Russian Roulette

Russia's decision to invade comes at a bad time for Western policymakers

Let me preface this piece by saying that I’m not a geopolitical expert, so take my thoughts on this topic with a grain of salt. That being said, I have been been following oil markets for a while and therefore Russia (being a large oil exporter) is a country of interest. I’m going to try to address three points regarding the current situation: 1/ why Russia is doing what it’s doing 2/ why it chose to do it now and 3/ the impact on commodity markets.

French philosopher Auguste Comte is often quoted as saying “demography is destiny”. Changing population growth and age dynamics have profound implications for economic growth, social stability, and geopolitics. During a meeting with school children last year, Russian President Vladimir Putin asserted that if it wasn’t for the October revolution of 1917 and the collapse of the Soviet Union, “some specialists believe that our population would be over 500 million people”.

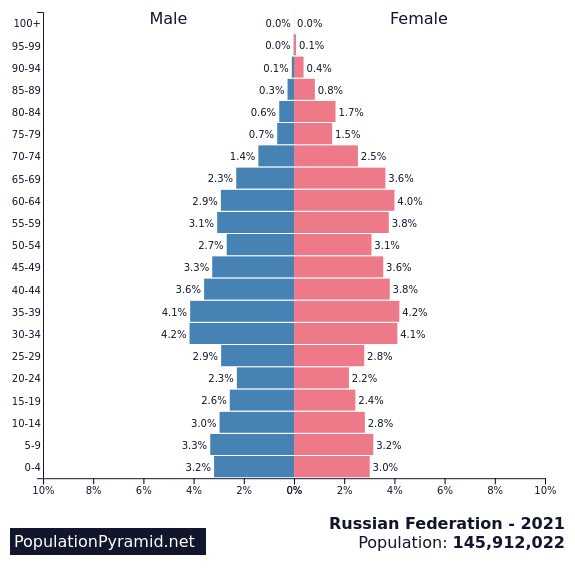

Russia’s population peaked in the early 1990s at 149mm and has been in steady decline since (currently 144mm). GDP peaked at roughly $2.3 Tr in 2013. The pandemic hit the Russian population particularly hard given low vaccination rates. Population in 2020 dropped the most since 2005, largely as a result of COVID related deaths and birth rates dropped to 20 year lows. It’s not just the size of the population but also the composition which is concerning. The age-sex pyramid chart below illustrates how fertile women and younger people are in limited supply in Russia which means a shrinking labor force will have to economically support an increasing proportion of older dependents, especially as life expectancy increases.

