Earlier this week, I took a small bet against the long-end of the bond curve (TLT April $94/92 put spread) as a response to the February CPI print (released on Tuesday). In my 2024 outlook piece, I described the current macro landscape as being shaped by an ‘interplay of complex macro forces’. We have inflation, GDP growth, monetary policy, fiscal policy, energy markets, geopolitics and the upcoming presidential elections, all pushing and pulling at macro markets in various directions (while also being interconnected to each other). However, there is one part of this muddy picture that is becoming a bit clearer in my mind: the risk of inflation rebounding or stabilizing at current levels, is continuing to rise.

There is always a vigorous debate regarding the various components of the CPI print, with every economist and analyst viewing the numbers through their own biased lens. However, after tracking inflation data closely for a couple of years, my view is to largely stay away from such debates and avoid arguing about individual components. Instead I like to focus on the math and the broad categories and trends.

The broad category I consider most important is ‘sticky inflation’ - i.e. inflation that is linked to wages and labor-intensive services. This is because I believe these metrics play a major role in setting future inflation expectations. The longer these measures remain elevated, the more embedded inflation expectations become in the behavior of workers and businesses. From a definitional perspective, you would call this core services inflation less housing, or ‘supercore’.

While the supercore print for February is not as disastrous as January (+85 bps), it’s still very bad. Supercore was up 47 bps, which annualizes to ~5.8% and represent a 4.3% increase YoY. The biggest contribution to the rise in supercore is from transportation and recreation, suggesting that disposable income / demand is still running too hot. It’s notable that the CEO of Delta Airlines stated this week that the Company had 9 of the top 10 sales days in its history within the last 10 weeks.

