Note: I have a lot of reading to catch up on so I’ll be taking a break from writing over the next couple of weeks to progress my research on some potential investments. I should get back to writing more regularly by end of September / early October.

Since posting my bullish view on oil in late July, oil prices have been volatile with WTI flushing down as low as ~$71.50 (August 21), and rising to break $80 briefly (August 12th). I’ve used these opportunities to trade in / out at the margin, but kept my core long position in WTI November futures and December call spread intact. My cost basis is around ~$73-74. On the fundamental front, developments have been mixed. Overall, I’ve become less bullish than I was about a month ago, however I still see a window for oil to sustainably break above $80 in the coming months. The OPEC+ situation has become more binary, and the risk of a OPEC+ price war has increased. As such, I’m putting a stop loss on my positions. Let’s go through both the bearish and bullish developments.

The Bad News

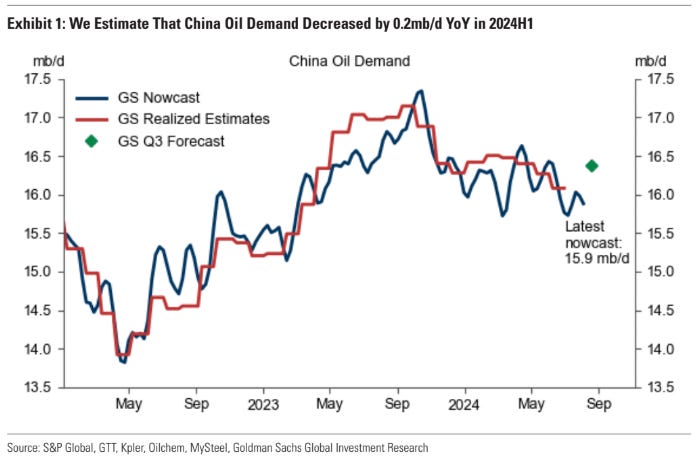

Chinese demand continues to be extremely weak, with Goldman’s nowcast tracking current demand at 15.9mm b/d. In comparison, most analysts and OPEC were expecting 16.5-17mm b/d for this year.

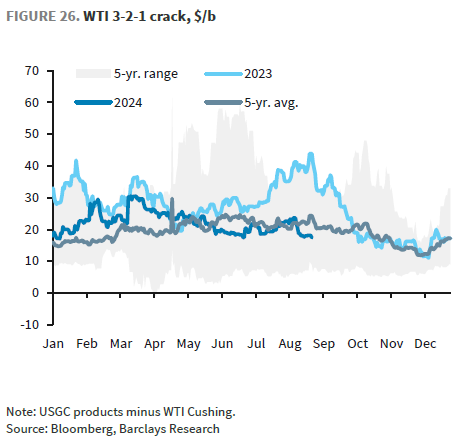

3-2-1 crack spreads are the lowest they have been since October of last year, and are near the lowest levels since 2021.

European and Asian cracks don’t present an optimistic picture either.

There are some troubling developments on the supply front as well. Saudi Arabia exports seem to have bottom’ ed out and are now rising. Overall OPEC+ exports seem to be on the way up. While it’s too early to call this a trend, if exports continue to rise into September, that will clearly negate my original thesis regarding OPEC+ wanting to squeeze prices higher ahead of the US elections.

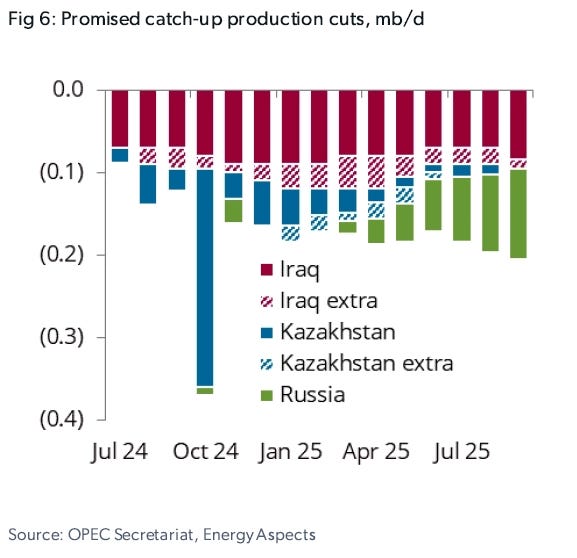

Equally troubling is that aside from the Saudis, not many in OPEC+ are complying with the cuts. The OPEC+ Secretariat recently published updated compensation plans for Iraq and Kazakhstan, the third version since May. Despite earlier promises to deepen cuts, Iraqi compliance worsened in July. If the Saudis are unable to discipline non-compliant members through diplomatic means, then they may have to punish them through a price war. This will be extremely painful for all OPEC+ members, including Saudi Arabia, given its robust fiscal spending plans.

