Having Fun Yet?

Back from vacation and bears back in charge

Before leaving on vacation I wrote a couple of important pieces on the broader markets. After the July inflation print (which came below expectations) I argued that while inflation may have peaked, it was too early to call for a Fed pivot since inflation was still well above the Fed’s target and because the recent CPI numbers showed inflation was becoming broader and ‘stickier’. I have also previously highlighted the risk that we could enter a stagflationary period with low or negative economic growth but persistently high inflation (due to structural / supply-side factors) which would be bad for both valuation multiples and corporate earnings.

Despite these risks, the stock market rallied ~19% from around mid-June to mid-August on the narrative that the Fed would manage to bring inflation under control and switch from rate hikes to rate cuts in 2023. The strength of the rally, exacerbated by short covering, caught many bears off guard but I noted that bear market rallies of ~20% are within the historical norm and that the game wasn’t yet over for the bears.

It seemed clear to me that if my macro view was correct, the Fed would need to say something to clarify the miscommunication regarding a policy pivot. An increase in asset prices is not conducive to the Fed’s inflation fighting goals as it stimulates consumption and investment. I wrote the following in my August 11th piece:

Ironically, lower CPI prints could make the inflation problem worse through the asset price channel. Equities and other risk-assets rallying will stimulate the wealth effect and encourage consumers to consume more. Bonds rallying will pull the cost of financing / borrowing lower and also encourage more consumption and investment. The US 10-year yield for example has dropped more than 50 bps since its peak in mid-June. Both these effects are detrimental towards the Fed’s objectives at the moment. The recent rally in equities and bonds is more ammunition for the Fed to maintain its hawkish stance.

On August 26th, Powell used his speech at Jackson Hole as an opportunity to bring the market back to its senses. According to sources close to Powell, he scrapped his original speech after seeing the stock and bond market rally and chose to be more blunt: The Fed would effectively be a single-mandate institution until inflation came back to target. Powell made it clear that the drop in inflation in July was far too small to have any meaningful impact on monetary policy. He used the term “unconditional” when talking about the Fed’s commitment to bringing inflation down, suggesting that the Fed was willing to inflict significant short term economic pain on consumers and businesses to achieve its targets.

The Jackson Hole speech marked the end of the bear market rally with the SPX down ~3.4% on the day of the speech. August’s inflation number sparked another round of selling as inflation came in higher than expected. Shelter (32% of the CPI index) was the big contributor to the August surprise since rents are still rising and the Owners Equivalent Rent (OER) calculation is a lagging indicator. More worryingly, some of the stickier parts of inflation (services) kept rising in large part due to labor market shortages and wage pressures. Many economists and market commentators have noted that the resilience of the labor market signals the need for a deep recession to break the cycle of wage increases. The SPX fell 4.4% in response to the inflation data.

