A Follow Up On Oil

Trying to understand oil price weakness, record bearish positioning and chat with an oil trader

I’ve been trading / following the oil market for many years, and I’ve invested through periods with very high volatility (including COVID), so I can say with some confidence that the price action in oil over the last couple of weeks has been abnormal.

On Tuesday, September 3rd, oil fell ~4.7%, stopping me out of my futures positions. The catalyst for the sell off appeared to be a weaker-than-expected manufacturing PMI reading, which reignited fears of a hard landing. Still, the magnitude of the sell off seemed unwarranted, given PMI readings have been exceptionally noisy post-COVID, and have de-coupled from hard economic data.

From Wednesday, September 4th to Tuesday, September 10th, traders proceeded to continue selling down oil further, in what felt like ‘programmatic selling’: price would flatten out and have a slight uptrend in the overnight session, but at around 10 am, a sudden surge of selling would push oil lower by $1-2.

The economic data released during this time was mixed at best, with some outright positive developments, like the services PMI coming in hotter than expected on Thursday, September 5th, and the unemployment rate dropping to 4.2% on Friday, September 6th. Even more incredibly, the EIA reported a significant ~7mm crude oil inventory draw for the week, which led to only a small bump up in price that faded shortly thereafter. US crude inventory levels are now approaching the 2022 and 2023 lows.

The market’s response to the Libya outage the prior week was also a bit of a head scratcher. Not only was the initial price spike ($1 - $1.5) quickly faded, rumors of Libya’s oil coming back over the Labor Day long weekend caused a swift $2+ decline in prices. While these rumors have now proven to be untrue, and satellite tracking shows that Libyan output is currently well below its production capacity (500K b/d vs. 1mm b/d), the oil market has refused to give any credit to the production loss, which appears to have no near-term resolution.

