Portfolio Update (5/22/2023)

I have reduced the frequency of my write ups recently because there hasn’t been much to add to my recent posts on economic growth, banking crisis (here, here and here), oil and uranium. Portfolio composition has also been quite steady since my last update. I maintain strong conviction in my uranium and oil positions, despite the continued negative price action. I also remain short the broader market and some specific names that I think are mispriced and offer good protection in a recession or higher-for-longer interest rate environment.

The markets have been saying I’m wrong - both on the long and short side - and I have decided to respect this price action and not push position sizes aggressively. However I’m also not ready to sell and admit defeat just yet. My fundamental macro analysis continues to point towards a soft landing by Q3 and Q4 of this year and I believe the markets have been too zealous in pricing in demand destruction in commodities like oil as well as rate cuts later this year.

I also think the safety bid in large/mega cap tech stocks, further fueled by recent AI hype, has made the broader markets particularly fragile and prone to downside. For example, AAPL is back to trading near all-time-highs and ~30x P/E multiple despite posting a second straight quarter of negative YoY revenue growth. If you think AAPL is a critical infrastructure play with no demand impact from a recession, I have a bridge to sell you. Or take a look at NVDA (one of my short positions), trading at close to 150x earnings with EPS down 30% YoY. Even if the company managed to compound earnings at 25% over the next 5 years (highly unlikely), the FCF yield at current valuations would be miniscule (not to mention almost half of the FCF being eaten up by stock-based compensation).

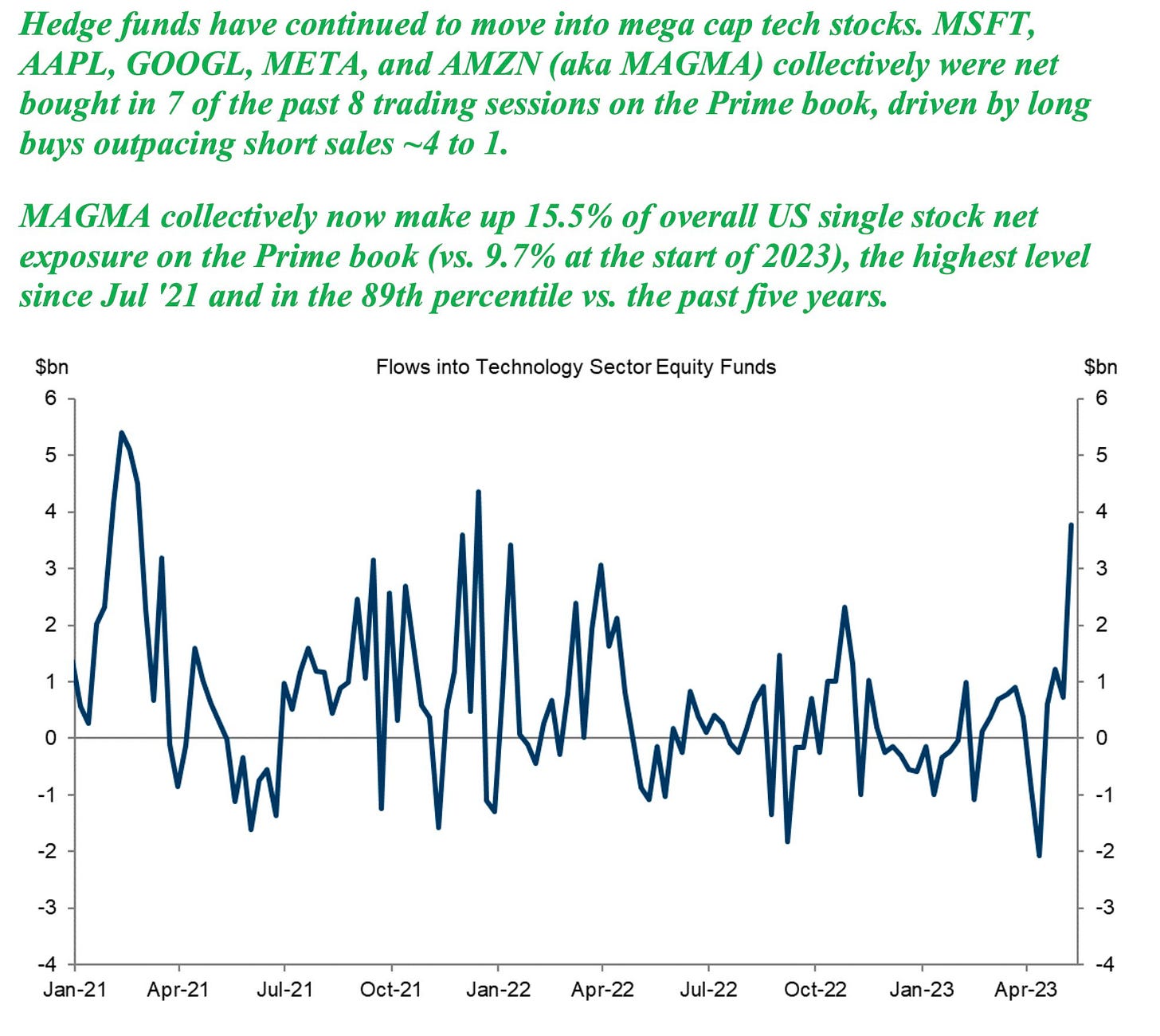

The below screenshot from a GS Prime Desk note illustrates how concentrated positioning has become in the largest technology names:

