A couple of weeks ago I had mentioned taking a long position in WTI futures call options for September, as I thought the sentiment on oil had become too bearish, without being supported by the fundamental data. I was looking for WTI to find support in the $76-77 area, and make a move back into the $80s. Since then, the situation has become more complicated, with OPEC+ announcing the potential unwind of voluntary production cuts starting Q3 2024, US economic data weakening, and inventory data skewing bearish. Oil prices broke below the supports this week, with WTI making a weekly low of ~$72.50. In my view, the market misinterpreted OPEC+’s actions, and financial players / CTAs pushed oil price well below its fair value. I doubled my position in WTI calls to bring my cost basis down to ~$1, and also added a $7/8 call spread for Transocean (RIG) expiring January 2025, for $0.17.

The OPEC+ news is a bit harder to unpack, so let’s deal with that first. Taking a step back in time, it was in October 2022 that OPEC+ started implementing a complex, multi-layered program of production cuts to support the oil market, that have totaled a whopping 5.86mm b/d in total (6% of oil demand). The cuts started with a 2mm b/d ‘official’ group-wide cut in October 2022, followed by a voluntary cut in April 2023 from Saudi Arabia, Iraq, UAE, Kuwait, Kazakhstan, Algeria and Oman totaling 1.66mm b/d. Finally, there was another series of voluntary cuts accumulating to 2.2mm b/d between June 2023 and March 2024, including a Saudi ‘lollipop’ cut of 1mm b/d. Complicating things further, each of these cuts has a different expiration date, and the cut level is in relation to a baseline / reference level of production for each country, which is also subject to negotiation.

If your head is spinning after reading the above paragraph, you’re in good company. However, as an oil trader / investor, there is an easy way to cut through all the complexity of various cuts and timelines, and focus on what really matters: export data and inventories. Countries can say whatever they want about their production, but ultimately what matters for supply / demand and prices, is how much these countries are exporting, and what’s happening to inventories globally (onshore and on water). Both exports and inventories can be tracked using satellites.

