2024 Performance Review - And Time For A Break

Note: This will be the last post for the year as I’ll be taking some much needed time off from the markets. I’ll be back to writing in the new year. Thank you for reading and Happy Holidays!

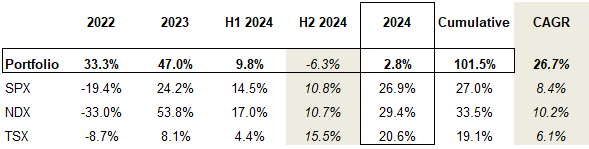

After experiencing sharp downward volatility in July and August, the portfolio recovered in September and October, and has since gone sideways. My largest position, the Sprott Physical Uranium Trust, continues to languish, as uranium spot prices are stuck in the high-$70s, and spot market volumes remain anemic. Uranium equities performance has been mixed, with larger, more liquid names like NexGen and Denison performing strongly, but smaller cap names like EnCore and URG struggling to gain upwards momentum. Global Atomic (which I reduced significantly in size post the Niger coup, but have held as a smaller position) has continued to face downward pressure due to geopolitical and financing uncertainty.

The frustration in uranium wouldn’t be so bad if my non-uranium positions had performed well, but alas this hasn’t been the case. My second largest position in offshore oil services has also struggled, as low oil prices slowed contracting activity, and fears of a 2025 surplus kept investors away from the energy sector as a whole. Copper prices stabilized above $4/lb, but my favored copper play, Ero Copper (ERO), experienced a large pull back due to production headwinds. After strong performance in October, Alphamin (AFM) shares lost some steam as tin prices have failed to break higher.

Charlie Munger once said “the big money is not in the buying and selling - but in the waiting”. This describes well the lens I’m using to look back at this year. While this year’s portfolio performance is uninspiring, the fundamental picture across all my investments has either improved, or at the very least, remained as attractive as when I first entered the investment. I continue to see significant upside convexity, and limited downside risk across my core portfolio positions. It’s now a matter of overcoming temporary setbacks, and waiting for the market to come to the same conclusion.

Uranium

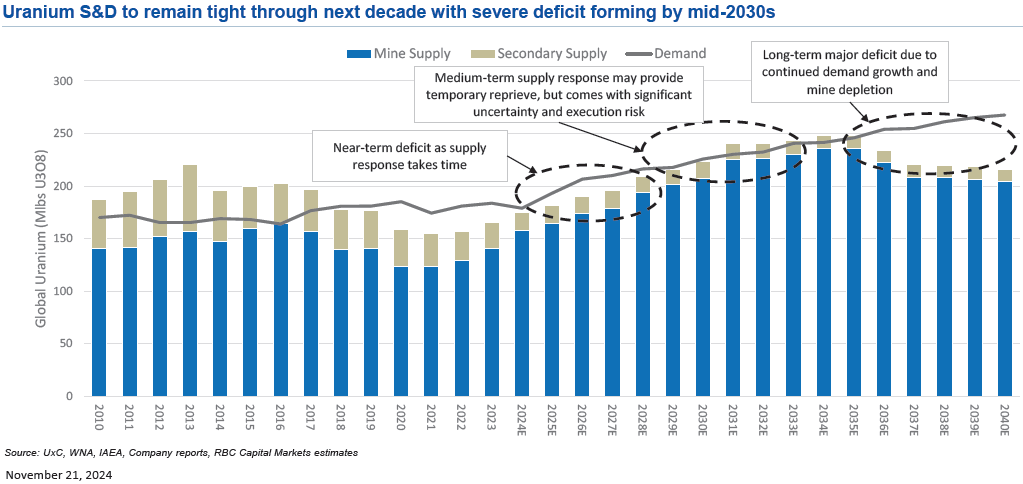

The developments in uranium over the last few months have been unambiguously bullish for both supply and demand. KAP’s 2025 production guidance was a ‘market clearing’ event, as it removed a major supply side risk for the bull thesis. Looking to smaller producers, production is coming in well below target across the board, proving out the hypothesis that uranium mining is incredibly hard, and that supplies will remain inelastic to short term price moves. On top of the production constraints, geopolitical bifurcation has made the supply chain significantly more fragile.