Excluding the ‘big six’ tech names (AAPL, AMZN, GOOG, META, MSFT, NVDA), the SPX would be down ~3% YTD and the NDX would be barely up. Given the magnitude of earnings growth priced into the multiples of these six companies, one has to wonder what kind of earnings growth the market expects from the other 494 companies in the S&P500. With the US economy growing at 1-2% real and 4-5% nominal, and the tech names pricing in 20%+ earnings growth, the market seems to be suggesting that the rest of the S&P500 is going to have barely any revenues or earnings at all.

Looking at oil positioning, one is confronted with another head-scratcher. Investors have been treating the energy sector as if it’s toxic, with trading positions of non-commercial traders (hedge funds, speculators, oil derivatives traders etc.) the lowest in more than a decade. The only scenario where this would be justified is a hard landing with oil demand destruction on the scale of 2008 or 2020 recession.

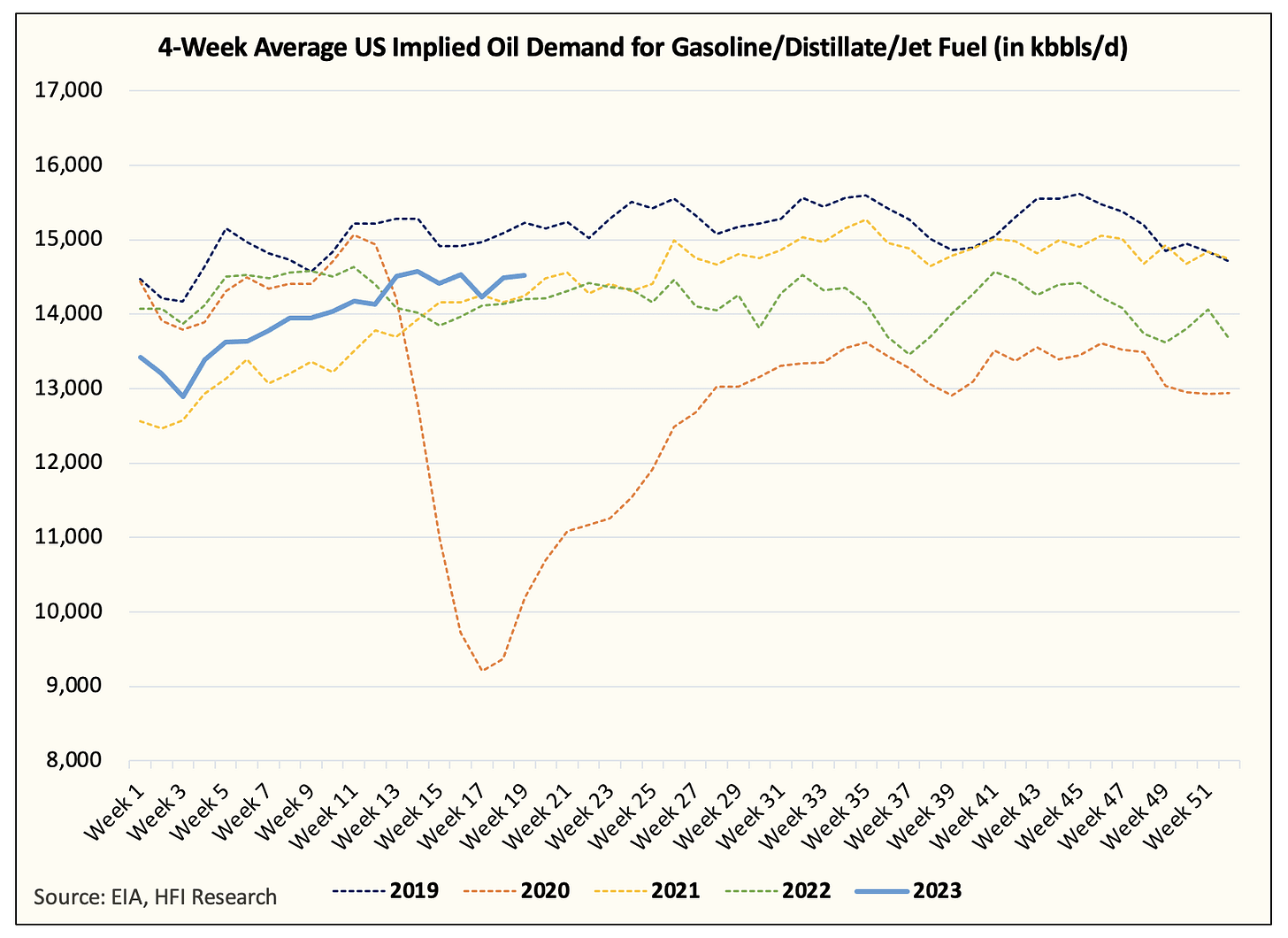

The reality on the ground however is that US oil demand is trending higher than 2022 levels. US refiners are all upbeat regarding the upcoming driving season demand, product inventories are low and crack spreads have been rallying in recent weeks.

