Portfolio Update

The portfolio is off to a solid start with a number of my top holdings performing well right out of the gates. The recent market reaction to technology sector earnings and capex guidance is a reminder of the rapidly changing financial profile of the coveted mega cap technology stocks.

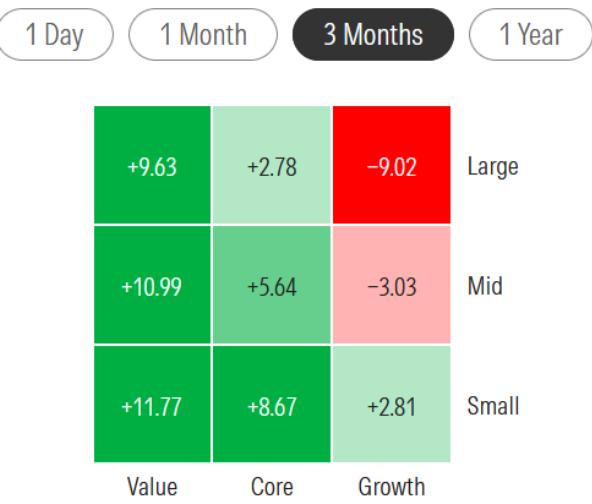

The gushers of free cash flow and share buybacks that once drove seemingly unassailable investor returns in the technology sector have now been replaced by capex-intensive business models with unclear ROI. The recent outperformance in energy and commodity names is a sign of the ongoing investor rotation into more value-focused stocks. I expect this trend to continue.

