Global Atomic (GLO) Update - Thoughts On Recent Developments in Niger

Trimming position by 50% on renewed financing uncertainty

Global Atomic (GLO) has suffered another setback, with Niger’s military government (‘junta’) revoking its defense cooperation agreement with the US in the wake of bi-lateral talks with a US delegation last weekend. The talks were designed to discuss Niger’s transition to a democratic government, as well as ensure that Niger doesn’t form an alliance with Russia (Russian intelligence has made some inroads in the country recently). The US also claimed that they had received intelligence that the junta has been speaking to Iran regarding supplying uranium for Iran’s nuclear weapons program, an accusation that the junta denied.

The junta broadly considered the US’ approach to the talks to be condescending, and decided to take a bulldozer approach by calling an end to military cooperation. It’s unclear what the status is of the 1000 US troops in Niger. Some media outlets speculated that the US will eventually need to withdraw all military personnel from the country, but US officials have tried to downplay the seriousness of the issue. Celeste A. Wallander, an assistant secretary of defense, made the following statement at the House Armed Services Committee on Thursday this week:

“The self-identified government of Niger has not asked or demanded that the United States military depart. There is actually quite a mixed message. We are following up and seeking clarification”

Below is my understanding of Niger’s stance on the recent talks with the US:

US military presence in Niger is illegal (US has imposed rules upon Niger with regards to military bases unilaterally since 2012).

Niger has to pay fees for US military planes stationed in the country that Niger never agreed to.

Niger is kept in the dark as to what is happening within the military base and how many people / what equipment is deployed on ground.

Since the coup, US has suspended financial aid but has kept soldiers at its base in Niger.

Niger finds the US posture on its relationship with Russia to be condescending and unacceptable; Niger is free to partner up with whoever they want.

Niger considers the US delegation behavior to be lacking diplomatic courtesy; Niger was only verbally notified of the visit a few days prior to arrival with no agenda shared.

Reading the tea leaves, it appears the US miscalculated its leverage (not surprising in light of Biden administration’s numerous geopolitical gaffes) and was caught off-guard by the junta’s reaction. The reality is that the US probably needs Niger as much as Niger needs US aid, a fact that junta has cleverly recognized, and will now use to negotiate better terms vs. what they’ve been able to extract from the US historically.

In the absence of a presence in Niger, the US is at risk of losing its influence over the Sahel region and its ability to conduct counterterrorism activities in the area. If Niger falls into the hands of Russia, this will mean that Niger’s uranium resource will become harder to access for Western utilities, something that the US can’t afford after the recent developments in Kazakhstan. This would follow the recent trend of African countries that were previously French colonies, falling under Moscow’s sphere of influence. Russians already have a presence in nearby Mali, and Burkina Faso has also acknowledged receiving Russian support for logistics.

For Global Atomic, these developments mean renewed uncertainty regarding the ability to access Western debt financing. The Company has been in talks with Export Development Canada and the US Development Bank for the debt component of the mine development capex (~US$255mm). However, in the scenario where US troops have to pull out of Niger, and Russian, Chinese and Iranian influence in Niger increases, it’s unclear if the banks would still be comfortable funding the project.

Even if the Western banks pull out, I believe that GLO will successfully complete Dasa and transition from being a developer to a producer. Given the strategic importance of uranium globally, GLO will be able to secure funding from other sources (most likely Chinese). The CEO, Stephen Roman, has reiterated numerous times that he has been approached by parties interested in financing the project in case Western financing falls through. These parties include end-users of uranium (utilities / power companies) who want to develop a strategic partnership to secure future uranium supplies. However there are some risks in this scenario for GLO shareholders to consider:

If investors know that GLO has lost access to Western sources of financing, they are likely to offer worse financing terms.

GLO’s cost of capital will increase if the US and Western interests in the region are compromised.

Western utilities are unlikely to continue contracting with GLO if Niger is perceived to be under Russian / Chinese influence.

Financing uncertainty may further delay the construction of the mine and the ability to start generating cash flows.

Mitigating these risks are some positive developments in Niger since the coup. I highlighted some of these developments in my November note, and things have continued to move in the right direction:

Niger has remained peaceful and civilian heads are running the Country’s various departments/functions effectively.

ECOWAS has removed sanctions from Niger.

The border with Nigeria has reopened, and it’s likely that the border with Benin will open as well.

