Gear Energy

With WTI prices stuck in the high-$60s to low-$70s, many investors have grown impatient and exited their E&P positions. I’ve largely stayed out of E&Ps this year, as I didn’t see a sufficient margin of safety in my favorite names to justify rotating capital from my existing holdings. However, some small-cap names are now becoming too cheap to ignore.

Gear Energy (GXE) is a company I’ve followed for many years, and at the current price of ~C$0.52 per share, I believe it offers an attractive risk/reward profile, allowing me to take a significant position without having to worry too much about oil prices remaining range-bound. A history of troubled acquisitions, missed production guidance, a dividend cut, and management turnover have led to capital flight and investor apathy toward the stock.

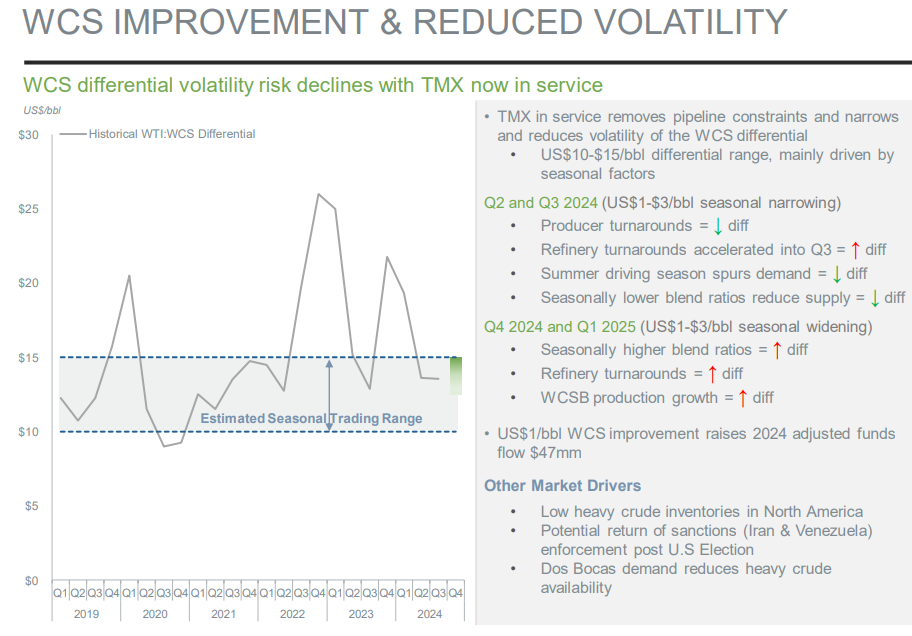

As a quick refresher, GXE is an oil producer with a high liquids weighting (82%) and a focus on heavy oil (57%). If you’ve read some of my prior posts on GXE and MEG, you’ll know that heavy oil has historically faced egress capacity issues. However, these challenges have now been resolved with the TransMountain (TMX) expansion completed earlier this year. The expansion has increased pipeline capacity from 300K b/d to 890K b/d, resulting in a narrower and more stable WCS-WTI spread. This provides greater cash flow stability and improved price realizations for companies like GXE and MEG Energy, which have significant heavy oil exposure.

Assuming a modest $70 WTI price, $15 WCS-WTI spread, and the mid-point of production guidance (5,400–5,600 b/d), GXE expects to generate C$65mm in FFO and C$25mm in FCF after accounting for the C$40mm capital budget (including asset retirement obligations). At $80 WTI, FCF increases to C$34mm. Based on the current stock price and market cap (C$140mm), this represents 18% and 24% FCF yield, respectively. Currently, investors are receiving 11% of this yield in the form of dividends.

Net debt is currently C$9mm, representing just 0.1x FFO. To sustain the dividend, GXE needs WTI prices to stay in the mid-$60s or higher. While a temporary dividend cut is possible, the clean balance sheet and high netbacks should make this a short-term setback until oil prices recover.

