Offshore Update

Increasing exposure

The offshore oil stocks have been a drag on the portfolio this year, with my two positions, Transocean (RIG) and Valaris (VAL), down ~35% and ~27% YTD, respectively. As I have mentioned in my last few updates (see here), this remains a ‘slow burn’ thesis, with recent weakness in the stock prices exacerbated by oil price volatility, low volume of contracting activity, and investors being generally underweight / disinterested in energy stocks. Recent actions by RIG have also signaled a more defensive posture, suggesting that management might be trying to extend the runway to the point where day rates and cash flows inflect higher.

Earlier in September, RIG sold 6G semi Development Driller 3 for $195mm and 6G drillship Discoverer for $147mm. Both rigs were warm stacked and had been out of service since mid-2023. Based on broker reports and comments from sector experts, these sales were 10-15% below what was considered ‘fair market value’. The buyer is a greenfield developer in the US, and not a competitor to RIG, therefore these ships will be out of the market supply going forward.

The bearish interpretation of this move is that RIG was ‘forced’ to sell these assets below market value to reduce leverage. However, as I’ve noted before when analyzing the quarterly earnings and cash flow, RIG does not have a debt service issue (as long as contracts don’t get canceled). Therefore, I view the sale more positively: it helps RIG translate tangible asset values to cash on balance sheet, helping reduce fixed costs by $40-50mm per year (interest expense and warm stack maintenance cost), while remaining focused on their highest spec vessels. RIG has 18-20 rigs in their fleet that are higher spec than the ones sold, and will use their top-of-the-line 7G and 8G vessels to drive day rates and cash flows going forward. I’m also skeptical of the claim that the rigs were sold below ‘fair market value’, given the market for older 6G vessels is not liquid. Some folks who are more in the weeds on drill ship market dynamics have argued that the gap between 6G and 7G is widening (customers increasingly choosing 7G), and that RIG getting ~$340mm for an older 6G drill ship and semi sub is actually a decent deal.

Another development that raised some eyebrows was RIG signing a one year deal for 2022 vintage Atlas for $632k per day, starting Q2 2028. The Atlas is already locked up through January 2027 at escalating rates as high as $650k per day. Several RIG bears have raised doubts about whether this rate covers RIG’s cost of capital, given the contract starts so far out in the future, and given that Atlas is one of the best rigs in the world. However, we have to keep in mind that this is just one contract for one year, and that the optics of getting another ‘6’ handle on day rates will help with RIG’s negotiations with other customers who have recently been “highly resistant” to sign anything starting with a ‘5’. It’s also notable that the Titan, another 8G, is currently locked into a $455k day rate through April 2028, so these recent contracts are a significant step up from existing / legacy contracts.

All of that being said, there is no denying that while day rates have performed well this year, contracting volumes have been lower than what many offshore bulls had expected. Of the ~10 cold stacked and stranded newbuild 7G drill ships at the beginning of the year, only one has been awarded a contract. However, if you believe that the best days for US shale are behind us, and that oil demand will continue to grow for the next 5-10+ years (as I do), then the recent weakness should prove to be temporary.