EQ Resources

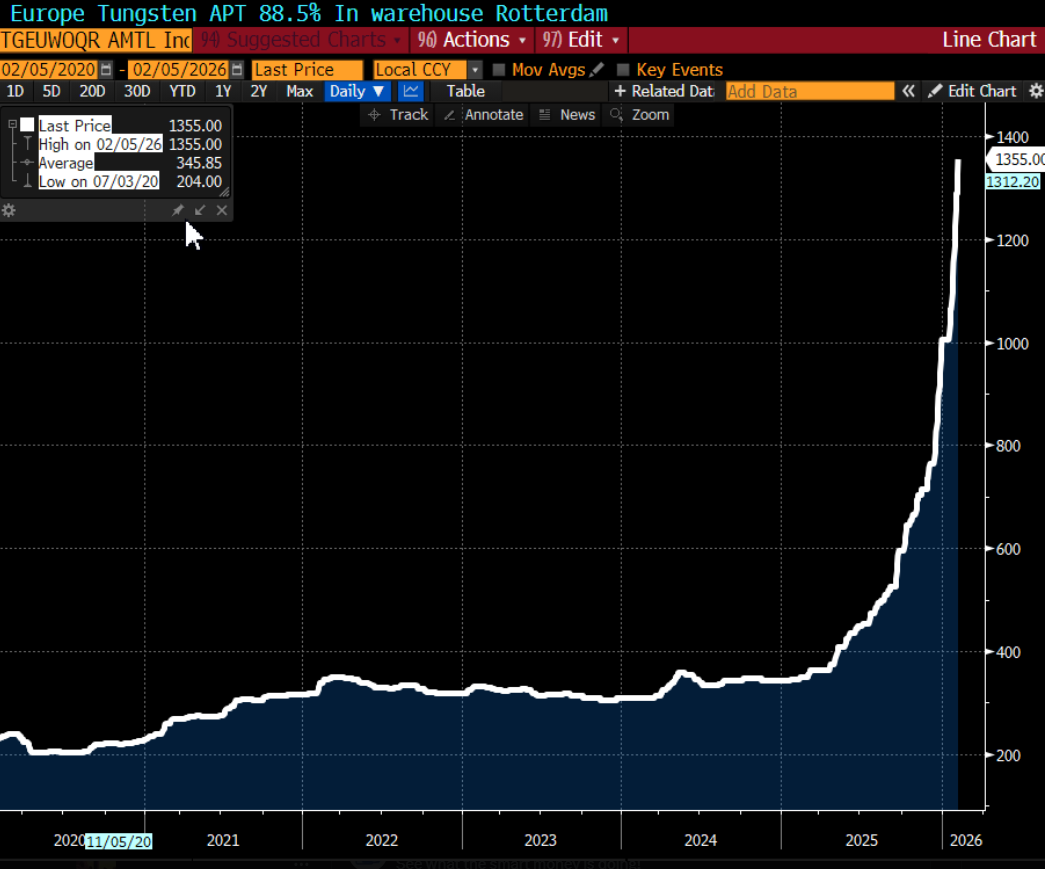

The tungsten and EQR story is gaining traction, with the stock up a blistering +120% YTD, and tungsten prices stubbornly north of $1000 / mtu (APT). Based on the current industry outlook, it appears the tungsten market will remain tight as China limits exports, and suppliers struggle to source material.

The article I linked above has the following to say about EQR (emphasis mine):

According to information disclosed by EQ Resources (EQR) in its Q4 2025 earnings briefing, the company's multinational resource footprint has achieved milestone progress. At the Barruecopardo mine in Spain, through continuous optimization of production processes, the resource recovery rate has steadily increased from the initial 40% upon acquisition to nearly 70%, solidifying its strategic position as a core supplier within Europe. Meanwhile, the Mt Carbine mine in Australia successfully overcame challenges in stripping engineering and fully commenced mining operations on the Iilanthi high-grade ore vein, with production expected to achieve leapfrog growth in 2026. Against the backdrop of major global powers intensifying efforts to reshape critical mineral supply chains, the strategic reserve value of tungsten is becoming increasingly prominent, and EQR's accelerated development is becoming a crucial cornerstone for supply diversification in Western markets.

The company did a investor webinar recently which provided some important updates:

The company is maintaining its 3000 - 4000 t production target for the year.

EQR has finally accessed the lolanthe vein system at Mt Carbine, known for its high-grade tungsten, which bodes well for future production.

Additional drilling is planned for the Mt. Carbine asset in the next two quarters, targeting reserves and material near the surface; plant expansion is expected to be commissioned in November, doubling processing capacity.

Management is also looking to expand the resource at Saloro by opening the north, south and east through more drilling. Management stated that there are lots of old tungsten mines in proximity to Saloro that can be using EQR’s mill.

So far, everything seems to be going as planned for EQR. However with the stock doubling in less than a month, I believe it’s prudent to take some money off the table here. No matter how good the macro backdrop, things often go wrong in mining, and history has shown that Saloro and Mt. Carbine can both be challenging assets to operate. On the bullish side, EQR continues to trade at a steep discount to its peer Almonty (~$3bn), which leads me to believe that further upside remains. While I’ve scaled down my investment, I continue to hold >50% of the original position.

Calumet (CLMT)

CLMT (see last notes here and here) has been a strong performer this year with the stock up roughly 28% YTD. As I had mentioned in the last update, the market has been ignoring the potential recovery in the bio fuels markets, and the earnings potential for Montana Renewables (MRL). With D4 RIN prices surging to ~$1.4 in anticipation of tighter balances, CLMT stock is getting some tailwinds.

At ~$25 / share, the implied value of MRL is ~$1.4bn, with the potential to earn $300mm+ EBITDA in a normalized RD margin environment. This is in addition to $300 - $350mm EBITDA from the base business at the current crack margins. The EPA’s finalized renewable volume obligation (RVO), as well as the successful commissioning of the SAF production expansion, should lead to rapid de-leveraging and a further re-rating of the stock. I continue to own the stock and 2027 LEAPS.

Precious Metals

The decision to exit silver and silver miners has turned out to be prescient, as silver has experienced a massive draw down. Volatility remains elevated as speculative and leveraged flows continue to move the futures market violently. The macro drivers behind silver remain unchanged; the metal is being re-discovered as a store of monetary value (especially in the East), driving physical accumulation amidst a tight float, strong industrial demand, and accumulated deficits. However, the near-term trajectory is likely to remain volatile.