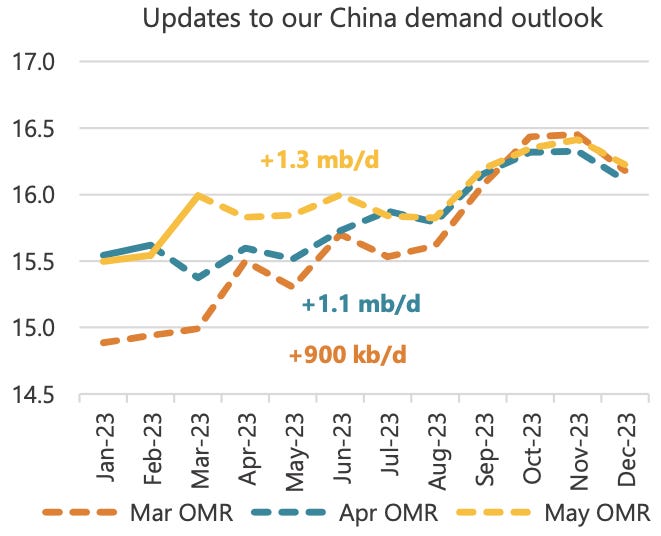

Non-OECD demand is on track to hit record highs, with China oil demand already trending +1mm b/d YoY.

While oil demand is robust, supply has already started responding to lower prices with OPEC+ announcing 1mm b/d+ of cuts and US Shale producers dropping rig counts.

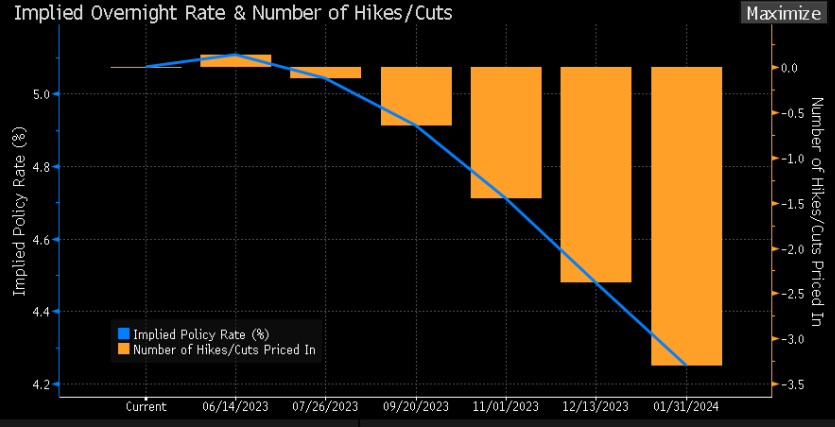

Turning to interest rates, Fed Funds futures are pricing in about 60bps of rate cuts this year starting in July. Meanwhile, US core CPI is currently running at 5.5% YoY and non-volatile measures of inflation are all becoming ‘sticky’ in the 4-5% range. Rate cuts would only make sense in a hard-landing scenario, as absent a significant rise in unemployment, sticky inflationary pressures are unlikely to subside and bring core inflation back to the Fed’s target.

Overall, the market seems to be selectively pricing in a hard landing in some asset classes (oil, interest rates) and not others (tech stocks), a situation that is not sustainable.

Portfolio Composition

Uranium: ~80%

Oil: ~50%

Shorts: ~ -25%

Put spreads: ~ 5%

Economy Update

If you’ve been following my posts over the last few months, this section might appear a bit repetitive. But I want to ensure that I’m continuously assessing the latest economic data to judge the validity of the soft-landing thesis.

Here is a review of some of the latest data points:

