Portfolio and Macro Update

In recent months, I’ve shifted my focus towards idea generation, rather than portfolio updates and macro analysis. However, I think we’re at an important juncture for some of the key themes I’ve been highlighting for several years, and it’s a good time to step back, take stock of where we are, and think about where we go from here.

I still strongly believe that the investment focus on commodities and energy will continue to pay off in the coming years, as a number of demand drivers are converging on supply constraints in mining / resource assets that have been ignored and left under-capitalized by Western governments and investors for decades.

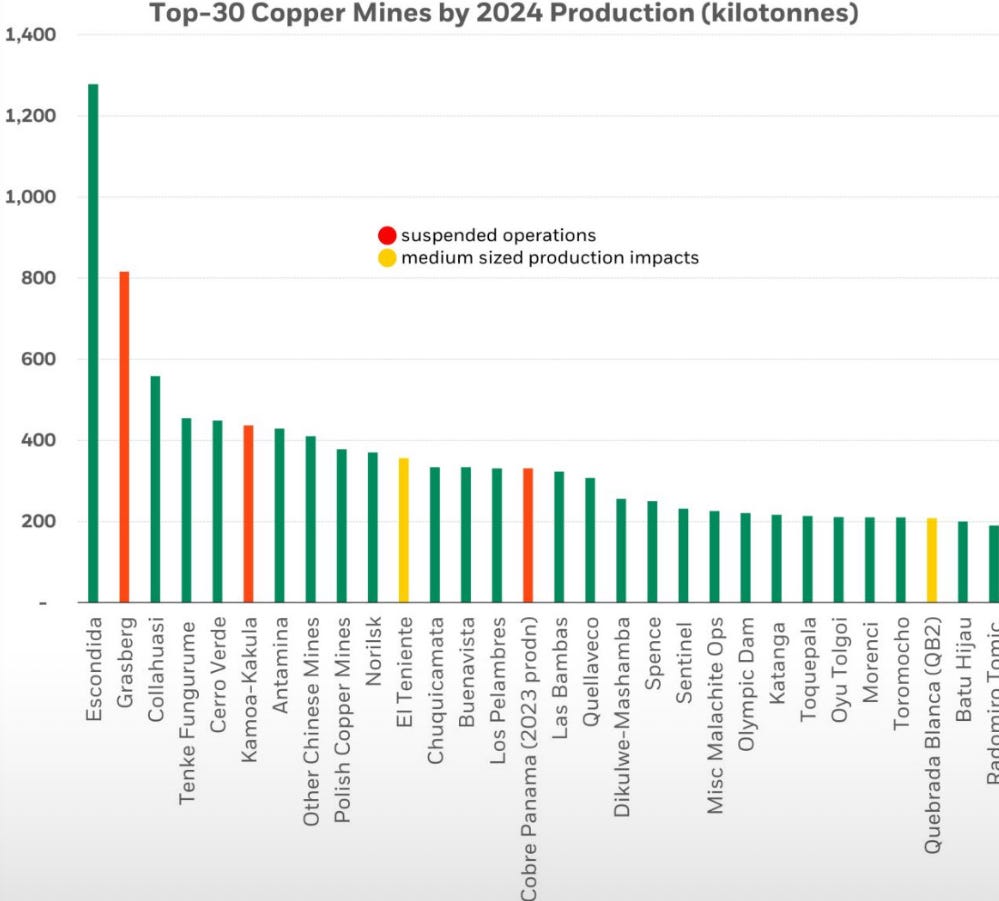

This week’s disruption at Freeport’s Grasberg copper mine in Indonesia (the world’s second-largest) sharply highlights the fragility of commodity supply chains. Currently, three of the world’s top copper mines are offline, representing approximately 7% of global supply.

Analysts expect tight Q4 balances for the copper market, with JP Morgan and GS expecting copper prices to average >$10K/t. Treatment and refining charges at copper smelters have also fallen significantly reflecting tighter supply conditions (reducing smelters’ bargaining power). While I’m currently not allocated to copper, I’m refreshing the valuation math behind some copper producers to explore opportunities.