Looking at reserves, Gear has 23,407.3 Mboe of net proved + probable reserves and 15,214.9 Mboe of total proved reserves, implying an RLI of ~11.6 years and a proved RLI of ~7.6 years. While some investors may see these figures as low, there are several points to consider:

Gear has historically maintained stable RLIs by replenishing reserves annually through drilling and exploration.

The current capital budget includes a 120% increase in land/seismic spending to bolster inventory.

Gear employs waterflooding for enhanced recovery, which isn’t reflected in reserves estimates.

At the current market cap, you’re effectively paying for just 4–5.5 years of cash flow, depending on oil prices.

On an NPV basis, using a 10% discount rate, GXE’s reserves are valued as follows (after-tax):

Proved, developed, and producing (PDP): C$206.3 million

Total proved: C$281.7 million

Proved + probable: C$432.4 million

These valuations are based on a conservative oil price deck, assuming a gradual increase in WTI from $74 to $80 between 2024 and 2029. This means investors can currently buy GXE at a 32% discount to PDP NPV, the most conservative reserves valuation.

What could go wrong? If I’m wrong about the supply and demand dynamics for the oil market, then oil prices could crash and obviously GXE would go down with the rest of the sector. There is also a possibility that GXE management enters into a value destructive acquisition, or allocates capital poorly in other ways. I’ve already written a lot about the oil market, and what I think is a fair oil price range, so I won’t repeat those thoughts here. As for capital allocation, I would highlight that GXE is ~8% insider owned, with several insider purchases in recent months above the current share price. In other words, the management and board have significant skin in the game and they are currently underwater on their share purchases. Their incentives are aligned with shareholders to re-rate the stock higher.

The new CEO, Kevin Johnson, has a background in operations, previously serving as a VP of engineering at Artis Exploration, a PE-owned E&P. During analyst calls and interviews, he has emphasized his focus on organic growth, and developing a deeper understanding of Gear’s current asset base and opportunities. GXE has also re-iterated its commitment towards shareholder returns, and keeping a clean balance sheet, which should give investors comfort that capital won’t be allocated to risky M&A deals or heavy growth capex.

If GXE stays focused on its strategic objectives, shareholders have the opportunity to earn significant cash returns through dividends and a potential 50%+ capital return to reach parity with PDP value. At $80+ oil, I could see the stock doubling from current levels.

Ero Copper

Ero Copper (ERO) (original thesis here) posted disappointing Q3 earnings last week, causing weakness in the stock price. While the quarter itself was decent, the company experienced operational setbacks in its copper assets, resulting in a significant downgrade in production estimates for 2024. As a reminder, ERO operates three major projects:

Caraiba (Pilar and Vermelhos underground mines and the Surubim open pit mine)

Tucuma (a new copper project that was completed this year)

Xavantina (gold)

Based on the latest guidance for 2024, Caraiba copper output for the year is now expected to be 35-37Kt, down from 42-47Kt and Tucuma is expected to be 8-11Kt, down from 17-25Kt. This means aggregate 2024 production guidance has been revised down to 43-48Kt vs. the original guidance of 59-72Kt, representing a 30% reduction at the mid-point. While such a significant downgrade is concerning at first glance, the management team used the analyst call to provide detailed color on the production issues, which appear temporary vs. structural, and expressed confidence in getting production back on track for 2025.

While Caraiba production increased ~12% in the quarter driven by higher mine grades, underground development at Pilar did not advance at the pace anticipated due to issues with a third-party contractor. The issues relate to ERO’s ability to access high-grade stopes that the company had hoped to access based on the plan for H2 2024, but are now being shifted out to H1 2025. To fix this issue, ERO is bringing on a second third-party contractor, but it will still take a few quarters for things to get back on track (likely H2 2025). Importantly, these issues do not impact the dilution and/or reconciliations with respect to the stopes, and have more to do with the access and timing of getting mining workers to start mining those stopes successfully. The management provided the following comments with regards to this issue:

I think when we're talking about underperformance (of the third-party contractor), it's relative to the expectation and the performance against the contract we signed. If I look at the curve of weekly increases, mobilization of equipment, mobilization and training of people, those were all behind. So when I look over the past couple of weeks, I'd say the development rates that the contractor is achieving are in line with the full mobilization. But that mobilization took much longer than we anticipated, and largely due to the availability of equipment and resources in Brazil. I think that's a theme probably throughout the sector, but it certainly impacted our contractor's ability to ramp up the development rates. As I said over the past couple of weeks, they've increased their productivity and rates. So I don't see that as a systemic issue or like a challenge in the operation itself. It more has to do with the timing and their ability to achieve higher development rates.