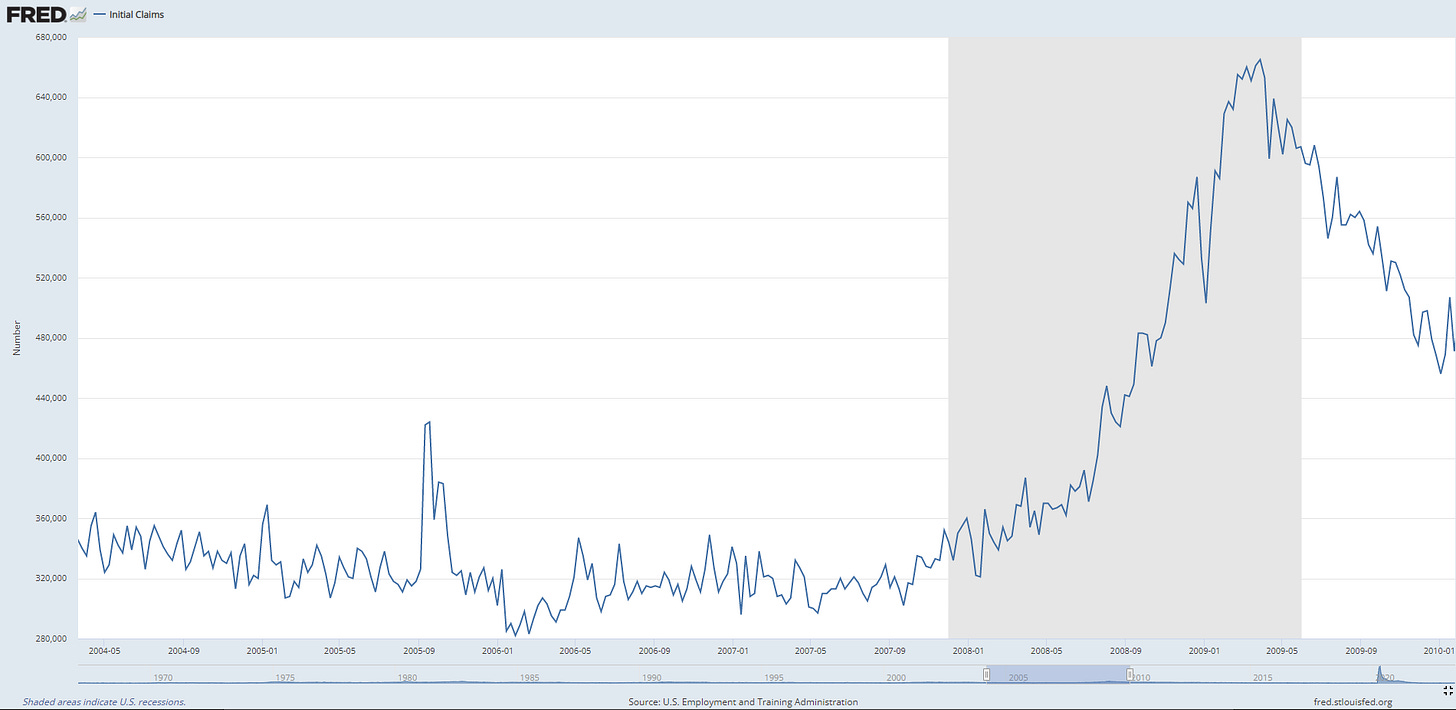

1/ The labor market remains secularly tight, and even though wage growth and unemployment claims are rising, they are deteriorating from 2022’s ‘red hot’ levels to just ‘hot’ levels.

To add some numerical perspective, claims are currently ~270K and they were 350K+ at the onset of the 2007 recession and had been running at ~300K+ for a few years prior to the GFC.

It will take several 300K+ prints to bring claims in line with a 4%+ unemployment rate (currently 3.4%).

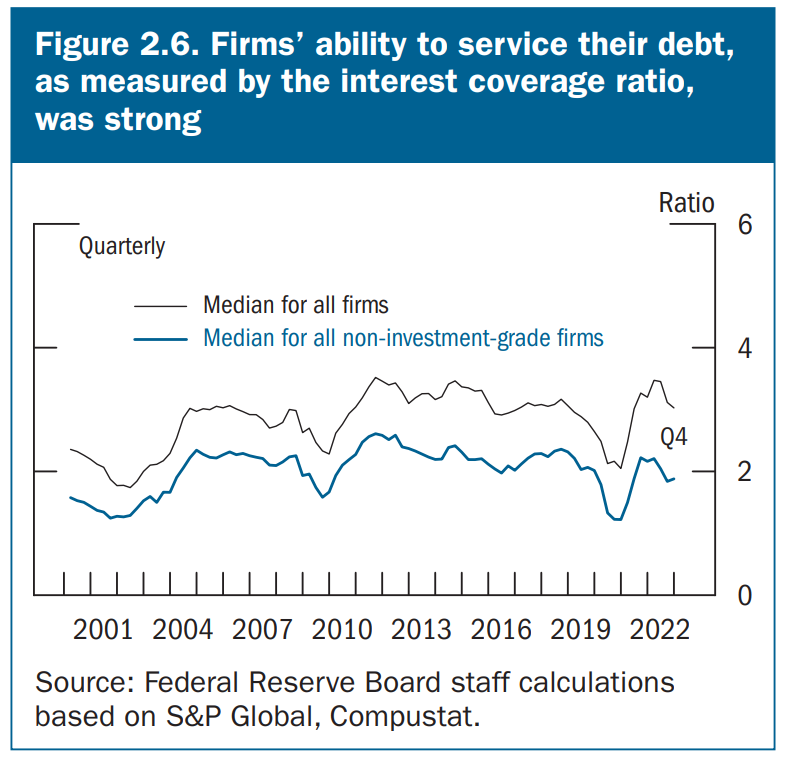

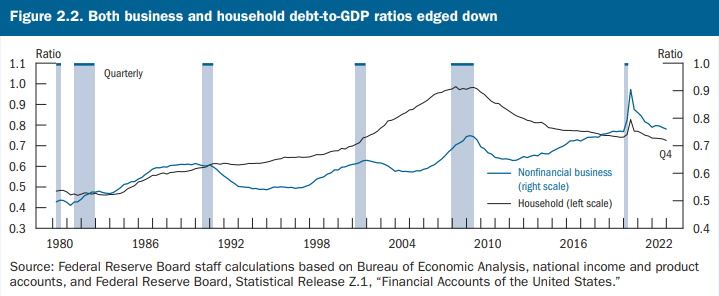

2/ Household and corporate balance sheets are healthy. The Fed’s most recent Financial Stability Report (FSR) shows that as of Q4 2022 many corporations and households had locked in low interest rates for the long term and continue to see robust income growth leading to conservative debt service coverage metrics.