The tin market is tightening, with China’s import data showing a pick up in demand for computing and electronics. Meanwhile, Indonesia is cracking down on illegal tin mining, squeezing the supply side. Myanmar tin mine restarts have had immaterial impact to supply so far. Tin smelters in Yunnan are running low on inventory, overcoming tight supplies by using lower feed grade.

With tin prices exceeding $35K/t, my position in Alphamin ($AFM) stands to benefit as mine production has ramped back up after the earlier closure. US intervention has calmed hostilities between Rwanda, DRC and their proxies, and the region should be more stable moving forward. Despite tin prices up 30%+ YTD, which represents nearly a 100% increase in AFM’s EBITDA, the stock is barely up YTD. The coming quarterly results should raise some eyebrows.

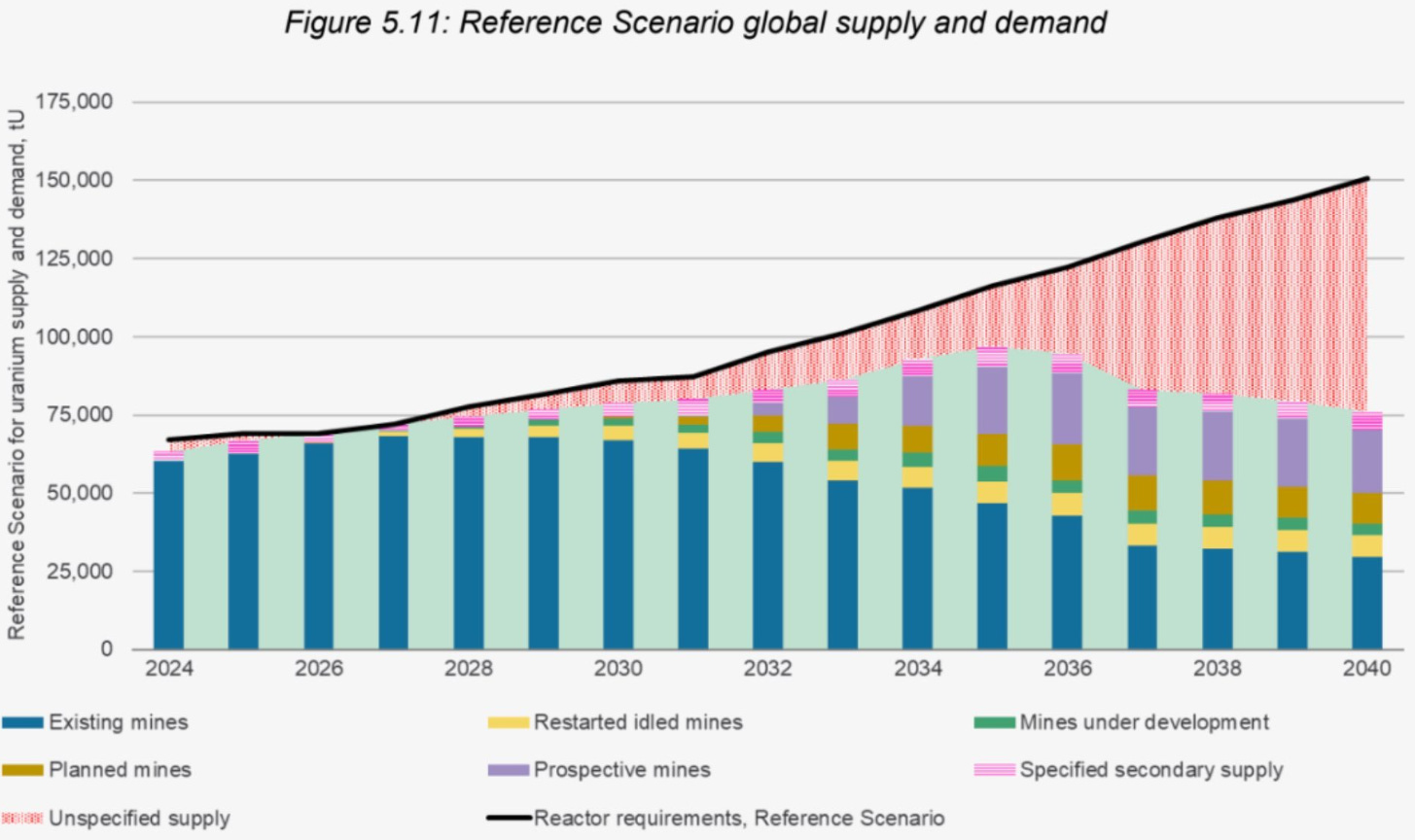

I’ve already written a lot about uranium so I won’t bore you with the thesis here again, but the recently published WNA forecast has reinforced the need for higher uranium prices to incentivize more supply. The market is heading into deep structural deficits in the later part of this decade. With brownfield restarts struggling, and greenfield projects taking 10+ years to come to production, these deficits are today’s problem. So far, utilities have been able to avoid contracting thanks to secondary supplies and excess inventories, but these buffers are now dwindling. The uranium term price hitting a 17-year high of $83 / lb for September is a reflection of these dynamics.

After a rocky start to the year, uranium mining stocks are approaching their 2024 highs as investors are flocking back to the sector on the back of bullish headlines on both the demand and supply side. SPUT and YCA are finally trading close to their NAVs, raising capital, and cleaning up excess pounds in the spot market. Spot prices are back above $80/lb, and the next wave of utility contracting will likely take us well above the prior highs of $106/lb.

Earlier in July, prices out of the biggest US power auction (PJM Interconnection) rose 22% over last year’s record-high level. This should be a green light for utilities to spend more on capacity expansion, and of course, fuel. Could the US nuclear utilities use sky-rocketing power prices, along with the WNA forecast, as the cover to finally come off the sidelines and contract uranium in size for the next 5-10+ years? Despite term prices approaching multi-decade highs, utilities are nowhere close to replacement rate contracting. The longer utilities wait to contract, the greater the eventual price spike. I remain heavily invested in SPUT, with a smaller position in URNJ.