It’s notable that a number of solar panel manufacturers are now in discussions to substitute copper in place of silver to manage costs. While this doesn’t bode well for industrial demand, the investment flows (especially from China and India) continue to be strong. A number of large physical dealers have stated that they are seeing strong retail demand re-emerge to take advantage of the recent drop in prices. For now, I prefer to stay on the sidelines and wait for the market to discover a firmer bottom before getting involved again in any significant size. In the near term, I think a re-test of the breakout at $50 / oz is possible.

In comparison, gold has been a lot more stable. While gold was unable to hold the $5000 level, anything above $4000 bodes very well for gold miner earnings and cash flow. One plausible scenario is for gold to retest the breakout level at ~$4400 and chop there for a while before resuming an uptrend. For both gold and silver, consolidation and reduction in volatility is necessary for a healthy uptrend to resume.

Cerrado Gold (CERT) experienced a setback with its Portugal asset. Regulatory roadblocks are always painful for resource investors, but it’s important to remember that the core of my thesis is the cash flows from MDN (ex-hedges), and mine life extension. Lagoa Salgada and Mont Sorcier are just icing on the cake. At the lower end of 2026 guidance (50K oz), and assuming a $3500 / oz gold price, CERT will generate ~$75mm in earnings at a market cap of just $185mm. The company has initiated a stock buyback program, and the CEO recently bought shares as well.

Minera Alamos (MAI) updated its 2026 guidance for Pan Mine, and is evaluating the potential to integrate Gold Rock into the Pan Operating Complex (POC) as early as 2027 (vs. my assumption of 2028 in my NPV model). At $3500 / oz gold, Pan generates $50mm in profits vs. the current market cap of $420mm. NPV8% at $3500 / oz gold, including Copperstone and Gold Rock, is ~$1.3bn per my calculations. There is also a non-zero chance that MAI’s Mexico assets are permitted, adding upside optionality.

BORR Drilling (BORR)

