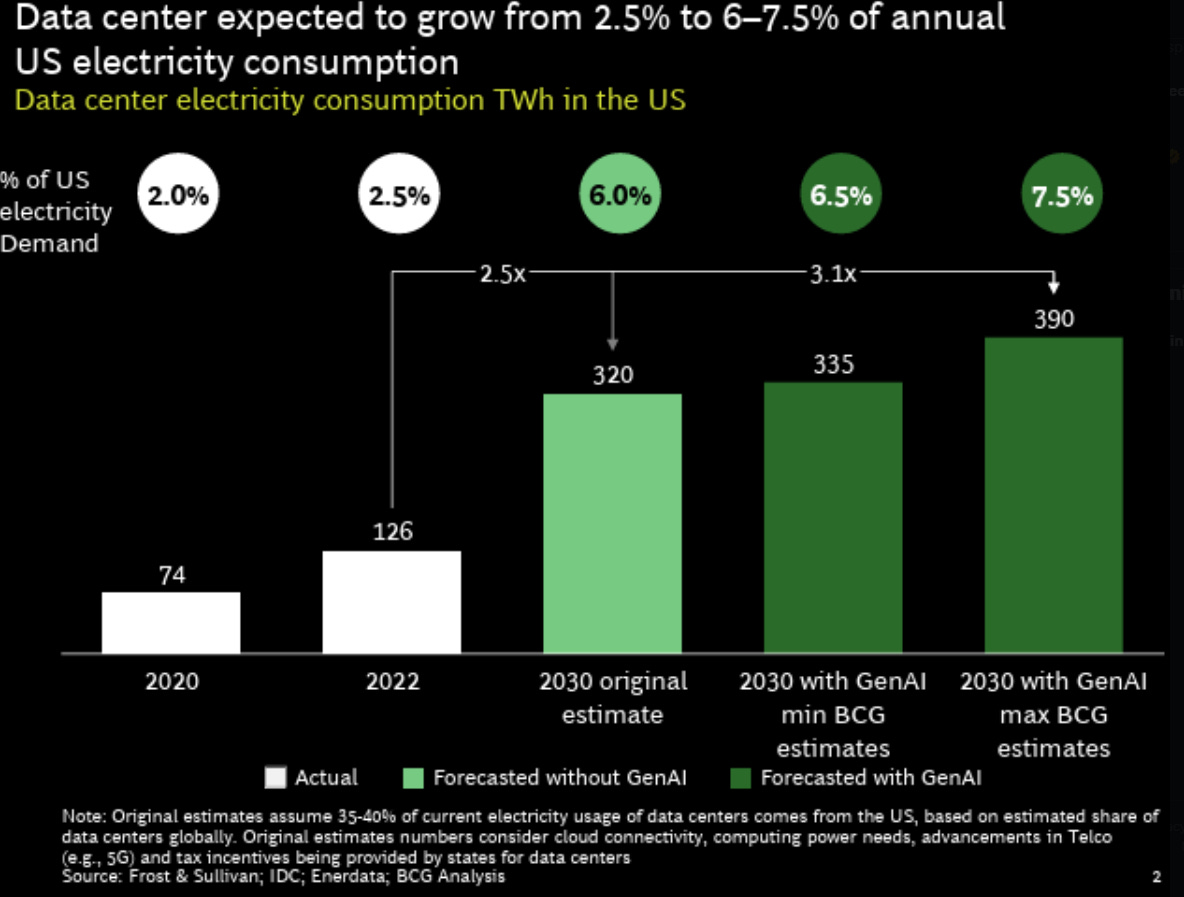

Long before the AI hype took off, datacenter electricity consumption in the US was expected to more than double by 2030 (see slide from BCG below), driven by cloud connectivity, telco advancements (5G) and increased computing needs. Outside of the US, electricity demand is booming due to urbanization (especially the increased usage of air conditioning), manufacturing and EVs (e.g. China). AI or no AI, demand for electricity is going up worldwide, and more nuclear power will be required to meet these needs.

