Uranium Sector Selloff Is A Buying Opportunity

Spot and term price increase is a matter of 'when', not 'if'

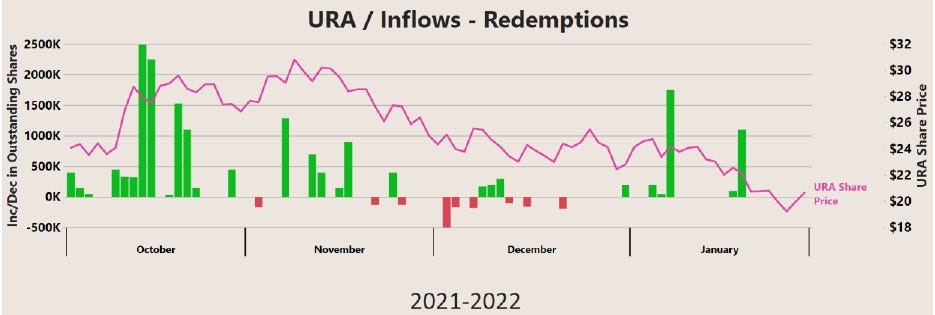

The uranium sector has been caught up in broader market volatility with many of the mining stocks down 40-50%+ over the course of the last few months. The two major uranium ETFs, URNM and URA, suffered drawdowns of ~40% from the highs in early November and are recovering a bit now.

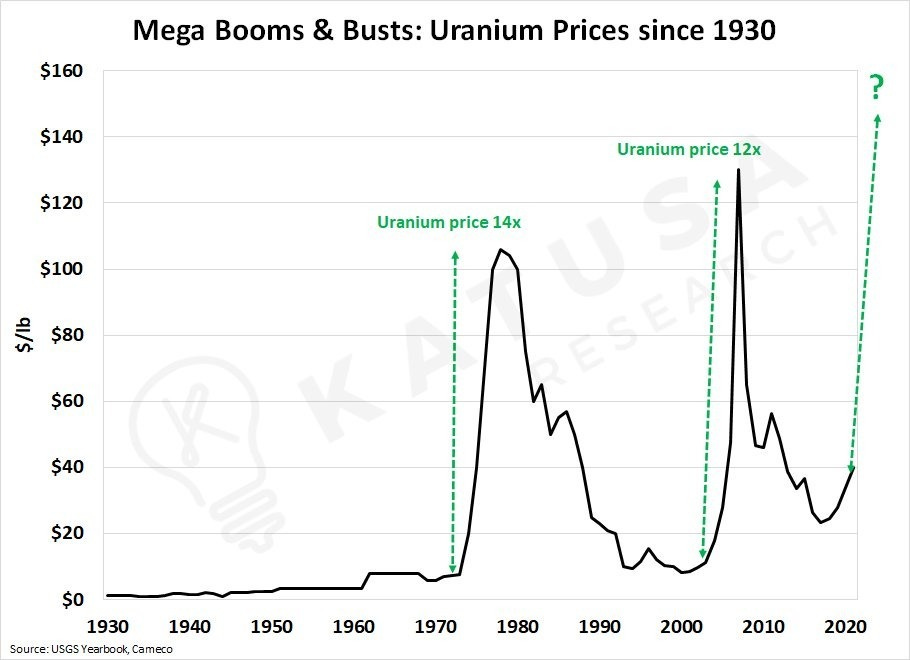

While the recent price action is scary, it’s in line with the historical volatility of the sector. The uranium bull market during 2005-07 was punctuated with several 30-50% declines, and this time will be no different given the small size and relative illiquidity of the sector (combined market cap <$50bn).

Despite the sharp selloff in the mining stocks, uranium spot price has remained fairly stable at roughly mid-$40s / lb.

The shares outstanding of URA and URNM have also been stable implying that the sell-off has not been led by investor redemptions from the ETFs (mostly institutional owned) but rather by the individual stocks - likely a sign of retail investor capitulation.

Developments in the sector have continued to be positive, with nuclear gaining traction as a green alternative in the EU, India looking to triple it’s nuclear output by 2031, calls for reactor life extensions increasing globally and Japanese reactor restarts still on schedule in addition to the tremendous growth coming from China.

While demand estimates continue to go up, supply has remained inelastic with spot and term prices still far below the levels required for mining companies to break even on new projects.