With supply risks out of the picture, all uranium investors need now is for demand to stay steady, and for the deficit to eventually be crystallized through a replacement rate contracting cycle. But demand is not only steady, it’s growing! Just a few years ago, nuclear was shunned by many as a ‘dangerous’ and ‘dirty’ form of power. But today, the world wants to triple nuclear capacity and Big Tech is clamoring to secure power from existing nuclear plants and investing in SMRs. The U-turn in sentiment with respect to nuclear power has been stunning to observe, and makes the thesis all the more compelling.

There is now a generally accepted consensus that the uranium market will be in deficit until the end of this decade, with a temporary surplus starting the early 2030s, if major projects like NexGen’s Arrow and Denison’s Phoenix come online on schedule. As RBC notes in the chart below, this expected supply comes with ‘significant uncertainty and execution risks’.

The natural question everyone is asking is why uranium spot prices are disconnected from the bullish fundamental picture. I’ve tried to answer this question in detail by describing the complexities, oddities and opaqueness of the nuclear fuel cycle, and utility buying patterns. In summary, the current period of consolidation we’re seeing is very similar to prior uranium market cycles, and is the result of a timing mismatch between supply and demand: supply in the spot market is persistent and price insensitive, while demand is lumpy, coming in bursts / waves.

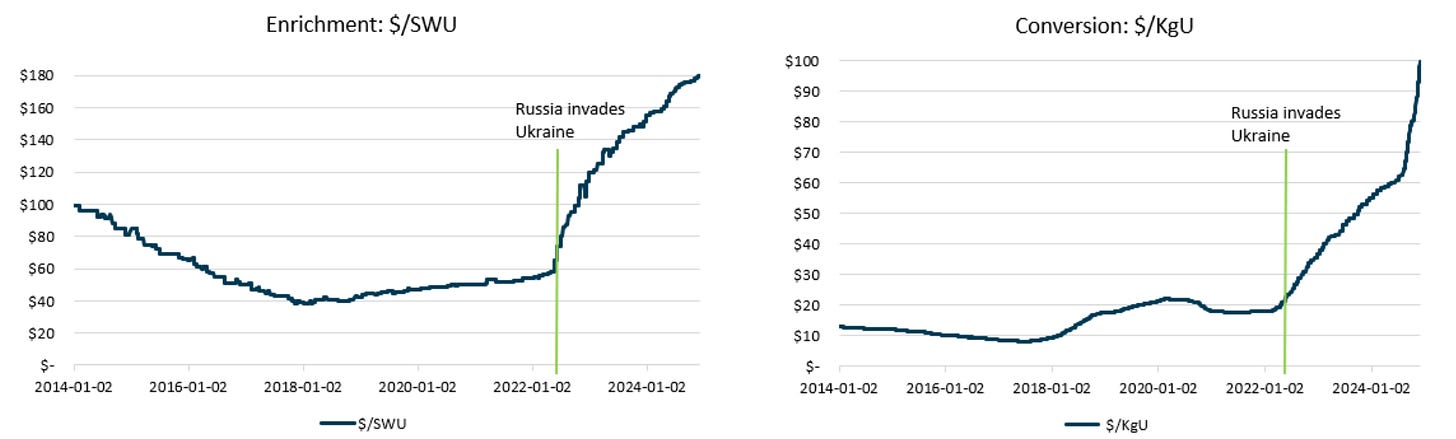

The difficulty is in timing these demand waves, because utilities hold their cards close to their chest in terms of procurement strategy, inventory management and future price outlook. The demand wave has been largely absent this year, with transaction volumes in both the spot and term markets significantly lower vs. last year. Uncertainty regarding Russian sanction waivers have contributed to the slowdown. In the meantime, price insensitive selling has been persistent from the usual sources, but also from some producer destocking and financial selling (ANU fund unwind). The price chart for SPUT below illustrates the periods of consolidation in 2020 - 2021 and 2022 - 2023 that preceded major rallies.

During these long periods of consolidation, investors tend to ask the same questions:

Why aren’t utilities buying?

Why aren’t spot prices going up?

Is there too much inventory?

I think constantly about these questions, and the answers haven’t changed. Until we see a significant improvement in the supply picture, or a significant deterioration in the demand picture, the risks to uranium price remain skewed to the upside.