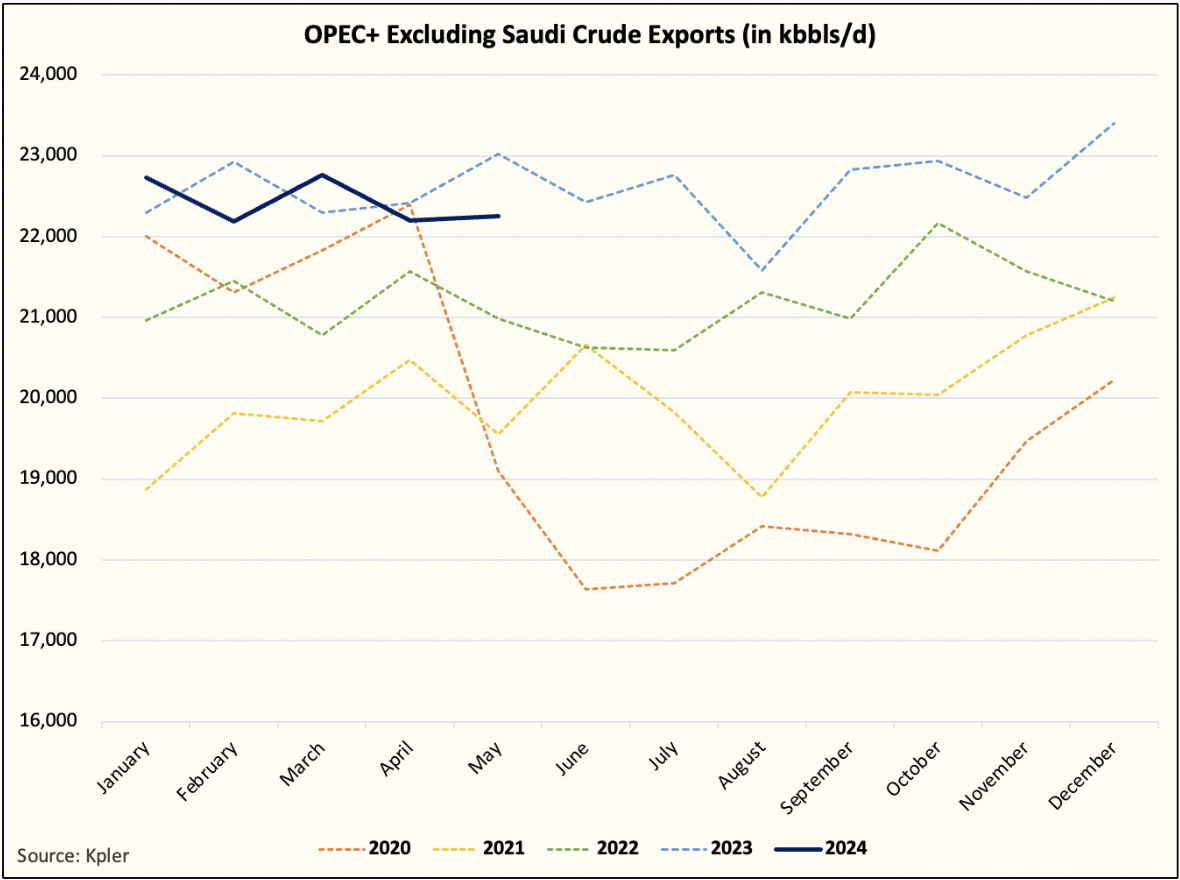

Looking at OPEC+ exports as a group, and comparing them to the announced cuts, you’ll quickly realize that the cuts are more of a PR stunt than a real supply indicator. OPEC+ crude exports relative to 2022 (green line) were HIGHER for most of 2023, and still are still trending at or above 2022 levels this year. In other words, despite ‘cutting’ almost 6mm b/d of oil production, OPEC+ is exporting the same or more in 2024, than it was in 2022.

Interestingly, around June / July last year, you’ll see that exports dipped sharply (light blue dotted line). This corresponds to the time when WTI was stuck in a $60 - $70 range - a price that was too low for the Saudis. By pushing exports lower, the Saudis managed to push oil prices back above $90 in Q3, and then increased exports again to cool things off towards the end of the year. These changes in exports were not publicly communicated, but serious oil watchers could easily track these movements through satellite.

If you break down the export data further on a country level, you’ll see that Saudis are the only ones who are really cutting, while everyone else is simply cheating / ignoring the voluntary cuts all together. The Saudis are not stupid, and are obviously aware of this, which means that the cartel works through implicit / backdoor agreements between the members that are very different from what is announced publicly / officially. This is why it’s always important to take OPEC-related headlines on Bloomberg / Wall Street Journal / Financial Times etc. with a big grain of salt. They are designed for public consumption, but practically useless if you’re looking to gain an edge on trying to understand where the market is going.

In my mind, there are two major insights to be gleaned from the above:

No matter what other countries say about their production, the Saudis are the ones who are really in the driver’s seat, managing prices and acting as the marginal / flex supplier.

When prices fall below the Saudi comfort zone, they will take action to tighten physical balances, and they will use their leadership to make others do the same (see that the ex-Saudi OPEC+ exports dipped as well during the 2023 intervention).

Now, let’s turn to what OPEC+ announced last weekend, and the market reaction. OPEC+ announced that the first layer of cuts, i.e. the ‘official’ 2mm b/d cuts, have been extended until the end of 2025. The voluntary cuts of 1.66mm b/d have also been extended to December 2025. However, the 2.2mm b/d of voluntary cuts will be extended to September 2024 only, after which the cuts will be tapered by 180-215K b/d over 12 months, subject to market conditions. Iraq, Russia and Kazakhstan pledged to fully comply with their production commitments and compensate for overproduced volumes since January 2024. Iraq and Kazakhstan agreed to submit a compensation plan by the end of June, while Russia has also pledged future compensatory cuts to address its overproduction in April.

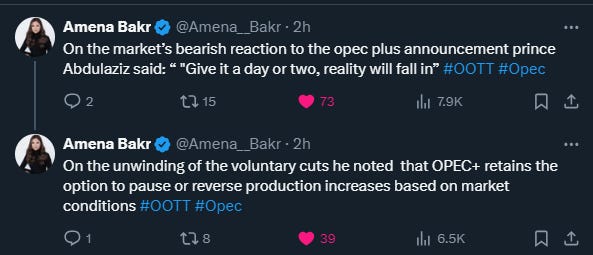

Since we know that ex-Saudi, OPEC+ members have not been complying with the voluntary cuts anyway, the announcement to ‘taper’ these non-existent cuts is a PR move, not a supply / demand move. It’s really the Saudis who would increase production, and they are likely not thrilled by the recent price action, which they refer to as ‘market conditions’. Prince Abudlaziz’s recent comments to journalists confirm this hypothesis.

But still, why make this announcement now when the oil market is already weak? I think the timing was forced on to the Saudis because of the upcoming US elections. Even though MBS and Biden are not on good terms, the Saudis want to tread lightly over the course of the year, and avoid triggering Biden to intervene with SPR releases, or other actions. It’s not a coincidence that soon after the OPEC+ announcement, the White House announced that they will be buying oil to replenish the SPR. These coordinated statements / press releases strongly suggest that the OPEC+ announcement was a political ‘you scratch my back, and I will scratch yours’ move, between the Saudis and the US, without fundamentally altering the supply / demand balances.

