A New World Order

Russia's war will have far-reaching implications for the global economy and commodity super cycle

We’ve all been drinking through a fire hose of information (and sadly, misinformation) regarding the Russia-Ukraine conflict these past couple of weeks. As we try to make sense of everything and assess the implications for the world going forward, it’s becoming apparent that there is a wide range of outcomes still possible. However there are a few things that are becoming a bit clearer in my mind.

The first is that there is no good outcome here for Russia. A prolonged conflict will have an unthinkable cost in terms of human life and the continued economic fallout under crippling sanctions. On the other hand a withdrawal at this stage will be humiliating and shatter the perception of Russia as a super power (if it hasn’t already). In both scenarios Russia ends up as an international pariah and the world will gain renewed confidence in Western, democratic values. The Russian economy will likely remain depressed for years to come given continued sanctions and international divestment.

This is not a great outcome for other authoritarian regimes of the world, most significantly China, that are looking to create an alternate axis of power to compete against the US and Europe for global influence. The forces of de-globalization that started in earnest with the US-China conflict are likely to accelerate as Western powers will draw stricter boundaries for trade and economic cooperation between friendly and unfriendly powers. The reworking of supply chains and in-sourcing will drive demand for commodities, labor and act as a structural tailwind for inflation.

Secondly, I believe the West is in the process of finally understanding the importance of energy self sufficiency and developing a newfound respect for commodity markets. This is how commodity cycles typically work: years of overinvestment lead to excess supplies and low commodity prices which allow people to take commodity supplies for granted and leads to underinvestment. After years of underinvestment the process reverses: commodity prices rise as supplies become tight, and we go from a narrative of abundance to one of scarcity. It’s easier to talk about ESG and fossil fuel divestment when oil prices are at $30 / bbl vs. when oil prices are $100 /bbl. Even Elon Musk was recently forced to admit that our reliance on oil and gas is not something that can be turned off like the flick of a switch.

What this means is that investor interest in the oil and gas sector might finally take a turn. Despite the strong rally in energy stocks over the last few months, oil company equities remain extremely undervalued relative to free cash flows. Some of my favorite Canadian oil stocks (Gear Energy, MEG Energy, Baytex etc.) continue to trade at double digit free cash flow yields and could theoretically buy back all their shares outstanding at prevailing prices in a couple of years if oil prices stayed in triple digits. Many investors are afraid that the run-up in oil stocks is overdone, but a quick look at Q4 earnings and modeling out the cash flows for 2022 at current oil prices will put their fears to rest. I believe a combination of shareholder capital returns (dividends and share buybacks) and a desire to support domestic energy production will be the catalyst to drive the next leg of capital inflows into energy stocks.