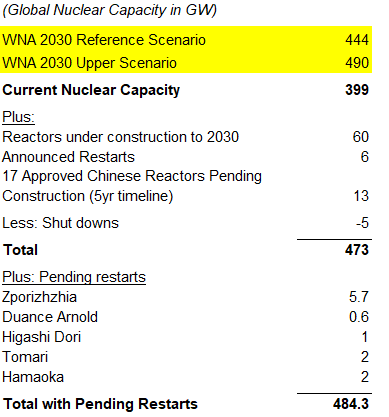

To further assuage demand concerns, lets put some numbers behind the existing pipeline of nuclear projects, ignoring any future AI-related demand factors:

There are currently ~65 nuclear reactors under construction, 60 of which are scheduled to come online by 2030.

Additionally, there are 17 reactors approved by China that have yet to start construction, and could potentially come online by 2030 (China has a ~5-6 year build timeline).

There is also an increase in demand from announced restarts (net shut downs).

Finally, there are some potential restarts that have a decent probability of getting approval in the coming years.

In the table below I’ve laid out the math bridging us from today to 2030, illustrating that based on the current pipeline alone, and assuming zero new demand from SMRs or any other newbuilds, power generation is comfortably on track to be above the WNA’s 2030 reference scenario, and potentially on track to be near the upper scenario if the pending restarts come to fruition:

This ‘base case’ scenario implies a primary demand for uranium of ~250mm lbs by 2030, roughly 30% higher than today.

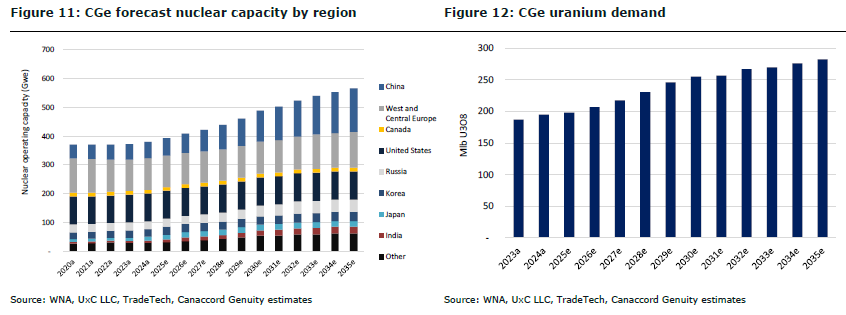

The big question investors should be asking is where the uranium will come from to meet this ‘base case’ demand growth, given primary supply is currently well below primary demand (~160mm lbs vs. ~190mm lbs), and struggling to grow. Canaccord Genuity summarized the situation well in a recent sector update report (emphasis mine):

Our base case supply demand model - which projects deficits over the next five years - excludes incremental demand from datacenter and AI-related new builds. There are currently 65 reactors under construction, representing >70GWe of additional capacity (one of the highest construction levels since the mid-2000s and a major trend reversal post-Fukushima).

In an interview last year, Mike Alkin of Sachem Cove emphasized the structural nature of the deficit as follows:

There are huge structural deficits in this market, in the contract market, where annual consumption is greater than annual economic supply. Significantly more so by 2030. 25% of the supply that is needed to meet the demand in 2030 does not exist. It is not a mine. It's not permitted. It’s not financed, nothing.

In my opinion there are significant odds (>50%) that some SMRs will also come online in the 2030s, and that additional new builds / restarts will be announced to service AI-related demand from hyper scalers, which will be a cherry on top of the cake. Investors appear to ignore the fact that more efficient AI models could ultimately lead to greater adoption of AI (and greater power consumption) as a result (Jevon’s paradox).

Digging deeper into MSFT’s recent moves, it becomes clear that the cancelation of datacenter leases is a recalibration, not a retrenchment. With the focus shifting from pre-training to test-time compute (inference), MSFT is trying to maximize agility to meet evolving AI demands. Shifting to a test-time compute, ‘inference first’ world, does not negate the case for more compute demand (and hence, more power demand). However, it shifts the type of compute needed, towards more 50-100MW datacenters geospatially and cost-optimized for inference, vs. large (1GW+) datacenters.

A recent report by Morgan Stanley adds that the recent changes also reflect MSFT’s evolving relationship with Open AI; i.e. MSFT is letting Open AI chart its own course, with more AI infrastructure spending to be allocated to the new Stargate project with SoftBank going forward.