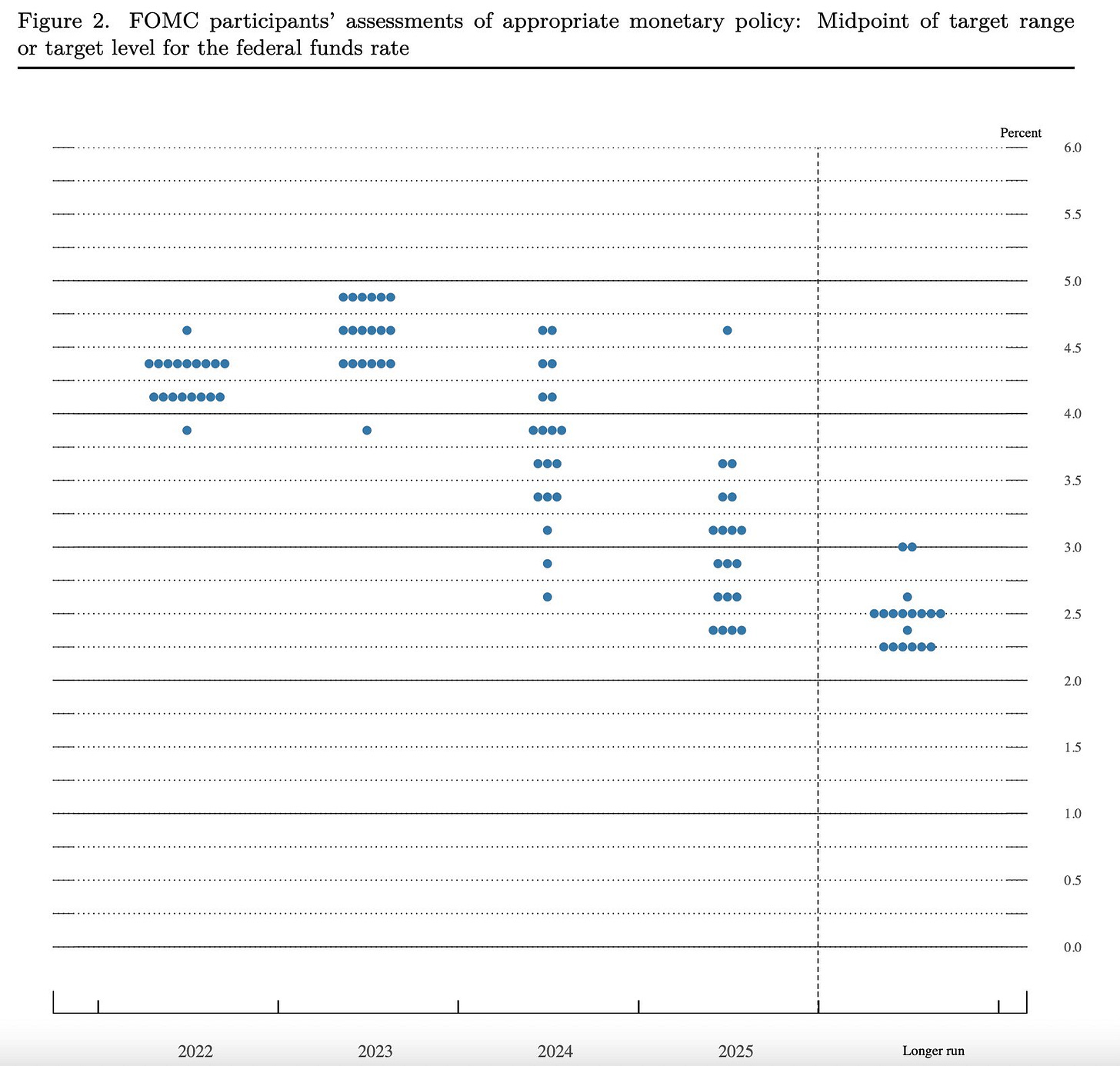

Powell’s Jackson Hole messages were re-iterated during the FOMC interest rate decision Wednesday this week. The new dot plot shows that the median year-end target rate is now 4.5% and the prospects for a rate cut in 2023 are now out of the window.

During the rally I had been adding back to my short positions in the indices including put options (which were priced very attractively with the VIX down to 20) as well as a short position on Apple which I described in my last portfolio update on August 28th. While those positions are doing well, I also made the mistake of adding back to my uranium and oil equities too early. I was under the impression that my longs would de-couple from broader market / long-duration assets as investors seek safety in critical commodities / assets that are in structural deficit. But this week the baby got thrown out with the bath water as most fund managers were in broad risk-off / liquidation mode. While the sell off in oil is somewhat understandable due to demand concerns, uranium demand is completely uncorrelated to the economy yet uranium stocks experienced a violent sell off.

