Sometimes you come across an investment story that seems too good to be true. When I first heard that a company based in South Africa had achieved the ability to enrich isotopes using techniques that require far less energy and capital than traditional methods (gas centrifuge), I was deeply skeptical. When the same company had a short seller report published, I was convinced it was likely a fraud.

However, sometimes it is worthwhile digging a bit deeper to discover the truth. In this case, I decided to listen in to management’s conference call responding to the short seller’s allegations, as well as read through the company’s formal response, and the excellent rebuttal published by Jacob Rowe of Rogue Funds. I came away convinced that the bull thesis has merit, and that despite the low odds, this small company with production facilities in Pretoria, South Africa (which I’m sure most of you, like me, have never heard of), is on to something big.

(Note: I would encourage readers to go through the linked write-ups, including the short seller report, and the business section of the 10-K thoroughly, before reading the rest of this piece).

Before we move on, I must warn readers that despite the investment merits, ASPI is higher risk on the spectrum vs. my typical investment write-up. Investors should conduct thorough due diligence on their own (as always) and make sure to size the investment appropriate to their risk tolerance.

The following factors make ASPI a tricky investment to analyze:

Complex technology

Pre-revenue

Foreign jurisdiction

I’m comfortable admitting that I have only a layman understanding of ASPI’s two major enrichment technologies, Aerodynamics Separation Process (ASP) and Quantum Enrichment (QE). But it’s my contention that you don’t need to be an expert on enrichment technology to get comfortable around this investment. The reason is that ASPI is in process of signing contracts to supply mission-critical advanced materials to a number of large companies, and these customers have done extensive technical due diligence to validate the technologies being deployed.

Take the recent Terrapower contract for example. Backed by Bill Gates, Terrapower is one of the leading small modular reactor (SMR) developers, expected to have its Natrium reactor up and running by 2030. The company has signed a ~$4bn, 10-year fuel supply agreement with ASPI to supply 150 MTU of High-Assay Low-Enriched Uranium (HALEU) (15 MTU/y), and committed to offer a term loan to finance the construction of the production facility.

This is the first large-scale private sector SMR fuel deal. Other US advanced reactor developers like X-energy, Oklo, and Kairos Power have not yet secured commercial supply contracts (although Oklo is rumored to be working on an MOU with ASPI). As part of its due diligence, Terrapower sent a team of scientists to South Africa to study ASPI’s technology and also tapped experts at the Lawrence Livermore Laboratory.

When asked about ASPI, the CEO of Terrapower, Chris Levesque, had the following comment in an interview with Energy Intelligence:

Q: I did want to ask about that. Should we view the ASP deal as speculative — meaning we're open to options that get us HALEU earlier than 2030 — or do you really believe they can build capacity by then?

A: I think that'll be the fastest source. We've done due diligence there. They have the technical capabilities. They have a government lab there, Necsa [the Nuclear Energy Corp. of South Africa]. Necsa and the energy minister are both supportive of South Africa enriching uranium again, and importantly they have full IAEA protocols in place there because enrichment is a sensitive technology.

We're excited about that agreement for two reasons. One is it helped us solve this schedule issue on our first core for Natrium. But beyond that, Bill created the company to bring nuclear energy to places like Africa. So to be working in South Africa, and have our first activity in Africa with a very knowledgeable nuclear nation like South Africa, you can really see how South Africa is just our first step toward eventually deploying Natrium reactors in Africa.

Fuel availability is a big issue for SMR developers as there is currently no reliable supplier of HALEU. Historically, Russia (Rosatom) has been the only country to produce HALEU in commercial quantities, but the Russia-Ukraine war, and the recent ban on Russian enriched uranium, means this is no longer an option for Western nuclear developers.