Only 5% of BBB and 1% of high yield bonds are due within a year and interest burden relative to earnings remains healthy.

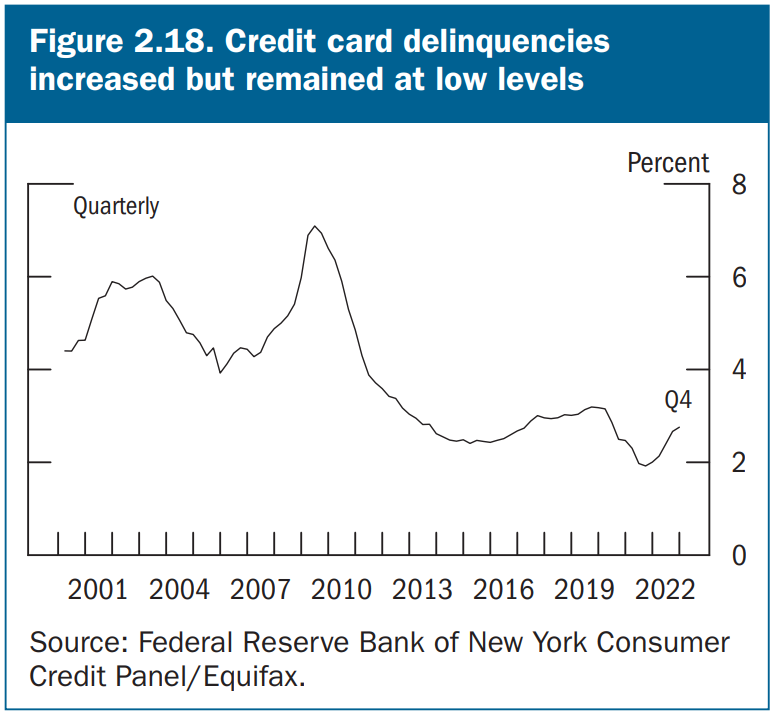

Credit card delinquencies have been rising but remain low by historical standards.

Both corporate and household debt as a % of GDP remains low by historical standards.

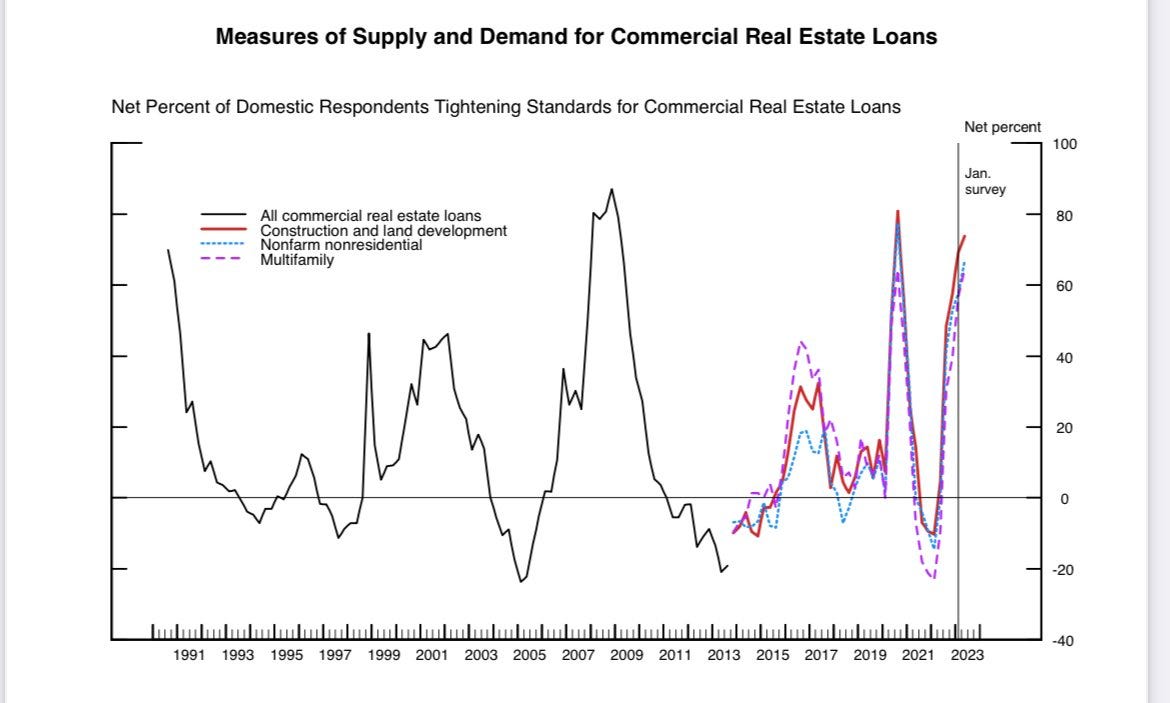

3/ One can argue that the FSR is backward-looking. Since Q4 we had the failure of several major regional banks, and data on credit card delinquencies and credit availability have been deteriorating. I expect that this data will continue to worsen and credit contraction will be a drag on growth - some sectors like Commercial Real Estate might suffer heavy losses / write offs - but the important point is that this deterioration in the overall economy will be more gradual vs. 2008 or 2020, absent an exogenous shock. We are starting from historically high / above trend growth levels, labor market strength and balance sheet strength.