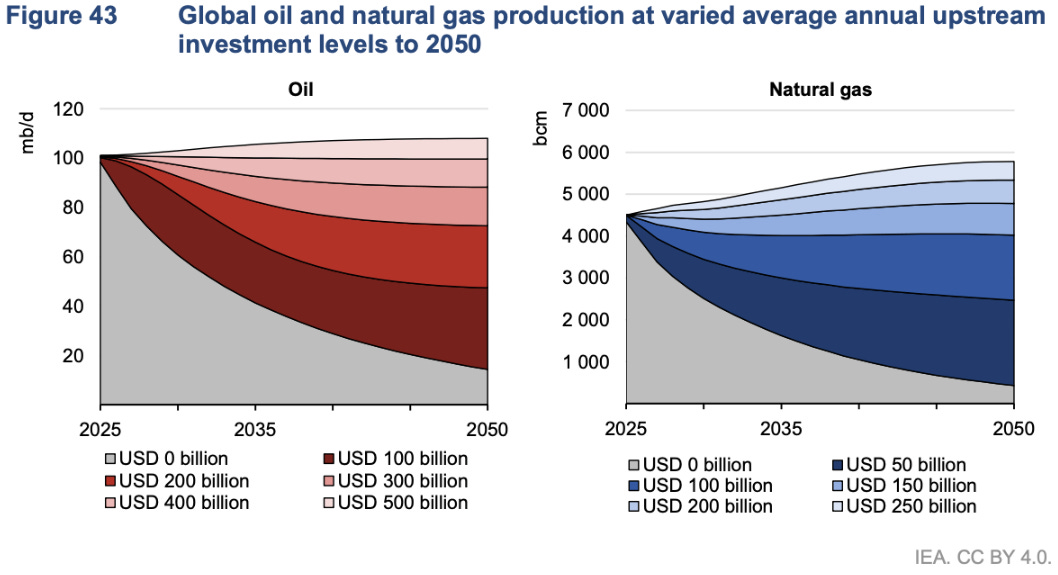

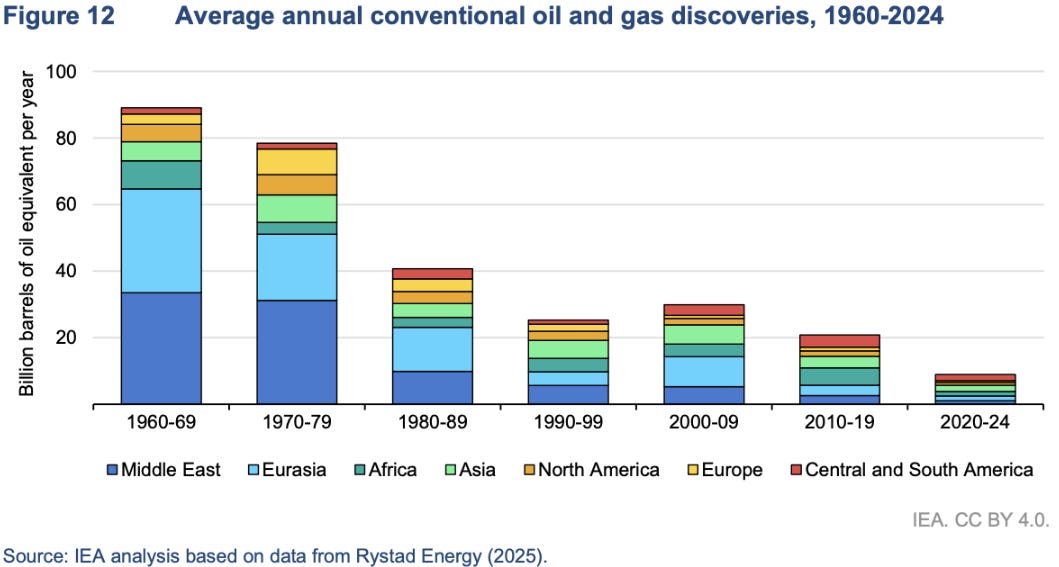

Amongst a mostly bullish commodity backdrop, the oil market has been an outlier, with prices -15.5% YTD (WTI). OPEC+ and US Shale seem hell-bent on increasing production despite low prices, but I believe a reckoning is coming. Oil demand is running well above consensus estimates, as expectations of higher EV adoption simply haven’t materialized. A recent IEA report shows the punishing math behind keeping oil supplies at the current level, let alone growing to meet future demand growth: 8.5% natural decline rate per year for oil fields (~5.5mm b/d) and 9.5% per year for natural gas (26Bcf/d), requiring $540bn per year of capex to offset.

At the 2025 run-rate capex of $570bn, the industry is barely above the sustaining capex levels. Since 2019, ~90% of upstream capex has simply offset existing decline rates. With so little spent on exploration, new oil discoveries are at record lows. This will come to bite as oil demand continues to grow in the coming decades.

With OPEC+ maxing out production capacity, and non-OPEC+ supply growth expected to peak in 2026, I think a new bull market in oil will rise again, and that offshore oil will be the biggest beneficiary. The tricky part is timing. I was clearly too early (and wrong) on the offshore thesis, but I think the trade will pay handsomely when the current marginal oil suppliers run out of steam. For now, I think playing event-driven situations with clear upcoming catalysts, like New Stratus Energy (NSE), is the way to go in the oil space.