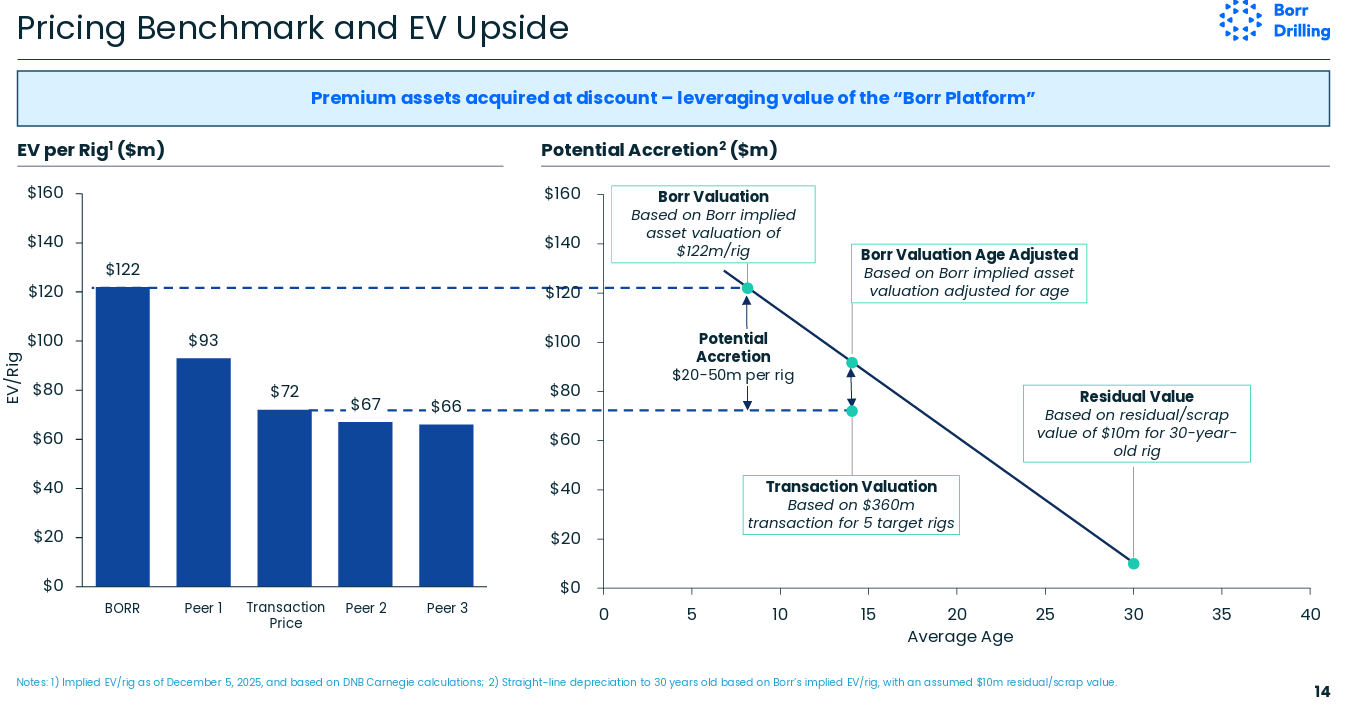

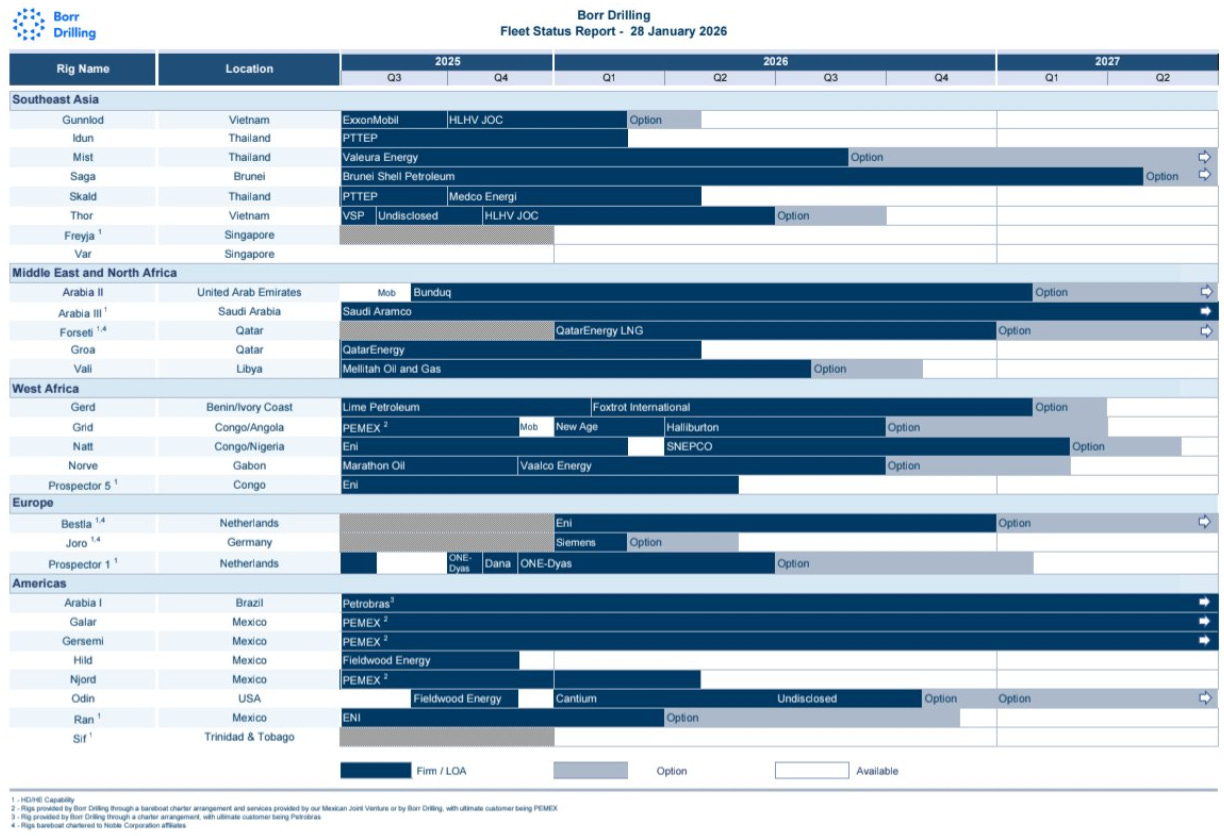

BORR has seen a strong rally since I decided to add it back to the portfolio in early December. Soon after my write up, BORR announced that it had acquired five jackups, three JU-3000Ns and two CJ-50s, from Noble Energy for $360mm. The implied transaction values are ~$77mm per JU-3000 and ~$64mm per CJ-50. In contrast, Seadrill sold three JU-3000Ns for $113mm per rig in July 2024, suggesting BORR got a good deal. In the chart below