EU management is continuing to deliver, with the company successfully transitioning from developer to producer, announcing the successful start of uranium production operations from its South Texas Rosita ISR Central Processing Plant (CPP) in November. The company has now produced its first drums of dried yellowcake, ready for shipment to customers. A grand opening ceremony was held in early February, with Texas Governor and US Secretary of Energy, Rick Perry, in attendance. Mr. Perry’s keynote address emphasized the importance of ending America’s reliance on Russian nuclear fuels by supporting companies like EU.

The restart of Rosita CPP is the first step in EU’s Texas production pipeline strategy utilizing the ISR method. What is most impressive about EU’s accomplishment is the ability to deliver the project on time, and at cost, in an industry that is notorious for delays and capex blowouts. The CEO had the following to say regarding the restart of Rosita CPP:

"It is with great satisfaction that in less than 20 months' time, the enCore team completed the refurbishment and upgrading of the Rosita CPP from long-term cold standby to monitor well ring installation, wellfield pattern and infrastructure installation, and construction of a new satellite IX facility. Our team has aggressively worked through supply chain disruptions and a significant expansion of our operating workforce to meet our targeted production schedule. We are very pleased to have our first uranium production underway at enCore, and we are honored to be both the first uranium producer in Texas in 10 years and the newest uranium producer in the United States. With these monumental achievements at hand, we continue to push for our 2nd uranium processing plant, the Alta Mesa CPP, to commence production in early 2024."

As a refresher, the thesis for buying EU last year was that the Company was trading at a big discount to peers due to constant M&A and share issuance. I mentioned at the time that while investors were fatigued by the numerous corporate actions, EU was being strategic about its capital deployment, and fast reaching a ‘steady state’ where it could start focusing on executing on its production strategy.

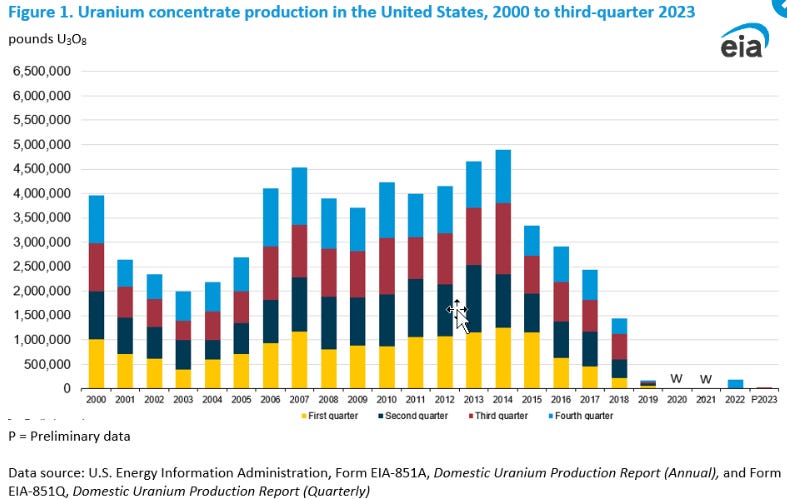

It’s also important to note that EU is one of a handful of mining companies in the United States that will be producing significant volumes of uranium in the near-to-mid term (~ 500K lb by end of 2024, ramping up to 3mm lbs in 2026, 5mm lbs in 2028). Uranium mining volumes in the US have dropped to negligible levels because nuclear energy became unpopular post-Fukushima, and the mining sector in general suffered from underinvestment and divestment due to ESG campaigns. This makes companies like EU prized assets for US utilities and the US government, especially in light of geopolitical bifurcation. As Cameco highlighted recently during its earnings call, utilities are willing to pay a significant premium to secure pounds in favorable jurisdictions.

In December, Boss Energy, an Australian uranium mining company, decided to acquire 30% of EU’s Alta Mesa ISR project in South Texas for US$60mm in cash. Boss funded this transaction by raising AU$205mm in cash through a share offering. In addition to the US$60mm in cash, Boss made a US$10mm investment into EU shares directly at a price of US$3.90 / share. The transaction includes a broader strategic relationship with EU which will involve sharing of ISR mining technology. While EU will be giving away 30% of the economics of Alta Mesa to Boss, I view this transaction as mildly positive for two reasons:

It provides the Company with additional funding to accelerate development of Alta Mesa (Texas) and Dewey-Burdock (Wyoming) projects, while minimizing share issuance / dilution.

Given the urgency to restart uranium production in North America, and how high uranium spot prices are likely to go, being able to ramp-up production quickly will allow EU to capture significant cash flow.

The chart below (highlighting mine) shows how the proceeds from the transaction will move up the timeline for EU’s various projects.

Boss is also an emerging ISR producer, and knowledge sharing could accelerate the development of technology that will help both companies optimize the ISR process.

In terms of capital structure, the company issued equity through its ATM facility last year to pay down the expensive convertible debt owed to Energy Fuels for the Alta Mesa acquisition (8% coupon with conversion price of US$2.91). Between September and November, EU raised ~$43mm to pay down US$40mm of the convert. The remaining US$20mm of the convert was converted to shares recently, leaving EU debt free. EU now find itself with no debt, US$70mm in cash and two near-term producing assets, an enviable position for a <$1bn market cap uranium mining company. EU also owns 17mm shares of Anfield Energy worth ~US$11mm (which it received as consideration for sale of its interest in Marquez-Juan Tafoya uranium project in Albuquerque, NM).

The next major milestones for EU are the upgrades and refurbishment of Alta Mesa ISR Central Processing Plant in early 2024, and the resumption of production from those assets. The CEO recently stated:

"Our South Texas operations continue to advance on schedule due to our successful planning to ensure all necessary supplies and equipment were secured well in advance of installation. With a full complement of people, materials, and equipment in the field, we are well positioned to make our timelines at our second production facility, Alta Mesa. Additionally, the wellfield drill results are some of the best grades we have encountered to date. These results support our plan to accelerate and expand the drill program at the Alta Mesa Uranium Project."

From a valuation point of view, using a 10% discount rate and $100 / lb uranium price, EU looks close to fairly valued from a NAV perspective. However, I believe EU continues to provide significant upside torque to uranium prices. Given the recent developments from KAP and Cameco, I’ve become more bullish on where uranium prices are eventually headed. If we assume a $130 / lb uranium price, for example, the NAV rises to ~US$7 / share, representing nearly 50% upside from today’s prices.

The NAV also doesn’t incorporate EU’s significant exploration growth potential. In my original piece on EU, I wrote:

“Texas is the most progressive permitting and production jurisdiction for uranium in the US and EU owns 200K acres of private land in South Texas, with exploration opportunities along 52 miles of stacked uranium roll-front of which only 5 miles have been explored. EU also holds a ‘checkerboard’ position of 300K acres of mineral rights in New Mexico’s Grants Uranium District (one of the largest in the world).”

Due to the significant exploration opportunities, management’s execution track record, and EnCore’s favorable jurisdiction, I expect EU to to trade at a premium to its peers, and a premium to its NAV (1.05 - 1.2x NAV), which suggests that substantial upside exists from current levels if the uranium bull thesis plays out as I envision.

BEAUTIFUL, THANKS