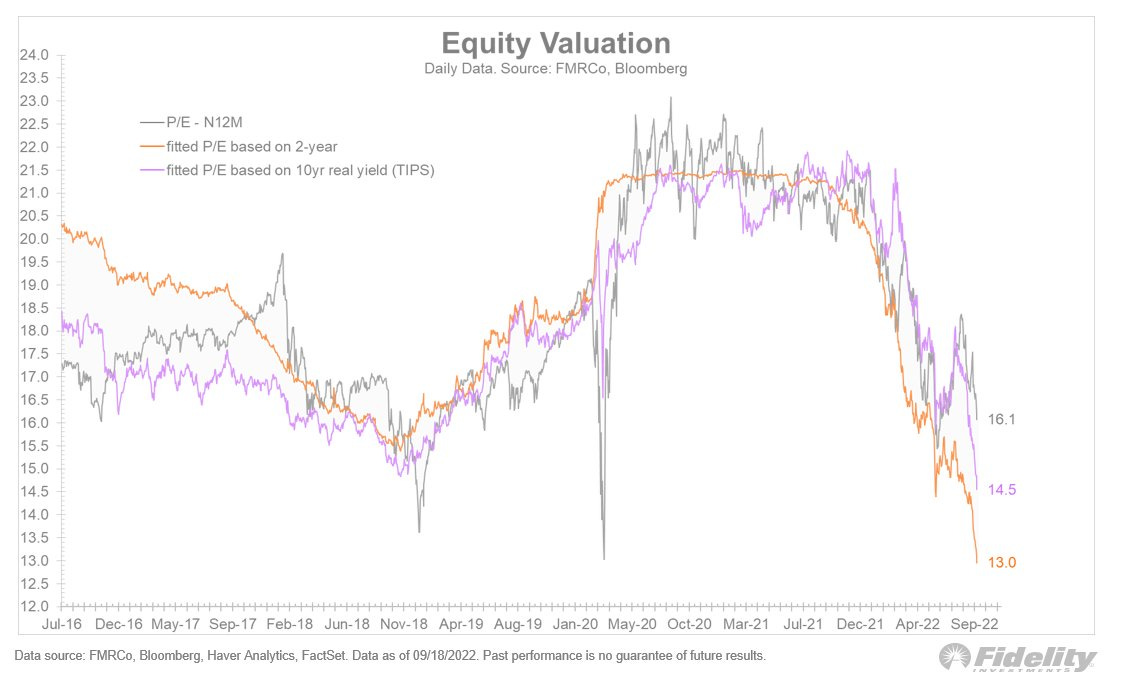

Looking forward, there is a high probability of the market continuing to make lower lows until the Fed changes its stance and bond yields stop rising. The chart below from Fidelity indicates that the fair value of the SPX based on the current 2-year and 10-year treasury yield is 13 - 14.5x P/E. Applying this ratio to 2023 EPS estimate of $234 (Goldman Sachs) would imply an SPX value between ~3050 - 3400, or 8 - 17% lower from here (assuming the EPS estimate is accurate). In a recessionary scenario we can expect EPS to be significantly lower, a risk that I believe is not currently reflected in analyst forecasts.

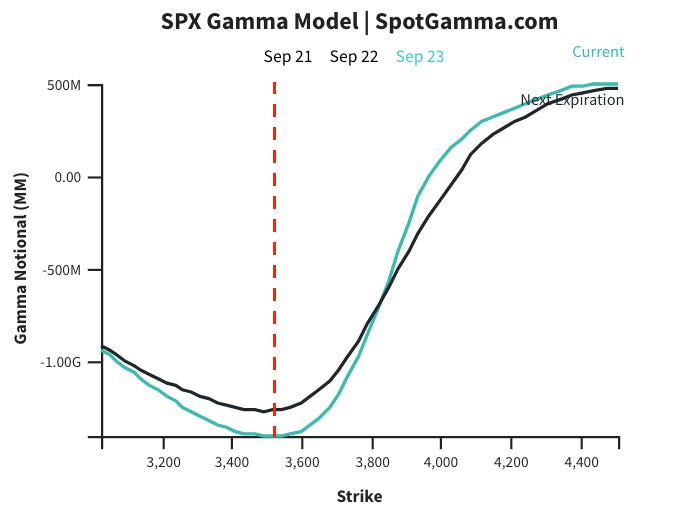

We are also in deeply negative gamma territory which could exacerbate a downward move (if you don’t know what this means, please read my primer on option-related dealer hedging flows and their impact on the market here and here). Spot Gamma’s model shows that below the 3600 area selling pressure from dealer hedging will start to ease but this could change if the demand for OTM put options increases.

From a technical point of view the SPY is breaking below the mid-point of the uptrend channel (dotted line) that started after the GFC in 2009 (click on the chart to magnify). This mid-point has acted as support for the market numerous times over the past decade and a break could signify that the bottom of the channel (somewhere in the 3000 - 3300 range) might be tested. This would fit nicely with the valuation analysis from above.

All of that being said, I took profits on some of my shorts on Friday since the market looks quite oversold and ripe for a bounce in the near-term, and I’ve earned good profits on these positions (especially the put options which have benefited from a decline in prices as well as volatility expansion). When it comes to shorting I’ve learned not to overstay my welcome and take profits when I can. I’ve also sold some of the uranium and oil stocks I bought back recently to raise more cash in case my long positions keep getting dragged lower. Until I see more convincing signs that commodities have de-coupled from broader markets, I’m going to continue trading in and out of these stocks. It’s a frustrating exercise but I believe the patience will be rewarded.