Moving on to Tucuma, construction of the mine and mill was completed successfully this year, with first production in July 2024. However, in late August, ERO experienced voltage fluctuations on the regional power grid, which limited the ability to maintain throughput levels. The company was initially informed that the voltage fluctuations were due to wildfires, however following a decrease in wildfire activity, the region was struck with a severe windstorm, causing a 10-day power outage. Once power was restored, ERO continued to experience recurring voltage oscillations. These oscillations are causing the mill operator to go into standby mode, requiring a physical restart, which takes ~15mins. With 8+ voltage fluctuations per day, ERO’s ability to continuously operate the mill is being hampered. Most of these fluctuations are very short, lasting a millisecond. The management team is working on two solutions to fix this issue going forward. First, it’s recalibrating the software package for the mill motor to desensitize it to downwards voltage fluctuations; instead of sending the mill into standby mode with every fluctuation, the mill will only go on standby in the case of a voltage increase / surge. The second solution is to install a transformer to accommodate voltage volatility at ERO’s substation. The cost for doing so is quite minimal, at around $1mm, and the engineering team has already started work on this.

On the positive side of things, cash costs for the quarter dropped 24.5% to $1.63/lb. This was driven by higher copper grades, tightness in the copper concentrate market (which allows for more favorable treatment and refining terms) and a more favorable USD/BRL exchange rate. It is worth highlighting that ERO’s recoveries and concentrate grades have continued to come in above design levels. The gold operations (Xavantina) realized cash costs and AISC of $539 and $1,034 per ounce of gold produced, respectively. ERO reaffirmed its gold production guidance of 60-65K oz and cash cost and AISC guidance of $450-$550 and $900-$1000, respectively. ERO also entered into a zero-cost gold collar contract for 2025 for just over 50% of projected 2025 gold production, setting a floor price of $2,200/oz, and ceiling price of $3,425/oz.

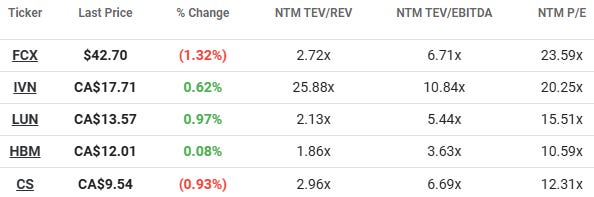

Using the mid-point of the new 2024 production and cost guidance, and assuming a copper price of $4/lb and gold price of $2,500/oz, ERO should generate ~$180mm of profits from its copper operations and $94mm of profits from the gold operations. At the current market cap of ~$1.6bn, investors are paying only 6x for these earnings, which is quite attractive considering the significant growth potential next year if production guidance can get back on track, as well as the long-term upside potential in copper prices. For reference, ERO’s peers trade at a 10-20x P/E multiple.

While the recent production issues are concerning, it’s important to remember that mining in foreign jurisdictions is hard, things often go wrong, and one should look carefully into a management’s track record and depth of experience when assessing the risk / reward. On this basis, ERO management pass with flying colors. The ability to bring Tucuma to completion in just over 3 years after publishing the optimized feasibility study, with zero injuries, is an extraordinary achievement. Since IPO, ERO management have successfully outperformed their original mine plans, extending the LOM with reasonable costs and capex intensity. I believe the production issues are a temporary setback, and management remains confident in their ability to get back on track for next year. At the current market cap, investors are giving zero credit to any potential earnings growth, which I think is too penalizing. I’ve decided to add to my position.

Hi thanks for the post!

What are your thoughts on the gear sale and spin? I have not been able to find much independent commentary on the matter.

Joe

:D