The Good News

That being said, it’s not all gloom and doom. Despite the weaker demand picture in China, global oil inventories have been drawing and are currently below 2023 levels.

Chinese oil stocks are below 2022 and 2023 levels, suggesting that while Chinese demand is weak, imports would need to ramp up sharply on any demand pickup to avoid further inventory draw downs.

According to energy consultant Energy Aspects (EA), domestic refining margins are picking up in China, driven by stronger end-product pricing. Based on EA’s talks with local Chinese refiners, demand is gradually improving, and runs will be higher going into the fall with two major refineries coming out of maintenance.

Several industry analysts have also commented on the fact that the weakness in crack spreads is to a large extent a reflection of new refineries coming online, rather than weak demand alone.

US implied oil demand from EIA data remains healthy, and the recent Q2 GDP print suggests that the US economy remains on solid footing.

On the supply front, while Saudi supply is increasing and OPEC+ compliance hasn’t been great, export levels are still ~1mm b/d below H1 levels.

There is also some recent news to suggest that the group is working towards improving cohesion and compliance. This week there was a meeting between the Iraqi PM and the OPEC Secretary General to discuss exactly this topic. The Secretary General also met with Kazakhstan. This visit coincided with the Iraqi Government issuing an ‘ultimatum’ to the semi-autonomous Kurdistan region to reduce its output, or face fiscal repercussions. While the market is likely to be skeptical of this given the track record, there is some evidence (spot sales and crude loadings) to suggest that this time is different.

Yesterday, Reuters published an article stating that OPEC+ plans to move forward with its unwinding of voluntary cuts, to increase production by 180K b/d in October. While the market took this news very negatively, with oil selling off as much as 3%, I have a less bearish interpretation: if OPEC’s disciplining efforts are successful, and non-compliant members agree to enact ‘catch up’ cuts, this could lead to ~200K b/d reduction in supply in the coming months from Iraq, Kazakhstan and Russia (see chart below), creating room for Saudi Arabia to unwind some of its own cuts.

In Libya, oil output dropped by ~600K b/d due to a dispute over control of the Country’s central bank. The shut down was initiated by the eastern authorities, after the internationally recognized western government replaced the current central bank governor, who has eastern allies. This is a fluid situation, with some indications that production will be partially resumed this week, but it highlights the geopolitical risks inherent in oil supply that are currently not priced in.

There is good news on the US Shale front as well. US production is flatlining, and currently tracking well below expectations for 700K b/d - 1mm b/d growth coming into the year. I do not expect US shale producers to show any meaningful growth at the current oil price levels.

Lastly, the paper market positioning remains extremely one-sided / pessimistic, while the physical market is still indicating tightness. The chart below illustrates the stark contrast between financial (left chart) and physical (right chart) markets. The last few times there was such a big discrepancy between the two markets, financial players were eventually forced to cover their short positions / increase net length, leading to a significant rally in oil.

Conclusion

While there have been some bearish developments in oil, the physical market remains tight and financial positioning remains one-sided, which implies that risk is skewed to the upside.

The biggest downside risk is lack of OPEC+ cohesion, and the potential for a price war. So far, Saudis have been bearing an unfair share of the production cuts, but recent developments suggest that other members are taking steps to correct this. I believe that the OPEC Secretary General’s visit to Iraq and Kazakhstan was to deliver a ‘tough’ message.

The other major risk is further economic deterioration in China, or a sharp turn in US economic conditions. So far, the economic indicators do not suggest that this a likely scenario.

Traders are also concerned by OPEC+’s messaging regarding unwinding of production cuts starting October. However, I think this concern is overstated given the recent developments in Libya and the prospect of compensation cuts from Iraq, Kazakhstan, Russia.

If the current OPEC+ export trend continues, then inventories should continue to draw in Q3 and Q4, and the physical market should continue to remain tight, eventually forcing oil traders to cover their short positions and catalyze an upwards move.