The border with Benin in particular will have a significant positive impact on GLO’s cost structure.

The most recent feasibility study includes significant contingencies for increased transport time and alternate logistics to account for the Benin border remaining closed.

In light of the above, I think that the risk / reward for holding the stock has deteriorated, but overall still remains favorable. The Company’s deeply discounted valuation, high-grade deposit, advanced development stage and the ability to access multiple financing sources due to the global thirst for uranium, means that there are still multiple scenarios where shareholders can win. Therefore I’ve reduced my position sizing, but I’m still keeping the stock in my portfolio.

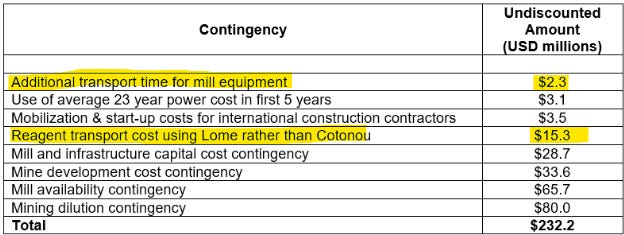

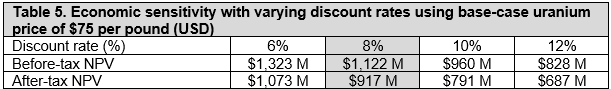

The margin of safety in GLO stock is clear from the latest NPVs in the revised feasibility study (FS) published just a few weeks ago. At US$75 / lb uranium price and a 12% discount rate, the Phase 1 after-tax NPV is US$687mm / ~C$930mm, relative to GLO’s current market cap of ~C$480mm. The consultants have taken a very conservative approach with the latest iteration of the FS, baking in ~US$230mm of contingency costs.

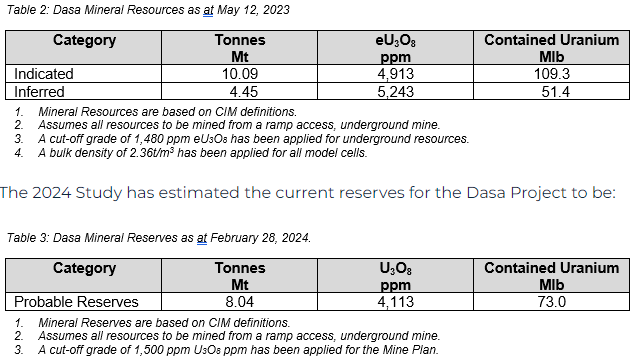

If we increase the uranium price assumption to US$90 (i.e. roughly equal to the current spot price), the NPV figure increases to US$1bn. At US$100 / lb, it increases to US$1.3bn. The NPV is based on 73mm of reserves, which at 93% recovery rate leads to 68mm in production over a 23 year mine life. It does not ascribe any value to the rest of the Company’s resource base (160mm total). GLO mentioned in its FS press release that it will be working towards converting the 51.4mm lbs of inferred resource into reserves and potentially increasing mine life and production (depending on the demand for uranium).

Global Atomic is poised to enhance the Dasa Project's value through strategic infill drilling targeting the 51.4 million pounds of high-grade Inferred Resources. This initiative, set to commence in Q3 2024 from both underground and surface positions, aims to elevate mineable grades post-2038 and extend the mine's operational life beyond 2048. Additionally, exploration drilling will seek to expand the deposit further, leveraging its open at depth and on-strike potential.

Based on growing global demand for uranium, Global Atomic is planning to complete a preliminary feasibility study in the early years of the mine plan for a plant expansion to 2,000 tonnes per day and incorporate additional drilling results.

The mine is already designed for higher production. Additional capital requirements are expected to be minimal and primarily used to expand the mining fleet and increase mill throughput. The current mine plan is based on throughput of 1,000 tonnes per day, the plant has been designed to handle up to 1,200 tonnes per day, with most equipment sized by 20% more than this. At 92% availability, throughput could be increased to 1,325 tonnes per day with minimal additional investment.

If we apply a 20% NPV discount to account for unfavorable geopolitical influence (assuming Niger is under Russian and Chinese influence), and ascribe no value to the Company’s remaining resources/assets, one can still justify a stock price that should be 2-3x higher than today if GLO is able to successfully get into production, and the uranium bull market progresses as expected.

Thankyou