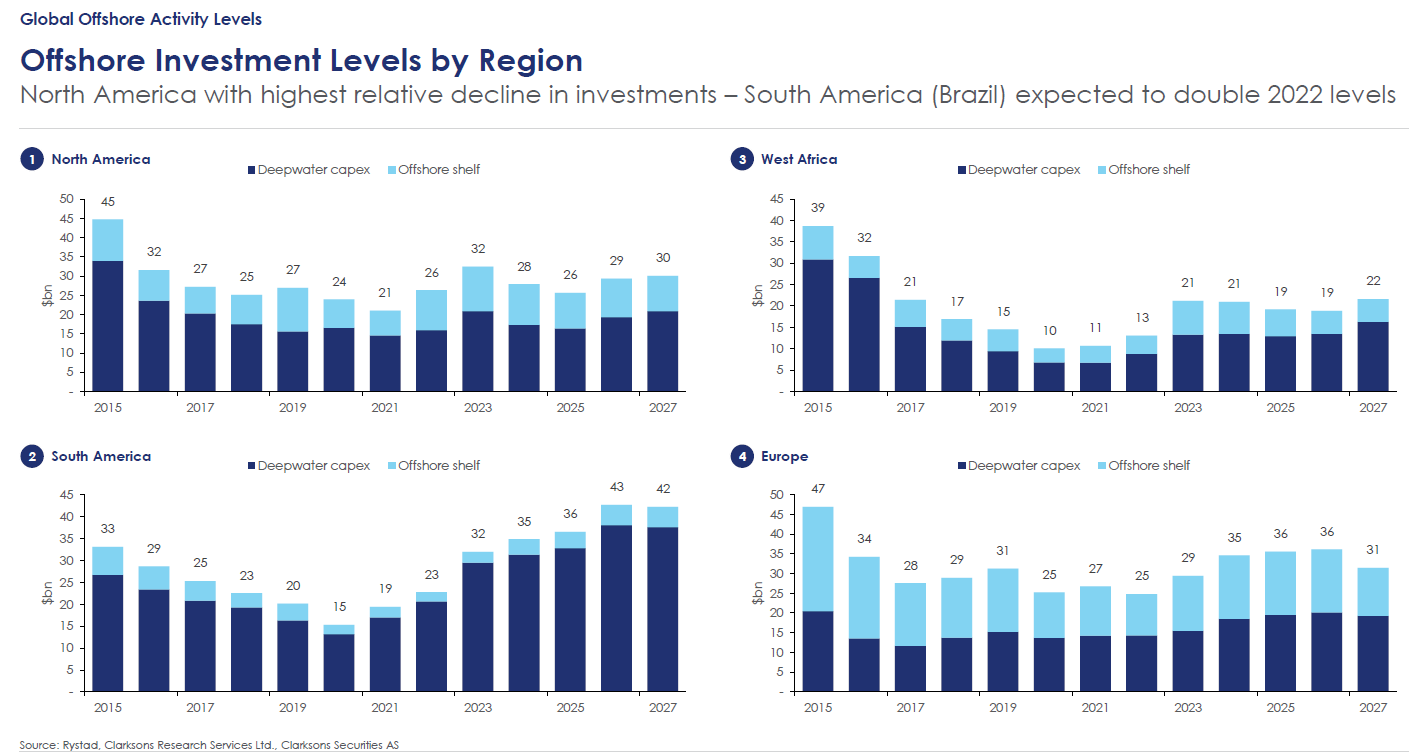

Energy consultant Ryastad is expecting a 20% increase in offshore spending in 2026 and 2027 vs. the annual amount between 2023 and 2025. The chart below from Clarksons illustrates ~$10bn increase in offshore capex expected in 2026 (vs. 2025) in the Americas. Petrobras recently lowered its capex guide but noted that it’s very focused on replacing reserves and stemming production declines post 2030. The company also noted that 100% of its capex budget is resilient at $45/bbl. West Africa remains a hot market for drill ships with Galp’s Mopane discovery and other exploration prospects being pursued in Namibia. Guyana and Gulf of Mexico also present opportunities. Evercore ISI analyst, James West, recently wrote the following in a note to investors:

“Offshore and deep water are currently undergoing a remarkable renaissance, driven by the imperatives of energy security, regionalization, and a maturing and disciplined North American shale supply,”