One of the pushbacks I regularly receive from investors is that many of the supply / demand drivers I’ve mentioned are a 2027+ problem, and since utilities are covered for the next year or two, there is no reason for anyone to care in 2025. I think this is a myopic view, and suggests a lack of understanding of the nuclear fuel cycle:

It takes 18-24 months to complete the fuel cycle, starting from yellowcake to conversion, enrichment and fuel fabrication. With geopolitical bifurcation and increased supply chain fragility (as evidenced by the spike in conversion and enrichment prices), the whole process might take even longer. This means uncovered needs a few years out are today’s problem.

It takes 10-15 years to bring new mines online (in a best case scenario). The deficits in 2035 and beyond are also today’s problem.

With spot price at $65 / lb and term price at $80 / lb, there is little incentive to start new mining projects today.

Inventory levels are low by historical standards. The lack of inventory coverage in light of the future deficits and geopolitical risks is something that needs to be addressed at present.

SMRs require 5-10 years of fuel upfront as they are designed for extended operation without shutdowns. They also require HALEU (20% enrichment, vs. 3-5% for LEU), which is currently only obtainable from Russia. Even though SMR demand is many years out, the upfront fuel needs and geopolitical dependency mean that the U3O8 required for fueling needs to be secured sooner vs. later.

A second major reason investors have dumped their uranium holdings is the possibility of peace between Russia and Ukraine. Once again, I fail to understand the rationale behind this thinking, given Russia is primarily a provider of services (enrichment), and not uranium (U3O8). In fact, Russia’s U3O8 needs have surged recently given accelerated EUP deliveries to the West, and fuel loads for new plants (Rosatom reactors are sold with lifetime fuel supply).

If the Russia-Ukraine war ended tomorrow, not much would change:

Utilities would continue to buy Russian EUP (as they are at present) as the ban doesn’t start until 1/1/2028.

Utilities will continue to search for Western enrichment alternatives, as it would be risky to continue relying on Russia, even in a post-war scenario.

The post-2027 picture would also remain unchanged; the ban on Russian EUP is not a ‘sanction’, and would require Congressional repeal of a law that passed with unanimous bipartisan support. I think a repeal of the ban is unlikely due to several reasons:

The ban is designed to force the restart of the US’ domestic nuclear fuel supply chain, and was required to unlock $3.4bn in funds for building and expanding domestic production of LEU and HALEU.

Some of the funds have already been awarded (Orano and Urenco) and have been met with billions in additional private spending commitments.

Ending dependence on Russian (and Chinese) conversion and enrichment remains a national security priority (reinforced under the new DoE)

Even if the ban is repealed, the uranium deficit would still exist. The calculation for U3O8 demand and supply is done on a worldwide basis, and is only impacted by Russian enrichment services to the extent that they lead to Western under / overfeeding.

In other words, a repeal of the ban would alleviate pressures on Western enrichment, and make overfeeding less likely, which would be a ~5-7mm lbs swing in potential secondary demand.

Notably, most analyst models do not include any impact of overfeeding in their models to begin with.

Interestingly, I haven’t seen much discussion of positive catalysts emerging from the resolution of the conflict:

Greater clarity on Russian EUP would allow utilities to shift their focus upstream vs. downstream (i.e. yellowcake vs. EUP and UF6)

A rebuilding of Ukraine’s infrastructure would be good for power demand. The massive Zaporizhzhia nuclear facility (5.7 GW), which is currently in cold shut down and under Russian control, could be re-started, leading to an additional ~2mm lbs of U3O8 demand.