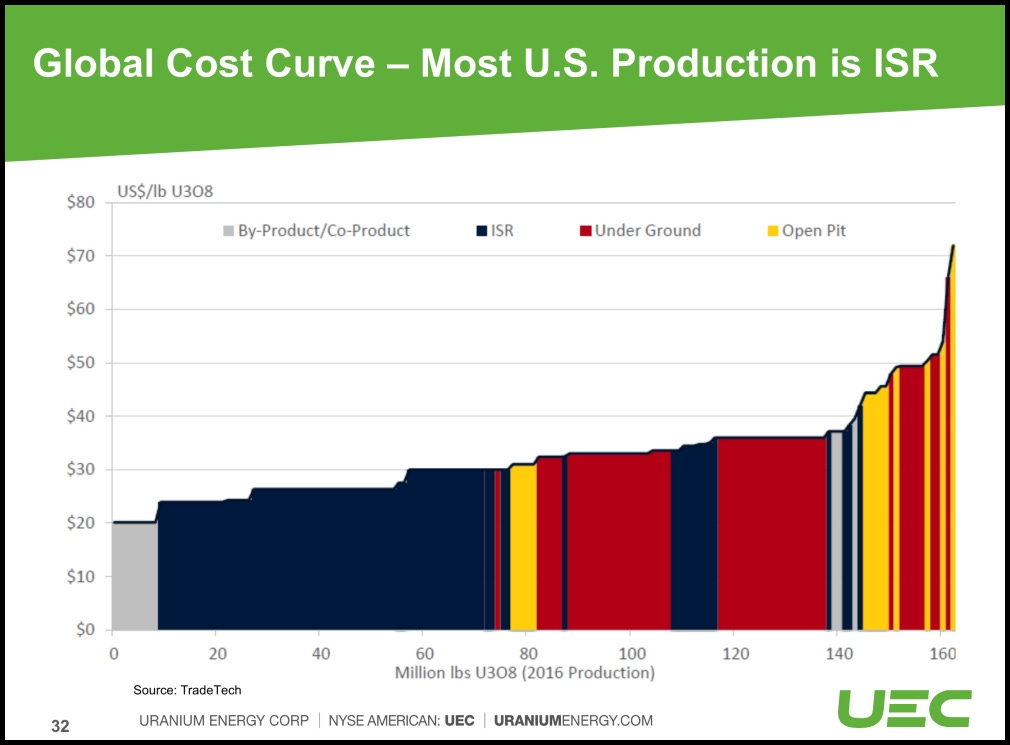

As the above cost curve chart from Uranium Energy Corp illustrates, a uranium price of $70+ / lb is needed to incentivize the appropriate supply response required to balance the market. This breakeven level is also rising rapidly with inflationary pressures.

Since it can take up to 10 years to develop a new uranium mine, uranium prices are likely to go much higher than what the cost curve suggests because there simply won’t be enough uranium to go around for everyone this decade. Adam Rodman of Segra Capital, a uranium-focused hedge fund, commented recently in an interview that his fund started investing in the uranium space back in 2017/18 when they realized that the world had “already missed that critical capex window to meet [future] demand”. He added further: “there are a lot of regulatory, environmental permitting hurdles, which means that this market should always be thinking 10 years ahead of when they see supply problems, but inevitably that doesn’t shake out - that’s why we get these hyper-cycles in this commodity”.

Let’s take a fresh look at the supply / demand math.

Power generation demand for 2022 is estimated at ~170mm lbs / year and expected to rise to ~210mm lbs / year by the end of this decade (2030). These numbers don’t take into account the potential for an additional 10-30mm+ lbs/ year of financial demand, conservatively speaking. The Sprott Physical Uranium Trust (SPUT) for example could easily acquire 50mm+ lbs this year if their 2021 purchases and 2022 YTD purchases are any guide.

Supply (including secondary supply) is running at ~155mm lbs / year and will remain largely unchanged until Cameco decides to bring McArthur River back online (expected this year). McArthur River can produce ~18mm lb/s year of uranium, but it’s a complex mine which will take 18-24 months to ramp up to full production. Assuming a restart is announced this year, 2023 production is expected to be only 5mm lbs. While a lot of people worry about the McArthur River restart as a bearish catalyst, I’m of the view that the announcement will highlight dwindling spare capacity in the system and could leave many utilities panicking to secure new supplies.