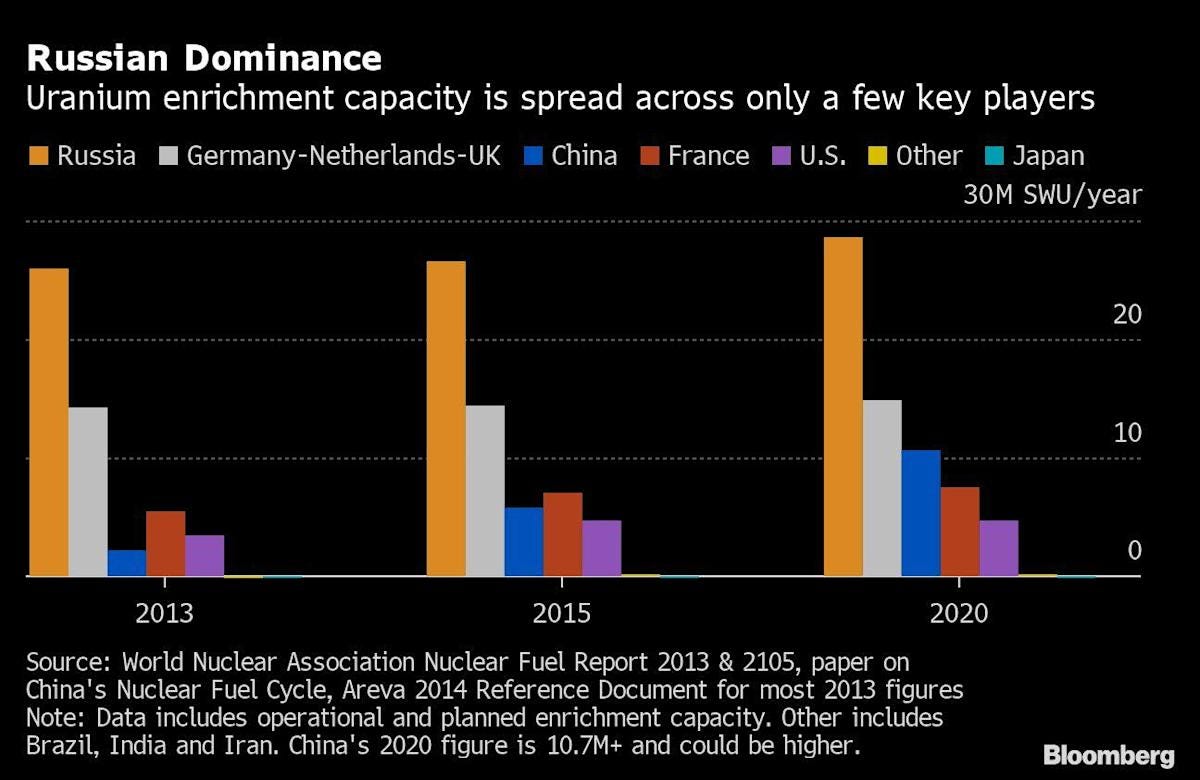

The uranium sector is going to benefit from similar tailwinds. Russia currently provides ~40% of uranium enrichment capacity. As countries look to move enrichment away from Russia, the demand burden on other enrichment facilities will increase dramatically. Enrichment facilities outside of Russia will go from underfeeding to overfeeding (the concept is too complicated to explain here, but there is a good explanation here if you’re interested) meaning increased demand for U3O8 to produce UF6 and less ‘secondary’ uranium supplies from underfeeding. This means increased competition for uranium in the spot market at a time when the Sprott Physical Uranium Trust is seeing strong inflows and the reverse carry trade is showing signs of exhaustion.

Additionally, Europe is realizing how important it is to keep its nuclear generation capability intact to wean off reliance on Russian energy imports. Even Germany, which has historically been extremely anti-nuclear, is now re-considering its decision to shut down nuclear power plants. With the uranium market already in a significant deficit, extending the life of existing reactors and restarting old reactors will only increase the upward pressure across the uranium price curve. Uranium spot and term price is still well below the marginal cost of production, so it’s only a matter of time before we see significant upward movement in the commodity price and the uranium mining stocks.

While I do own some uranium equities (NexGen, Denison Mines, Global Atomic and ISO Energy), my largest position is in the commodity itself through the Sprott Physical Uranium Trust. The last bull market saw uranium spot prices rise to $140 / lb. I believe we could go much higher this time given the various structural tailwinds for the sector. Buying a commodity at a discount to the marginal cost of production and potentially earning a 200%+ return without having to expose yourself to jurisdictional, operational and capital structure risk feels like a pretty good risk / reward. I believe the sector should see strong inflows this year as investors continue to embrace nuclear as the only emissions-free, baseload power source that can meet rising electricity demand at scale.

Lastly, I think this conflict is going to be very bad for food security. Russia and Ukraine are major exporters of essential food items including wheat and ammonia (used to make fertilizer). The recent sharp rise in food prices globally could lead to political instability in developing countries with fragile economies. Even if the situation de-escalates in the short term, Russia could weaponize ammonia and wheat exports in the future in exchange for sanctions removal. Rising fuel prices are also feeding into food inflation. For example natural gas is needed to produce ammonia and rising oil prices will impact the costs of mining for phosphate.

As the world grapples with the new reality of de-globalization and commodity scarcity, I continue to believe that having exposure to the commodity sector is one of the best sources of alpha at the moment. Oil and uranium are my two favorites but there are a lot of smart money managers out there digging deep [pun intended] to find opportunities in other commodities like coal, agricultural commodities, copper etc. It’s important to remember that we are still in the early stages of this cycle. Over the past decade investors over invested in the world of bits and bytes and underinvested in the the world of atoms and molecules. It will take several years to fix this and there is still an ample runway of investment opportunities out there for the contrarian investors that are willing to roll up their sleeves and dig in.