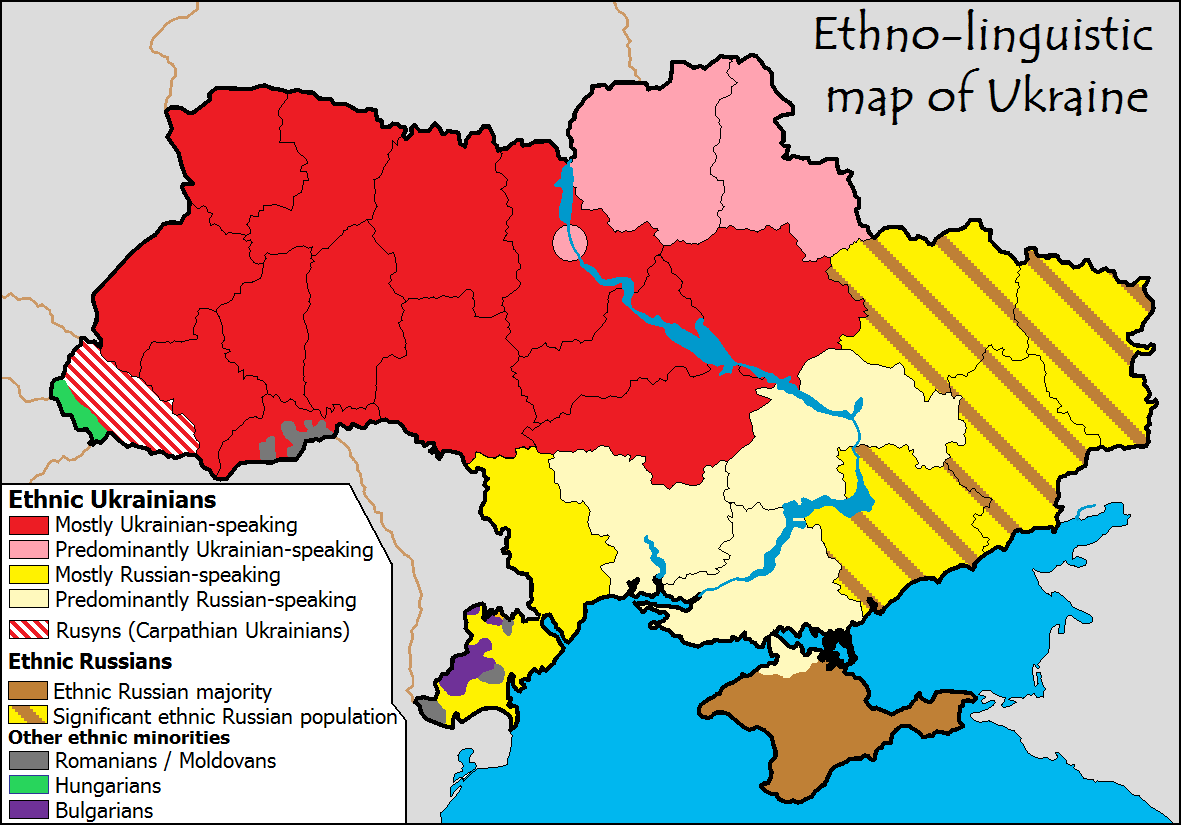

Russia has been pursuing pro-natalist policies to counter this trend for many years, but to no avail. Therefore the only option left for Russia to maintain its geopolitical clout and avoid being labeled a declining world power is to ‘acquire’ population through inorganic/external means including migration, offering citizenship to members of the former Soviet Union and in extreme circumstances, invading neighboring countries.

The annexation of Crimea added 2.5mm to the Russian population. Taking over Russian speaking parts of Ukraine would add a couple of million more. Invading Ukraine could also allow Putin to divert attention away from domestic issues and point to Western sanctions / intervention as the cause for economic woes.

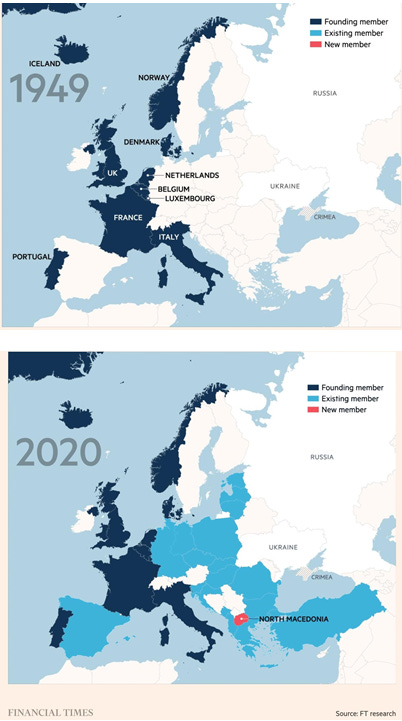

The more commonly cited reason for Russia’s aggressive stance is the expansion of NATO over the past century and a feeling of isolationism, especially if Ukraine decided to join the alliance. However this dynamic has been at play for several years and doesn’t explain Russia’s current sense of urgency. An invasion of Ukraine is a big undertaking and comes with various economic and political risks, so there’s got to be more at play for Russia to have decided to take the gamble.