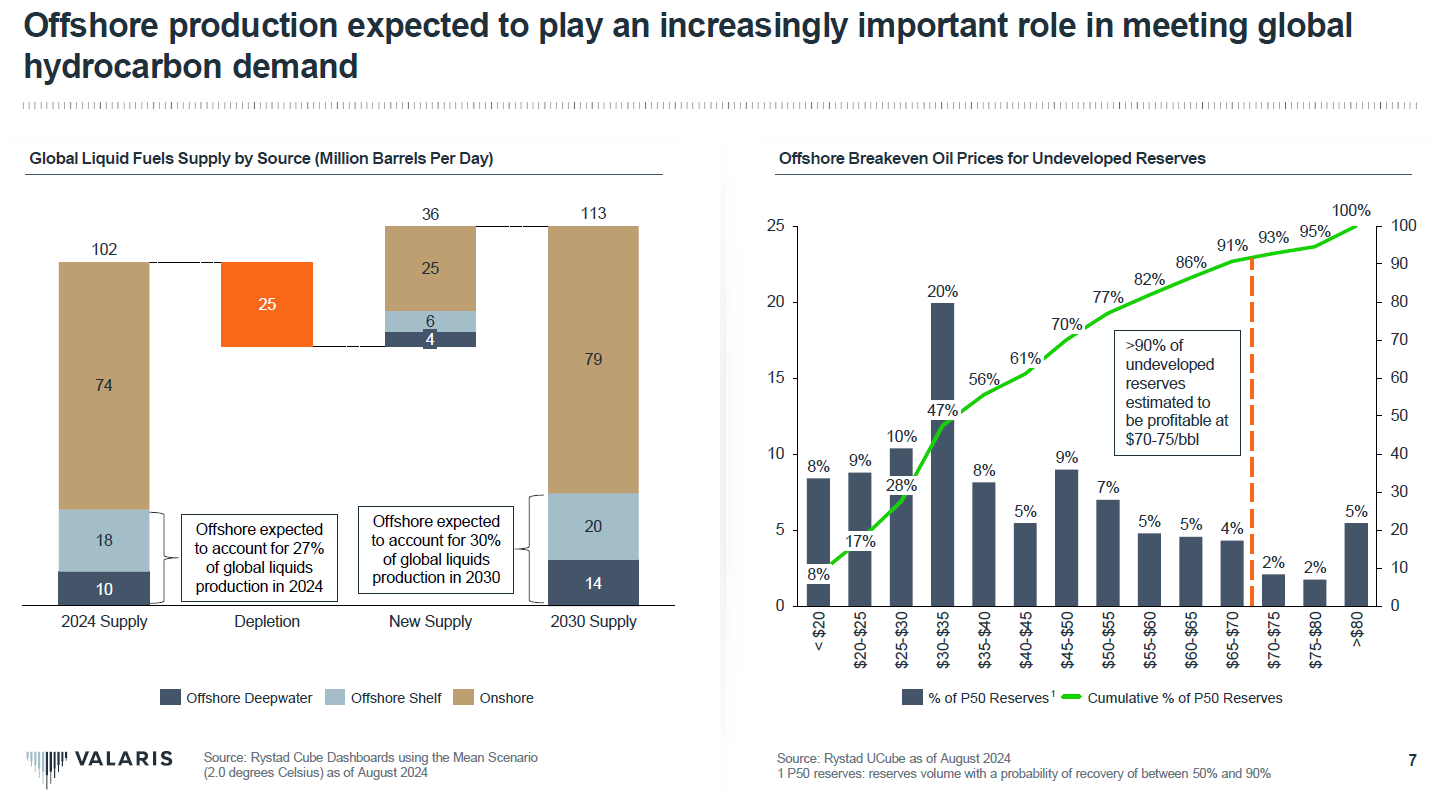

Not only is the energy industry bullish on the future prospects for offshore, there is also agreement that a greater portion of offshore capex will be spent on deep water (1k-5k feet) and ultra deep water projects (5k+ feet) going forward. According to Wood Mackenzie, deep water projects will produce ~17mm b/d by the end of this decade, compared to the current ~10mm b/d of production. Ultra deep water projects are expected to account for half of all deep water production by 2030. This is incredibly bullish for owners of higher spec vessels like RIG and VAL, given the inelastic supply of such rigs and resulting pricing power.

Some skeptics have stated that the recent decline in oil prices spells a death knell for the offshore thesis, but I believe this is a misunderstanding of the long-cycle nature of offshore oil projects and breakeven prices. Offshore projects require 4-8 years to develop, and cost north of $5bn+. Any E&P looking into offshore seriously is not going to base their decision on volatile front-month oil price movements. Instead, offshore FIDs are more dependent on 2027+ prices, which have been resilient in the high-60s to low-70s (see chart below which illustrates the Brent futures curve at different points in time). Based on the current cost curve (see slide above from Valaris investor presentation), ~85% of undeveloped offshore reserves are estimated to be profitable at the current long-end oil price curve.