Traditional enrichers of uranium like Centrus are only capable of supplying low-enriched-uranium (LEU) because producing HALEU through traditional cascading centrifuges is much more energy intensive and expensive, and does not reliably produce the desired 20% enrichment level of U-235. Centrus would require a $4bn+ investment to produce roughly 100 MTU of HALEU through centrifuge technology.

The only real competitor to ASPI is an Australian company named Silex, which is looking to produce HALEU using laser enrichment. However, Silex currently has no customer contracts, and is estimated to reach full-scale commercial deployment by the early 2030s, which would be too late for many SMR developers. In comparison, ASPI expects to produce HALEU by 2028, giving it a massive first-mover advantage.

How is ASPI able to achieve commercialization sooner? There are three primary reasons:

Design: QE uses a modular, single-step laser-based process that is simpler than traditional gas centrifuge or laser cascade systems like Silex.

ASPI has already demonstrated the process on medical isotopes (like Ytterbium-176), giving them real operational experience.

Size: ASPI is targeting a smaller facility that will produce 15 MTU of HALEU per year to start, while Silex is aiming for a larger scale, more capital intensive project.

Regulatory Environment / Jurisdiction: ASPI’s plant is at the Pelindaba nuclear complex in South Africa, a legacy enrichment site with an established nuclear regulatory framework. In contrast, competitors like Centrus and Silex must navigate extensive US regulatory oversight from the NRC and DOE.

South Africa has a long history of uranium enrichment research, development and testing. The country was able to produce weapons-grade uranium in the 1970s, and test its first nuclear weapon in 1979.

The development of nuclear weapons cut off South Africa from the West, but the nuclear program, and enrichment technologies, continued to develop in isolation in South Africa throughout the 1980s.

By the 1990s, South Africa had dismantled its nuclear weapons program but developed capabilities in laser isotope separation techniques. The scientists behind the research went on to form a small company called Klydon, which was acquired by ASPI in 2023.

ASPI claims that its QE technology achieves higher selectivity than traditional laser enrichment, and therefore requires less enrichment stages. ASPI’s QE is expected to achieve a separation factor of 678 vs. 20 for Silex. This indicates a dramatically higher efficiency in isotope separation, which directly impacts production cost and scalability. Separation factor is calculated as (U-235/U-238 ratio in product) / (U-235/U-238 ratio in feed). So a separation factor of 678 implies one pass through the system enriches U-235 ~678× more than in the original feedstock.

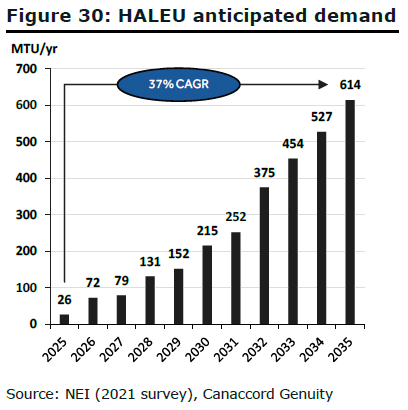

While the Terrapower deal gives ASPI visibility to $4bn+ in revenues, the HALEU opportunity is much larger. The NEI estimates that the US will require 600 + MTU/y of HALEU to fuel projected SMR demand by 2035. The Terrapower contract implies $25K / kg price for HALEU, which equates to a $15bn/y TAM in the US alone. Of course, ASPI won’t be able to satisfy this demand on its own, but it reflects the future potential for HALEU suppliers.

While HALEU is the most exciting opportunity for ASPI, it’s not the only revenue stream the company is banking on. In fact, ASPI is already generating revenue from the medical isotope side of the business. Commercial production of Ytterbium-176 is expected this quarter, while the first batch of Carbon-14 is also to be delivered this year. ASPI will start construction of new QE plants for Nickel-64 and Lithium-6/7, and aims to have them up and running by the end of 2025 (permits have already been obtained from the South African Government and equipment has been ordered).

Notes: please read through ASPI’s 10-K and investor materials to learn more about each isotope, its practical application and market opportunity size.