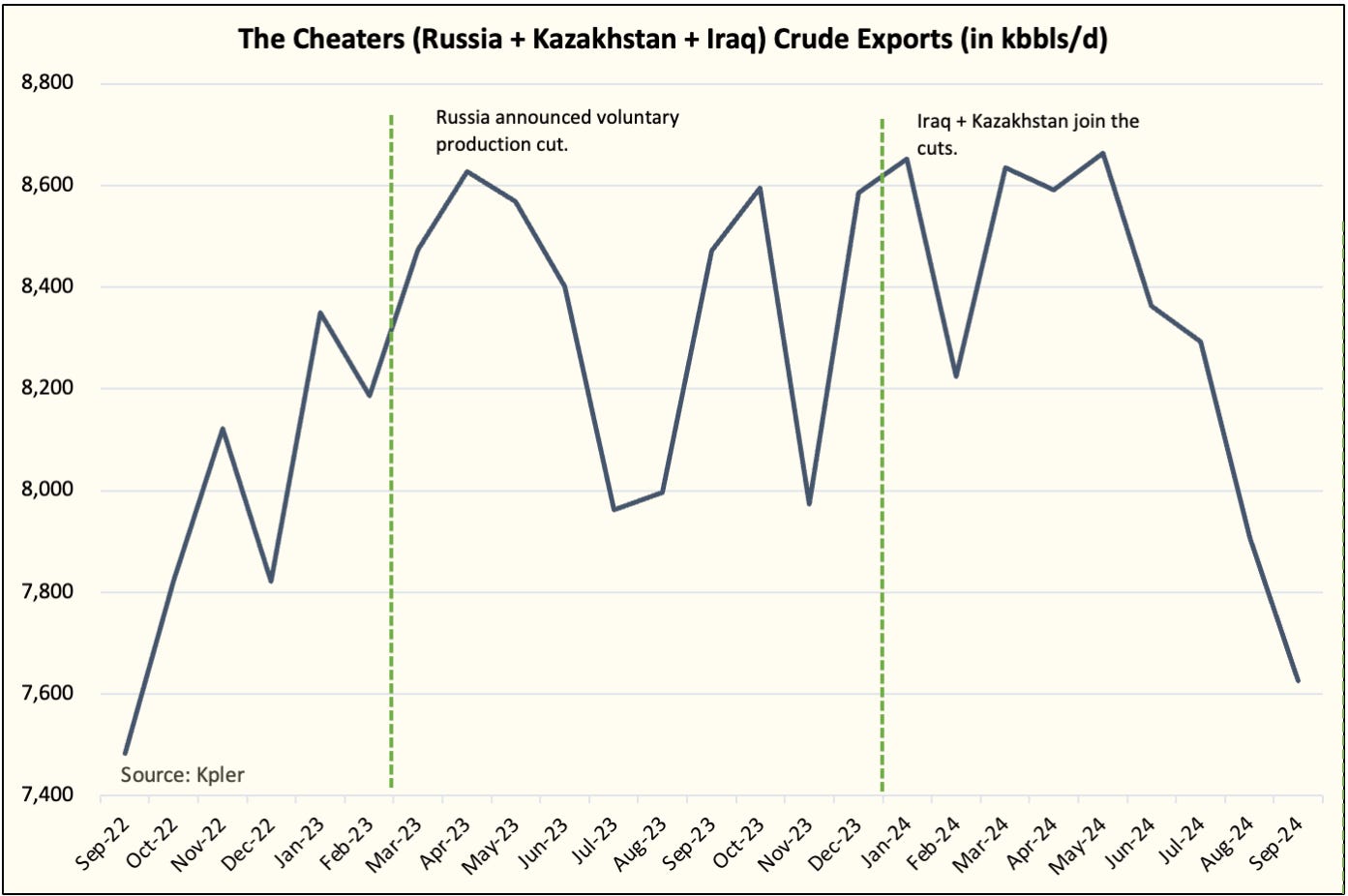

I had mentioned in my last update that a market share war was a real possibility given repeated compliance issues / cheating within OPEC+, and that it was critical for Iraq and Kazakhstan in particular to move forward with ‘compensation cuts’. So far, all the evidence suggests that these cuts will happen. Satellite tracking data shows that exports from Russia, Iraq and Kazakhstan are trending significantly lower.

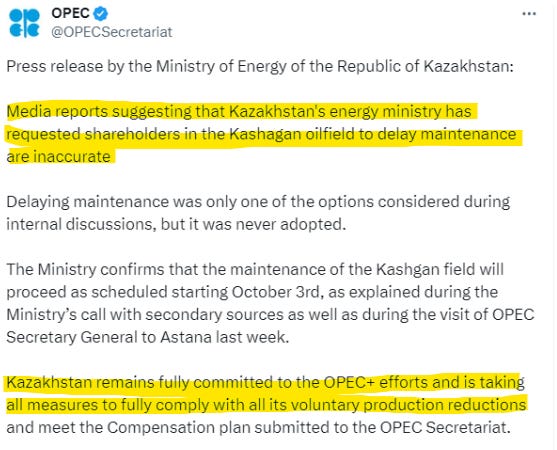

There are other signs too. When reports emerged that the Kazakhstan government had requested a postponement of maintenance at the Kashagan oil field, a refuting statement was quickly issued through the government news agency, followed by a statement under the OPEC letterhead. This appears to be a clear signal that Kazakhstan wants to avoid any miscommunication regarding its commitment to the compensation cuts. Kazakhstan's volumes are planned to drop significantly in October.

Not only will compensation cuts tighten the market further by ~200K b/d, OPEC also decided to delay the taper of voluntary cuts to the end of the year. As a reminder, voluntary cuts of 2.2mm b/d enacted by Saudi Arabia, Russia, UAE, Iraq, Kuwait, Kazakhstan, Algeria and Oman were originally scheduled to start tapering by 183K b/d each month, starting this October.

It is very strange for the oil market to ignore so many bullish supply side developments, as well as low inventory levels and a clearly tightening physical market. But as an investor one should always be humble and try to better understand the other side. Based on my discussions with traders, the market seems to be ignoring the current physical market tightness because of: 1/ persistent weak demand from China 2/ hard landing fears in the US and 3/ expected surge of non-OPEC supply into 2025. The bear case is therefore forward-looking, and is willing to ignore current market tightness because it expects balances to flip to surplus next year, which may also force OPEC+ to give up on their price management strategy.

