I’ve written about Transocean (RIG) and Tidewater (TDW) to play the offshore thesis, and mentioned Valaris (VAL) in passing a few times. I think it’s a good time to expound on the VAL thesis, as I’ve reduced my exposure to TDW in light of the run-up in stock price, and re-allocated funds to my position in VAL 2028 warrants. I’ve historically kept VAL as a smaller position as I felt the Company’s contracting strategy didn’t position it well to take advantage of higher dayrates, however as legacy contracts rollover, Valaris should experience a significant cash flow inflection in H2 2024, going into 2025.

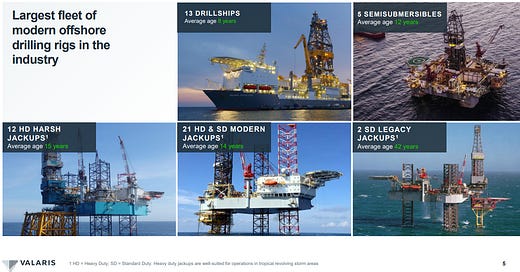

VAL is the largest of the offshore drillers, with 53 total rigs (13 drillships, 5 semisubs, 35 jackups). Jackup dayrates have less ‘beta’ to supply / demand fundamentals vs. floaters, which is why a floater pure-play like RIG is considered a higher torque way to play the offshore thesis (along with the higher financial leverage). However, the lower upside torque is made up for by VAL’s cleaner balance sheet which allows for quicker shareholder capital return. With 2024E net debt / EBITDA of <1x, shareholders can expect management to return capital to shareholders through buybacks and potentially dividends.

After undergoing several acquisitions (Pride International in 2011, Atwood Oceanics in 2017, Rowan Companies in 2019), VAL was highly leveraged coming into the 2020s, and had to undergo restructuring during the COVID oil crash. The Company emerged from restructuring in May 2021, with the new stock initially trading in the low $20s, resulting in a market cap of ~$1.6bn. Through the bankruptcy proceedings, $7.1bn in debt was wiped out, with $550mm debt staying on balance sheet in debt in the form of a second lien note maturing in 2028, along with $615mm in cash. The Company relocated its headquarters from London, UK, to Houston, Texas.

As part of the restructuring, 5.645mm warrants were issued to former common stock holders. These warrants are set to expire on April 29, 2028, with an exercise price of $131.88. Due to the bankruptcy proceedings, ownership transitioned to the former bondholders. Several former bondholders still hold shares, including Oak Hill, Lodbrok Capital, Adage Capital. Elliott Investment Management recently sold out of its stake and added a position in RIG. One of the reasons VAL stock price has been weak is because of the overhang from former bond holder selling. The shareholder register changing hands and transitioning to long-term equity investors should help with VAL’s valuation.

Improvement in the offshore market allowed VAL to increase its EBITDA by 82% from $77mm in 2021, to $140mm in 2022. The growth trajectory slowed in 2023 due to legacy contracts fixed at below market rates, but the next couple of years are expected to be much better. For 2024 Valaris expects total revenues of $2.3-2.4bn, contract drilling expense of $1.65-$1.75bn, G&A of $105-$110mm, and EBITDA of $500-$600mm (including reactivation expense of $40mm). Capex is anticipated to be $390-$430mm, including maintenance capex of $290mm, reactivation capex of $80mm, and $40mm of newbuild capex.

While not a floater pure-play, VAL does have thirteen 6th and 7th generation drillships which are currently fetching leading edge dayrates in the mid-to-high $400K range. The Company also has 3 stacked 7G drillships, including the recently acquired DS-13 and DS-14. These were purchased last year for $119mm and $218mm respectively, through purchase options negotiated with the shipyard during the 2020 bankruptcy. Each drillship was originally ordered by Atwood Oceanics (predecessor company) for $635mm, for a total of $1.27bn, meaning VAL had to pay only 26% of the original purchase price. To get a sense for how good this deal is, even at a below market $400k dayrate, both 7G drillships should generate ~$140mm of FCF/year relative to a total purchase price of $337mm. While each rig will have activation costs near $100mm, the operator may pay a meaningful portion of these costs.