BORR has extrapolated a fair value of the rigs to be $20-$50mm higher than the purchase price, based on the market implied valuation of BORR’s pre-acquisition fleet.

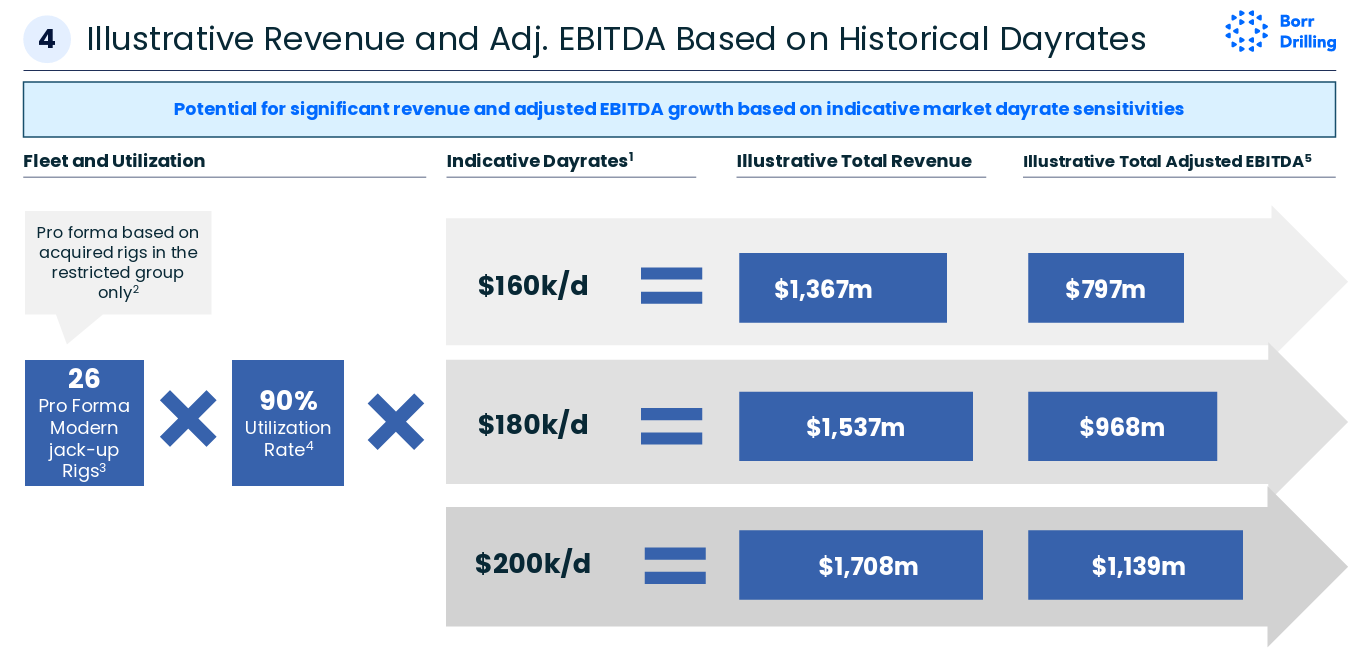

As part of the transaction, Noble will receive a $150mm, 6-year note from BORR secured by three JU-3000N. BORR also issued $85mm in equity to support liquidity. The company is projecting $800mm - $1bn in EBITDA from 26 jackups in the ‘restricted group’ (for credit purposes) at a dayrate range of $160-180K/d.