While one can’t completely rule out such a bearish scenario, I think the odds of this outcome are far lower than what the market is currently pricing in.

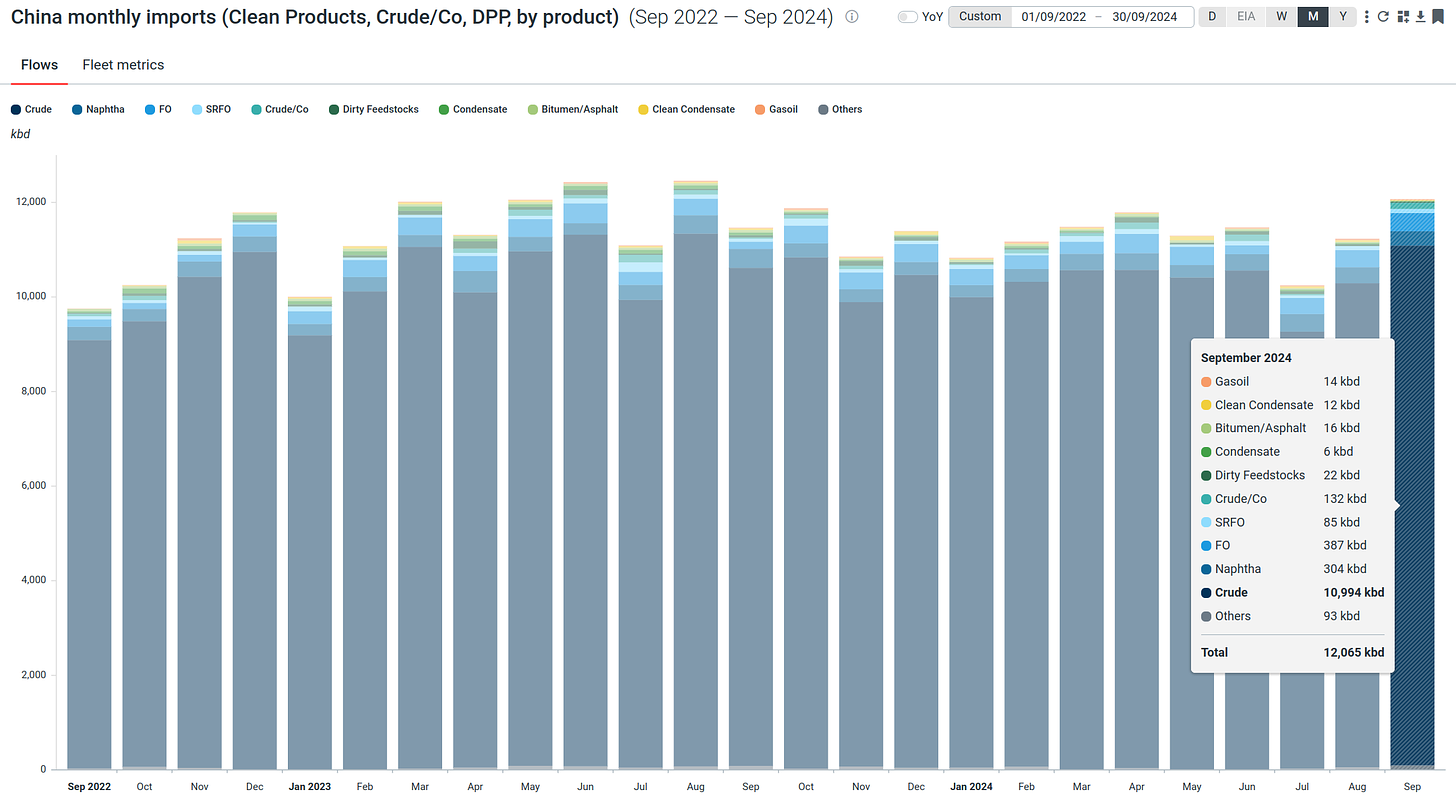

Firstly, while Chinese demand is certainly weak relative to expectations, it is not falling apart either. Recent data shows that Chinese imports are rebounding and absolute import levels should have bottomed in July, as refiners pick up runs seasonally. Oil traders have also mentioned that there is interest from Chinese buyers to rebuild strategic reserves at these price levels.