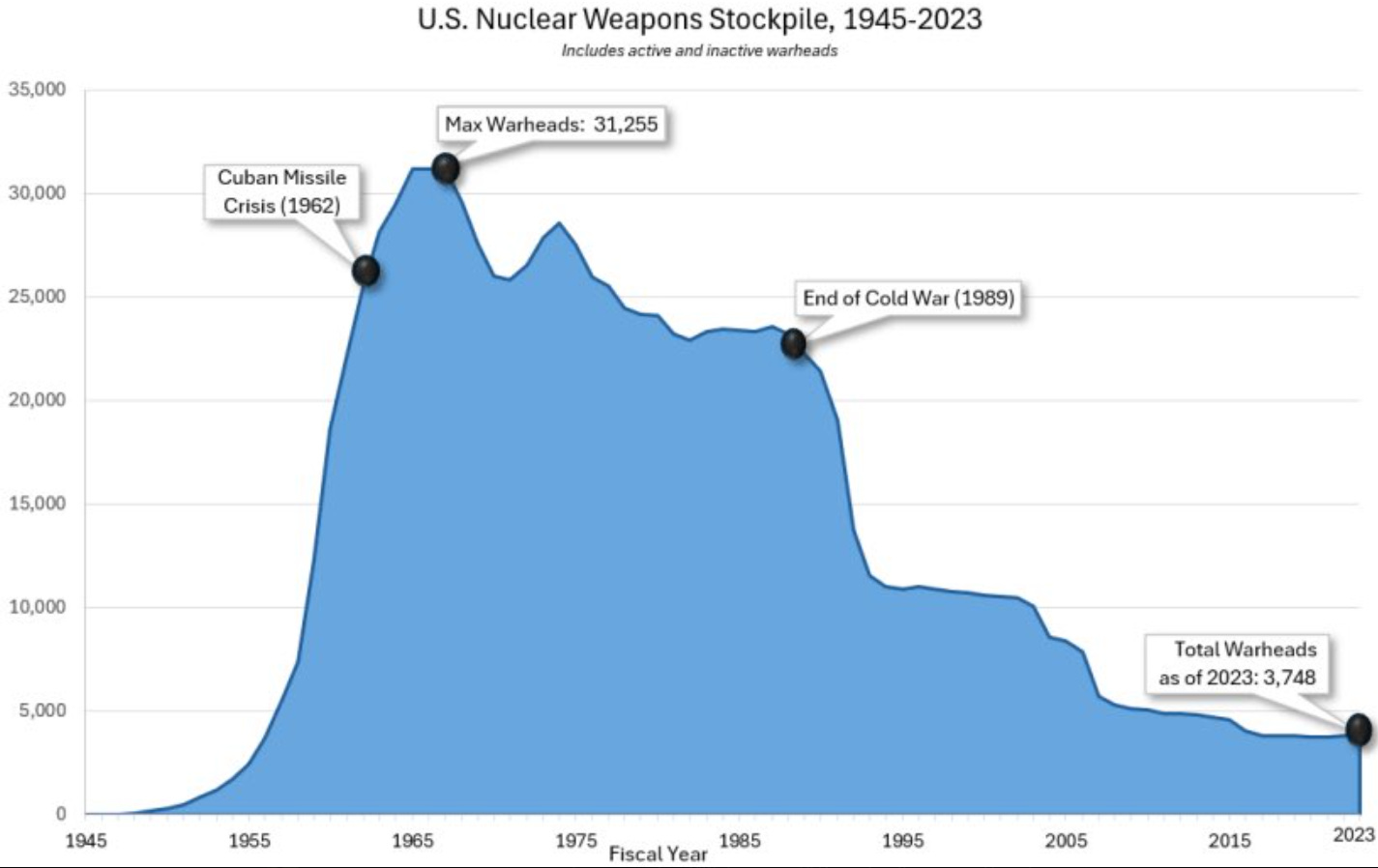

What about Megatons to Megawatts (MTM) 2.0? It’s a stretch to think that Russia and America would rush towards a nuclear disarmament pact given the current geopolitical setup. The original MTM program (1993–2013) was a unique post-Cold War disarmament effort, and is unlikely to be repeated as it would contradict the current administration’s emphasis on energy independence. However, since some investors panic sold their uranium holdings at Trump’s mention of ‘de-nuclearization’ talks with Russia, let’s entertain the possibility.

The first major hurdle to such a program is that it would require extensive negotiations given it would represent a major shift in US-Russia relations. While Trump is eager to end the war in Ukraine and normalize relations with Russia to appease the US electorate, the deal would be a lot riskier for Putin; Russia would agree to reduce its nuclear arsenal, and agree to increased IAEA audits, with no guarantee that future US governments would continue their friendly posture towards Russia. The revenues from selling down blended HEU would be miniscule relative to Russia’s oil exports, and would cannibalize Russia’s existing LEU exports.