A number of VAL’s floaters that are currently on legacy, below market rate contracts, will be re-contracted in Q2 and Q3 of 2024 (DS-10, DS-16, DS-15, DS-4). By H2 2025 only 4 out of the 13 floaters will be on legacy contract, implying that 9 floaters will see an increase in dayrates from ~$250K to current market rates. Even if we assume a conservative $200K dayrate upgrade to $450K, this implies an annual FCF boost of $657mm on 9 rigs, or ~12% of VAL’s current market cap. By 2025 VAL should have line of sight to $1bn+ of EBITDA annually.

The Company’s sensitivity analysis below guides to what EBITDA and FCF would look like if VAL’s fleet was fully re-contracted at various dayrate scenarios. The base case shows $1.07bn of FCF with drillship dayrates of $450K, semisub dayrates of $350K and jackup dayrates of $125K-150K with 75% utilization. As I mentioned in my original piece on the offshore thesis, I expect dayrates to converge to newbuild economics eventually, which means Scenario C or higher is possible. Valaris CEO has stated in the past that $900K dayrate would be required to justify a newbuild drillship.

If VAL is able to generate $1.65bn in FCF under Scenario C, it’ll be able to retire ~29% of its shares outstanding every year at the current stock prices. What multiple should we apply to this cash flow stream to value VAL? The average useful life of a rig is 30 years, while VAL’s fleet has an average age of 9 years for floaters, and 7 years for jackups. Below is a valuation sensitivity analysis using 7-10x cash flow multiple and a conservative annual FCF range of $1-$1.5bn. This implies a target stock price as high as ~$135-203 (vs. $77.40 as of Friday’s close), excluding the impact of share buybacks, or the dilution from warrants being exercised.

Another way to look at valuation is from an asset perspective. VAL originally purchased its drillships for ~$600mm per rig, which equates to an EV of $8bn, or ~$100 per share book value. Based on current market conditions, drillship replacement cost is estimated to be ~$1bn. If we valued VAL’s drillship fleet on replacement value, that would imply an EV of $13bn or $170 per share. Importantly, this is the value of drillships only, and ascribes zero value to VAL’s 35 jackups and 5 semisubmersibles.

The Company has already been rewarding shareholders with share buybacks, with $200mm worth of shares repurchased in 2023. 2024 buyback authorization was increased to $600mm from $300mm. It’ll be important for management to continue messaging their commitment to returning capital to shareholders, especially given the Company’s history. Most investors in the space are scarred by the last cycle’s overinvestment in newbuilds, and the subsequent destruction in equity value. As the largest player in the space, investors will be looking to Valaris management to lead the way in terms of capital discipline and ensure many years of cash returns.

One of main criticisms made against VAL is the management track record. Unlike RIG, VAL had to wipe out its equity holders, and restructure its debts during COVID. However, this is not unique to VAL. Four of the seven largest offshore drillers went bankrupt in 2020 including Noble, Seadrill and Diamond. VAL also doesn’t have the best track record in terms of contracting, with several industry observers suggesting that management has been too eager to sign contracts at below market rates, rather than holding off, waiting for better deals, and negotiating more aggressively. During 2022 and early 2023, VAL management arguably expressed overly pessimistic views on the market, even though the tide had clearly turned and dayrates were moving up sharply. For example, in early 2023, VAL leadership stated that they were not interested in exercising the option to acquire DS-13 and DS-14 due to a lack of demand. This made little sense given the deeply discounted valuations being offered (and as laid out in my math above), and the Company back-tracked on this assessment later in the year.

While the management issues are concerning, and potentially one of the reasons why VAL trades at a cheaper multiple than peers, I don’t think they are a deal breaker. Given the magnitude of the dayrate inflection and the operating leverage in the business, even with the current sub-optimal contracting strategy, VAL will be on track to enjoy very healthy cash flows relative to its market cap. What would be more troublesome is if management didn’t keep its word on capital returns, and instead decided to invest in newbuilds prematurely. I consider this a bigger risk for VAL vs. RIG, based on my assessment of the two management teams. I’ll be monitoring VAL’s capital allocation decisions and contracting strategy closely.