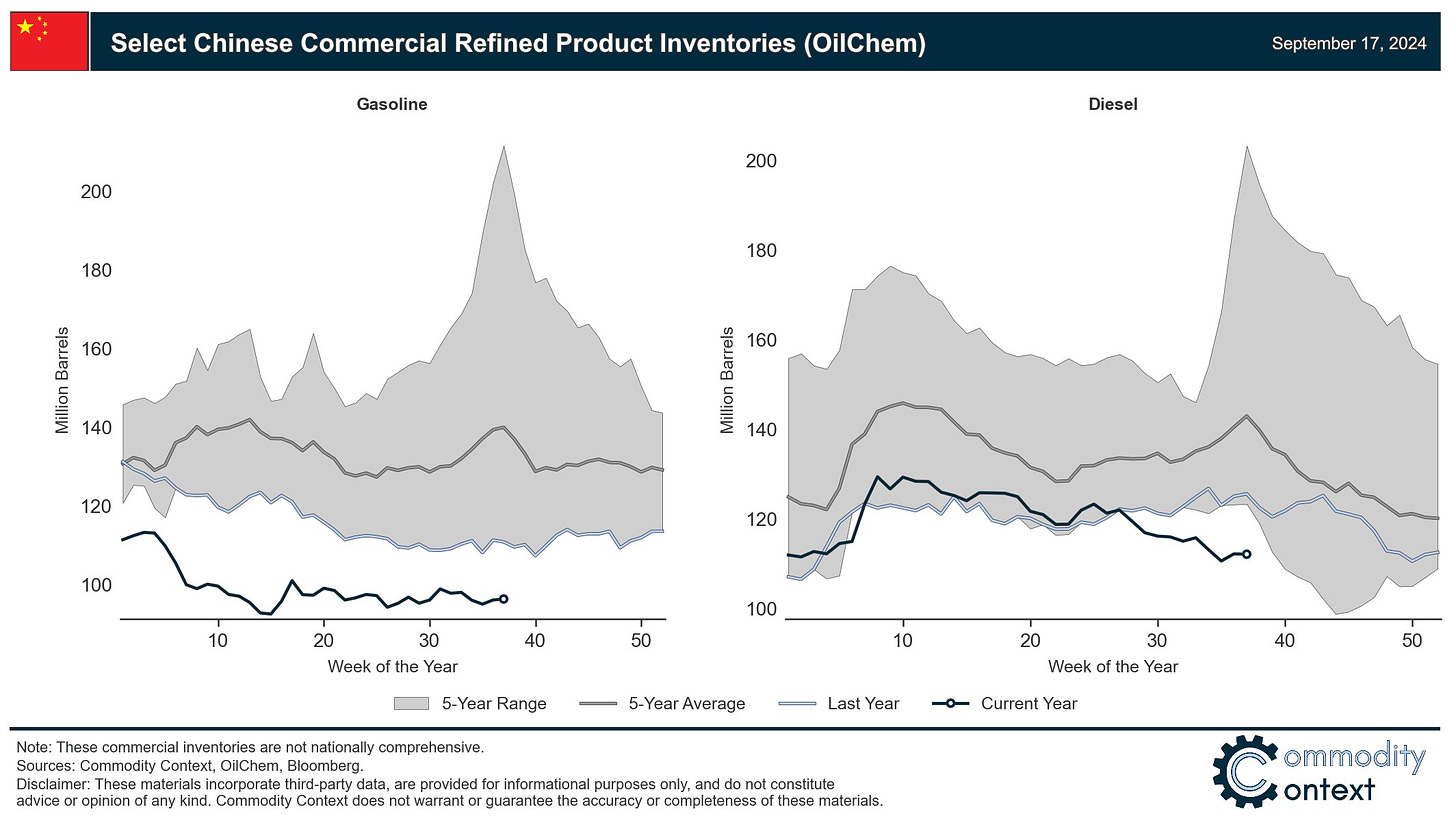

Chinese product inventories are near or below their historical ranges, suggesting that Chinese refiners will have to ultimately increase crude runs to replenish stocks.