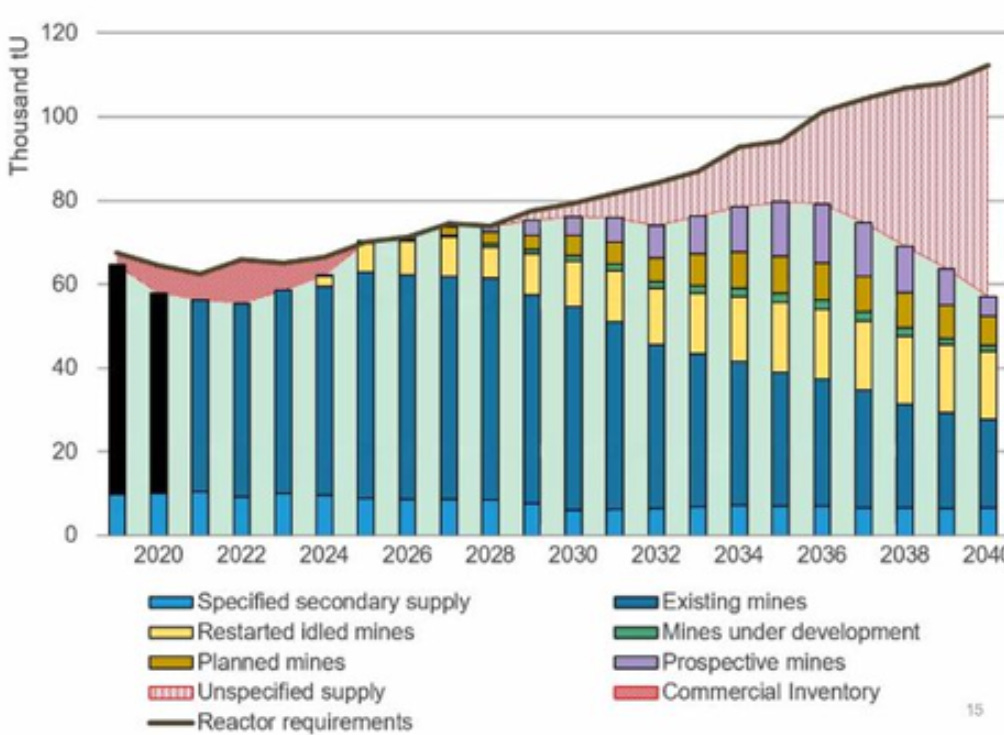

By the time McArthur River is producing at full capacity in 2025, generation demand will have grown another 10-15mm lbs / year. Kazatomprom (KAP) (which has guided flat production out to 2023) could increase supplies by ~6mm lbs / year based on peak production levels in 2016. There are several other projects such as Paladin’s Langer-Heinrich project in Namibia, Global Atomic’s Dasa Project in Niger, Orano’s Zoovch Ovoo deposit in Mongolia, Boss Resources’ Honeymoon Project in Australia (to name a few) etc. that could add another ~20mm lbs / year in supplies over the course of the next ~3-6 years. Assuming all the idled mines and planned mines come online as scheduled (which is rare in the mining world), the market could reach equilibrium during the 2025 - 2028 period (again this is assuming no significant financial demand).

But the equilibrium won’t last as production from older mines will start declining while China and India are expected to continue adding 10+ GWe of generating capacity each year in 2029-2030+. By this time the world will have exhausted its pipeline of planned mines. Even if companies started prospecting new mines today, they wouldn’t come online in time to supply the new reactor builds 2030 and beyond. Uranium price needs to move to a level to reflect this.

The below chart from the World Nuclear Association’s (WNA) 2021 Nuclear Fuel Repot illustrates this graphically. The black line representing reactor requirements doesn’t reflect recent reactor life extensions such as the Dresden Plant in Illinois. The chart also assumes zero demand from financial players, so the demand side is extremely conservative.

Despite this compelling fundamental picture, uranium spot price has refused to budge worrying some investors that there is something wrong with the bull thesis. I addressed some of the unique dynamics behind uranium spot prices in an earlier article. The other unique feature of uranium markets is that demand cycles are very lumpy, so spot price can remain disconnected from underlying fundamentals for long periods of time. Since utilities typically carry multiple years of forward inventory cover, it’s hard to predict when they show up and re-contract with producers for future supplies. It’s currently estimated that utilities on average have 2-3 years of forward cover remaining, which means that the time is coming soon (this year / 2023 latest) when they sit down with producers to re-negotiate contracts.

The combination of reverse carry traders running out of pounds to sell in the spot market, SPUT receiving an NYSE listing (which will allow them to raise more capital to buy in the sport market) and utilities sparking off a real demand cycle later this year / 2023 is what will finally spark the next leg of the uranium bull market.

In summary while the recent price action has turned investor sentiment deeply negative, the bull thesis for uranium has only gotten stronger and it’s only a matter of time before upcoming catalysts spark a major rally in spot and term prices which will drive equity prices up with them.

Uranium stocks are known to generate life-changing returns for those who can identify the cycles correctly. But in order to realize those returns one needs to have strong conviction in the underlying fundamentals to avoid getting shaken out during corrections. A number of investors who haven’t studied the long-term supply/demand fundamentals, spot market dynamics and / or who were looking to make quick gains from a repeat of the strong upward moves last year have already thrown in the towel. I’ve personally taken this opportunity to add aggressively to my holdings.