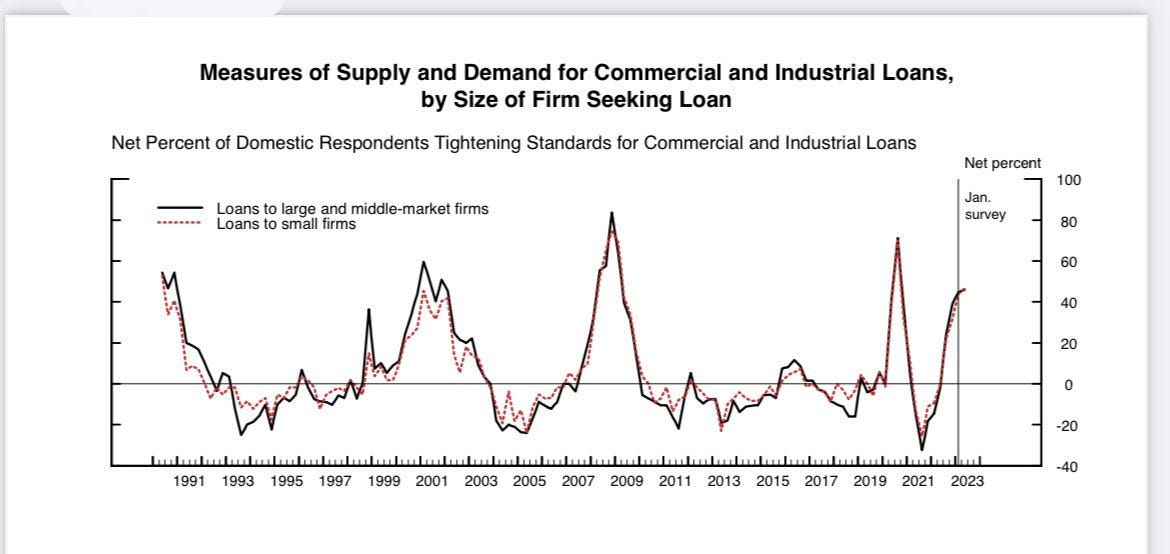

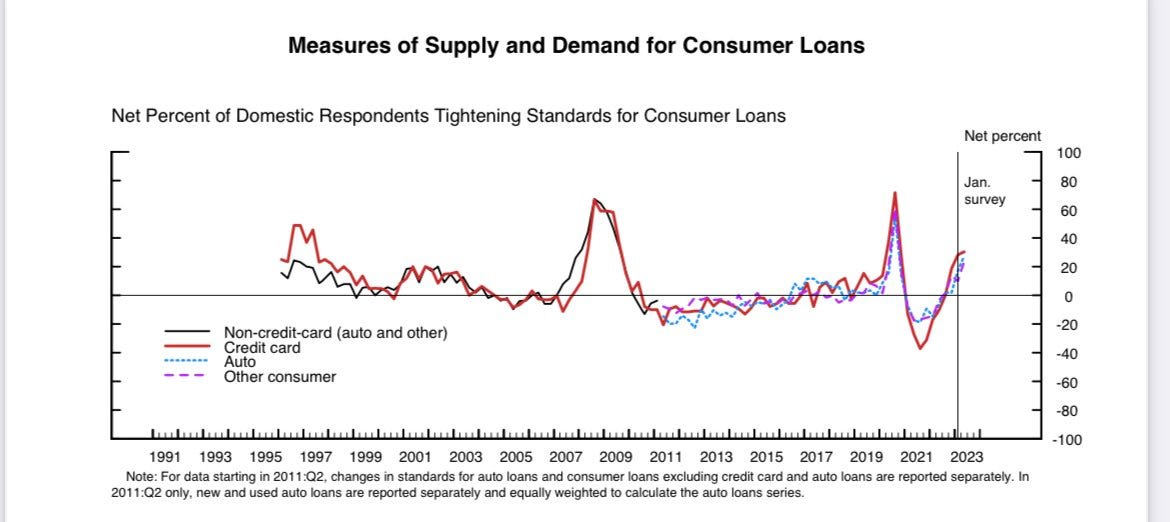

4/ For a more real-time view on bank lending / credit contraction - we can take a look at the recently released Senior Officer Loan Survey (SLOOS):

The number of respondents observing tighter lending standards in Q2 vs. Q1 inched up only marginally for business loans.

There was no discernable change in consumer lending.

CRE standards remained extremely tight.

Overall, the sharp tightening in credit contraction that many were expecting post-SVB didn’t materialize. Most of the tightening in credit availability happened pre-SVB and rolled over into Q2 with 50 - 70% of respondents reporting no change in lending standards.