ASPI is also targeting the semiconductor industry by becoming the world’s leading supplier of enriched Silicon-28. ASPI aims to enrich Silicon-28 content from 92.2% to >99.995% purity by removing Silicon-29 and 30 isotopes. Research suggests that enriched Silicon-28 can deliver better heat conductivity (60% higher than naturally occurring silicon), unlocking greater computing potential. ASPI has signed a contract with a large semiconductor company (name undisclosed) for Silicon-28 supply. Production is expected to occur at ASPI’s Iceland facility (construction start 2025, expected completion mid-2026), which will also support Germanium-72 & 74, Xenon-129, Deuterium, Zinc-68, Molybdenum-100 & 98 and Chlorine-37 isotope production.

In an industry plagued with cost over runs and delays, many view ASPI’s ability to build its plants so quickly with a degree of skepticism. How does a small <$1bn market company manage to get such complex technology up and running so quickly? From my due diligence the answer lies in the nature of ASPI’s plants. Unlike traditional enrichment technologies that require the construction of large facilities, ASPI’s ‘production facilities’ are more akin to modular setups in leased industrial space (see picture below)—enabling rapid deployment within as little as 9 months.

Whether this process will scale operationally as ASPI increases its revenues remains to be seen, and is certainly a risk worth pondering. I think the stock will be significantly de-risked if ASPI successfully delivers on its contractual obligations for medical isotopes over 2025-26. The CEO, Paul Mann, has commented several times during interviews and investor meetings that the company deploys rigorous internal operational procedures to ensure projects are completed on time and budget.

Given the unique nature of the uranium enrichment business (regulatory scrutiny, licensing, permits etc.), and the large potential market opportunity in SMRs, ASPI will be spinning out the HALEU division as a separate entity in H2 2025. The remaining business will remain focused on medical and semiconductor isotopes. ASPI’s recent acquisition of Renergen will add another important component to the non-nuclear business by giving ASPI ownership to the best Helium deposit on earth.

Liquid Helium is used as a cryogenic refrigerant in the medical industry, for leak detection in pipelines and in the production of semiconductors and optical fiber. It’s also used in aerospace, with Space X’s Falcon 9 and Heavy launches consuming more than 10% of global daily Helium production per launch. Helium is also used as a coolant in advanced reactors, particularly High Temperature Gas-Cooled Reactors (HTGRs).

Since ASPI’s isotope business already services the medical and semiconductor industry, the acquisition is expected to have significant customer overlap and cross-selling synergies. It’s notable that due to Helium’s scarcity and strategic significance, Renergen has received more than $500mm in debt funding from the US International Development Finance Corporation (DFC). The acquisition press release states the following:

The combined group will help the U.S. secure supplies of critical and strategically important materials vital in many end markets which enable tomorrow’s megatrends, such as quantum computing and advanced semiconductors.

ASPI management expect the combined company (excluding the HALEU business) to generate $300mm in EBITDA by 2030. While this ambitious target might raise some eyebrows, based on the current pipeline of contracts and plant commissioning for the medical and semiconductor isotope business, ASPI can achieve $100mm+ EBITDA run-rate as early as Q4 2026. If we apply a 15x EBITDA multiple on this base business alone (ignoring any EBITDA from Renergen, or any value for the HALEU business), one can justify a $1.5bn+ EV vs. $620mm today.

Conclusion

While ASPI’s story seems highly improbable, the following factors and recent developments have convinced me to take a position in the stock given the large upside potential if the company is able to execute:

Terrapower contract and due diligence by Terrapower and Lawrence Livermore Lab scientists to validate QE technology.

$15bn+ HALEU opportunity and significant first-mover advantage.

Commercial deliveries in the next 3-6 months that will substantially prove out / de-risk the company’s technology and production capabilities, and make the company cash flow break even.

10% ownership of the company by the CEO.

South Africa’s long history in uranium enrichment.