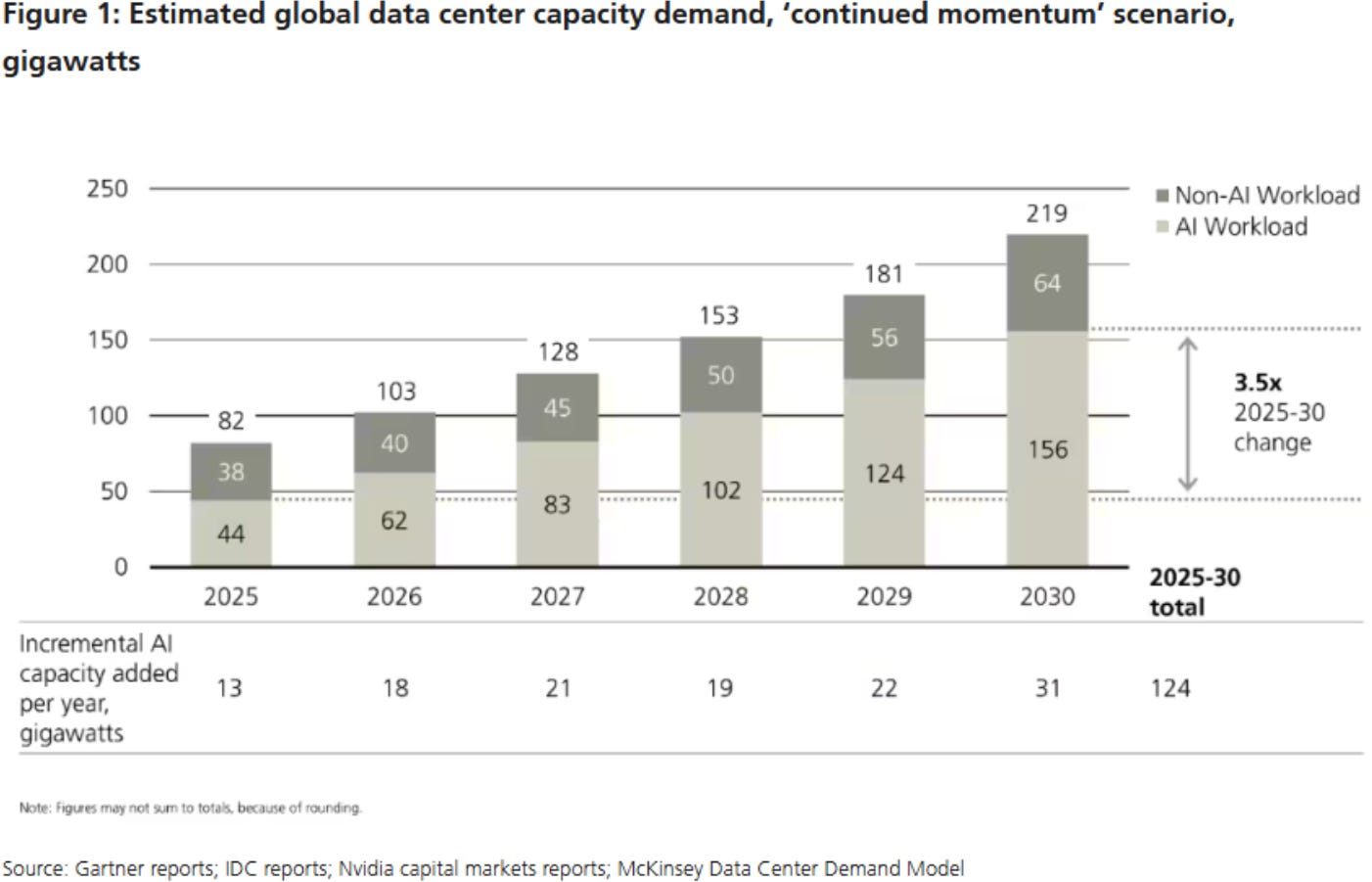

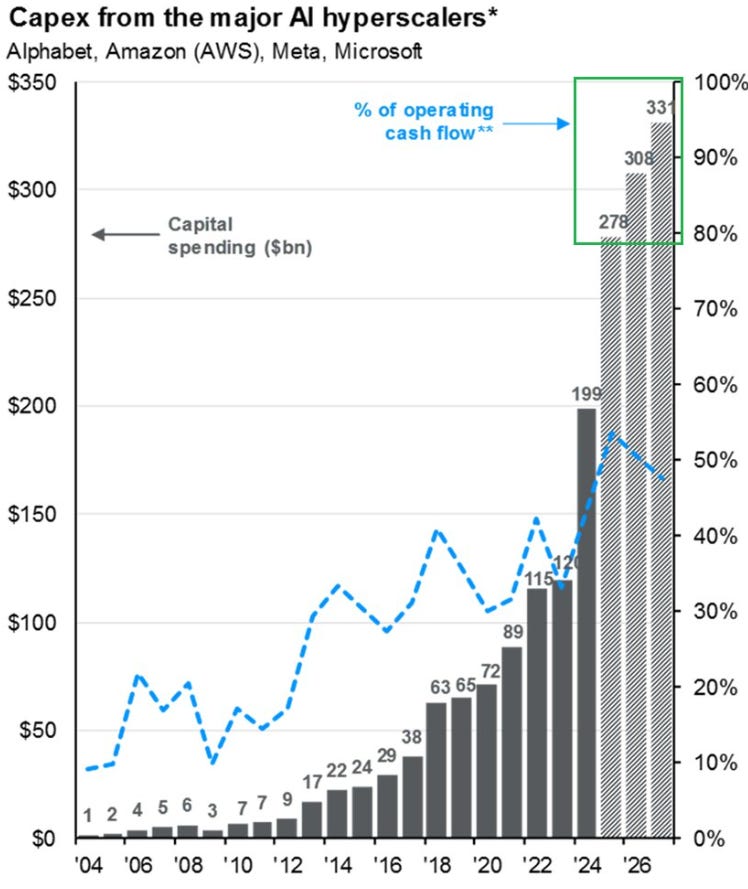

Taking a step back, I believe that tightness in commodities and energy markets will remain a structural theme as long as the world’s governments and corporations are focused on winning the AI race, and as long as GDP per capita rises across the world. Everyone is competing to secure baseload power, at both an international and domestic level, and this is not a trend that will change anytime soon.

I’ve seen several smart folks argue about the ROI of AI investments, and how the capex is ‘wasteful’. Our job as investors is not to argue with corporations and governments about how to allocate capital, but to carefully monitor their actions and position ourselves to profit from them. The CEOs of the mega-cap tech companies have repeatedly stated that they would rather risk having their AI investments go to zero, than risk losing the AI race. Both the US and China consider losing the AI race an existential risk. These are not statements to take lightly.

Adding to the challenge of rising energy and commodity needs is the changing geopolitical landscape, and the importance of fulfilling these needs domestically. The Russia-Ukraine war has made it abundantly clear that relying on foreign powers for energy and critical minerals/metals is a major national security vulnerability. Resource nationalism is back, and countries are increasingly saying “what’s mine is mine”. This means added pressure on commodity prices as Western economies build strategic stockpiles, and try to stimulate domestic commodity production, which entails greater labor and capital costs than the mining operations in the East.

Just a couple of weeks ago, Energy Secretary Chris Wright, spoke about the need for a strategic uranium reserve for the US. While no specifics were mentioned, it’s noteworthy that many US utilities hold <2 years of inventory, while China holds more than ten times its annual consumption. Adding just one year of buffer to US uranium inventories (50mm lbs) would have a dramatic impact on prices given the tightness of the market.