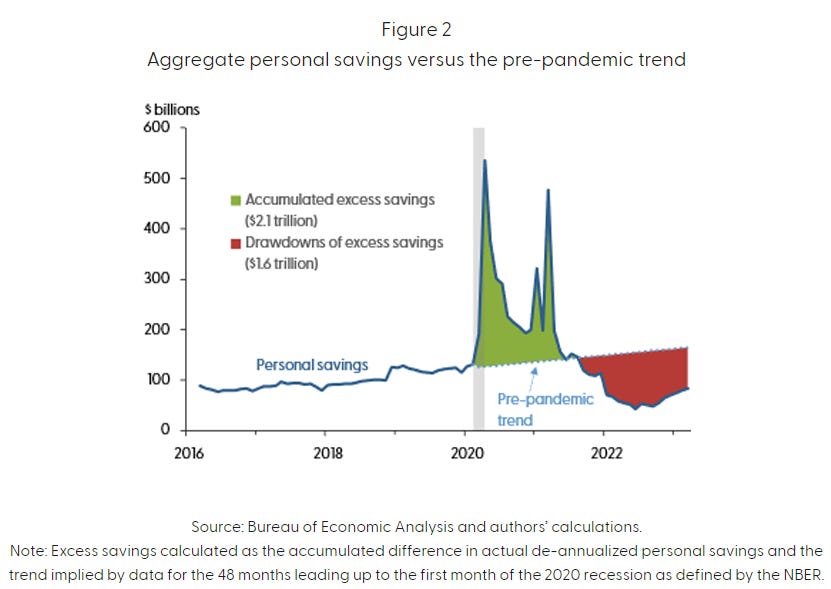

5/ Households still have $500bn in excess savings to cushion them from credit tightening and / or job losses. Recently, the household savings rate has started ticking up. This means that households are becoming more conservative in their spending, but also that their savings are going to last for longer than previously forecast. The Federal Reserve Bank of San Francisco recently stated the following in their research note on household excess savings:

“Should the recent pace of drawdowns persist—for example, at average rates from the past 3, 6, or 12 months—aggregate excess savings would likely continue to support household spending at least into the fourth quarter of 2023. This outlook can be possibly extended into 2024 and beyond if, for instance, drawdown rates moderate or household preferences for savings increase.”

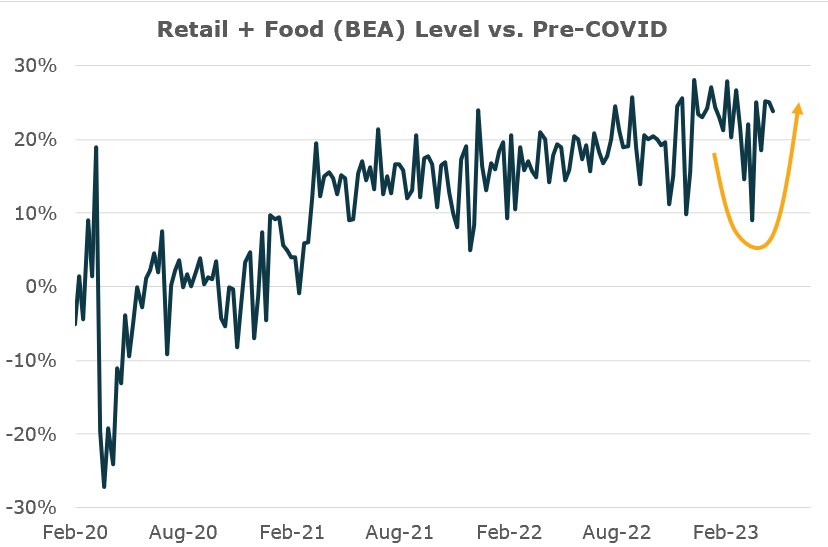

6/ Credit card data spending data turned up in April. There was a lot of panic around credit card spending contraction in March, but this data series is often noisy and volatile. Overall spending trends remain healthy, as further evidenced by the Q1 GDP report.

7/ Bank deposit flight has moderated and most banks have continued to guide towards loan growth for 2023 in their Q1 earnings. Despite losing ~$800bn in deposits since March, banks have increased their loan books by ~$480bn. This seems counterintuitive, but makes more sense when one realizes that loan-to-deposit ratios are still historically low, banks remain rich in cash assets ($1.5T in cash and $4T in securities, many of which are short-term) and have access to sufficient liquidity through the Fed’s various programs.

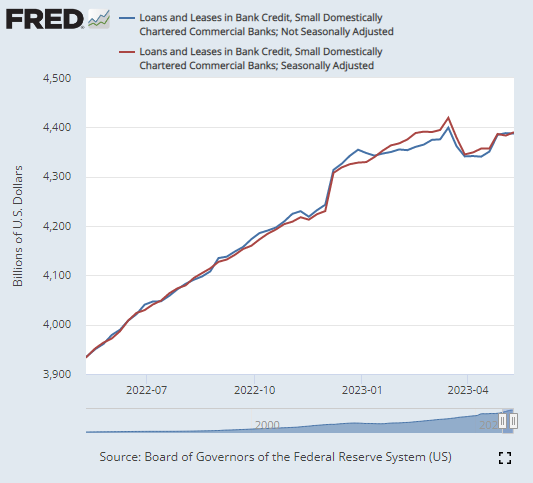

Small bank lending has remained stable.