Second, the deal would require significant infrastructure preparation, regulatory and legal approvals (Congressional review in the US) and bi-lateral commercial agreements. Governments, the companies involved in the down blending process, and regulatory bodies, would all need to agree on key terms, pricing, timelines, safety measures, auditing, and funding. Combined with diplomatic negotiations, the whole process could take 2-3+ years from the start of negotiations, to the production of the first down blended LEU. At the present moment, there are still significant doubts regarding the resolution to the war, let alone normalization of relations with Russia.

Last but not least, the stockpile of warheads and HEU available is much smaller this time around vs. the last program. The original MTM deal converted 500 metric tons of HEU to roughly 15K tons of LEU over 20 years, or 750 metric tons of LEU per year (7200 metric tons / ~16mm lbs per year of U3O8). Since then, the US and Russian nuclear weapons stockpile has reduced significantly. Russia’s HEU inventories have been reduced by 50%+.

Let’s assume a new MTM deal is signed to down blend 100-200 metric tons of HEU over 20 years. This would displace around 3-6mm lbs / yr of U3O8 demand. While this is nothing to sneeze at, we have to remember that: 1/ we are talking about a highly improbable scenario based on the current geopolitical dynamics 2/ by the time the supply comes online the deficit will be even larger 3/ the new supply could easily be absorbed by SMRs and pending restarts (e.g. Zaporizhzhia restart alone will consume almost all the 2.2mm lbs in additional supply per year).

Having dealt with the two major ‘fundamental’ bearish argument, let me touch briefly on broader market dynamics. It’s no surprise that the violence of the selling we are seeing in uranium stocks coincides with a sharp sell off in the SPY and QQQ. Given the sector’s small market cap and volatility characteristics, it’s one of the first positions to be sold during broad de-risking. The recent stretch of selling in the indices is the worst since August last year. Uranium investors will remember well what happened to their uranium holdings in August. Unfortunately, until utilities return to the market, and term and spot prices start their next leg upwards, the uranium sector is going to continue experiencing strong correlation with sectors like AI, energy, metals and mining etc.

Of course, this all begs the question of when utility buying will return. I’ll be the first to admit that timing utility demand waves, and corresponding bull run in the equities has been extremely hard. Based on all the positive developments last year, I expected a strong pick up in contracting activity in the second half of the year, but I was clearly wrong. A new administration in the White House, geopolitical uncertainty, and accelerated EUP deliveries from Russia to the West in 2023, have all kept utilities out of the market.

What I can say with some confidence however, is that we are closer to the end of this correction than the beginning. The table below from BidBird10 on X shows how utility buying comes in waves, after long pauses that can stretch 10+ months. As Grant Isaac of Cameco said recently:

Utilities will go through very prolonged periods where they’re out of the market together. And then they’ll go through these periods where they all enter the market together.

The red cells in the table below indicate times when utilities were out of the market, and term prices were largely flat. The green cells indicate times when contracting activity picked up, and so did term price. The trend since 2020 is clear: every time utilities pick up their contracting activity, term prices rise significantly. In the last buying wave (2023-2024), term prices rose from the mid-$50s to the high-$70s.