I also view the downside from current spot price levels ($76.50) to be limited. Term prices are at $81 / lb, and producers are negotiating ceilings as high as $150 / lb (e.g. NexGen). Due to pent-up demand, and diminishing spot market liquidity, the next wave of buying is likely to catalyze an outsized move to the upside, similar to the move towards the end of last year. We are already seeing this type of price action in conversion and enrichment, where prices are gapping up in response to panicked buying.

When these buyers turn their attention to procuring uranium, they will find the market similarly constrained. We have to remember that utilities are obligated to provide feedstock (U3O8) to fulfill the SWU and conversion contracts that they just secured; utilities can defer and delay, but they cannot avoid procuring sufficient uranium to replace their annual burn rate (i.e. replacement rate contracting).

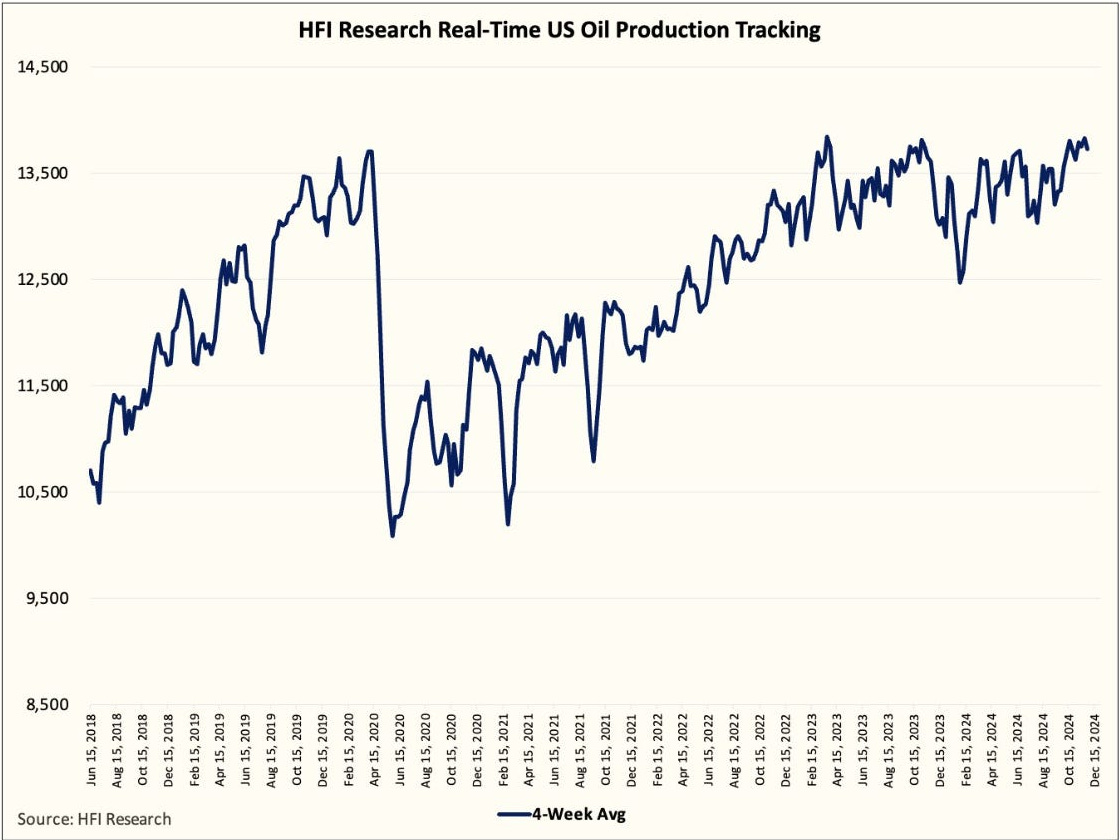

Offshore

Turning to offshore oil services, I see a similar setup emerging. While offshore stock prices have dropped due to a temporary lull in market activity and low oil prices, the long-term fundamental picture continues to look incredibly bright. Around this time last year, the oil market was shaking with fear at the prospect of US Shale crude oil production increasing by 500K+, yet production growth has stalled out, and 2025 estimates will soon be revised downwards as well.