Banks outside of the Bay Area have noted limited spillovers from SVB and First Republic.

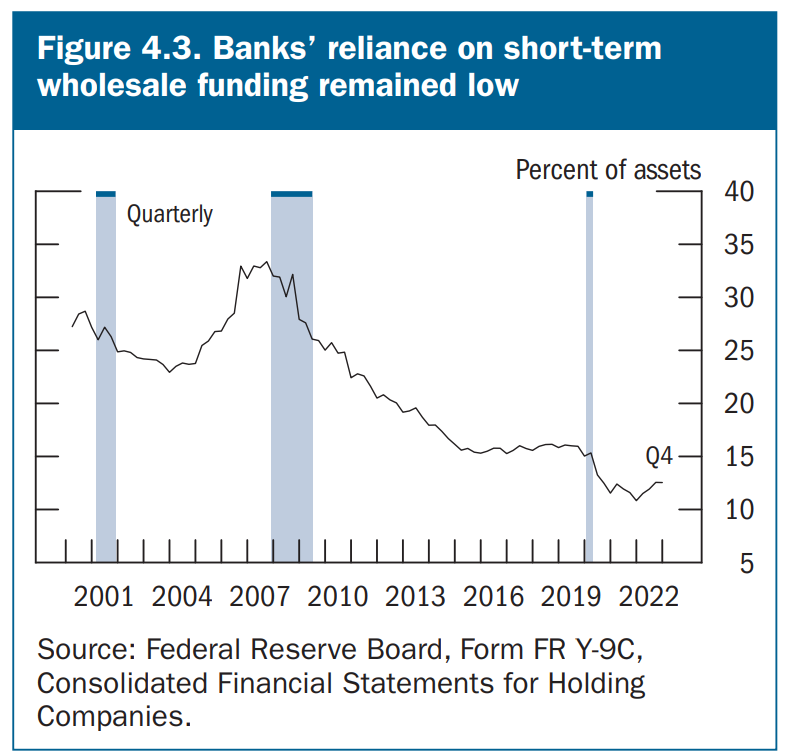

Overall banks are less reliant on short-term wholesale funding since the GFC which is why bank funding costs remain low even as the Fed hikes.

An erosion in bank profitability is more than priced in looking at implied ROA’s based on the current market cap to assets ratio (discussed in more detail here).

Parting Thoughts

Looking forward to the end of the year, credit contraction, sticky inflation, diminishing excess savings and increased duration supply (post debt-ceiling resolution) will all eventually lead to the much anticipated recession by creating economic headwinds for consumers and liquidity headwinds for the markets. A number of fiscal stimulants have also started to roll over:

SNAP benefits ended in March

Medicaid changes in April

Student loan repayment restart in Sept

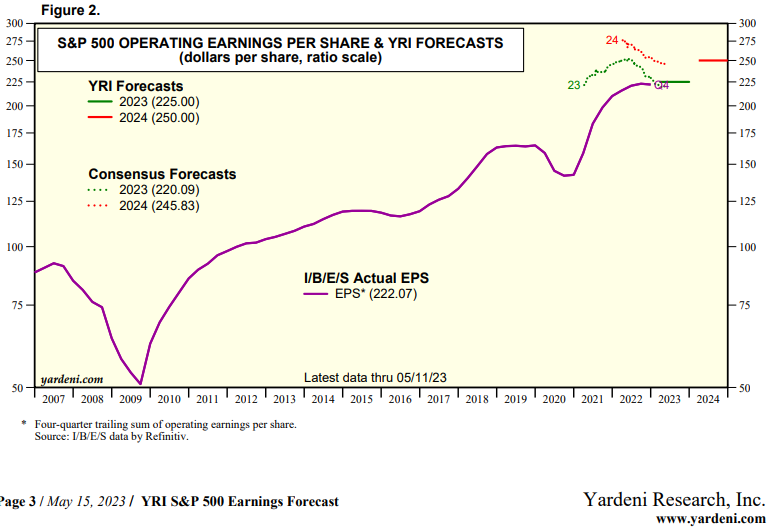

Once the recession begins, the next big variable to focus on will be how quickly inflation reverts to the Fed’s target and the Fed’s reaction function. If inflation remains stubborn and interest rates have to remain high throughout this period of growth contraction, then a hard landing is on the cards. Historically, it’s very rare for the Fed to break the back of inflation without causing significant pain on the economy and the markets. So far, 2024 earnings estimates don’t seem to be too worried about an impending recession.

Rising oil price is another recessionary factor to keep an eye on. While I remain an oil bull, I am aware that there is a narrow window for the thesis to work over the next couple of quarters. If oil prices rise to $100+ / bbl as I expect, consumers will start to really struggle and oil demand destruction will start sooner vs. last year. It is therefore important for energy investors to time their exits smartly and aim to re-enter positions after recessionary forces have pulled prices lower and monetary policy has flipped to being accommodative again.