While these EBITDA figures would imply a high free cash flow yield (20%+), the current realized day rates are significantly lower. Per the company’s latest disclosures, BORR is 79% contracted at a dayrate of $139K for H1 2026, and 44% contracted at a dayrate of $143K for H2 2026. In comparison, 2025 average dayrate was $145K. This means that the recent rally in the stock is front running future contracting activity.

This makes BORR a bit risky at this juncture, as a failure to realize the higher dayrates and utilization could lead to a significant negative adjustment. While there are strong signs that the jackup market is firming up, and that bullish contracting outcomes will materialize, there is always a risk of erratic behavior with national oil companies (NOCs). As such, I’ve cut my position in 1/2 for now, and am waiting for the stock price to cool off a bit before I add back to the position.

New Stratus Energy (NSE)

I continue to hold a significant position in NSE (see last note here) as my favored event-driven play for idiosyncratic returns. I’ve had mixed success in the past with event-driven situations, but I continue to believe that the quality of the management team, and their depth of experience and relationships in South America, makes a shareholder friendly outcome likely.

While NSE is currently an event-driven play, there is also the potential for it to become a longer-term oil beta play. I’ve become more bullish on oil prices recently given the underperformance of oil vs. other commodities, the washed out positioning in oil futures, and the gradual fading away of the ‘super glut’ narrative which has so far been invalidated by inventory data. Depending on the exact details of the deal announced, NSE could be worth a long-term hold for oil price exposure.

ASP Isotopes

ASPI remains a ‘show me’ story. I had mentioned in my last update that 2026 would be all about execution. Unfortunately, the company hasn’t shared any developments that inspire confidence. Isotope deliveries continue to be delayed for one reason or another (faulty lasers, power outages, customer feedstock delivery issues etc.). Despite the lackluster operational results, management continues to plough shareholder capital into more and more acquisitions.

I sold the stock in December for tax-loss harvesting, and have not added back. In light of all the other opportunities available, I find it hard to find a place for ASPI in the portfolio at the moment. I would like for management to meet delivery timelines, focus more on the core businesses instead of constantly acquiring new businesses, and provide greater revenue visibility going forward.

Millennial Potash (MLP)

MLP has lost steam after the most recent MRE update. As I mentioned in my original piece, I think this asset will ultimately be acquired given its strategic importance. The lack of news flow and a recent equity offering has caused sentiment to sour, but the thesis hasn’t changed. The next major catalyst will be the publishing of a feasibility study which should show a significantly higher NPV than the existing PEA, and make M&A more actionable. It’s notable that Howard Lutnick’s previous employer, Cantor Fitzgerald, was sole bookrunner on the equity offering.

Uranium

After my last update on uranium the sector went on a tear with many of the sector ETFs and stocks rallying 60-70% from the lows in November to the peak in mid January. As is often the case with uranium, the sentiment and prices tend to overshoot in both directions. While term prices continue to grind higher, utilities are largely absent from the contracting market, which makes it hard to sustain backwardation in the delivery curve (spot > term). The recent spike in spot price to $100 / lb was largely driven by financial flows (SPUT accumulation) making the trend fragile.

I decided to exit most of my uranium positions in late January given the extremely overbought conditions and the equities being valued to perfection. The recent correction in equities and in spot price (back to the mid-$80s) makes the sector attractive again. I’m looking for opportunistic entries into SPUT, URNJ and Cameco call spreads.

New Ideas

Discussing these in detail is beyond the scope of this piece, but I’ve recently entered starter positions in Comstock Inc. (LODE), Energy Fuels (UUUU), Largo Inc. (LGO), uniQure (QURE) and Bravo Mining (BRVO). I will write more detailed / focus notes on these if I build conviction to size them up for a full position.

Great call on EQR, I did exited most of my position as well (as they say, no one has gone broke by selling early). Also, while you research Comstock Inc (LODE), I encourage you to form an unbiased position on management.