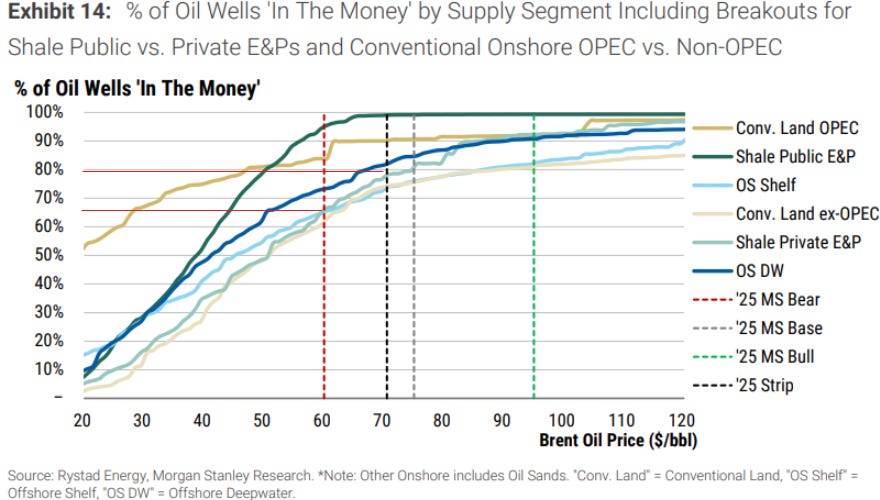

While US Shale has made significant efficiency gains, it’s becoming clear that drilling longer laterals and high-grading has its limits. ‘Per foot’ productivity is declining, and longer laterals are likely to produce less cumulative oil due to water encroachment and wellbore hydraulics that lower reservoir pressure and ultimate recovery. To increase production significantly from here, rig counts will have to go up in the Permian from the current ~300 level, for which higher oil prices are required. Morgan Stanley estimates that ~20% of private E&Ps, which represent roughly 1/3rd of total US oil production, are unprofitable at $70 oil.

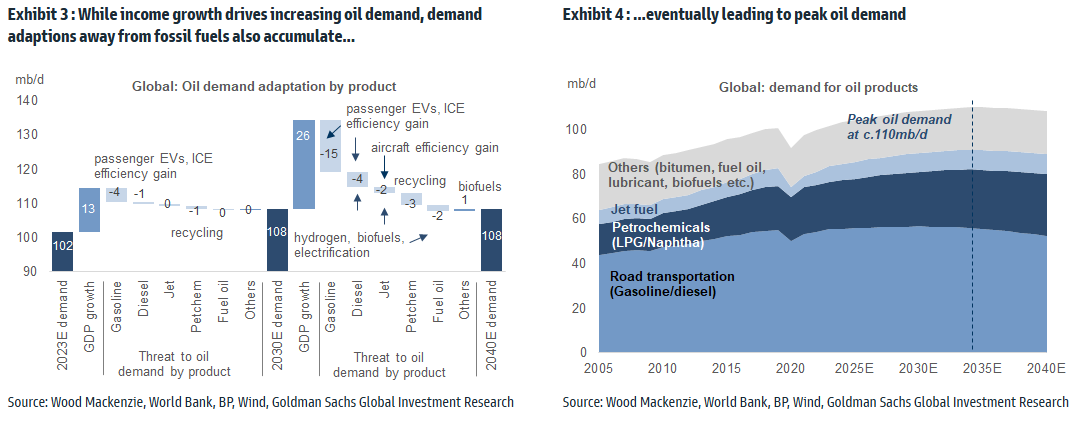

With the largest driver of onshore non-OPEC supply growth stalling out, the prospects of higher offshore exploration and production are quite bullish. If we assume conservatively that oil demand increases by 1% each year (or roughly 1mm b/d), we can see that US Shale will struggle to meet this demand. GS forecasts that oil demand will peak at 110mm b/d in 2035 and then plateau at 108mm b/d, 2040 onwards. Even after demand plateauing, significant new production (5.5 - 7.5mm b/d) will be needed to offset the natural 5-7% decline in production each year.