A recent Wall Street Journal article on oilfield services talks about the resilience of long cycle oil services spending [emphasis mine]:

Spending on short-cycle resources such as U.S. shale has been more pressured because those tend to respond more quickly to short-term commodity prices, while investment in long-cycle resources look more resilient, according to SLB. This is a relative advantage for SLB, which has higher exposure to long-cycle weighted international customers. The company also derives about 40% of its revenue from offshore upstream spending, according to a report from Morgan Stanley. Every $10-a-barrel decline in oil prices causes a roughly 5% to 10% reduction in capital expenditures for short-cycle production, while the same move causes just a 1% to 2% fall in spending for long-cycle resources, according to Morgan Stanley.

For investors the big difficulty is trying to predict when the market will recognize these dynamics and drive liquidity / flows back to the sector. Will it be 2025? 2026? The market can be extremely forward looking / optimistic towards favored sectors like tech / AI. But when it comes to old economy stocks in mining, energy etc. investors can become unwilling to look beyond near term hurdles / uncertainty.

In many ways the situation in offshore is similar to buying uranium stocks in 2021 and 2022. It was clear to me that the uranium market was in deficit, and that the world would continue to pivot towards nuclear power in the coming years. But it took until H2 of 2023 for the market to give credit to these dynamics, with gut-wrenching volatility in the interim. A few months ago, the uranium market once again became obsessed with near-term spot price movements, and started completely ignoring the bigger picture. Uranium stocks kept dropping until it became glaringly obvious that the thesis was still intact through Big Tech nuclear power deals.