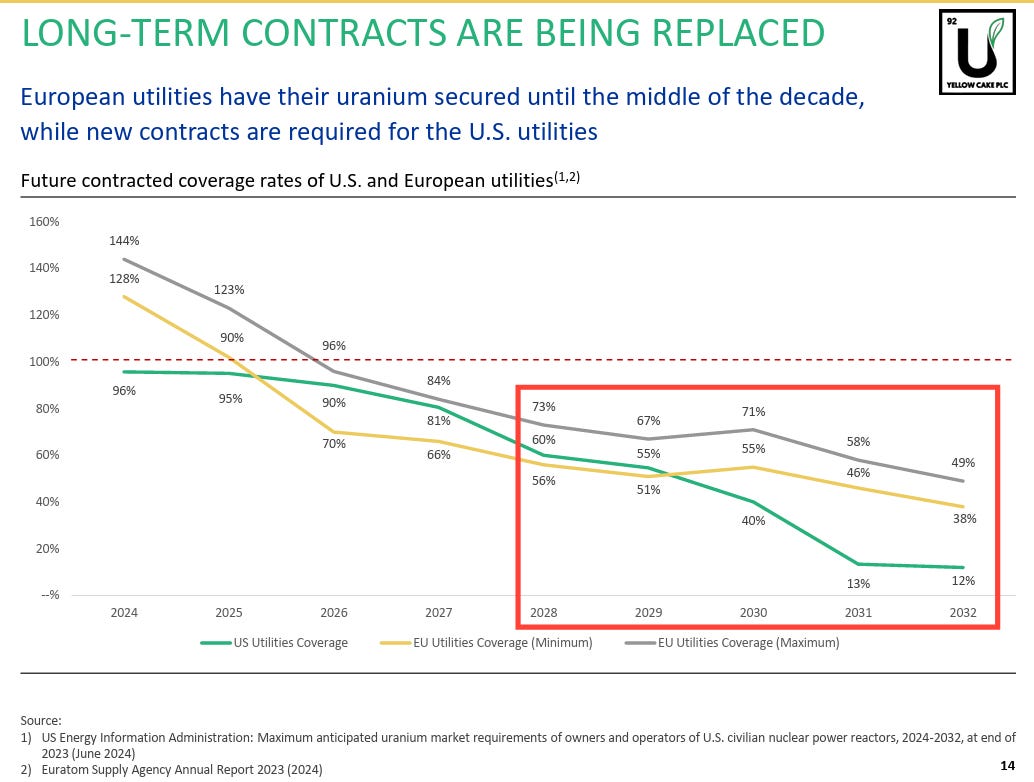

It has now been almost a year since the term price made a significant jump higher (which has also soured sentiment in the spot market). Utility coverage falls off significantly starting 2028. As a US fuel buyer with ~40% of fuel needs uncovered a few years out (see utility coverage chart below), I would not want to wait until the last minute to contract, especially in light of production target misses, Kazatomprom contracting out more than half their future production to China, and the impending demand wave from the global nuclear renaissance (and potentially AI).

I expect to see increased contracting activity later this year push term price into the $90s, or even triple digits. This will likely result in the market going into backwardation once more (spot > term), attracting financial players / speculators, and driving the equities significantly higher.

The other near-term catalyst for the sector is clarity on the new US administration’s nuclear policy. While the news headlines are currently dominated by tariffs and Russia, I think energy will be back in the headlines as the DOE will make some splashy announcements with respect to new nuclear capacity in the States. The new energy secretary, Chris Wright, has spoken several times about unleashing the “Golden Era of American Energy Dominance”. The launch of SMR or AP1000 newbuilds in the US would be hugely constructive to the sector and investor sentiment towards uranium.

The DOE is also expected to finalize contracts with 10 companies for the LEU and HEU reserve program this summer, using the $3.4bn in funding I referenced earlier. The contracts will require procurement across the fuel chain, including U3O8. This will lead to much needed contracting activity, and price discovery in the uranium market. The NRC is expected to announce its decision regarding the restart of Palisades power plant in Michigan in the summer as well.

Conclusion

It’s been a rough ride for uranium investors. In all humility, I did not expect uranium stocks to be dumped to this extent in light of the various supply and demand tailwinds; markets can be humbling.

At the end of the day however, the only rational thing to do is analyze / re-analyze the data and fundamental case for your thesis, and decide whether to buy, sell or hold the investment. I think the market’s fears with respect to AI demand and de-nuclearization are misplaced, that utility contracting cannot be deferred forever, and that there are a number of positive demand catalysts on the horizon with respect to US nuclear policy. I remain bullish.

A very cogent, well-thought-out overview. The trade has been tough sledding recently, but as your research shows, the math is the math, and the industry seems to believe greenfield supply will appear with the flip of a switch. It won't. An enormous amount of utility contracting lies ahead. Should be an interesting next few years. Great work, and I look forward to reading more in the future.

This was a rally enjoyable article and packed full of very useful information. I've got a watchlist and this has helped my personal thesis on Uranium. Thank you for the input and also the great pun at the start when you wrote 'bear with me'.