Japan Cries Uncle

Covering short positions given Fed's drastic change of tone

My last couple of posts have expressed concern about the aggressiveness of the Fed’s policy path and how the recent market moves (especially in the bond and FX markets) might be signaling that something is about to break. It looks like the Fed may have reached the same conclusion. At around 9am on Friday, Nick Timiraos of the Wall Street Journal (who many consider to be a Fed mouthpiece), published a piece suggesting that some Fed officials have started becoming concerned about the pace of rate hikes.

This was followed by a number of statements from Mary Daly at around lunch time signaling a sharp reversal in tone with respect to future rate hikes:

“We don’t want to be too reactive; one can easily find oneself overtightening.” — “we don’t just keep going up at 75 bps increments, we will do a step-down, not to pause, but to 50 bps or 25 bps increments.”

“We need to consider global factors.”

Compare this to the tone just a couple of weeks ago on October 5th:

“San Francisco Fed President Mary Daly Says More Rate Hikes Needed, Dismisses ‘Pivot’ Talk”

At around the time of Daly’s comments, I also noticed that treasury yields and the Yen had started reversing sharply. The fact that Daly referenced ‘global factors’ suggested that someone outside the US reached a breaking point.

Roughly an hour later another piece of news hit the tape and everything started to make sense:

“TOKYO -- Japan's government and central bank intervened in the currency market early Saturday to support a falling yen, sources told Nikkei, triggering a dramatic rebound against the dollar.

Japan's currency surged about 7 yen in an hour during New York trading to touch the 144 yen level.

The yen had reached a fresh 32-year low of nearly 152 against the dollar before Japanese authorities showed their readiness to push back against sharp movements in the currency.

Finance Ministry vice minister Masato Kanda, Japan's top currency diplomat, told reporters he would not comment on whether an intervention had taken place.”

‘Early Saturday’ in Japan is around lunch time on Friday on the East Coast. It seems pretty clear that the Japanese had called up their friends in the US to say “we’ve had enough”. The timing of these two events is no coincidence.

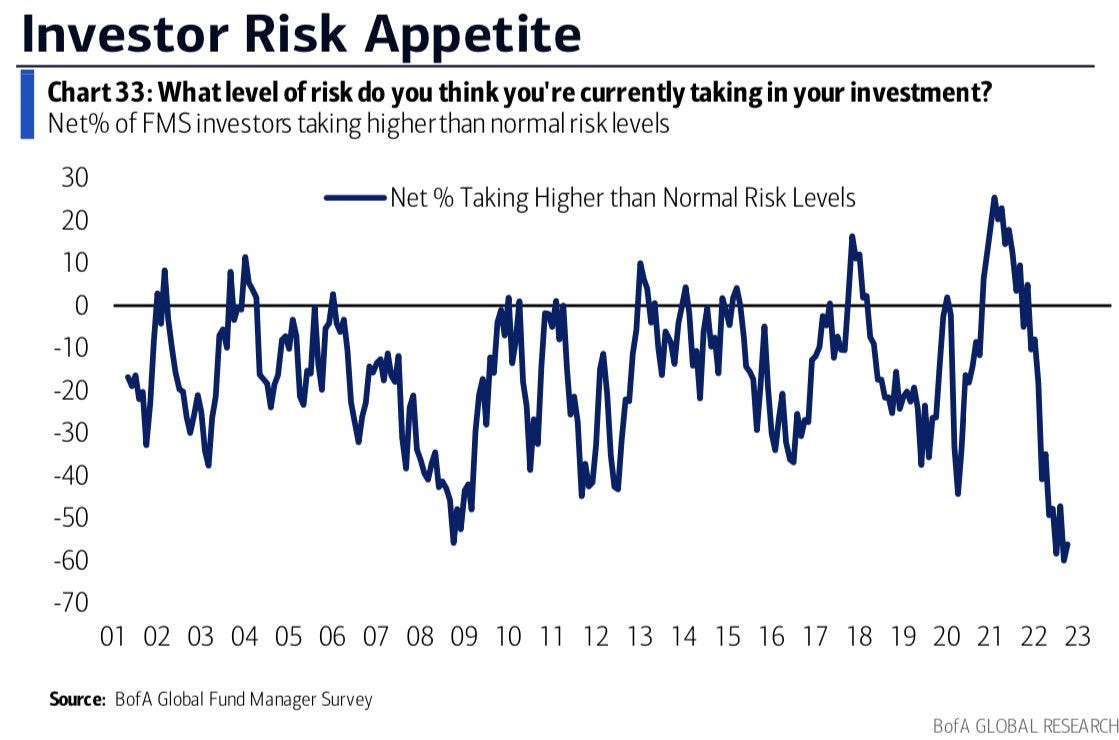

While it’s still early, this change in tone regarding rate hikes could prove to be a significant shift for the markets. If the Fed is starting to wake up and pay attention to the fragility of the global financial system, then perhaps some of the more draconian scenarios for asset prices aren’t that likely anymore. This means a lot of hedges might need to be unwound. It could also mean that fund managers sitting in cash feel comfortable taking risk again. The BAML fund manager survey shows risk appetite is currently at the lowest levels since the 2008 GFC.

With this in mind I closed out of the ‘dirty beta index hedge’ I had described in my last portfolio update on Friday. I caught a decent bit of downside in the indices and in AAPL, but now it’s time to take profits on short positions and get out of the way of a potential liquidity train.

Will the Fed’s comments be enough to assuage markets and lead to a sustainable rally? Or will the markets reverse again and continue to squeeze policy makers until they are forced to give up the inflation fight all together? What if October’s inflation number is worse than expected? What if the market starts to pay more attention to the deteriorating outlook for corporate earnings? What about the mid-term elections? There is still a lot of uncertainty and it’s hard to know the answer to these questions which is why I think it might be too soon to get aggressive on the long side. But it does seems like the risk-reward of being short has deteriorated in the near-term.