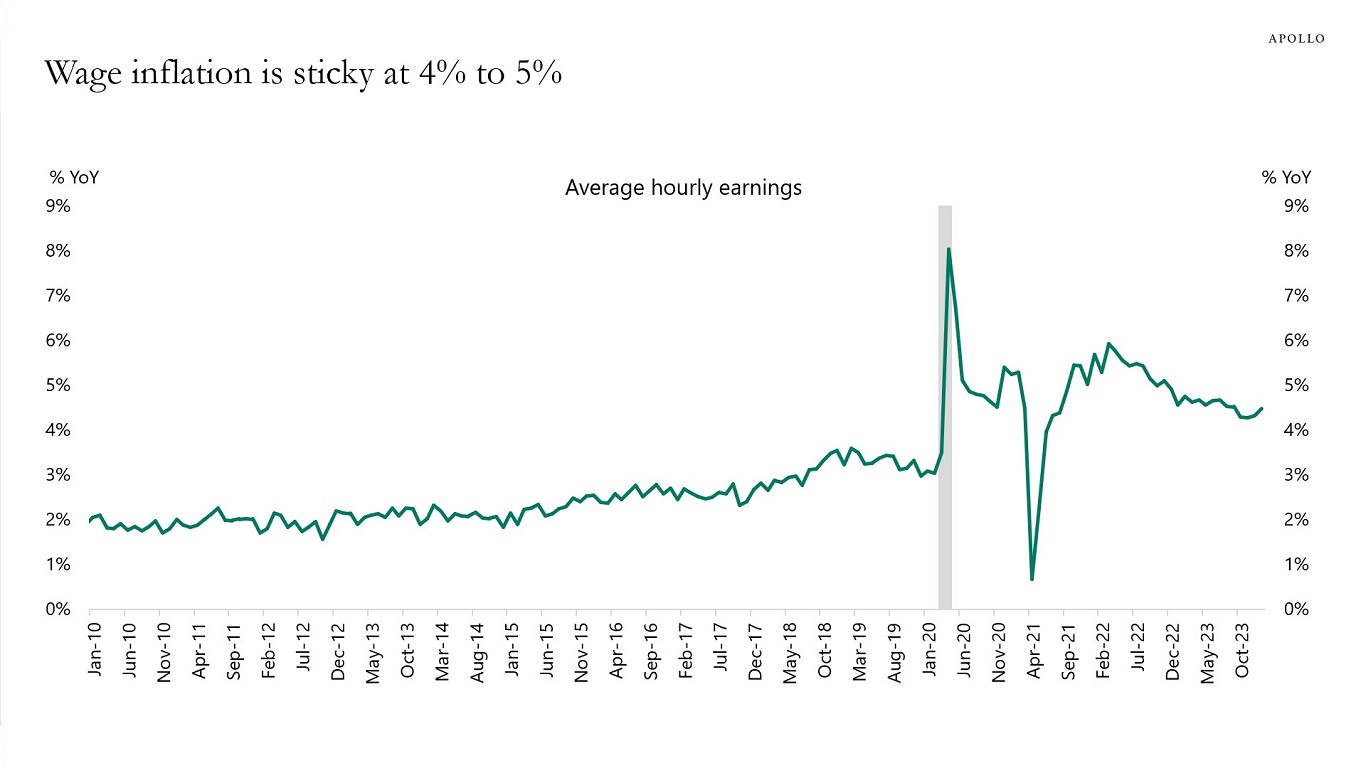

The labor market has refused to budge, with both initial and continuing claims staying well out of the danger zone, and healthy numbers being added to non-farm payrolls. As a result, wage growth has remained healthy, and seems to be settling well above the pre-pandemic range of 2-3%.

Earlier this year, I was hopeful that shelter inflation would continue to drag CPI lower, as its lagged impact has been hiding underlying disinflationary trends in housing. However, I think that this dynamic may be coming to an end. The latest data shows that the US housing market is no longer softening. Housing prices are appreciating again, and various rent measures are showing 2% - 3% growth YoY.

While this is significantly lower than the 8%+ shelter inflation readings during late 2022 / early 2023, if shelter inflation stabilizes at the current levels, its disinflationary impact will eventually disappear. In order for shelter to continue pulling inflation lower, we would need to see shelter deflation, which is unlikely to happen as the US is suffering from a housing shortage.

Last but not least, the disinflationary impact of core goods may also be coming to an end. I have shared data previously to highlight that supply chain pressures are rising in response to geopolitical events. I think those trends may be starting to show up in the CPI data, with core goods inflation showing a positive print after many months.

The big picture I draw from all of this is that the distribution of inflation risks is continuing to skew higher. One way to visualize this is through the chart below which shows how core services inflation (yellow bars) - i.e. the “sticky inflation” - has started to flatline at levels significantly above pre-COVID levels. This means we are at the mercy of core goods, energy and food prices to bring inflation back to the Fed’s 2% target in the coming months. Based on my most current views of the energy sector, I think the risks to energy prices are also skewed to the upside.

At the start of the year I believed that a few rate cuts from the Fed this year would make sense given the progress made on inflation. I’ve changed my mind in light of the analysis above. I now think it’s safer to keep rates where they are. With the equity markets ripping higher, GDP tracking another solid 2%+ print for Q1 2024, and labor markets still healthy, why risk stimulating the economy? Clearly, the current level of real rates is still not restrictive enough to have detrimental impacts on the real economy or financial assets.

As a bond holder, the most concerning aspect of this scenario is that the Fed seems unperturbed by the recent data. While the Fed has done a good job of walking back the number of rate cuts to be expected this year, Powell’s language at the recent Congressional Testimony (March 7th) made me wonder if the Fed acknowledges the rising risk of second inflation wave:

What’s interesting about Powell’s current stance is that while the Fed was ok with inflation overshooting 2% for a while before hiking, they seem to not be ok with inflation undershooting even momentarily below 2%. It appears that the Fed is willing to risk re-igniting inflation expectations by starting a rate cut cycle ahead of the 2% target. When asked regarding the inherent contradiction / inflationary bias in this approach, Powell refused to give a straight answer saying that ignoring the inflation overshoot was a mistake in 2021/22, but that this time the Fed is doing it right. If you own bonds you must now contend with:

Potential for the Fed to ease prematurely and for LT inflation expectations to start rising

Perpetual fiscal deficits and increased bond supply

QT / lack of Fed bond purchasing

Decrease in foreign buyer interest in treasuries

With fiscal policy running unrestrained, the Fed is the last stand against inflation and protecting bond holders from monetary debasement. Powell’s recent comments don’t inspire much confidence. In the absence of a hawkish pivot / resetting of expectations, I think bond prices may start a new leg lower.