Offshore is best suited to meet this future demand. Not only does offshore oil have attractive break evens, it’s also more ESG friendly as offshore drilling produces the lowest carbon emissions per barrel of oil. There was a lot of press coverage recently regarding Chevron’s 2025 capex cut, but there is one little nugget that went largely unnoticed: “The company said it would continue to raise offshore output in the Gulf of Mexico, where it recently began production at its deep-water Anchor platform.” Globally, E&Ps are continuing to increase their offshore footprint, with $10bn YoY increase in offshore capex expected in 2026 after a flat 2025.

On the supply side, offshore newbuild activity is nearly non-existent. Once whitespace is fully utilized, dayrates will need to converge to newbuild economics to bring on more rig supply. This implies dayrates well north of the current ~$500K for drillships, and ~$150K for jackups, which would lead to a strong positive inflection in earnings for offshore drillers, given the high operating leverage inherent in their businesses.

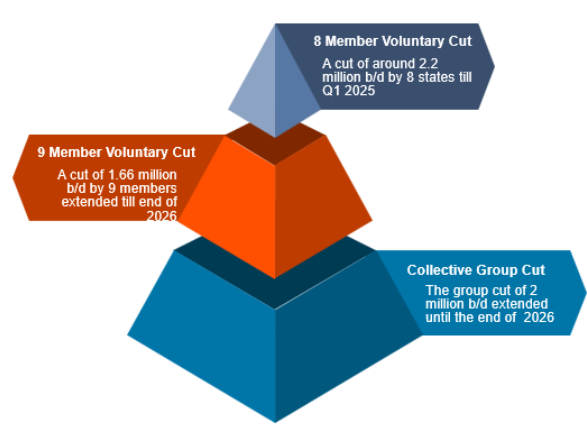

With oil prices hovering near $70, and marginal supply (US Shale) struggling to grow, I don’t see significant downside to dayrates from here absent an OPEC+ price war, or global economic collapse. With respect to the former, the risks have been significantly ameliorated with OPEC+’s recent decision to extend the 2.2mm b/d of voluntary cuts through Q1 2025, and the 2mm b/d ‘Collective Group’ cuts and 1.65mm b/d of prior voluntary cuts through 2026 (see diagram below illustrating the various layers of cuts and expiration dates).

In addition to the cuts, the UAE agreed to delay the start of its gradual quota increase (300K b/d) by 3 months, and also spread that increase over 18 months vs. 9 months. The relationship between UAE and Saudi Arabia has always been considered one of the bigger risks to OPEC+ unity. Outside of the UAE, OPEC+ cheaters have been complying with ‘compensation cuts’, as confirmed by satellite tracking. These developments should increase investor confidence regarding OPEC+ unity.

With my offshore positions in Valaris, Transocean, Borr Drilling trading at a fraction of their replacement values, I’ve added aggressively to these positions as I view the risk / reward to be quite attractive. I expect contracting activity to pick up in H2 2025, and for management teams to ramp up share buybacks to take advantage of the depressed valuations.

Copper and Tin

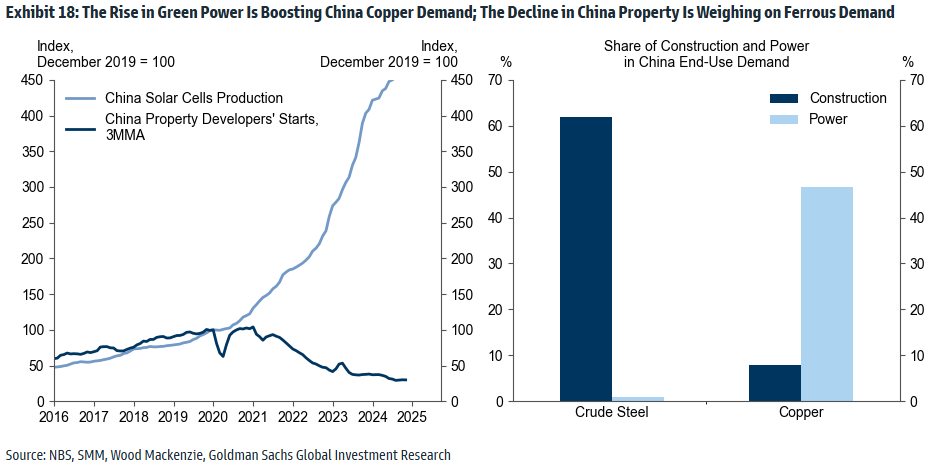

While smaller in size than my uranium and offshore positions, it’s worthwhile touching briefly on copper and tin. Copper remains a play on electrification and greening of the economy through EVs and renewables. While I think that nuclear is a better solution to the emissions problem, the world will need to increase all sources of power to meet increasing demand, including renewable energy. China in particular is aggressively pursuing its renewables buildout, and pushing increased EV sales to counter rising emissions.