While Chinese consumer demand (gasoline) is likely to remain weak due to the property sector weakness, manufacturing demand (naphtha and petrochemicals) remains strong, as the Chinese government is focusing on exports to maintain its economic growth. EV manufacturing for example requires large quantities of composite materials that are made from naphtha, LPG. This is reflected in strong naphtha vs. gasoline pricing in Asia.

Regarding US hard-landing fears, I find it hard to see the case for a US recession based on the latest economic data, and especially with the start of a rate cutting cycle. Whether it’s corporate earnings, labor market, or data on consumer health (e.g. retail sales), the picture seems to be of an economy that’s slowing, but still growing. It is also odd that while oil traders seem confident that a recession is imminent, other major asset classes don’t seem to agree with this assessment. For example, equity indices are making new all-time-highs, and analyst earnings expectations for 2024 and 2025 remain robust. Bond credit spreads remain at levels indicating a benign credit risk environment. Long-end bond yields rose recently in light of the Fed’s 50 bps rate cut, signaling that the market expects stronger economic growth in the future.

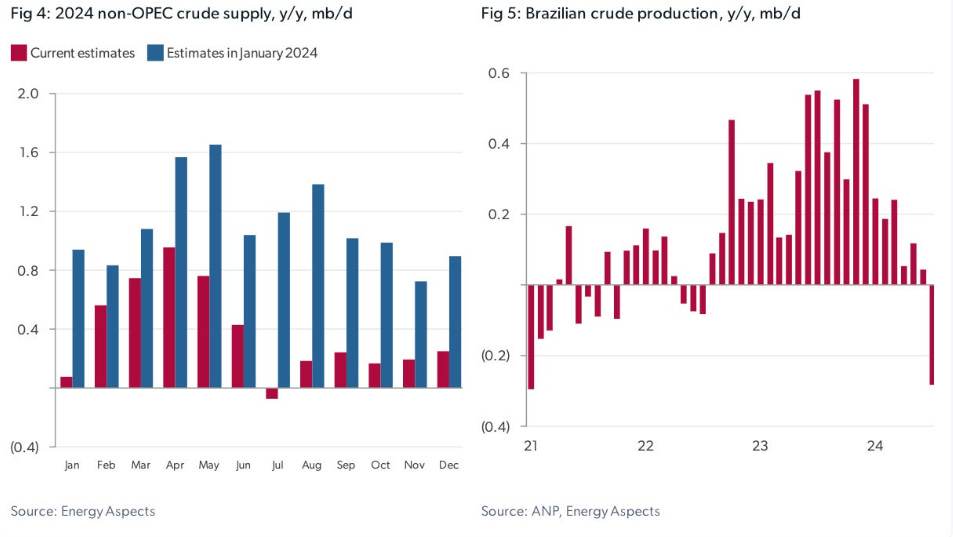

Finally, let’s talk about non-OPEC growth. The bear camp is penciling in 1.5mm b/d of supply growth for 2025 from US, Brazil, Guyana, Canada and UAE. This forecast seems quite optimistic, and reminds me of the bearish sentiment towards the end of 2023 / beginning of 2024, primarily due to analyst expectations of 1mm b/d+ of supply growth from the US. I warned at the time that many investors were too sanguine on US shale growth, and this turned out to be prescient, with US and non-OPEC production coming in well below expectations. The left side chart below shows 2024 supply estimates in January 2024 (blue), and the revisions (red).

I believe that if current oil prices prevail, non-OPEC production will disappoint once again. At ~$70 WTI, I expect US production to decline 200-300K b/d, and Canadian production to be flat. While Brazil has a number of offshore production projects slated to come online in Q4 and into next year, it has a history of production setbacks. Most recently in July, Brazil suffered a production outage at Buzios, Marlim Leste and Roncador due to strikes, causing output to drop ~0.3mm b/d below last year’s levels. UAE is part of the 8 OPEC+ countries participating in the voluntary production cuts, and I expect that it will comply with any group decision to hold back production if necessary to support prices. Guyana is probably the only country that could reliably increase production by 150-200K b/d next year. Overall, I believe non-OPEC production will show close to zero growth at the current oil price level.