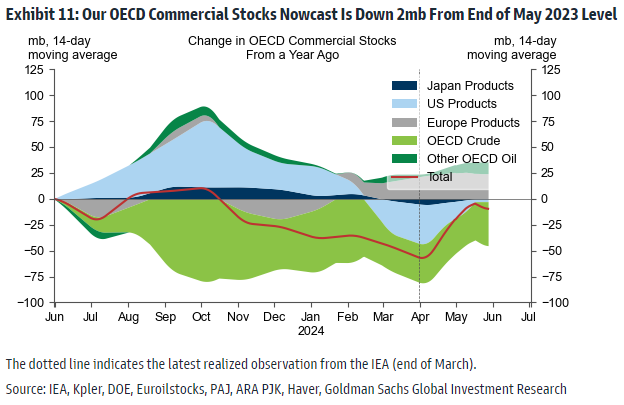

Now let’s turn to some of the fundamental macro and inventory data. Firstly, OECD inventories, including products, while below last year’s levels, have been building sharply over April and May.

The global picture doesn’t look a whole lot better.

Combine this with weak refining margins in Asia, and you can paint a picture of lackluster demand relative to the supply available. At this stage, I would put this in the ‘mildly concerning’ bucket. Part of the inventory build up could be refinery maintenance and timing issues, and the weakness in margins can be partially attributed to new CDUs coming online. There is nothing to suggest in the data that the world economy is slowing sharply, causing a sudden drop in demand. In fact, global jet fuel demand is running 1mm b/d higher vs. last year, and EV sales have slowed sharply, suggesting gasoline consumption should remain steady.

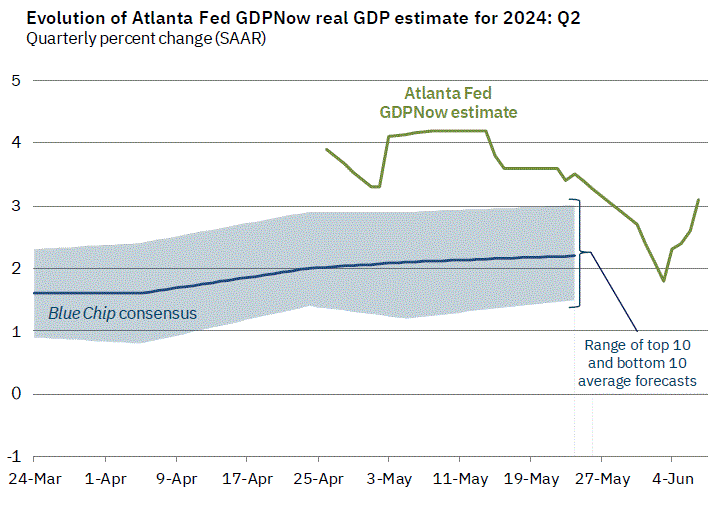

There is some data to suggest that the US economy is slowing. Q1 real US GDP was revised down to 1.3% from 1.6%. Real consumer spending was negative m/m in April, and the prior month was revised lower. Pending home sales in April fell by 7.7%. ISM Manufacturing New Orders fell down to 45.5 in May, the lowest for 2024 so far. May’s non-farm payrolls (NFP) were healthy, but the household survey was weak, painting a mixed picture. As a result of all these data points, the Atlanta Fed GDPNow estimate for Q2 has dropped from 4.2% to 3% last month.

Again, I would put this in the ‘mildly concerning’ bucket for now given slower growth is still growth, and oil demand has become less elastic to GDP growth over time due to efficiency gains. The recent slowdown can also be attributed to timing issues. There can be ebbs and flows in fiscal funds flows into the economy due to the lumpiness of tax receipts around major filing/payment deadlines. This April, tax-related fiscal monthly surplus was larger than usual, and was funded through net selling of financial assets, which will be a temporary headwind for consumers. The fiscal surplus will switch to a large deficit in July / August, which should propel growth higher in Q3.

Last but not least, the sell off in oil was exacerbated by algorithms that are trained to buy/sell based on momentum / trend factors, and are blind to fundamentals. CTAs are estimated to be net short in Brent by about 36% compared to being net long by 27% at the end of last week. In WTI, they are similarly bearish and are about 54% net short compared to 9% net short last week. Net positioning WTI and Brent combined has fallen to a multi-year low. Scott Shelton of the TP ICAP Group had the following to say about CTA action on Tuesday: “CTAs are just hammering away the market with massive selling seen yesterday, I think that there is more CTA selling out here this morning, which is just pressuring the market and making the spreads look worse as they are”.

Over the next couple of months, I expect refinery runs to increase and for oil inventories to drain, tightening the physical market. I also think it’s going to become increasingly apparent that the Saudis have no interest in adding supplies if the market can’t absorb it. These two factors should help push oil prices back into the $80 - $90 range. With positioning so heavily skewed bearish, I think the current setup is a favorable risk / reward for oil bulls.