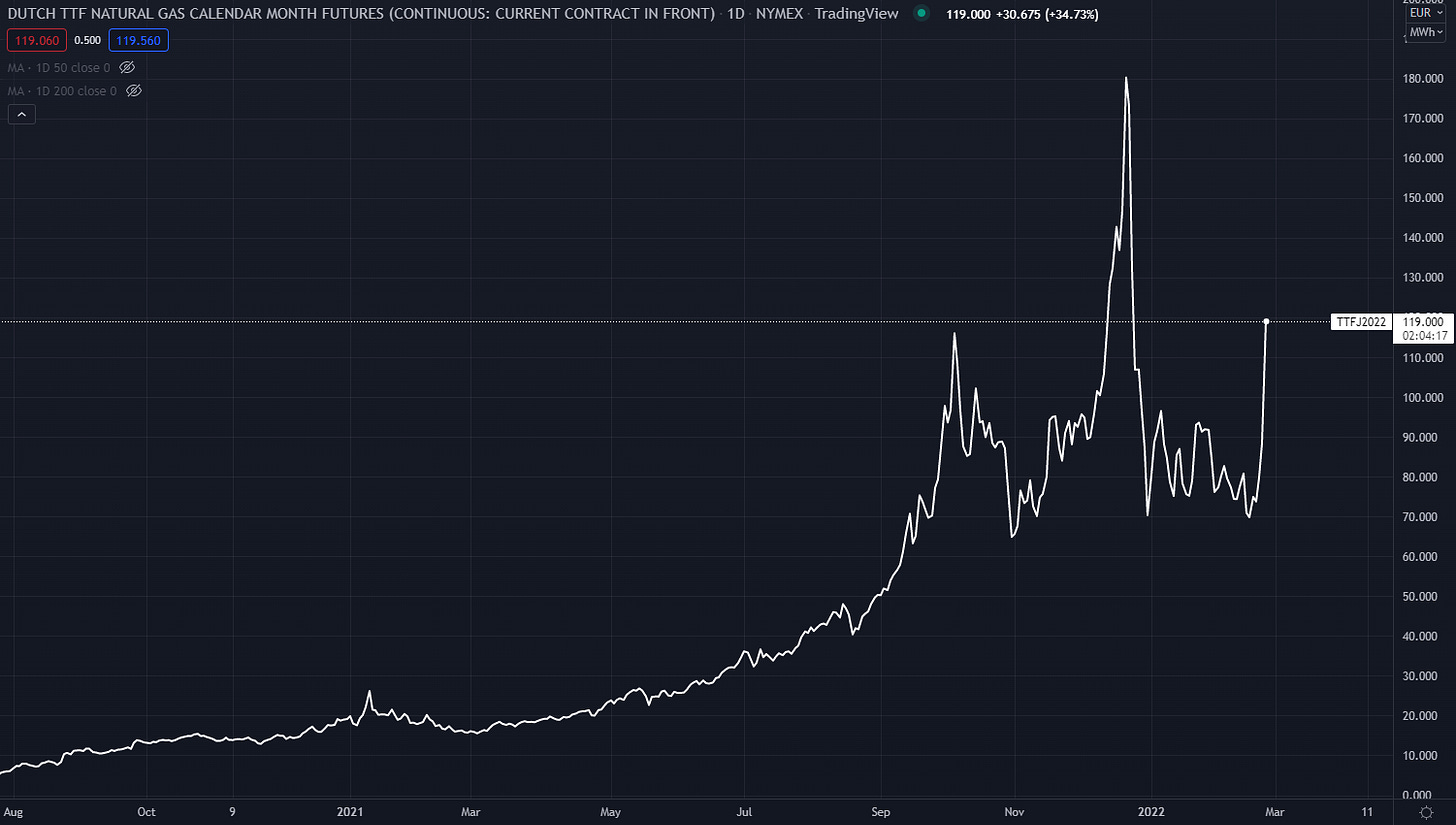

I think the reason for conducting the invasion right now is the economic leverage Russia has gained as a result of the West’s flawed energy policies. Thanks to the Western jihad against domestic fossil fuel production, pipelines and other policy missteps such as Germany’s decision to shut down its nuclear plants, Europe is highly dependent on Russian oil and natural gas to keep the lights on. Roughly 30% of the EU's oil and 40% of it's natural gas is imported from Russia - and for parts of the EU like Finland, Poland and Estonia, >75% of imported petroleum is Russian.

Additionally, Russia is the largest exporter of wheat in the world and controls about half to two-thirds of global ammonium nitrate supply (used in fertilizers). With commodity inventories running low across the board, and energy and food inflation running high, Putin knows that Western politicians will have to suffer a large economic and political cost if they imposed sanctions on Russian commodity exports. European gas prices are still 5x their 2019 levels. And with mid-term elections coming up in the US and inflation being top of mind for US voters, the political calculus of punishing Putin at the cost of higher inflation for US consumers is a risky one.

Putin’s actions also create a dilemma for central banks who have been trying to reign in inflationary expectations: if central banks decide to pause their rate hike trajectory or ease monetary policy to support financial assets and help governments fund a war against Russia, they would risk inflationary expectations spiraling out of control; on the other hand if banks continue on their current path of tightening they risk causing a break down in financial assets in the near term given the double whammy of geopolitical tensions and higher interest rates.

Looking forward, the invasion of Ukraine ensures that energy and food security remains top of mind for politicians and corporate decision makers. Russia exports ~4.6mm b/d of oil and ~23.3 Bcf/d of gas (out of a global LNG market estimated to be ~53 Bcf/d), so export sanctions would be catastrophic for the global economy. Over the next few days, clarity regarding how much economic pain politicians are willing to take on will determine the level of geopolitical risk premium embedded in commodity prices.

My hunch is that the economic cost of harsh sanctions will prove to be too high and oil prices will cool off in the coming days as the world realizes that Russian export bans are off the table. In fact, as of this writing WTI has already dropped ~$7 / bbl after briefly breaching the $100 mark. I also feel that an Iran deal is becoming more likely given the US administration’s dwindling options to bring oil prices down. All of these developments would be healthy for oil investors in the longer run as a volatile oil price spike would severely damage the global economic recovery and hamper oil demand growth. With oil equities still only pricing in $60 - $70 / bbl oil - there is significant room for oil prices to drop without impacting the relative undervaluation / attractiveness of oil stocks.

Over the longer term oil prices will continue to rise (albeit more gradually) even in the absence of geopolitical tensions due to the structural factors I’ve outlined earlier. A gradual rise in oil price which is accompanied by a continuing economic recovery will be more sustainable and therefore more accretive to equity value of oil companies. As a holder of oil equities one should prefer a de-escalation of the current situation rather than a super spike in oil price as a result of sanctions on Russia.

Lastly, a quick word on uranium. Russia provides ~20% of the nuclear reactor fuel for the US and Europe and 43% of uranium enrichment capacity. Similar to the situation with oil and gas, it will be impossible for the world to completely displace its reliance on Russian nuclear supplies, though they might look to diversify. Sweden has already suspended purchases of uranium and nuclear fuel from Russia. Other countries might look to North American producers for future supply contracts. This is bullish for Canadian and US uranium mining stocks in the long run.