The US has also started buying equity stakes in strategically important companies (MP Materials (rare earths), Lithium Americas and Intel), highlighting the evolving relationship between government and private enterprises. This makes me quite optimistic regarding my investment in ASP Isotopes, which sits at the crossroads of several important trends including small modular reactors (SMRs), semi conductors, quantum computing and nuclear medicine. I would not be surprised if ASPI is able to secure some type of government support to build out HALEU facilities in the West.

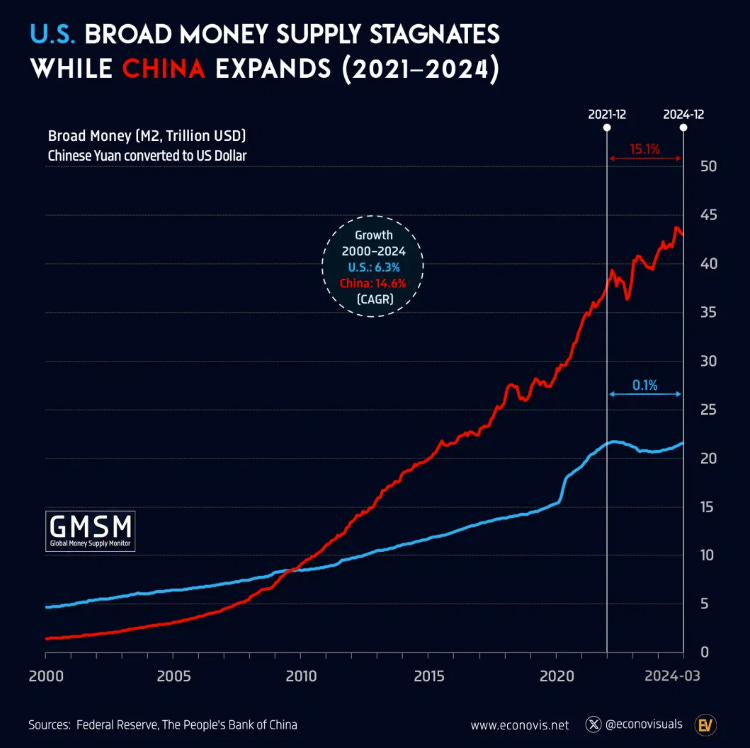

Interestingly, this thirst for more energy, and the pivot to resource nationalism, comes at a time when governments have given up any pretense of running balanced budgets, and are actively de-basing their currency (please read my piece on monetary debasement) to continue spending beyond their means.

In the US, inflationary risks have taken a back seat in favor of high government spending, and a Fed that’s more focused on labor risks. Politicians have given up on austerity, and are hoping to ‘grow out’ of the debt problem by running the economy at high nominal growth rates. Ignoring inflation is great if you owe a lot of money (i.e. the government), but not so great if your wages don’t keep up with rising costs of living (i.e. main street). It’s no wonder then that alternative stores of value like bitcoin and gold are doing well, and retail speculation in stocks is increasing, as people look for alternate sources of wealth creation.

The situation in China isn’t a lot better. While China doesn’t have an inflation problem, Chinese banks are sitting on trillions in property losses which they can’t recognize without becoming insolvent. The solution? China has created more M2 in the past two years than the US has since COVID. Chinese investors, who have a much higher propensity to save than their Western counterparts, and who used to consider real estate a safe place to invest, are now increasingly pivoting towards gold as a store of value. China has a long history and institutional memory with respect to gold, and the recent affinity for gold vs. real estate could be the start of a longer-term trend.

The Chinese central bank (as well as central banks around the world) is also buying gold heavily to reduce its exposure to US treasuries. After the US froze Russian USD assets post the 2022 invasion of Ukraine, many countries have re-thought their decision to rely heavily on the US Dollar and USD assets to store their national wealth. Trump’s recent trade war has also raised doubts regarding the US’ role as a reliable partner in trade and fiscal matters.

