I have a mixed track record trading precious metals so I generally avoid the space, but I think the current setup is attractive enough to take a small wager on gold futures:

Gold sold off recently on news of peace talks between Russia and Ukraine, but it’s quite likely that these talks are nothing more than Russia trying to appear reasonable and biding time to regroup and rearm its forces.

Civilian casualties have continued and Zelensky continues to plead to Western powers to get involved. The US will be sending an aid package to Ukraine including drones and surface-to-air missiles.

The conflict has significantly altered the world’s perception of the US dollar. The West’s decision to sanction the Russian Central Bank and freeze its assets is going to make a number of oligarchs question their decision to hold assets in US$s abroad.

For China in particular, the large exposure to Western assets ($3 trillion + of China’s FX reserves are invested in Western countries’ debt) in a world where tensions with the Western world are consistently rising is not ideal.

Inflationary pressures and negative real yields are also making the prospect of holding treasuries as a store of value increasingly unattractive.

Given the size of the gold market, even a small increase in allocation to gold by central banks and institutional investors could lead to a significant upward move.

From a sentiment point of view, gold remains extremely under-owned and out of favor given the recent ascendency of crypto assets / bitcoin. However the tide could be turning with crypto under increasing regulatory scrutiny both in the US and abroad.

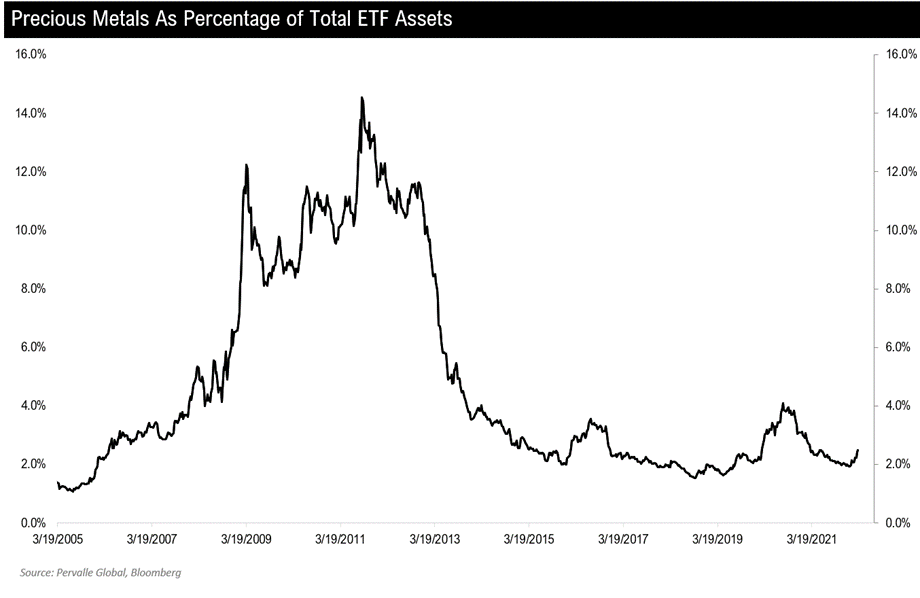

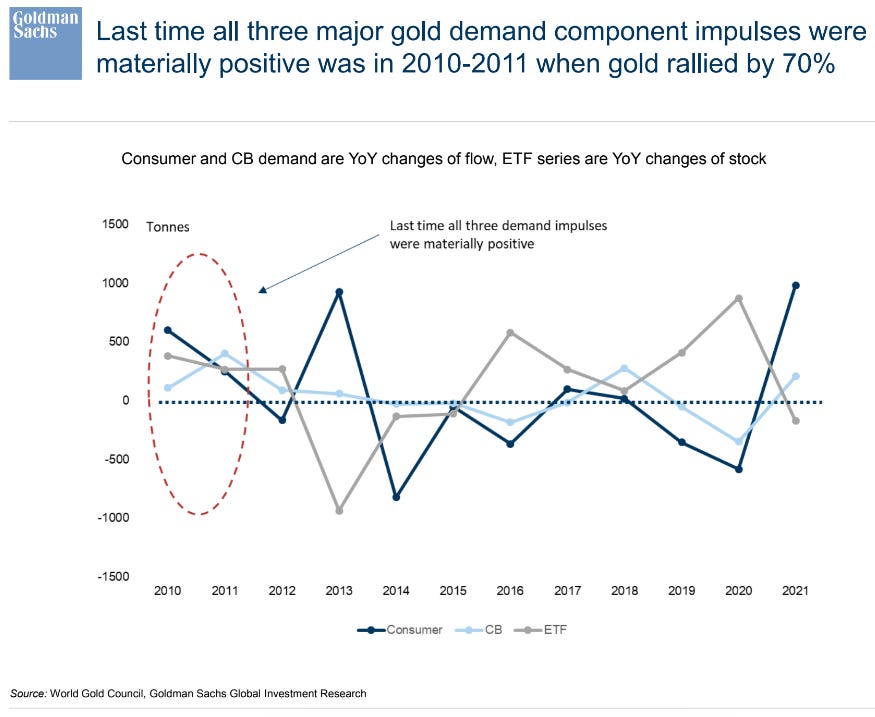

Precious metals as a % of total ETF assets is near the lows. But despite this lack of institutional investor interest, demand impulse is rising from both retail and central banks. For investors and traders, price is a big driver of sentiment and if gold is able to make news highs it could attract fresh capital to push prices even higher. Precious metals are an ‘emotional’ / ‘meme’ asset and often make the biggest moves when they get caught in a self-reinforcing feedback loop of price driving sentiment and vice versa. Therefore I might look to add to this trade as gold goes higher.

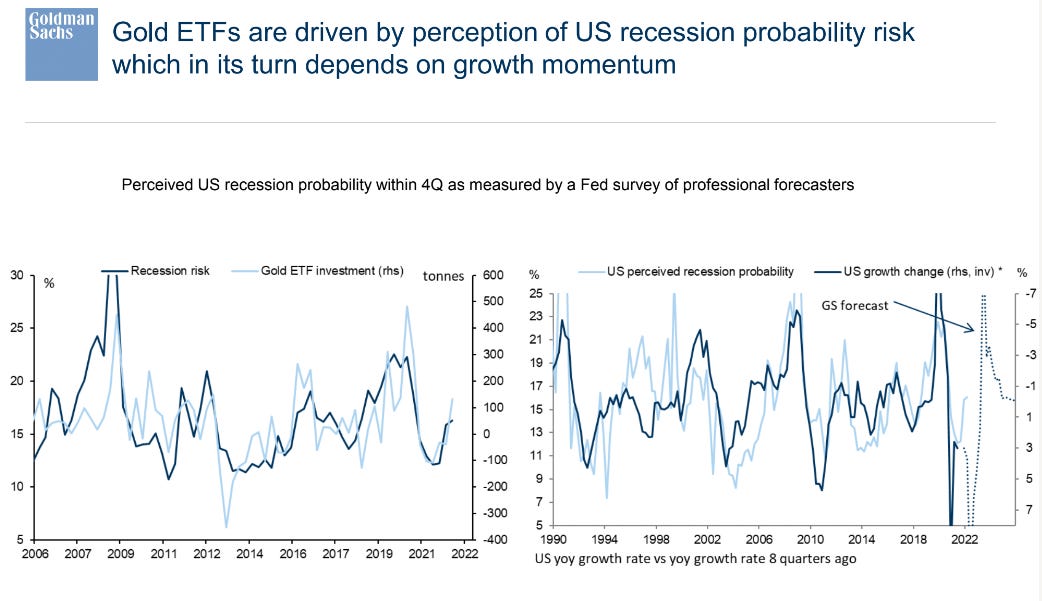

Also, if you believe that rate hikes combined with supply-side inflationary shocks could push the economy into recession, gold can be a good hedge against this scenario.

From a tactical point of view, it appears that the recent downtrend on the hourly chart has finally broken. The ~$1980-85 level (June) is going to be important resistance to break above as it represents 50% retracement of the move that started at the eve of the Russian invasion (on Feb 24th) and acted as support before finally breaking down on March 14th. I’m long the June 2022 futures with a stop loss. It’s very important to have the correct sizing and risk management in place for this trade given the high volatility in precious metals prices.