Outside of China, copper demand will keep growing for many years given the electrification needs of developing regions like India and Africa. The end of the war in Ukraine, and the rebuilding of Ukraine’s infrastructure, will lead to an additional wave of copper demand that isn’t accounted for in most demand models.

Meanwhile the supply side is facing constraints similar to what we’ve observed in uranium and offshore: a prolonged period of underinvestment, and long lead times for new projects make it hard for supply to keep up with demand, even at higher price levels. New copper discoveries are becoming increasingly rare, and ore grades have dropped from 1% to 0.53%.

Near-term copper balances may be negatively impacted by Chinese property sector woes, tariffs and a rising USD. However, miners like ERO Copper, that have access to high-grade reserves, and enjoy low operating costs per lb, will fare better in such a scenario. ERO will also benefit disproportionately when copper prices rebound, given the ability to grow production significantly. The recent production setbacks are disappointing, but given ERO’s history of operational success, I’m confident that management will be able to execute and turn things around. I’ll be looking to add more to this name upon greater clarity regarding Tucuma’s output for next year.

Last but not least, tin prices have also been a victim to the overall bearish sentiment across commodities and base metals. Net speculative positions have decreased significantly from the highs seen in July and September. This has led to Alphamin (AFM) stock losing some steam, which I think is an opportunity to accumulate given the attractive FCF and dividend yield at the current ~$30K tin price.

The LT outlook for tin is extremely bullish given its crucial role in the future of digitization. Tin is technology’s ‘glue’, used as a solder to join together electronic components and semiconductors to circuit boards. While demand for semiconductors and soldering is temporarily weak, supply side issues remain unresolved. Over the last couple of years, tin demand has been growing at ~5%, while supply has been declining at roughly 5-10% due to major structural production disruptions in Myanmar and Indonesia. This has pushed the market into a yearly deficit of ~40Kt (~350Kt supply / ~390Kt demand).

So far, the deficit has been filled through scrap usage and inventory draw downs, preventing a price spike. Since April this year, prices have remained stubbornly at or above the $30K/t level, which is quite high by historical standards, suggesting that the market remains tight despite the weaker demand. With a cyclical rebound in demand, prices should inflect significantly higher. Over the longer term, cost curves suggest a incentive price of $40K/t+ will be required to meet rising tin demand. This would imply a 50% increase in AFM’s earnings. Unfortunately, due to the jurisdictional risks involved with AFM, I remain conservative on the position sizing.

Conclusion

After two strong years, portfolio performance has been weaker this year. However, as I look across my largest positions and examine the underlying fundamentals, I remain optimistic that there is significant future upside to be realized. The overarching theme across my investments has remained the same: there has been a multi-decade underinvestment in the supply of essential commodities, which is now colliding with increasing demand from secular trends such as energy transition, the rise of artificial intelligence and digitization.

We continue to live in a world where investors salivate over every major growth narrative and technological trend, yet few seem willing to invest in the commodities and commodity producers that will make these narratives a reality. When I see Mag 7 stocks or Bitcoin fly higher, I don’t experience FOMO. Instead, I picture the enormous amounts of energy required to power AI and crypto applications, and the gusher of cash flows my portfolio companies will generate to fulfill this demand.

There will be a time in the future when high commodity prices lead to increased investment, and higher supply. I recognize that commodities are cyclical, and that it’s important not to overstay one’s welcome. However, based on my study, we are still far from such time, and the big wave of investment flows into commodities is yet to come. Until then I’ll wait patiently.

Great summary piece - & something I needed to hear! My portfolio very similar to yours, & has been cut in half since May this year....

The question is how long to wait until the catalyst!

Nice write up and summary. I’m waiting in the catalyst. We could have multiple catalyst all colliding. The big one is just a rotation into value. That could be the biggest driver of sp appreciation.