I continue to like both bitcoin and silver to play these monetary and geopolitical themes. Silver prices are marching higher driven by record industrial demand (solar panels, electric vehicles, and electronics), a global supply deficit, and its role as a cheaper alternative to gold as a safe-haven asset. Additionally, the inclusion of silver in the draft US Critical Minerals List for 2025 (released by the Department of the Interior in late August) has elevated it to a ‘strategic mineral’, opening the door to federal incentives for domestic production and strategic reserves.

Closing Thoughts & Portfolio Positioning

I continue to be nearly 100% allocated to commodities, and I think this portfolio construction will handily outperform the indices in the coming years backed by four massive secular trends:

Rising energy consumption per capita

AI-driven energy needs

Resource nationalism

Monetary debasement

With uranium stocks reaching their 2024 highs, I’ve reduced my allocation to uranium miners to add to new ideas such as Calumet, and increase my exposure to existing positions in tin, precious metals miners, ASPI and NSE, that I think are poised to outperform in the coming months.

Given the sharp run up in Andean Precious Metals ($APM), I’ve been scaling down the position and adding new precious metals positions: Cerrado Gold ($CERT), New Pacific Metals ($NEWP), Jaguar Mining ($JAG). I hope to write more detailed notes on each of these to explain my rationale. I think Q3 earnings for the precious metals miners will be eye-opening for a lot of investors, as the cash flow generation will clearly demonstrate the operating leverage inherent in these businesses at the current gold prices.

I’ve also added a couple of smaller positions (<10%) that I’m still researching and will scale up as I build conviction:

Greenland Resources ($MOLY) is a molybdenum project in Greenland that is poised to received Export Credit Agency (ECA) financing from the EU. The EU is the second-largest consumer of molybdenum, with no current domestic production. With the EU’s defense budget expected to increase significantly, securing more molybdenum (a critical alloying agent in steel and other metals) is crucial. MOLY has seen heavy insider purchasing from the CEO recently, and signed an MOU with a German steel manufacturer.

Millenial Potash ($MLP) is a generational potash deposit located in Gabon, Africa. Potash has been classified as a critical mineral given its importance in agriculture and global food security. With Russia supplying ~20% of the world’s potash needs, it’s essential for countries to secure their potash supplies. MLP’s Banio Potash Project will rank among the world’s lowest-cost and best-located potash deposit. I believe the company will eventually be acquired by a larger player at a multiple of today’s market cap to secure decades of potash supply to key markets in the US and Brazil.

Iris Energy ($IREN) is a bitcoin miner with data centers in Texas and British Columbia that benefit from low-cost solar and hydro power. The advantageous geographical locations allow IREN to buy power very cheap ($0.03 kW/h), and achieve a low cash cost of $40K per bitcoin. With bitcoin prices flirting with $120K, the company is generating significant cash flows, which it is now using to buy GPUs and convert some data centers to serve AI-related demand. If successful, the pivot from bitcoin mining to AI-cloud could dramatically increase revenues and profitability. Microsoft’s recent deal with Nebius and Meta’s deal with Coreweave highlight the scramble to secure compute and power that could put IREN’s data center assets in the spotlight.

I’m close to fully allocated at the moment, as I think we’re in a benign liquidity environment. However, the key risks I’m monitoring are inflation, bond markets and cracks in the AI thesis. With the US government and the Fed both trying to ignore inflation risks, it’s up to the bond market to decide what level of inflation and future inflation risks it will tolerate. If yields start rising too much, too fast, it could put an end to the broad market rally that’s currently lifting all assets.

A lot of my portfolio is also exposed to the AI capex story. As we saw with the DeepSeek scare earlier this year, a shift in the AI narrative could cause a stampede out of all stocks benefiting from the AI thesis. I’m not an expert in AI, however all the experts I follow, as well as the hyperscaler CEOs, are convinced that AI is akin to the next ‘industrial revolution’. Maybe it’s dangerous to put too much faith in ‘experts’, and perhaps we will look back at this period similar to how we look back at the 2000s dot-com bubble. But as long as the music is playing, we shall dance.

thankyou ;)