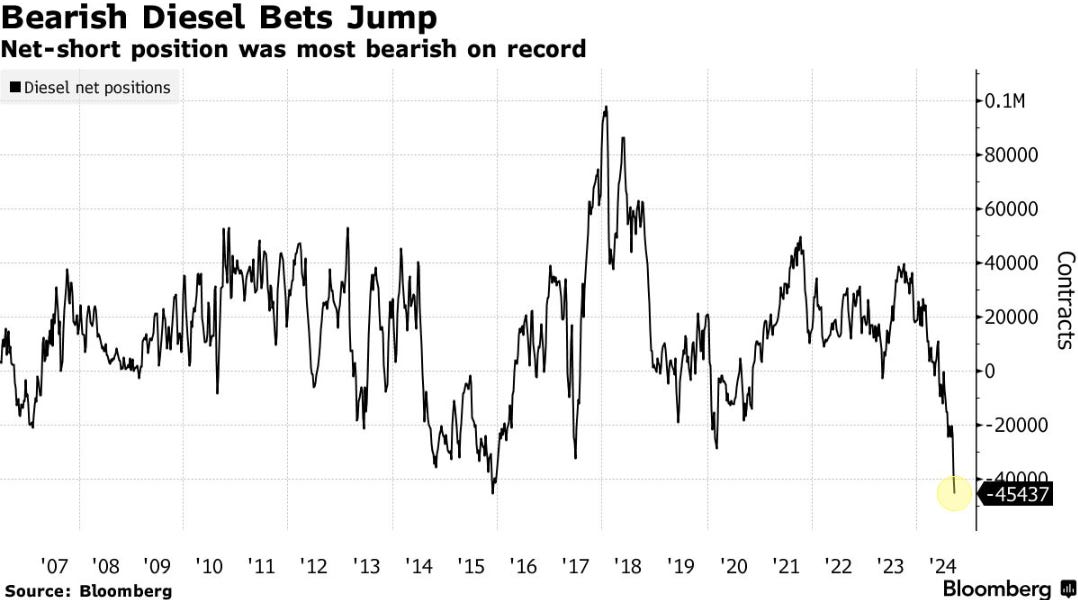

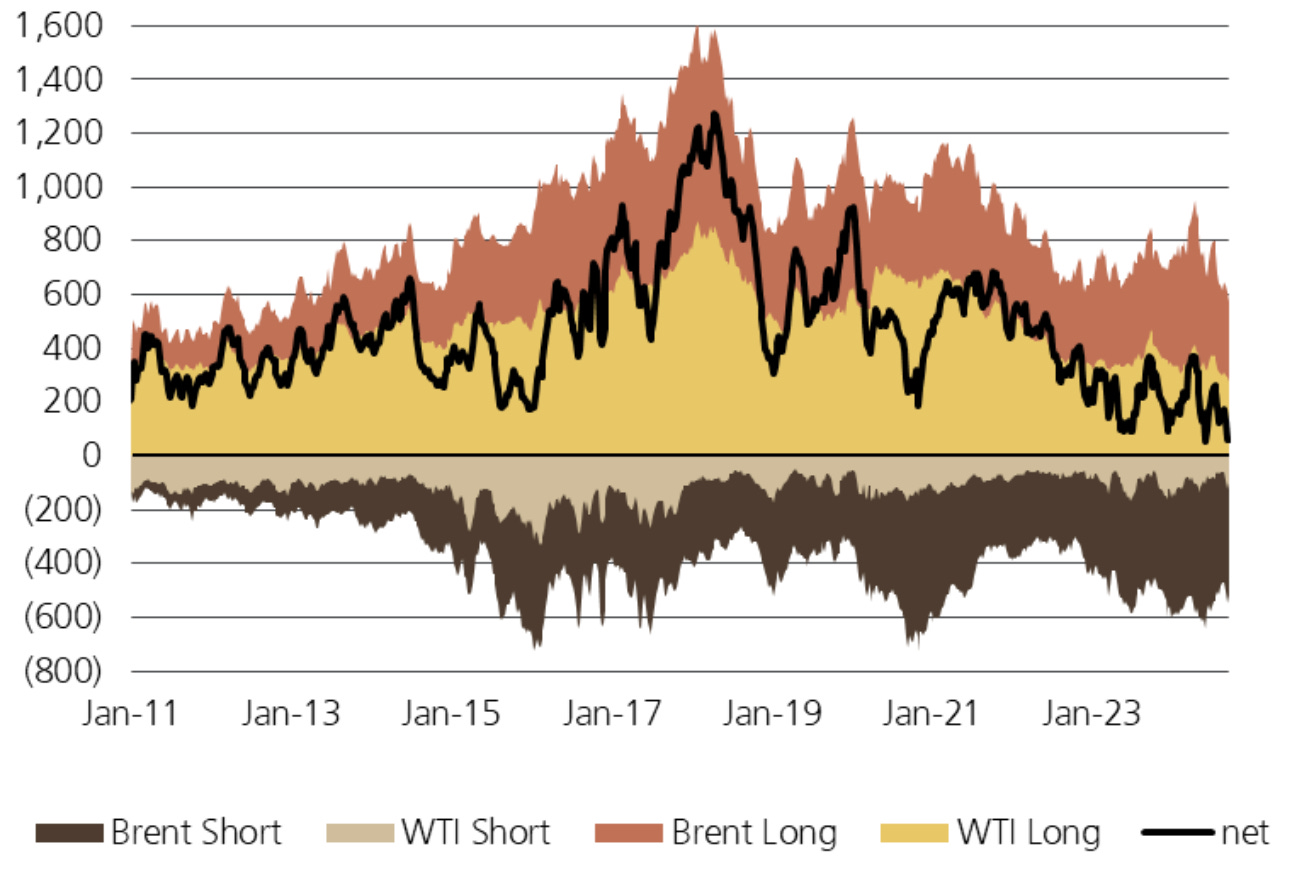

In light of the above, I maintain my bullish views on oil and I think the historically low / bearish non-commercial positioning, combined with low inventories and continued backwardation in the futures curve, represents a short squeeze opportunity.

I wanted to share a snippet of a conversation with an oil trader which I think captures well the evolution / financialization of oil trading, and why the paper and physical markets can diverge so much in the current environment [emphasis mine]:

I’ve been trading oil professionally for 30yrs....at one point WTI oil was the best fundamentally driven, physically delivered futures market on the planet. I have watched the transition from pit trading where all participants were either market makers, physical traders or a handful of funds (T. Boone etc.) all of which were fundamentally driven.

BP controlled much of the storage in Cushing, dominated the front 3 months calendar spread action, which in turn dictated flat price. All based on supply/demand available storage etc. NYMEX introduced an after hours (AH) platform (Access) where the first high-frequency trading (HFT) programs were being introduced to the oil contract by VV and friends.

When the regular trading hours volume migrated to the screen and the mini oil contract was introduced, the physical traders slowly started to lose their influence. The mini arbs were getting more active, HFT was blindsiding resting orders AH, technical traders emerged, macro funds got involved, and it all started to devolve. I remember a day when the VLO guys asked "WTF is going on" because of some arbitrary volatility. Long story short, BP blew up (spill), left the market, and most physical trading was moved OTC.

The past week has been the culmination of this 15yr transition of oil becoming a casino. Fundamentals don't seem to have much, if any influence, anymore. I could go on and on but my guess is the lack of investment in the sector and the ignorance of most oil "traders" will be punished.

After being stopped out of my oil position for a loss a couple of weeks ago, I switched to a tactical trading approach, taking intraday positions based on 1-hr support and resistance levels (see chart below where I’ve marked the key levels I’ve been using to place my trades). This has helped me recoup my initial losses, without tying up a lot of capital. When the market is ignoring fundamentals and trading firmly in a downtrend, it’s prudent to wait for signs of a momentum change before re-establishing a buy-and-hold position. Over the last few trading days, such signs are emerging, with oil making higher highs and higher lows. As such, I’ve started rebuilding a core long position that I’m willing to hold for a more substantial move to the upside. My target price for WTI is $80-$85.