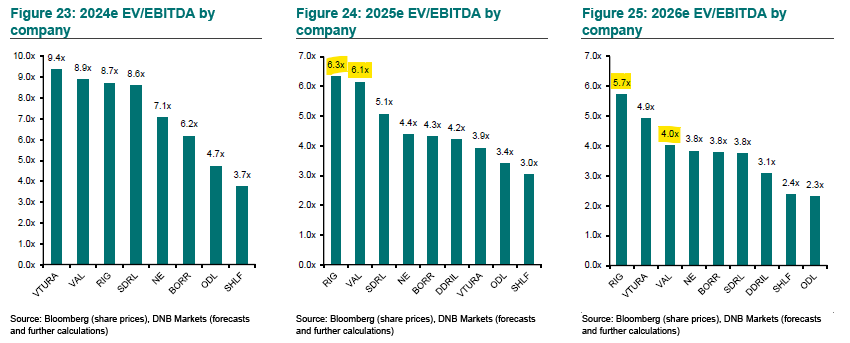

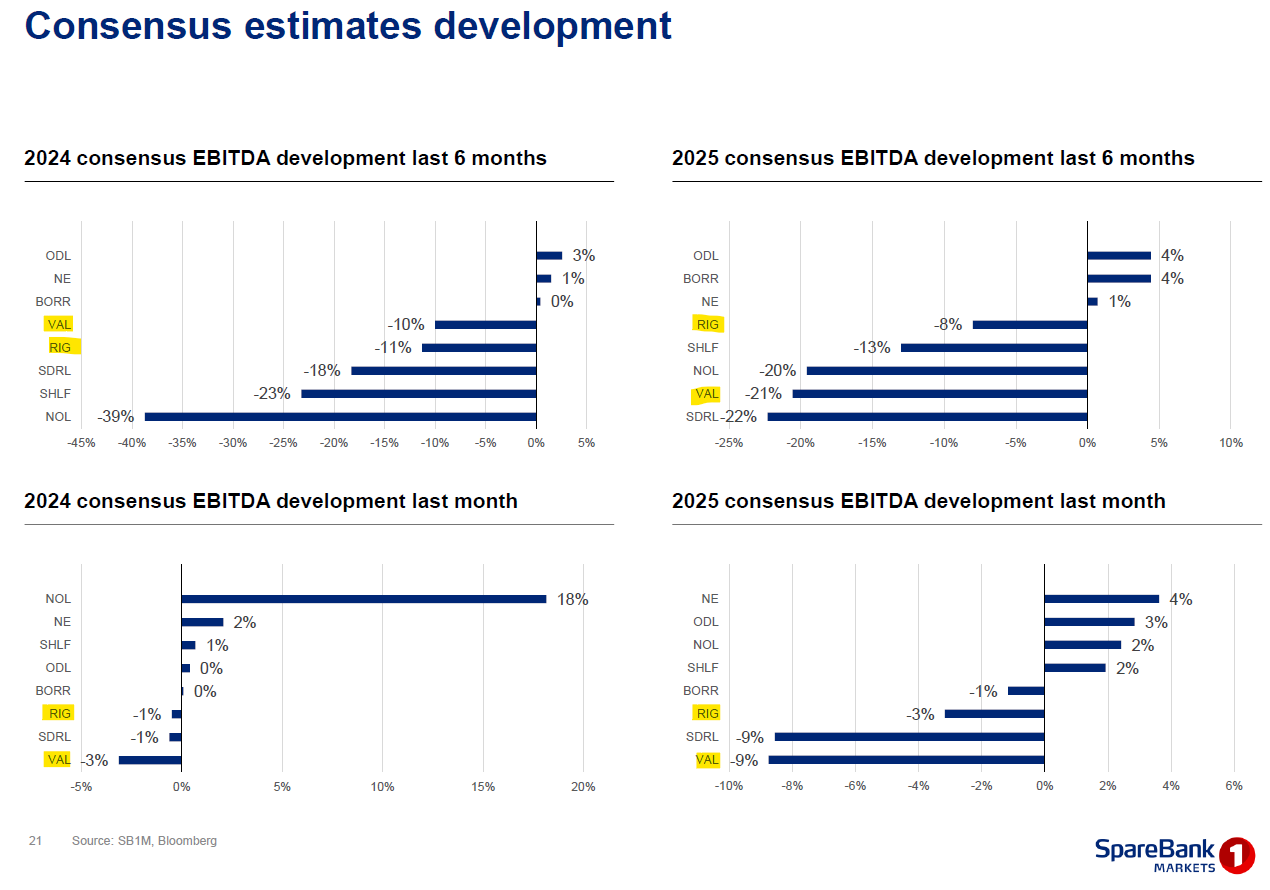

I’m quite confident that the world will need significantly more offshore oil in the coming years, but at present, the market is not willing to look beyond what seems to me like a temporary / cyclical slowdown in the market. Almost every new piece of information is interpreted as bearish, especially in the case of RIG. While this price action and timing uncertainty may put off some investors, it’s also what creates the opportunity. If you’re willing to look beyond the next month, or the next quarter, and take a 2+ year view, the offshore sector is quite attractively valued at the moment. For example, RIG and VAL are trading at ~6x 2025E EBITDA and 6x and 4x 2026E EBITDA, respectively, based on analyst EBITDA estimates that are arguably conservative as they suffer from recency bias (see estimate revisions chart below).

Paying mid-single-digit multiples for companies that should be able to exploit pricing power, and generate significant cash flows well into the next decade, seems like a good deal. Pricing power could be further enhanced through consolidation, as recently highlighted by rumors of a potential RIG and Seadrill merger transaction. Such a deal would give RIG control over nearly 50% of the high spec market. None of this optionality is currently priced into the stocks at present. If past cycles are a guide, the sector should eventually re-rate to double digit EV/EBITDA multiples when investors finally wake up to the opportunity, implying multi-bagger returns. I’m taking advantage of the market’s myopia to add to my offshore positions. While both RIG and VAL offer good value here, I’m adding more to VAL stock (in addition to my position in the warrants). VAL’s clean balance sheet offers a very favorable risk / reward at the current valuations.

I appreciate these updates, Saad! Your dives into broader commodities (and individual companies along the way) are very useful