A Quick Word On Warrants

I’ve chosen to get exposure to VAL through the 2028 warrants that were issued as part of the bankruptcy process. The warrants trade under the ticker $VAL.W. There two primary reasons I chose to buy the warrants instead of the stock: 1/ upside torque 2/ cheap implied volatility. My cost basis in the warrants is ~$12.50, and I purchased them at an implied volatility of 30.5%, which is quite attractive given VAL has realized 35-40% vol over its post bankruptcy trading history.

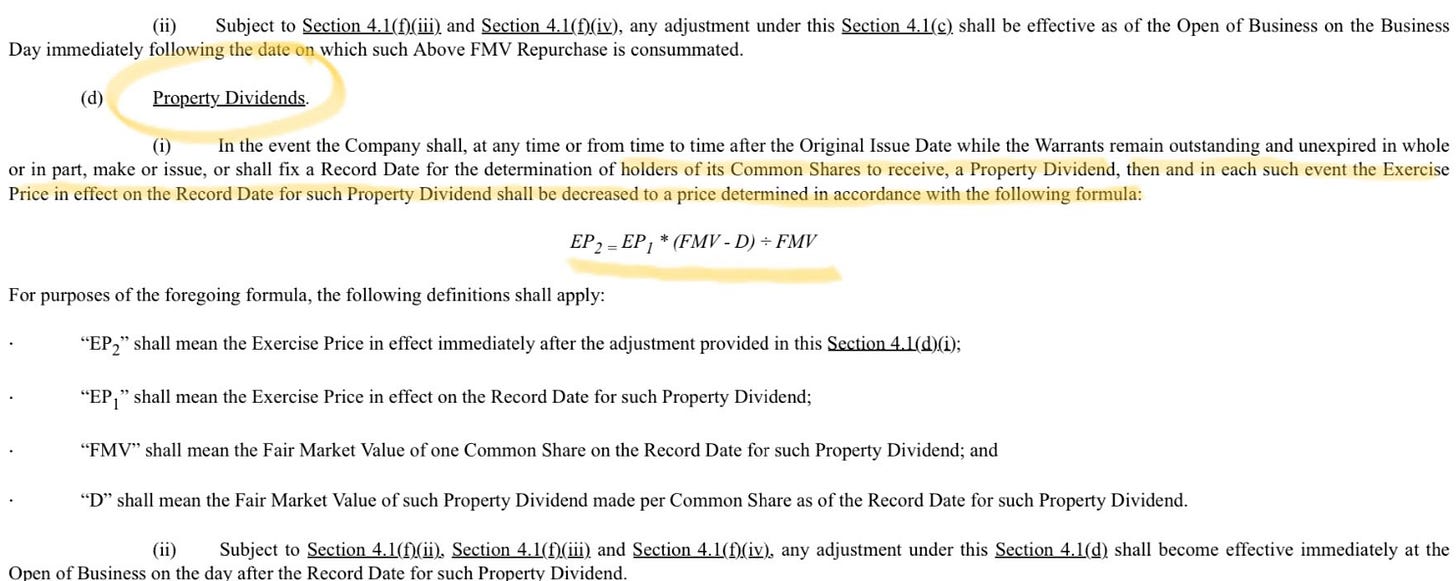

However, there are a couple of risks associated with warrants. Firstly, there is theta / time decay. To make a profit on the warrants VAL stock will have to experience a significant upward move over the next couple of years. At a $12.50 cost basis, I will need the stock to be $144.38 at maturity (April 29, 2028) to break even. Another risk is M&A. The warrant language doesn’t provide change of control protection, so if someone acquired VAL at a price below the strike price, warrant holders will not receive any intrinsic or time value. However, I view takeover risk as de minimis given VAL is the largest player in the space and likely to be an acquiror vs. target. The warrant document does provide protection against dividends, so warrant holders will be compensated for any cash distributions through a proportional reduction in exercise price (see language below).

The below data table shows my calculations for warrant valuation at different points in time, using a 35% implied volatility assumption and 5% interest rate to term. Based on my stock price target range of $135 - $203 at a 7-10x cash flow multiple, and my cost basis of $12.50, the warrants should return 100% - 500% if I’m proven correct by January 2027.

What has to go wrong here for you to lose money? Also, why do you think they paused buybacks during the last quarter?

Thanks for the note, I can't help but notice that post recent sell-off the shares offer a similar payoff / torque without the time decay, CoC risk, etc... Throughts?